Kaje Forex-Some important Details about This Broker

Abstract: Kaje Forex was started in 2016 and is based in Bulgaria, although it isn't regulated by any government. It offers a wide range of trading services, such as forex, commodities, cryptocurrencies, and indices, all through the MetaTrader 4 platform. It has a lot of different account kinds and reasonable spreads for sophisticated users, but it currently has no valid regulations.

| Kaje Forex Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Bulgaria |

| Regulation | No regulation |

| Market Instruments | Forex, Commodities, Cryptos, Indices |

| Demo Account | ✅ |

| Leverage | Up to 1:5 |

| Spread | 1 pip (Standard account) |

| Trading Platform | MetaTrader 4 (MT4) |

| Minimum Deposit | $250 |

| Customer Support | Skype |

Kaje Forex Information

Kaje Forex was started in 2016 and is based in Bulgaria, although it isn't regulated by any government. It offers a wide range of trading services, such as forex, commodities, cryptocurrencies, and indices, all through the MetaTrader 4 platform. It has a lot of different account kinds and reasonable spreads for sophisticated users, but it currently has no valid regulations.

Pros and Cons

| Pros | Cons |

| Multiple account types including ECN | No regulation |

| Demo accounts available | No Islamic (swap-free) accounts |

| Supports various trading assets | High minimum deposit |

| No direct contact channel |

Is Kaje Forex Legit?

Kaje Forex is not regulated in its registration jurisdiction and does not have a license from the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission. Please be aware of the risk!

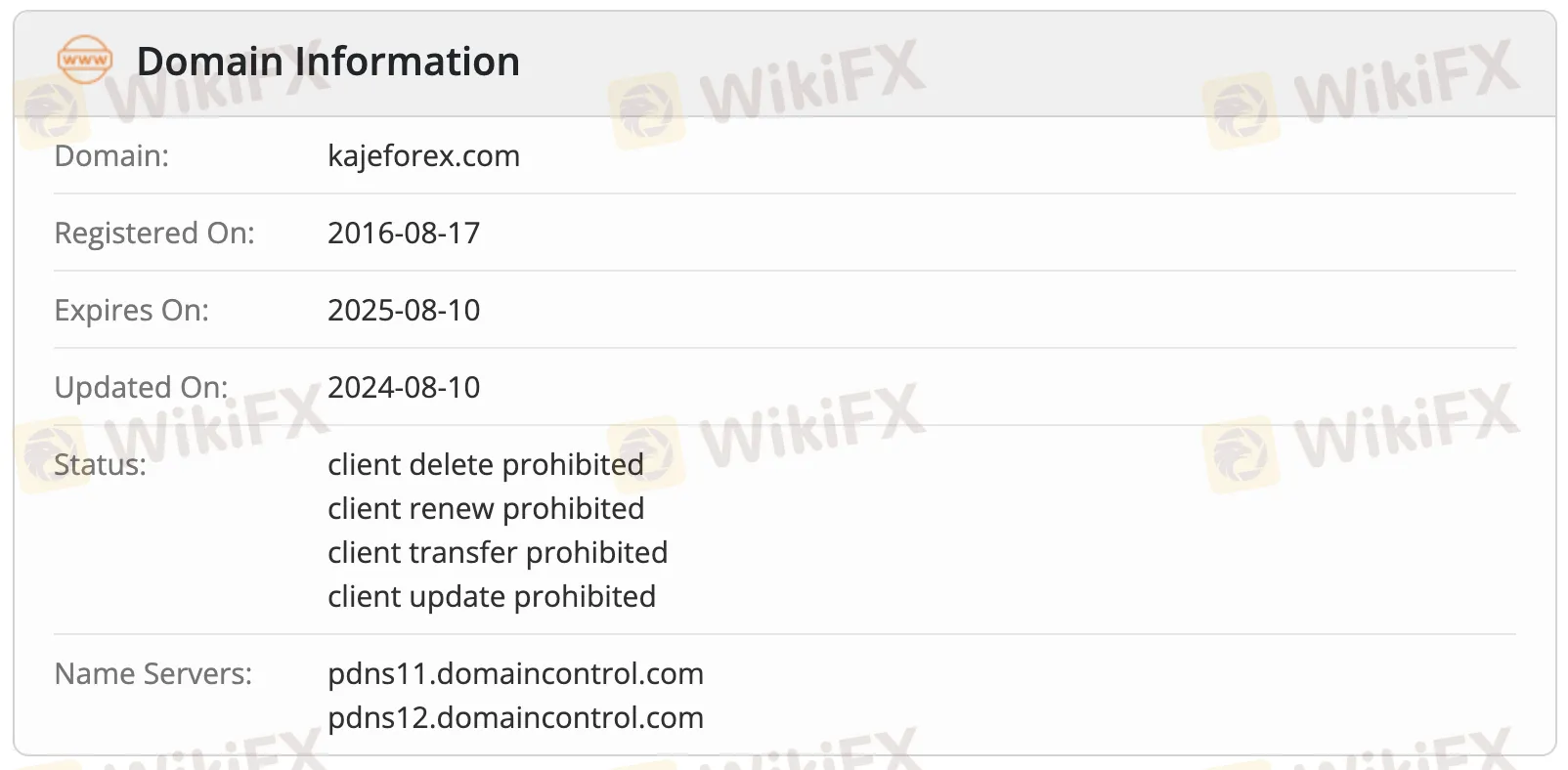

The WHOIS database shows that kajeforex.com was registered on August 17, 2016, and will expire on August 10, 2025. Last updated on August 10, 2024, the domain has numerous protective statuses: “client delete prohibited,” “client renew prohibited,” “client transfer prohibited,” and “client update prohibited.”

What Can I Trade on Kaje Forex?

Kaje Forex has a lot of different trading instruments, such as 40 currency pairings, key indices, precious metals (gold and silver), commodities (crude oil and natural gas), and cryptocurrencies. This variety lets traders deal in many different types of assets on one platform.

| Instrument Type | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Indices | ✔ |

| Stocks | ✘ |

| Bonds | ✘ |

| Options | ✘ |

| ETFs | ✘ |

Account Type & Fees

Kaje Forex has four types of trading accounts: Standard, Active Traders, EA Robot, and ECN. It also has demo accounts for practicing.

Compared to industry standards, Kaje Forex's trading fees are moderate to high on lower-tier accounts but become more competitive with advanced account types such as ECN.

| Account Type | Minimum Deposit | Spread | Commission | Suitable for |

| Standard | $250 | 1 pip | ✘ | Beginners |

| Active Traders | $1,000 | / | ✔ | Frequent/high-volume traders |

| EA Robot | $500 | 1.4 pips | ✘ | Automated strategy traders |

| ECN | $10,000 | 0 pips | ✔ | Professionals, institutional |

Leverage

The leverage is up to 1:5, significantly lower than typical forex brokers.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Desktop, Web, Mobile (iOS/Android) | Beginners |

| MetaTrader 5 (MT5) | ✘ | – | Experienced traders |

Deposit and Withdrawal

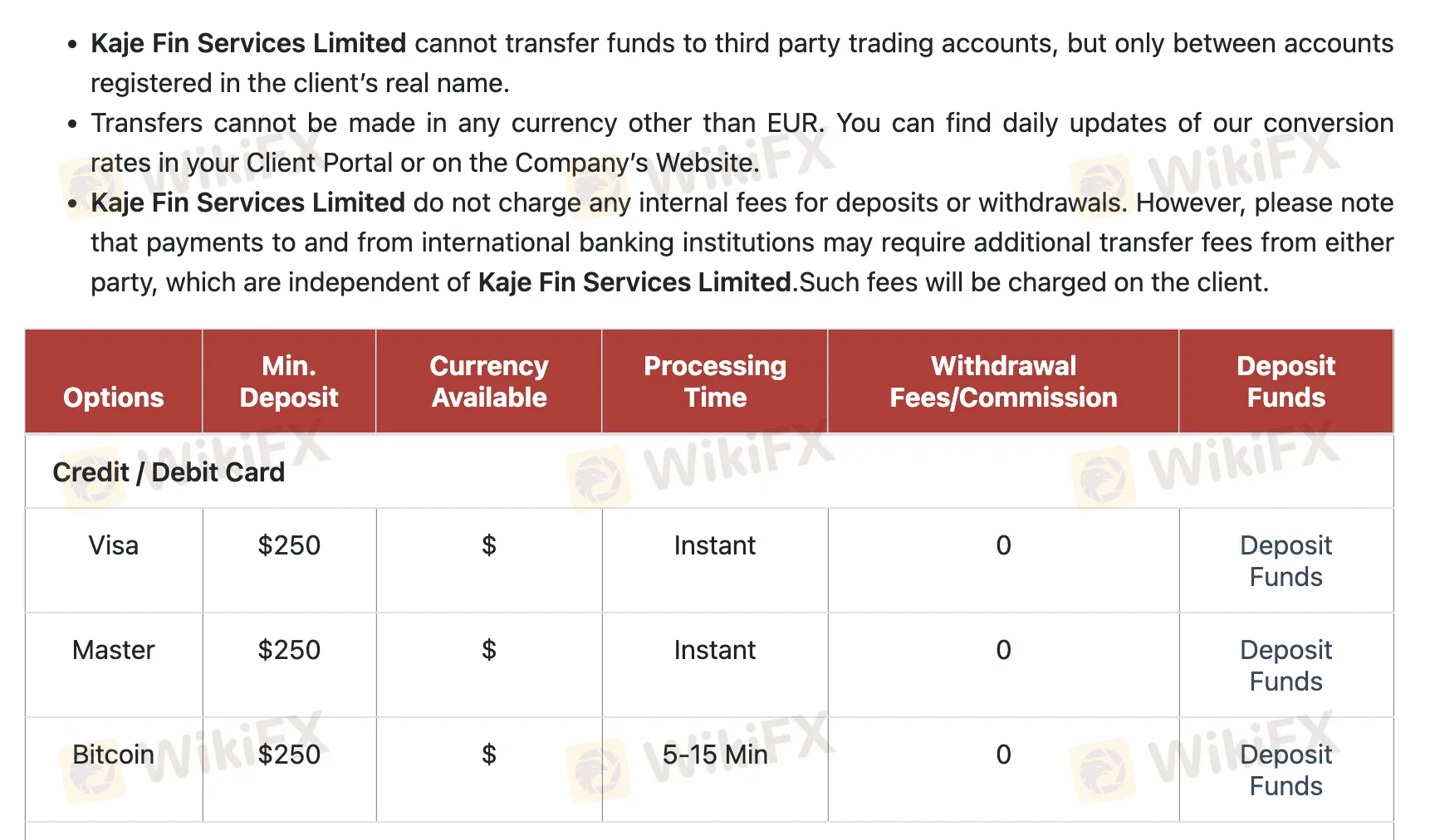

Kaje Forex doesn't charge any fees for deposits or withdrawals. But there may be costs from other banks or intermediaries, especially for transactions that happen between countries. Most methods require a minimum deposit of $250, however bank transfers need at least $1,000.

| Payment Method | Minimum Deposit | Fees | Processing Time (Deposit) | Processing Time (Withdrawal) |

| Visa (Credit/Debit) | $250 | $0 | Instant | 1–5 business days |

| MasterCard | ||||

| Bitcoin | 5–15 minutes | – | ||

| Bank Transfer | $1,000 | 3–5 business days | 3–5 business days | |

| Internal Transfer | – | Instant | Instant |

Read more

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

Understand what indices in forex are, how DXY works, key differences vs pairs, pros/cons, and where to trade CFDs—beginner-friendly, expert-backed guide.

Malaysian Finfluencers Could Face RM10 Million Fine or 10 Years in Prison!

A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the country’s online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

Juno Markets: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

Complaints Against Weltrade | Traders Can’t Get Their Money Back

Opening a trading account and watching your capital grow can feel exciting and full of promise until the moment you realise you cannot get your money back. That’s when the dream turns into a nightmare. Recent complaints submitted to WikiFX reveal an unsettling pattern seen at Weltrade where deposits vanish, withdrawals stall for days or even months, and support channels lead nowhere.

WikiFX Broker

Latest News

Scam Alert: Know the Risky Side of InstaForex in India

Going to Invest in FXCL? Move Back to Avoid Scams & Losses

What Is Forex Trading Fee? A Beginner’s Guide

Understanding UAE’s Financial Market Regulation: SCA and DFSA

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

FBI Issues Urgent Warning on Crypto Recovery Scams

Robinhood Moves Toward MENA Expansion with Dubai DFSA License Application

How to Use Retracement in Trading

CySEC warns the public against 17 investment websites

IBKR Lite Singapore Debuts with Zero-Commission US Stock Trading

Rate Calc