4XC

Abstract:Founded in 2015, 4XC is a trademark of 4xCube Ltd, registered in the Cook Islands, New Zealand. It's an online trading platform operating without proper regulation. Its tradable products cover Forex, Metals, Indices, Oil, Cryptocurrencies, and Forward Contracts with flexible leverage up to 1:500 and spread from 1.0 pips on the Standard account through the MT4, MT5 and TradingView platform. 4XC offers a demo account and three types of real accounts with a minimum deposit requirement of $50.

| 4XCReview Summary | |

| Founded | 2015 |

| Registered Country/Region | New Zealand |

| Regulation | FSC (Exceeded |

| Market Instruments | Forex, Metals, Indices, Oil, Cryptocurrencies, Forward Contracts |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 1.0 pips (Standard account) |

| Trading Platform | MT4, MT5, Trading View |

| Min Deposit | $50 |

| Customer Support | 24/5 live chat |

| Tel: +44 8000 488 033 (UK) | |

| WhatsApp: +44 8000 488 033 | |

| Toll-Free: 1800 914 5011 (Colombia) | |

| Email: support@4xc.com, info@4xc.com | |

| Social Media: Facebook, YouTube, Instagram, Twitter, Telegram, Discord, Linkedin | |

| Company Address: 1st Floor, BCI House, Avarua, Rarotonga, Cook Islands | |

| Regional Restrictions | The USA, Iraq, Iran, Myanmar, North Korea, and Portugal |

Founded in 2015, 4XC is a trademark of 4xCube Ltd, registered in the Cook Islands, New Zealand. It's an online trading platform operating without proper regulation. Its tradable products cover Forex, Metals, Indices, Oil, Cryptocurrencies, and Forward Contracts with flexible leverage up to 1:500 and spread from 1.0 pips on the Standard account through the MT4, MT5 and TradingView platform. 4XC offers a demo account and three types of real accounts with a minimum deposit requirement of $50.

Pros and Cons

| Pros | Cons |

| Various tradable assets | Exceeded FSC license |

| Demo accounts | Withdrawal fee charged |

| Three account types | |

| Commission-free accounts | |

| Flexible leverage ratios | |

| MT4 and MT5 offered | |

| Low minimum deposit | |

| Multiple payment options | |

| No deposit fees | |

| 24/5 live chat |

Is 4XC Legit?

No. 4XC currently has no valid regulations. It only holds an exceeded Common Business Registration license from the Financial Supervisory Commission (FSC).

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| The Financial Supervisory Commission (FSC) | Exceeded | 4XCUBE LIMITED | Common Business Registration | MC03/2018 |

What Can I Trade on 4XC?

4XC offers a wide selection of tradable products, including forex, metals, index CFDs and oil, cryptocurrencies, and forward contracts.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| indices | ✔ |

| oil | ✔ |

| cryptocurrencies | ✔ |

| forward contracts | ✔ |

| stocks | ❌ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

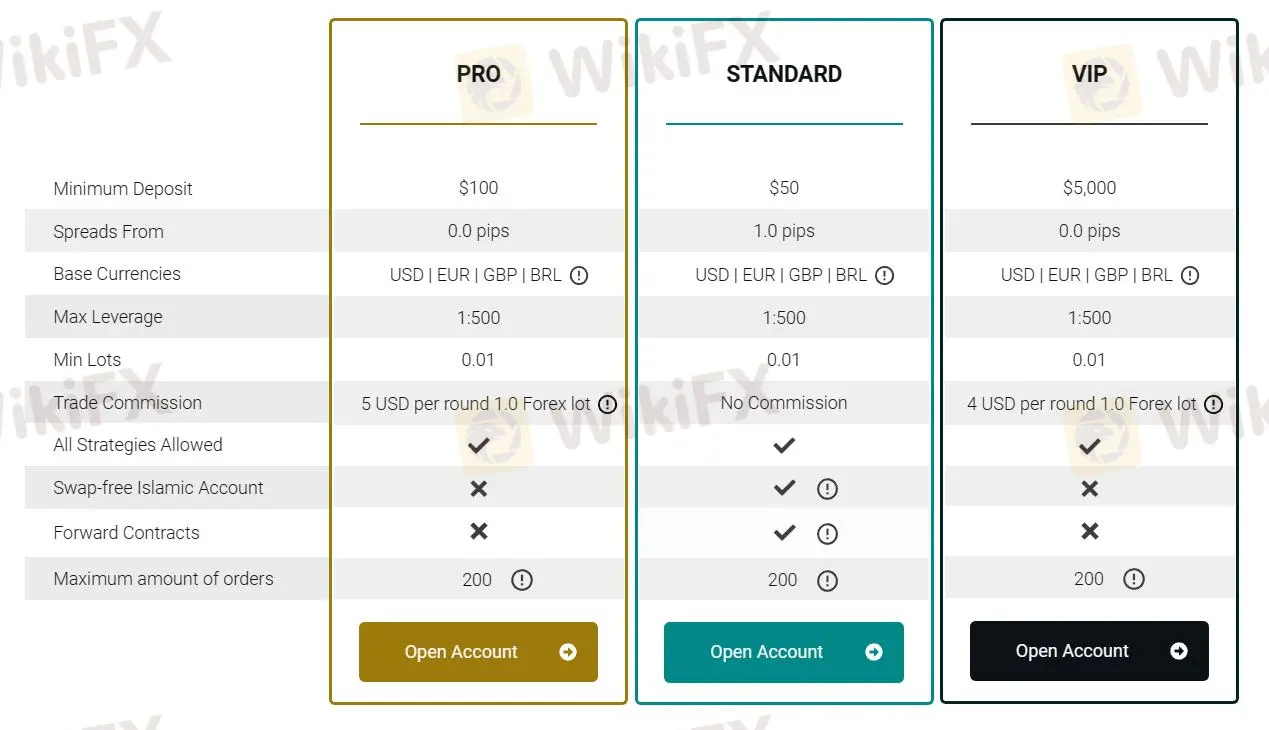

Account Type/Fees

A demo account and three types of live account are available on 4XC.

| Account Type | PRO | STANDARD | VIP |

| Base Currencies | USD | EUR | GBP |

| MinDeposit | $100 | $50 | $5,000 |

| Max Leverage | 1:500 | 1:500 | 1:500 |

| Spread | From 0.0 pips | From 1.0 pips | From 0.0 pips |

| Commission | 5 USD per round 1.0 Forex lot | ❌ | 4 USD per round 1.0 Forex lot |

| Swap-free Islamic Account | ❌ | ✔️ | ❌ |

| Forward Contracts | ❌ | ✔️ | ❌ |

Leverage

| Asset Class | Max Leverage |

| Forex | 1:500 |

| Metals | |

| Indices | 1:200 |

| Oil | |

| Cryptocurrencies | 1:20 |

| Futures Contracts | 1:200 |

Trading Platform

4XC offers both MT4 and MT5 as trading platform. Additionally, clients with Christmas Promos can access a free Trading View subscription during Christmas.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| Trading View | ✔ | Desktop, Mobile, Web | Beginner |

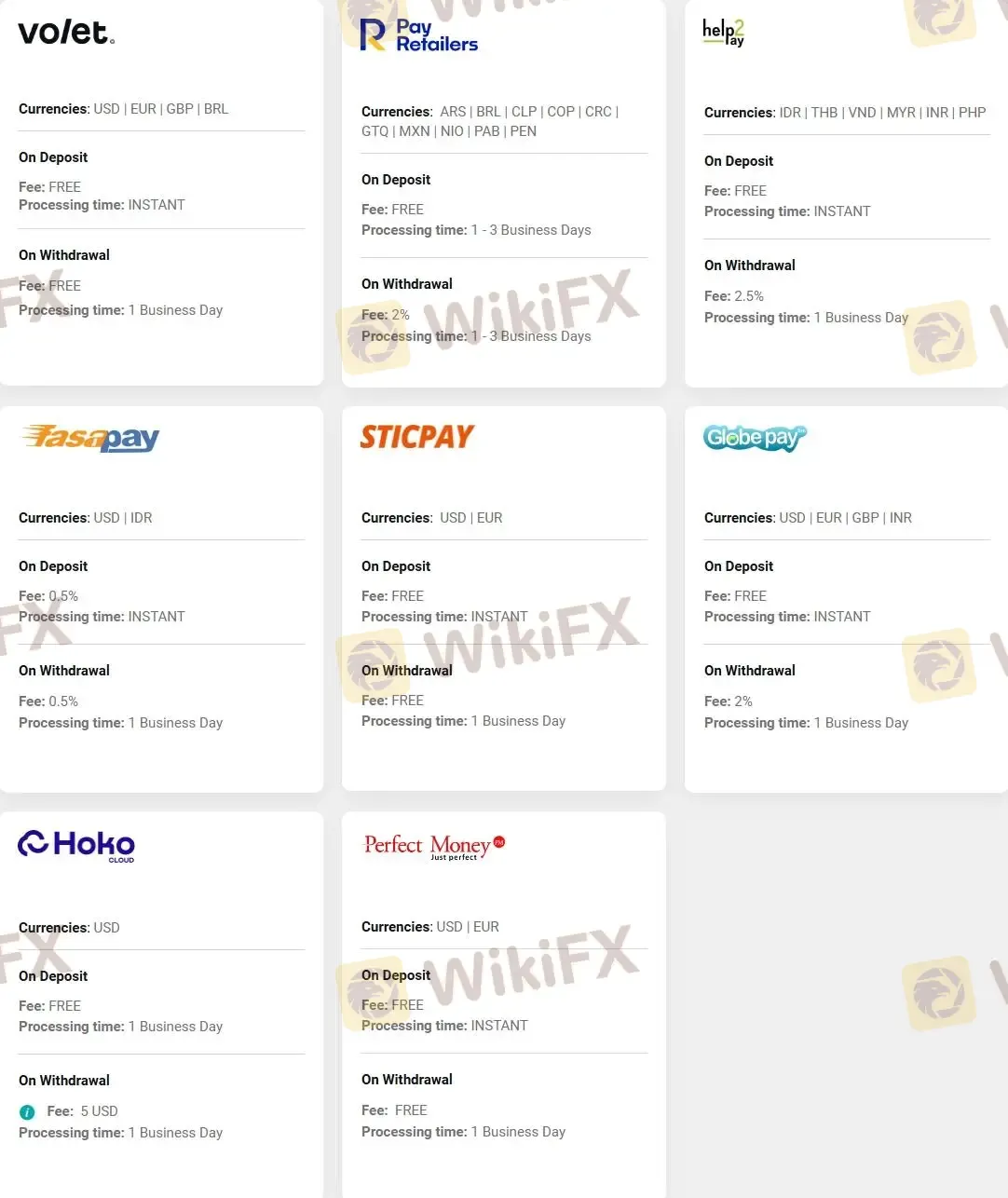

Deposit and Withdrawal

4XC accepts deposits and withdrawals via Bank transfers, CAPTEIRAX, VISA, MasterCard, American express, Crypto, Neteller, Skrill, Volet, Pay Retailers, helpay2, fasapay, Sticpay, Globepay, Hoko, and Perfect Money.

No fees for most deposits, while withdrawal fees vary on the method.

You can find more detailed info in the screenshots below.

Read more

WikiFX Review: Is IVY Markets Reliable?

IVY Markets, established in 2018, positions itself as a global brokerage offering a diverse range of trading instruments, including Forex, Commodities, Cryptocurrencies, and Stocks. The platform provides two primary account types—Standard and PRO—with a minimum deposit requirement of $50 and leverage up to 1:400.

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

Germany is set to hold a crucial general election on 23 February 2025, with voter frustration over migration emerging as a dominant issue.

ED Exposed US Warned Crypto Scam ”Bit Connect”

The Indian Enforcement Directorate (ED) recently exposed a crypto Scam from a firm called Bitconnect. During the investigation, which took place on February 11th and 15th, 2025. The authority recovered bitcoin worth approximately Rs 1,646 crore & Rs 13.50 Lakh in cash, a Lexus car, and digital devices. This investigation was conducted under the provisions of the Prevention of Money Laundering Act (PMLA) of 2002.

B2BROKER Launches PrimeXM XCore Support for Brokers

B2BROKER launches PrimeXM XCore support and maintenance services, enhancing trading efficiency for brokers with expert management and optimization.

WikiFX Broker

Latest News

Pi Network Mainnet Launch: Game-Changer or Crypto Controversy?

GlobTFX Users Report Same Issue! But Why?

Rate Cut or Not? It Depends on Trump’s Policies

eToro Adds ADX Stocks to Platform for Global Investors

Why Do You Keep Blowing Accounts or Making Losses?

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

WikiFX Community Creator Growth Camp

Effect of Tariffs on Gold and Oil Prices

Rate Calc