TriumphFX

Abstract:TriumphFX, a trading name of Triumph Int. Limited., presents itself as a forex and CFD broker founded in 2009 and registered in the Virgin Islands that claims to provide its clients with various tradable financial instruments with leverage up to 1:400 on the MT4 for desktop, Web, iOS and Android trading platforms.

Risk Warning

The United Kingdom FCA regulatory (license number: 763697) claimed by this broker is a suspicious clone, please be aware of the risk!

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| TriumphFX | Basic Information |

| Company Name | TriumphFX |

| Founded | 2009 |

| Headquarters | The Virgin Islands |

| Regulations | Suspected Fake Clone |

| Tradable Assets | Currency pairs (60), metals (4) |

| Account Types | Standard Fixed, Standard Variable, Islamic Variable Account, Premium, Platinum, Islamic Platinum Accountand VIP Account |

| Minimum Deposit | from 100 USD |

| Maximum Leverage | 1:30 (for the clients of European subdivision), 1:500 (or the clients of international subdivision) |

| Spreads | from 1.6 pips (Standard), from 0.5 pips (VIP) |

| Commission | 0~6 USD per lot |

| Deposit Methods | Wire Transfer, Bank Card, Neteller, Skrill |

| Trading Platforms | MT4 (desktop, mobile, web) |

| Customer Support | Operates 24/5Contact via phone, ticket, and email |

| Education Resources | Forex Basic, Forex Glossary, Market Analysis |

| Bonus Offerings | None |

General Information

TriumphFX, a trading name of Triumph Int. Limited., presents itself as a forex and CFD broker founded in 2009 and registered in the Virgin Islands that claims to provide its clients with various tradable financial instruments with leverage up to 1:400 on the MT4 for desktop, Web, iOS and Android trading platforms. Here is the home page of this brokers official site:

As for regulation, it has been verified that TriumphFX has suspicious clone BaFin and FCA licenses. That is why its regulatory status on WikiFX is listed as “Suspected Fake Clone”. Please be aware of the risk.

Pros and Cons :

It has been verified that this broker is suspicions about a clone and lacking valid regulation. [W1] Traders should be aware of the risk when evaluating TriumphFX for their trading needs.

| Pros | Cons |

| None.[W2] | Small inventory of trading instruments. |

| High spreads on the most affordable account types. | |

| Small selection of withdrawal methods. | |

| Suspicions about a clone and lacking valid regulation may pose risks. | |

| Customer support is not available 24/7 or on weekends, which may be inconvenient for traders requiring immediate assistance outside of regular business hours. |

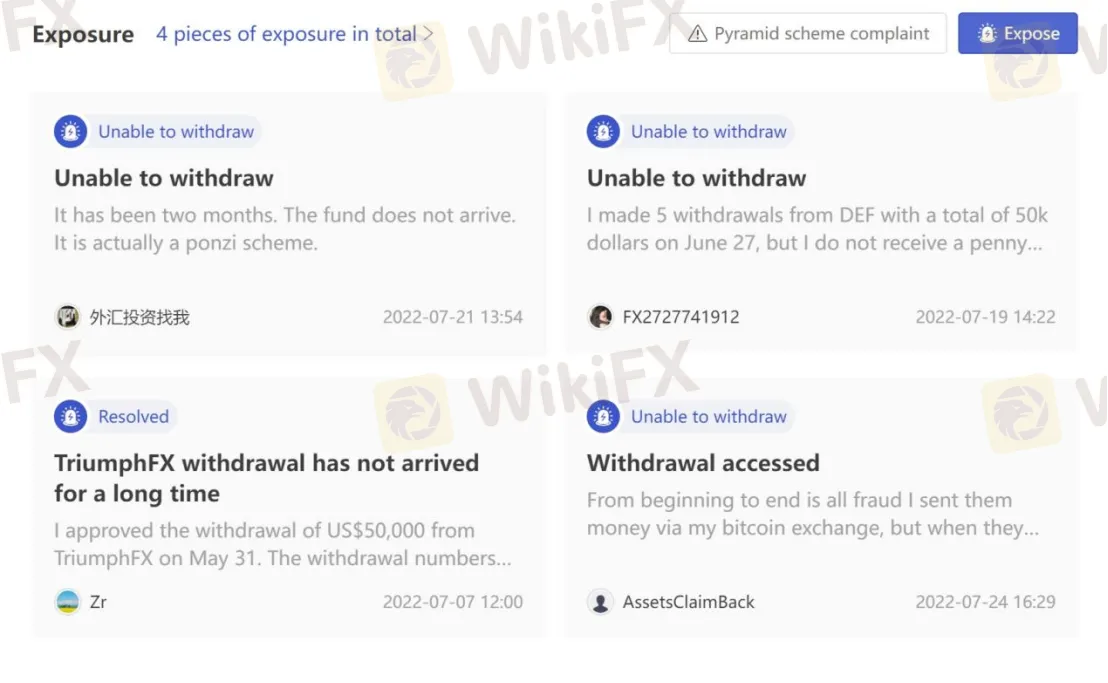

Negative Reviews

Some traders shared their terrible trading experience on the TriumphFX platform at WikiFX. They said they were unable to withdraw. It is necessary for traders to read reviews left by some users before choosing forex brokers, in case they are defrauded by scams.

Market Instruments

TriumphFX advertises that it offers rich trading products, including forex, CFD, fund custody and precious metals (such as gold and silver). However, more specific information about tradable assets cannot be found on the Internet.

Below is a comparison table about trading instruments offered by different brokers:

| Forex | Metalls | Crypto | CFD | indexes | Stock | ETF | Options | |

| TriumphFX | Yes | Yes | No | No | No | No | No | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Pocket Option | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No | No |

Account Types

The brokerage company TriumphFX offers five types of accounts that are suitable for clients with various financial means: Standard Fixed, Standard Variable, Islamic Variable Account, Premium, Platinum, Islamic Platinum Accountand VIP Account. The conditions on standard accounts are not that favorable, because the spread starts from 1.6 pips with a minimum deposit of $100. TriumphFX offers the most interesting conditions for wealthy clients on the VIP trading plan, where the spread starts from 0.5 pips in the absence of other commissions. However, the minimum deposit amount rises to $5,000.

Standard Fixed Account: This account type requires a minimum deposit of 100 USD. It offers a fixed spread type with a typical spread of 1.6 pips for the EURUSD currency pair. Swap charges apply, but there are no commission charges. Traders can enjoy a maximum leverage of 1:500.

Standard Variable Account: With a minimum deposit of 100 USD, the Standard Variable Account features a floating spread type with a typical spread of 1.6 pips for the EURUSD pair. Similar to the Standard Fixed Account, it also incurs swap charges, while commission charges are not applicable. Traders can utilize a maximum leverage of 1:500.

Islamic Variable Account: The Islamic Variable Account shares similarities with the Standard Variable Account, including a minimum deposit of 100 USD and a floating spread type with a typical spread of 1.6 pips for the EURUSD pair. However, this account is swap-free, meaning no swap charges are applied. There are no commission charges, and the maximum leverage available is 1:500.

Premium Account: Designed for more experienced traders, the Premium Account requires a higher minimum deposit of 500 USD. It offers a floating spread type with a narrower typical spread of 0.6 pips for the EURUSD pair. Traders will be subject to swap charges, and a commission fee of 6 USD is applicable. The maximum leverage available is 1:500.

Platinum Account: The Platinum Account is tailored for advanced traders who can meet the minimum deposit requirement of 2,000 USD. It provides a floating spread type with a similar typical spread of 0.6 pips for the EURUSD pair. Like the Premium Account, it incurs swap charges and charges a reduced commission fee of 3 USD. Traders can utilize a maximum leverage of 1:500.

Islamic Platinum Account: Similar to the Platinum Account, the Islamic Platinum Account requires a minimum deposit of 2,000 USD and offers a floating spread type with a typical spread of 0.6 pips for the EURUSD pair. However, this account is swap-free, meaning no swap charges are applied. There are no commission charges, and the maximum leverage available is 1:500.

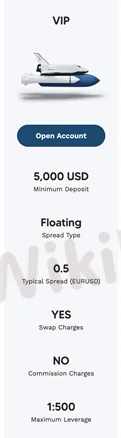

VIP Account: Geared towards high-volume traders, the VIP Account demands a substantial minimum deposit of 5,000 USD. It offers a floating spread type with a narrower typical spread of 0.5 pips for the EURUSD pair. Swap charges apply, but there are no commission charges. Traders can leverage their trades up to a maximum of 1:500.

These account types cater to traders with varying levels of experience and trading preferences, providing options for different deposit amounts, spread types, costs, and leverage ratios.

| Account Type | Minimum Deposit | Spread Type | Typical Spread (EURUSD) | Swap Charges | Commission Charges | Maximum Leverage |

| Standard Fixed | 100 USD | Fixed | 1.6 | YES | NO | 1:500 |

| Standard Variable | 100 USD | Floating | 1.6 | YES | NO | 1:500 |

| Islamic Variable | 100 USD | Floating | 1.6 | NO | NO | 1:500 |

| Premium | 500 USD | Floating | 0.6 | YES | 6 USD | 1:500 |

| Platinum | 200 USD | Floating | 0.6 | YES | 3 USD | 1:500 |

| Islamic Platinum | 2,000 USD | Floating | 0.6 | NO | NO | 1:500 |

| VIP | 5,000 USD | Floating | 0.5 | YES | NO | 1:500 |

How to Open an Account:

1. Visit the TriumphFX website. Look for the “Register” button on the homepage and click on it.

2. Fill in the required information, such as your name, email address, and phone number.

3. click on the “Submit” button.

4. After completing the initial registration, the system will direct you to a more in-depth questionnaire.

Here is a tutorial video that provides visual instruction on how to open an account in TriumphFX:

Leverage

Traders receive leverage with a maximum value of 1:30 to 1:500. Potential clients can test the trading conditions on a demo account. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads and Commissions (Trading Fees)

TriumphFX offers a variety of account types with competitive spreads and transparent trading fees. The spreads on all account types start from as low as 0 pips, providing traders with tight pricing. TriumphFX operates with variable spreads, reflecting the market conditions and liquidity.

The Standard Fixed and Standard Variable accounts have a typical spread of 1.6 pips for the EURUSD pair, which is relatively higher compared to some other brokers in the market. The Premium and Platinum accounts offer a narrower spread of 0.6 pips for EURUSD, providing potentially better pricing for traders. The VIP account offers the tightest spread of 0.5 pips for EURUSD.

Swap charges apply to all accounts, except for the Islamic Variable and Islamic Platinum accounts, which are swap-free. This can be beneficial for traders adhering to Islamic principles.

Commission charges are applicable for the Premium and Platinum accounts, with fees of $6 USD and $3 USD respectively. However, the VIP account does not incur any commission charges, which can be advantageous for high-volume traders.

Traders across all account types can enjoy a maximum leverage of 1:500, allowing for potentially larger trading positions. TriumphFX also offers fractional pip pricing, which allows traders to benefit from smaller price movements by adding a 5th digit, enhancing precision in quoting.

With its range of account types and competitive trading fees, TriumphFX provides traders with options to suit their trading preferences. It's important for traders to consider the spread, commission charges, and other factors in relation to their trading strategies and objectives when choosing an account type.

| Account Type | Spread (Minimum Value) | Withdrawal Commission |

| Standard Fixed | 1.6 pips | No commission |

| Standard Variable | 1.6 pips | No commission |

| Islamic Variable | 1.6 pips | No commission |

| Premium | 0.6 pips | $6 |

| Platinum | 0.6 pips | $3 |

| Islamic Platinum | 0.6 pips | No commission |

| VIP | 0.5 pips | No commission |

Non-Trading Fees

When withdrawing funds, the commission of the intermediary bank will be from $25 to $75. The broker compensates the banks commissions for deposits, but only in case of a deposit starting from $500.

There are swaps (commission for moving a position to the next day).

Below is a comparison table about average commission charged by different brokers:

| Broker | Average commission | Level |

| TriumphFX | $9 | High |

| RoboForex | $1 | Low |

| Pocket Option | $2.50 | Medium |

Trading Platform Available

Platforms available for trading at TriumphFX are MT4 for desktop, Web, iOS and Android. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

TriumphFX says to offer a variety of deposit methods, yet no more information is specified. The withdrawal is normally T+3-5 working days to the account.

Customer Support

TriumphFX‘s customer support can be reached by WeChat: 3131999. Company address: 2283 Columbus Centre, Road Town, Tortola, British Virgin Islands. However, this broker doesn’t disclose other more direct contact information like telephone numbers that most brokers offer.

Conclusion

The broker TriumphFX offers its clients 60 currency pairs and four precious metals for trading as well as the classic MetaTrader 4 terminal. The minimum spread value ranges from 1.6 points on a standard account to 0.5 points on a VIP type account. Traders receive leverage with a maximum value of 1:30 to 1:500. Potential clients can test the trading conditions on a demo account. Muslim traders have access to 2 types of Islamic accounts, which do not charge swaps.

However, it's important for traders to exercise caution and conduct thorough research before making a decision. It is worth noting that there are suspicions about a clone claiming to be regulated by the United Kingdom FCA, which poses a risk.It is essential for traders to consider their risk tolerance and understand that online trading involves a significant level of risk, and they may lose all of their invested capital.

FAQs:

Q: Is TriumphFX a regulated broker?

A: It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Q: What is the minimum deposit requirement for TriumphFX accounts?

A: The minimum deposit is $100 for Standard Fixed, Standard Variable, and Premium accounts. Platinum account requires a minimum deposit of $2,000, while VIP account requires a minimum deposit of $5,000.

Q: How are the spreads and commissions structured on TriumphFX?

A: Standard Fixed and Standard Variable accounts have a minimum spread of 1.6 pips, which includes the brokerage commission. Premium account has a floating spread starting from 0.6 pips and charges a commission of $6 per lot. Platinum account also has a floating spread starting from 0.6 pips, with a commission of $3 per lot.

Q: Does TriumphFX provide negative balance protection?

A: Yes, TriumphFX offers negative balance protection to its clients.

Q: Are there any non-trading commissions on TriumphFX?

A: Yes, there may be a commission charged by the intermediary bank for fund withdrawals, ranging from $25 to $75. However, TriumphFX compensates the bank's commissions for deposits of $500 and above.

Read more

New Zealand's FMA Warns Against "YouTube Crypto Investment Scam"

The Financial Markets Authority (FMA), New Zealand's financial regulator, warns individuals against investment scams that use YouTube channels to promote fraudulent cryptocurrency investment firms/websites. The authority explained on its official website how the YouTube cryptocurrency scam works, providing a step-by-step guide to help people recognize and avoid it. Read HOW THE SCAM WORKS and BE SAFE.

Trading is an Endless Journey

Every trader dreams of quick success, but rushing the process often leads to mistakes. It’s easy to get swept up in the excitement of winning trades or discouraged by unexpected losses. The truth is, mastering the emotional side of trading can be even more important than understanding market analysis or strategies.

How to Know if the Market is Correcting or Reversing?

In trading, distinguishing between a market correction and a market reversal is crucial for making sound decisions. Misjudging one for the other can lead to missed opportunities or significant losses. While both involve price movements, their causes, duration, and implications differ substantially. Understanding these differences can help traders improve their strategies and adapt to market conditions effectively.

Empowering the Next Generation in Finance with WikiFX: Gen Z’s Investment Journey

With a steadfast commitment to fostering sustainable financial literacy and providing clear, strategic guidance to the next generation, WikiFX has collaborated with Van Lang University and Hoa Sen University to host an exclusive series of financial education workshops. This marks a pioneering initiative by WikiFX in Vietnam, designed not only to deliver foundational knowledge but also to instill a sense of responsibility and cultivate prudent financial decision-making among aspiring young traders.

WikiFX Broker

Latest News

Two Californians Indicted for $22 Million Crypto and NFT Fraud

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

SEC Warns on Advance Fee Loan Scams in the Philippines

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Rate Calc