Azure Xchange

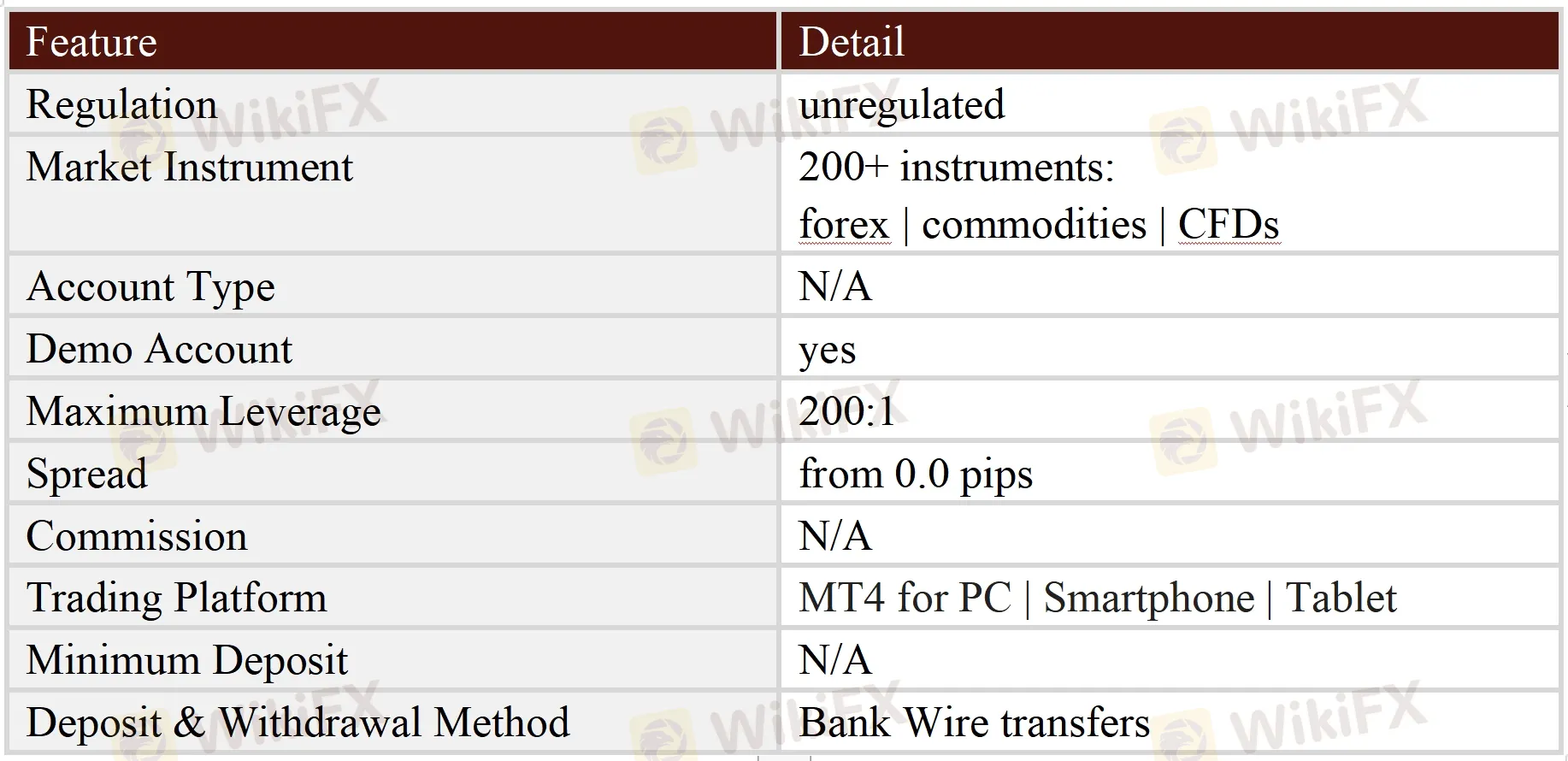

Abstract:Azure Xchange is allegedly a forex and CFD broker registered in the United States that claims to provide its clients with over 200 tradable financial instruments with leverage up to 200:1 and spreads from 0.0 pips on the MT4 for PC, Smartphone or Tablet trading platforms, as well as 24-hour multilingual customer support service.

General Information & Regulation

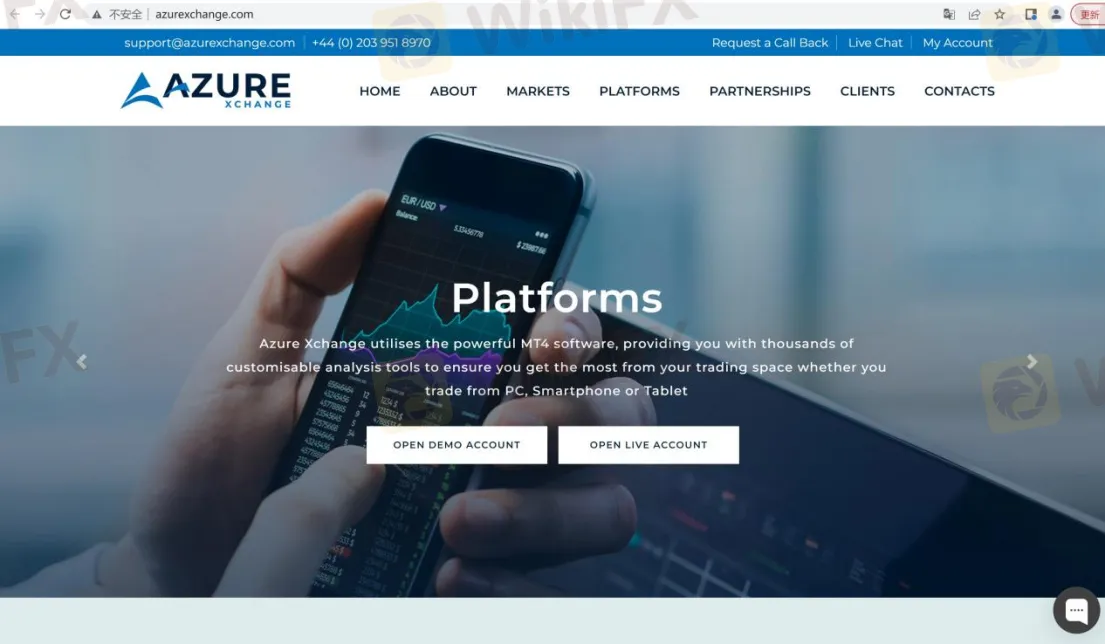

Azure Xchange is allegedly a forex and CFD broker registered in the United States that claims to provide its clients with over 200 tradable financial instruments with leverage up to 200:1 and spreads from 0.0 pips on the MT4 for PC, Smartphone or Tablet trading platforms, as well as 24-hour multilingual customer support service. Here is the home page of this brokers official site:

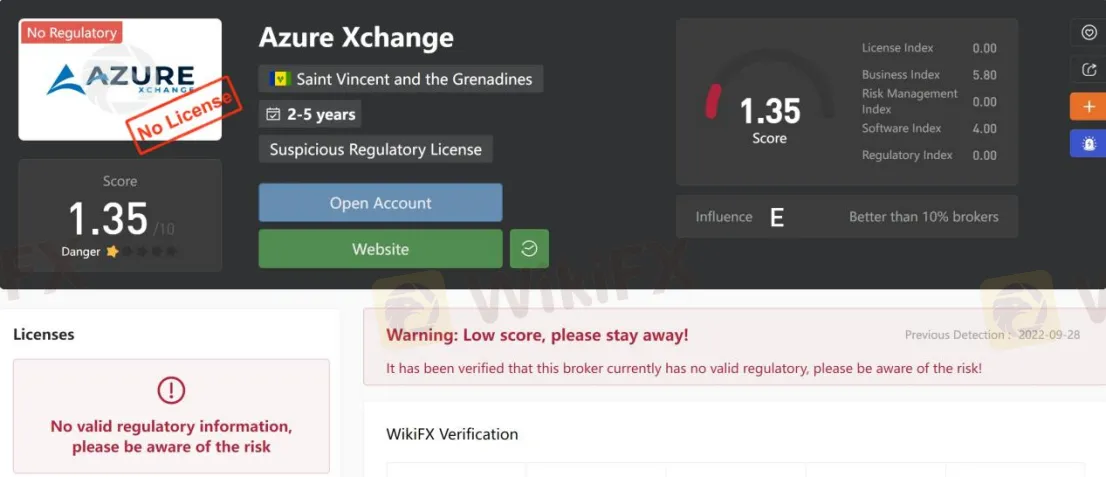

As for regulation, it has been verified that Azure Xchange does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and it receives a relatively low score of 1.35/10. Please be aware of the risk.

Market Instruments

Azure Xchange advertises that it offers access to more than 200 tradable instruments in financial markets, including forex, commodities and CFDs.

Account Types

Azure Xchange claims to offer demo and live accounts. However, the broker says nothing about the minimum initial deposit requirement to open an account.

Leverage

The leverage provided by Azure Xchange is capped at 200:1. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

Azure Xchange claims that the spread starts from 0.0 pips.

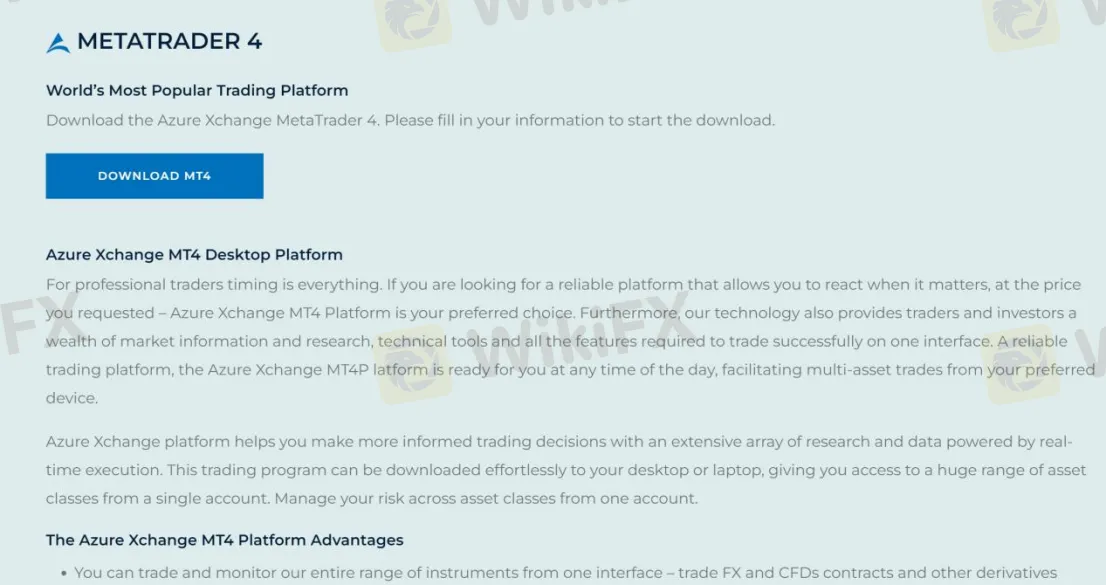

Trading Platform Available

Platforms available for trading at Azure Xchange are MT4 for PC, Smartphone or Tablet. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

Azure Xchange says to work with Bank Wire transfers only. The broker says it does not charge fees for withdrawing funds by bank wire transfer over $150. While for any withdrawal of more than $150, it will cover the bank charges from our side. Fees can be applicable dependent on your location and method of transfer. Withdrawal requests are processed within 24 hours after being received. The time that withdrawals arrive in the bank account depends on the country the money is sent. Standard bank wire transfers can take up to 5 working days.

Customer Support

Azure Xchanges customer support can be reached by telephone: +44 (0) 203 951 8970, email: support@azurexchange.com, info@azurexchange.com, live chat, send messages online to get in touch or request a callback. Company address: Suite 305, Griffith Corporate Centre, PO Box 1510, Beachmont, Kingstown, St. Vincent and the Grenadines.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

Understanding the New York Forex Trading Session Time in the Philippines

The forex market operates 24 hours a day, 5 days a week, with different trading sessions that overlap and offer various trading opportunities. One of the most active trading sessions is the New York session, which plays a crucial role in the global forex market. If you're in the Philippines, understanding when the New York session overlaps with local time is essential for maximizing your trading potential.

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Italy’s Securities Regulator Consob Orders Shutdown of 6 Illegal Financial Service Websitese

Italy’s financial regulator, Consob, has ordered the shutdown of six unauthorized financial service websites to combat illegal financial activities and protect investors. This action is based on regulatory powers granted under the 2019 “Crescita Decree.” Since 2019, Consob has blocked 1,211 fraudulent websites. Investors can use WikiFX to verify compliance and avoid investment scams.

WikiFX Broker

Latest News

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

RBI: India\s central bank slashes rates after five years

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Rate Calc