Fin Cap FX Market -Some Important Details about This Broker

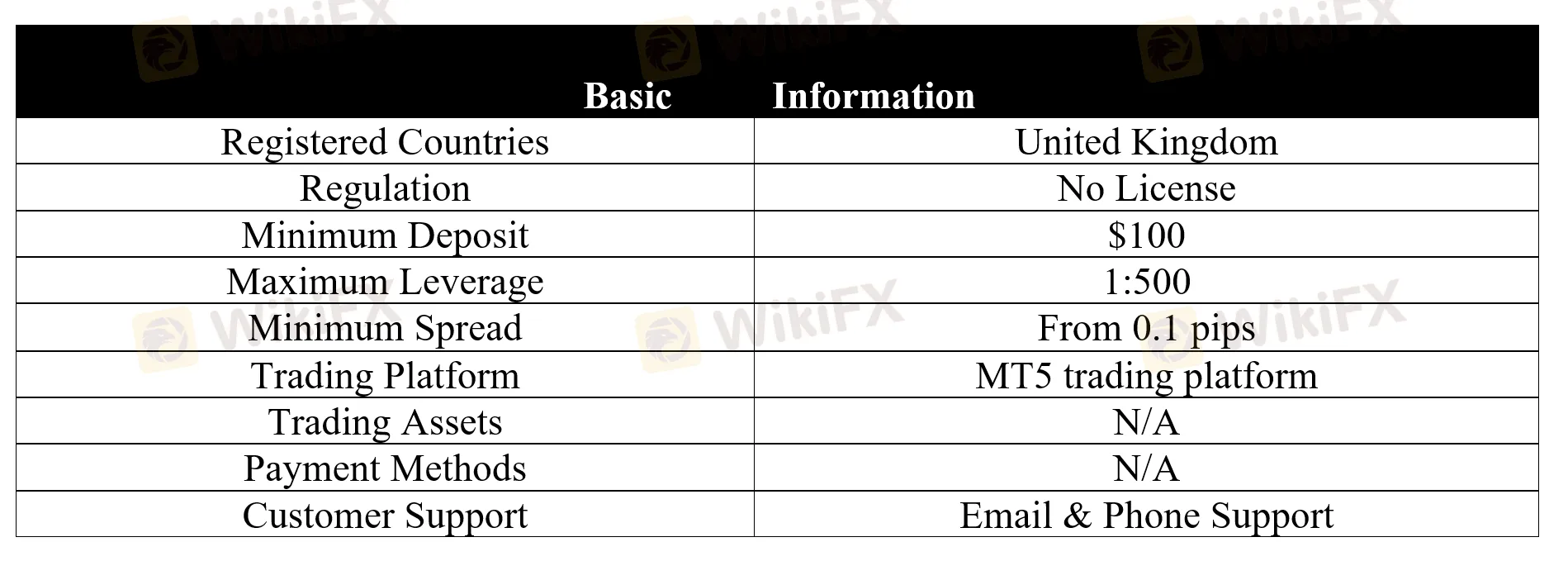

Abstract:Registered in the United Kingdom, Fin Cap FX Market presents itself as a forex broker providing easy access to a massive financial market. With the Fin Cap FX Market platform, four types of trading accounts can be chosen from, with the minimum deposit to open a Standard account starting at $500, and the maximum trading leverage that traders can use is up to 1:1:500. Fin Cap FX Market does not hold any regulatory license to show it operates legally. Please be aware of the risk.

Since Fin Cap FX Market 's official website (https://fincapmarket.com/) is now down, we had to resort to scouring other websites for relevant information in order to construct a rough picture of the company's forex broker operations.

General Information

Registered in the United Kingdom, Fin Cap FX Market presents itself as a forex broker providing easy access to a massive financial market. With the Fin Cap FX Market platform, four types of trading accounts can be chosen from, with the minimum deposit to open a Standard account starting at $500, and the maximum trading leverage that traders can use is up to 1:1:500.

Fin Cap FX Market does not hold any regulatory license to show it operates legally. Please be aware of the risk.

Account Types

Fin Cap FX Market provides four tiered trading accounts to accommodate different traders trading needs, namely Standard, Premium, Elite and Professional accounts. To open a Standard account, $100 is all you need to take if you are willing to bear the risk of trading with an unregulated broker. The Premium account requires a minimum deposit of $500 and the Elite account asks for an initial deposit of $5,000. The professional account is designed for professional and institutional traders, and traders who want to try this account need to fund at least $10,000.

Leverage

With regard to trading leverage, it varies depending on different types of trading accounts, ranging from 1: 200 to 1:500. Fin Cap FX Market allows its clients to use leverage of up to 1:500, much higher than the levels regarded appropriate by many regulators. This is the typically tactic employed by offshore brokers trying to attract more investors.

Since leverage can magnify gains as well as losses, it can also cause serious fund losses, especially to inexperienced traders. Therefore, it is wise for beginners to choose the smaller size no more than 1:10 until they gain more trading experience.

Trading Platform

Fin Cap FX Market provides access to the industry-leading MT5 trading platform, which features robust charting package, multiple technical indicators, user-friendly interface.

Negative Reviews

Some traders shared their terrible trading experience on the Fin Cap FX Market platform, saying that this broker has eaten his 28,000-rupee deposit, with nobody response his withdrawal support. Come to WikiFX to see the whole story.

Customer Support

If clients have any inquiries or trading-related issues can also get in touch with this broker through the following channels:

Telephone: +44 2080896133

Email: support@fincapmarket.com

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Read more

VPFX Secures UAE SCA License, Expands FX and CFDs Services

VPFX obtains UAE SCA Category Five license, enabling FX and CFDs promotion. Learn about its expansion and broker services at vpfx.net.

Scam Exposed: GlobTFX Deceives Another Investor

This article will focus on sharing the testimonies of victims deceived by GlobTFX's false profit claims, revealing how the platform responds to user complaints and demands for compensation with fraudulent tactics.

Key Risks and Downsides of Forex Trading Explained

Discover the key risks and downsides of forex trading, including market volatility, leverage dangers, and emotional challenges. Learn how to trade wisely.

eToro Review 2025: Trading Accounts & Withdrawals to Explore

eToro is an intuitive online trading platfrom that features social trading solutions, a unique being in the industry, with great popularity among both novices and seasoned traders. On the eToro platform, traders can trader over greater amount of stocks and ETFs with zero commission charged,anencouraging feature was later adopted by many of its competitors. 55 currencies can be traded, with spreads starting at 1 pip (typically on the euro/usd pair), not that competitive, and a trading fee of 1% trading fee of 1% applies to crypto trading. Opening a trading account is quite easy for investors, and demo accounts (funded with $100,000 virtual money) are also provided to enhance beginners' trading courage. However, a major disencouraging point is that this broker has a more limited platform options, only eToro proprietary trading platform and MetaTrader (MT4) supported.

WikiFX Broker

Latest News

EBSWARE Prop Launches Forex Trading Tournaments for Brokers

Key Risks and Downsides of Forex Trading Explained

How a Crypto Scam Cost Company Manager RM2.56 Million

TD Bank to Sell $14.9 Billion Schwab Stake, Repurchase Shares

Warning Against Agra Markets: Stay Cautious!

Scam Exposed: GlobTFX Deceives Another Investor

Trump tariffs: Retaliate or negotiate - what will US partners do next?

Hacker Who Breached SEC Account and Falsely Announced Bitcoin ETF Approval Faces Trial

Oil Prices Fluctuate as Iran and Trump Clash!

Best Regulated Forex Brokers Offering Daily Trading Signals

Rate Calc