WikiFX Review: the score of Swiss Markets is reduced due to recent complaints

Abstract:Swiss Markets raises our concern as there are a lot of complaints arising there. Is this broker still as trustworthy as it was before? WikiFX conducted a comprehension review on this broker to assist you in better understanding the truth; we will analyze this broker's dependability based on specific information such as regulation, exposure, and so on.

If you want to know whether Swiss Markets is a reliable forex broker or not, please continue to read.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of Swiss Markets based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 38,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether Swiss Markets is a scammer or not, we evaluated this broker from different aspects, such as regulatory status, exposure, etc.

1. Evaluate the reliability of Swiss Markets based on its general information and regulatory status

To understand Swiss Markets better, we explore Swiss Markets by analyzing three main perspectives:

A. General Info of Swiss Markets

B. Regulatory Status

A. General Info of Swiss Markets

Swiss Markets general info has been shown below:

Established in 2013, Swiss Markets is a Cyprus registered online Forex and CFD broker. It provides investors with trading assets in Forex, Metals, Energy, Commodities, and Indices. This broker offers a range of underlying assets, including foreign exchange, metals, energy, commodities, and indices.

Minimum Deposit

Swiss Markets Switzerland offers two types of trading accounts, both with straight-through-processing mode: Classic STP account and Raw STP account. The minimum initial deposit for both accounts is $200, the base currencies of the accounts are EUR, USD, and GBP, the minimum trade size is 0.01 lots, hedging allowed.

Leverage

Retail traders who open an classic STP account can use trading leverage up to 1:30, while professional traders in this accounts can leverage up to 1:500. As for the leverage in the Raw STP account, the trading leverage availbale for retail traders is capped at 1:30, while for professional traders, they can apply the higher leverage up to 1:200.

Spreads & Commissions

The Swiss Markets Classic STP account has a minimum spread of 0.9 pips for EURUSD, 22 pips for XAUUSD, and 55 pips for USOil. The minimum spread for the Raw STP account is 0 pips for EURUSD with a commission of 11 USD per lot, 18 pips for XAUUSD with a commission of 5 USD per lot, and 35 pips for USOil with a commission of 5 USD per lot. All indices for both accounts have fixed spreads at 1 pip, with a commission of $2 per lot.

Trading Platforms

Swiss Markets offers investors the market-leading and highly popular MT4 trading platform, as well as MT4 Mac, MT4 iOS, MT4 Android, and MT4 Web.

Deposit and withdrawal

Swiss Markets supports traders to deposit and withdraw funds to and from their investment accounts via various methods such as Visa, MasterCard, Maestro, PostePay, SOFRT, eps, iDEAL, Skrill, Neteller, and wire transfer. Swiss Markets states that no fees are charged to traders for deposits and withdrawals.

B. Regulatory Status

What is a Legitimate License?

l The legitimate license is the business license issued by the financial regulatory institution of each country/region.

l Holding a license means that the broker is recognized and regulated by the regulatory authority, therefore your money is under the protection to some extent.

l Whether a forex brokerage firm holds a legitimate license or not is one of the important factors to evaluate the reliability of forex brokers.

l The content of the regulation and the difficulty of obtaining a license vary with the country and agency issuing the license.

The legitimate license of Swiss Markets

Swiss Markets is part of BDSwiss Holdings PLC, and this company is currently regulated by the Cyprus Securities and Exchange Commission (CySEC) and holds a full license under its regulation, license number: 199/13.

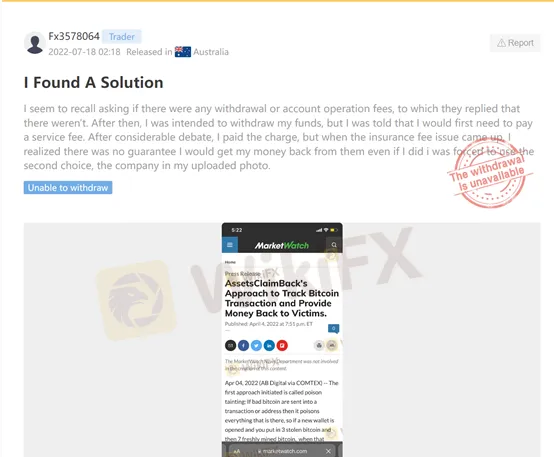

2. Exposure related to Swiss Markets on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

3. Special survey about Swiss Markets from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments etc |

| Risk Management index: the degree of asset security |

Swiss Markets has been given by WikiFX a decent rating of 6.52/10.

B. Field Investigation

l To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

l On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

l WikiFX did make an on-site survey on Swiss Markets in 2019 and successfully found their office.

4. Conclusion:

It is no doubt that Swiss Markets is a solid and regulated broker. However, as you can see, the score of this broker on WikiFX has been reduced due to too many complaints. We advise you to be aware of the potential risks. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself. If you have any problems with this broker, please do not hesitate to contact WikiFX. The global customer service of WikiFX is +234-706 777 7762 on WhatsApp. Or you can call +65-31290538. We are willing and ready to help you out.

Click on Swiss Markets' WikiFX page for details

Read more

How to Automate Forex and Crypto Trading for Better Profits

Find out how automating Forex and crypto trading is changing the game. Explore the tools, strategies, and steps traders use to save time and maximize profits.

Is Infinox a Safe Broker?

INFINOX, founded in 2009 in London, UK, is a regulated online broker under the UK FCA. It offers diverse trading instruments like forex, stocks, commodities, indices, and futures. Clients can choose between STP and ECN accounts and access educational resources. With 24/7 customer support, INFINOX aims to empower traders with reliable tools and guidance.

Is Your Zodiac Sign Fated for Stock Market Success in 2025?

The idea that astrology could influence success in the stock market may seem improbable, yet many traders find value in examining personality traits linked to their zodiac signs. While it may not replace market analysis, understanding these tendencies might offer insights into trading behaviour.

Tradu Introduces Tax-Efficient Spread Betting for UK Traders

Tradu’s introduction of tax-efficient spread betting and groundbreaking tools like the Spread Tracker signals a new era of accessible, competitive, and innovative trading solutions for UK investors.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Rate Calc