Smart FX Vest

Abstract:Smart FX Vest appears to be an unregulated online trading platform that offers 250+ trading instruments, including Forex, CFDs on Shares, Futures, Indices, Metals, and Energies. Additionally, it claims to provide its clients with leverage up to 1:1000, floating spreads from 0.5 pips, and commission-free trading via 3 different live account types.

Note: Smart FX Vest's official website - https://smartfxvest.com/ is currently inaccessible normal.

| Smart FX Vest Review Summary | |

| Founded | / |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | 250+, Forex, CFDs on Shares, Futures, Indices, Metals, Energies |

| Demo Account | / |

| Leverage | Up to 1:1000 |

| Spread | From 2 pips (Classic account) |

| Trading Platform | / |

| Min Deposit | $100 |

| Customer Support | Live chat, contact form |

| Email: support@SmartFxVest.com | |

| Regional Restrictions | The United States, Cuba, Iraq, Myanmar, North Korea, and Sudan |

Smart FX Vest appears to be an unregulated online trading platform that offers 250+ trading instruments, including Forex, CFDs onShares, Futures, Indices, Metals, and Energies. Additionally, it claims to provide its clients with leverage up to 1:1000, floating spreads from 0.5 pips, and commission-free trading via 3 different live account types.

Pros and Cons

| Pros | Cons |

| Various market instruments | Unfunctional website |

| Three account types | Unregulated status |

| No commissions | High spreads on the Classic account |

| Flexible leverage ratios | Only email support |

| Multiple payment options | Regional restrictions |

| No deposit and withdrawal fees | |

| Live chat support |

Is Smart FX Vest Legit?

No, Smart FX Vest operates without valid regulation, which means trading on this platform your fund is not safe.

What Can I Trade on Smart FX Vest?

In its advertising, Smart FX Vest claims to provide access to more than 250 trading instruments, including Forex, CFDs on shares, futures, indices, metals, and energies.

| Trading Asset | Available |

| Forex | ✔ |

| CFDs | ✔ |

| Metals | ✔ |

| Energies | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Futures | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Leverage/Fees

Smart FX Vest claims to offer 3 types of trading accounts - Classic, Pro and ECN, with minimum initial deposit requirements of $100, $500 and $10,000 respectively.

| Account Type | CLASSIC | PRO | ECN |

| Min Deposit | $100 | $500 | $10,000 |

| Max Deposit | $1,000 | $5,000 | Unlimited |

| Max Leverage | 1:1-1:500 | 1:1-1:400 | 1:1-1:100 |

| Spread | From 2 pips | From 1.2 pips | From 0.5 pips |

| Commission | ❌ | ||

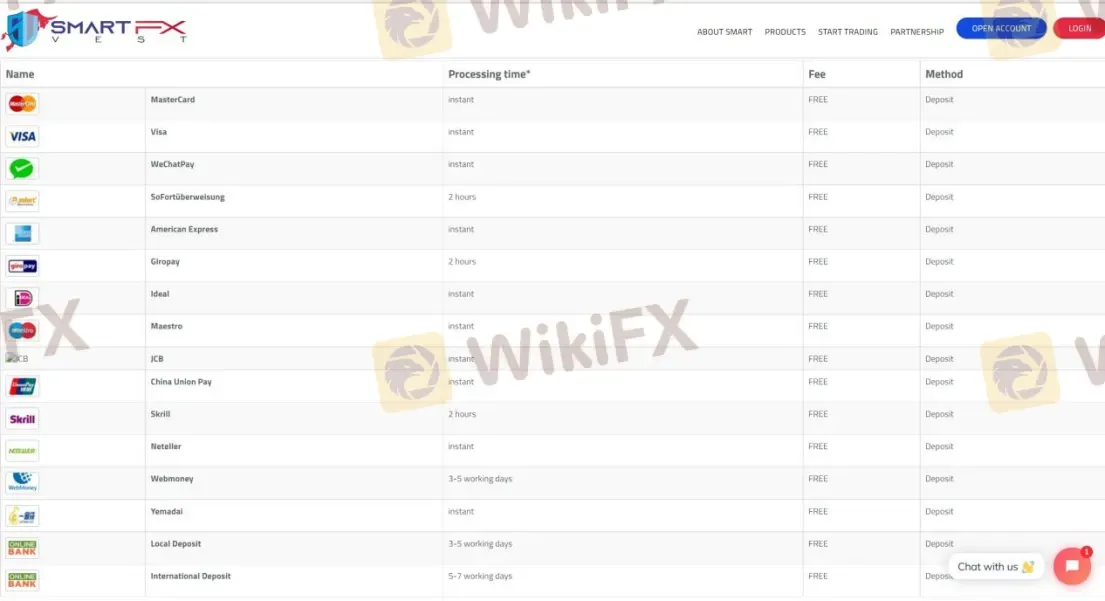

Deposit and Withdrawal

| Payment Option | Min Deposit | Deposit/Withdrawal Fee | Deposit/Withdrawal Time |

| MasterCard | $100 | ❌ | Instant |

| Visa | |||

| WeChatPay | |||

| SoFortüberweisung | 2 hours | ||

| American Express | Instant | ||

| Giropay | 2 hours | ||

| Ideal | Instant | ||

| Maestro | |||

| JCB | |||

| China Union Pay | |||

| Skrill | 2 hours | ||

| Neteller | Instant | ||

| WebMoney | 3-5 working days | ||

| Yemadai | Instant | ||

| Local Deposit and International Deposit | 5-7 working days |

Read more

Unmasking the ‘Datuk’: The Anatomy of a RM638,205 Investment Scam

Authorities in Malaysia have launched an extensive investigation into a fraudulent stock investment scheme, which has resulted in losses amounting to RM638,205.

Unmasking the ‘Datuk’: The Anatomy of a RM638,205 Investment Scam

Authorities in Malaysia have launched an extensive investigation into a fraudulent stock investment scheme, which has resulted in losses amounting to RM638,205.

ATFX Enhances Trading Platform with BlackArrow Integration

ATFX integrates the BlackArrow trading platform, offering advanced tools for forex, crypto, and stocks with automation and real-time analytics for traders.

Understanding Currency Intervention in Forex Markets

Currency intervention involves actions by a nation's central bank or monetary authority to influence the value of its currency in the foreign exchange (forex) market. These interventions aim to achieve specific economic objectives, such as controlling inflation, stabilizing the currency, or influencing trade balances.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

ATFX Enhances Trading Platform with BlackArrow Integration

Become a Full-Time FX Trader in 6 Simple Steps

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Rate Calc