“You will never get your money back if you invest in a scam called VICTORIA CAPITAL," victims said.

Abstract: Recently one forex broker called VICTORIA CAPITAL caught our attention because traders told WikiFX that this broker does not allow them to withdraw and even put forward unreasonable demands. Protecting the legitimate rights and interests of forex traders are always the primary concern of WikiFX. In this article, we will expose this case to you in detail based on the evidence we gathered.

About WikiFX

WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 40,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

About VICTORIA CAPITAL

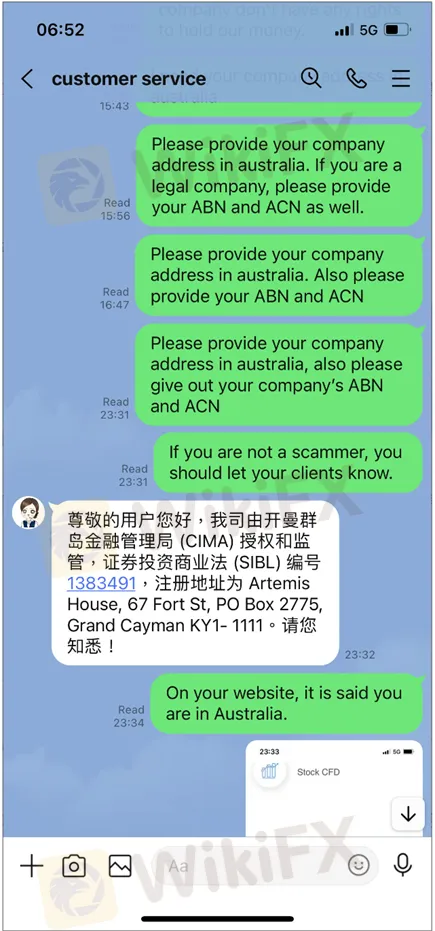

VICTORIA CAPITAL is an online forex broker registered in Australia. WikiFX has received a lot of complaints against this broker recently. In addition, we find this broker is not regulated and WikiFX has given this broker a low rating of 1.39/10. Please note that investing in an unregulated broker with a low WikiFX score is pretty dangerous for your fund safety.

According to our investigation, this brokers original name is Rui win, it changed Rui win to VICTORIA CAPITAL not long ago. We do not the reason why this broker changed its name, but we know that many scam brokers like to change their name in order to cover their disreputable behavior.

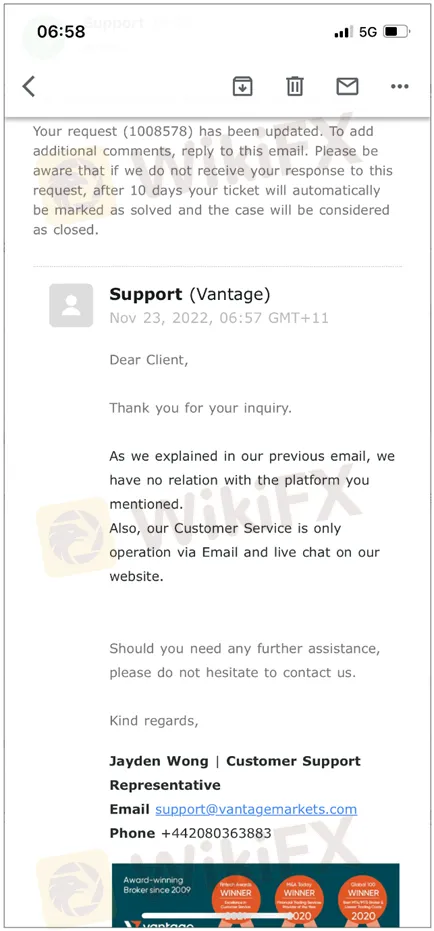

The victim requires the withdrawal, however, this broker asks extra tax fee for the withdrawal. he invested a lot of money with them, but the victim haven't yet received any returns. The victim can't get to the profits in his account unless he pays a commission and tax fee. “ I recently almost spent all of my cash with VICTORIA CAPITAL, which absolutely aided the recovery process. I never get a response they automatically stopped communicating with me when I request for withdrawal.” Even worse, this broker did not give any response to this trader.

Conclusion

We believe that VICTORIA CAPITAL is getting involved in a scam. This broker eventually took the victims money away fraudulently without giving any response to the victim. The reason why WikiFX exposed this case to the public is to remind all traders of the potential risks. All traders should be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim and other traders hoping to find more evidence to help resolve the problem. Please stay tuned for more information.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Read more

Forex Trading Mastery: The Ultimate Winning Formula

The foreign exchange market is inherently volatile, with its sharp fluctuations driven not only by changes in the global economic landscape but also by large-scale speculative capital and the influence of major market players, further intensifying its instability.

Gold Surge News: Central Banks Expand Gold Reserves—Will Prices Rise?

Central banks have purchased over 1,000 tons of gold annually for three consecutive years, and 2024 is no exception. However, the key question remains: as demand for gold continues to rise, will its price keep increasing?

5 Arrested in the TriumphFX Investment Scam Investigation

Malaysian authorities have intensified their investigation into the TriumphFX foreign exchange investment scam, resulting in the arrest of five individuals linked to the fraudulent scheme.

Notice: The WikiFX Simulated Trade Weekly Competition has been suspended for one week

Due to an upcoming product upgrade to enhance your overall trading simulation experience, the WikiFX Simulated Trading Weekly Contest will be temporarily suspended from March 10 to March 16. The contest will resume on March 17 with a host of improvements.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc