24ProfitMarket

Abstract:Designed in 2017, 24Profit Market is an unregulated internet trading platform. Among the several financial tools it provides are forex, indices, equities, commodities, and cryptocurrencies.

| 24ProfitMarket Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Not mentioned |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Demo Account | × |

| Spread | From 0.0 pips (claimed) |

| Trading Platform | MetaTrader 4 web platform, MetaTrader 4 mobile platform |

| Min Deposit | €250 |

24ProfitMarket Information

Designed in 2017, 24Profit Market is an unregulated internet trading platform. Among the several financial tools it provides are forex, indices, equities, commodities, and cryptocurrencies.

Pros and Cons

| Pros | Cons |

| Offers a range of financial instruments | Unregulated |

| Provide MT4 | High withdrawal fees |

| Multiple account types |

Is 24ProfitMarket Legit?

24ProfitMarket operates without any regulations.

What Can I Trade on 24ProfitMarket?

24ProfitMarket offers trading in MANY financial instruments.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

Account Types

24ProfitMarket provides 3 types of live trading accounts but does not offer demo or Islamic accounts.

| Account Name | Minimum Deposit | Bonus | Suitable For |

| Bronze | €250 | 20% | Beginners |

| Platinum 1 | €750 | 30% | Intermediate traders |

| Platinum 2 | €1,000 | 50% | Advanced traders |

24ProfitMarket Fees

24ProfitMarket's fee structure is high compared to standards.

Trading Fees

The broker offers competitive spreads starting from 0.0 pips. But it doesn't mention other trading fees.

Trading Platform

24ProfitMarket offers the MetaTrader 4 (MT4) platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 | ✔ | Web, Android, iOS | Both novice and experienced traders |

Deposit and Withdrawal

Deposit fees

24ProfitMarket charges fees for withdrawals and has a minimum deposit requirement of at least €250.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Credit/Debit Cards | €250 | Not specified | Not specified |

| Wire Transfer | €250 | Not specified | Not specified |

| E-Wallets | €250 | Not specified | Not specified |

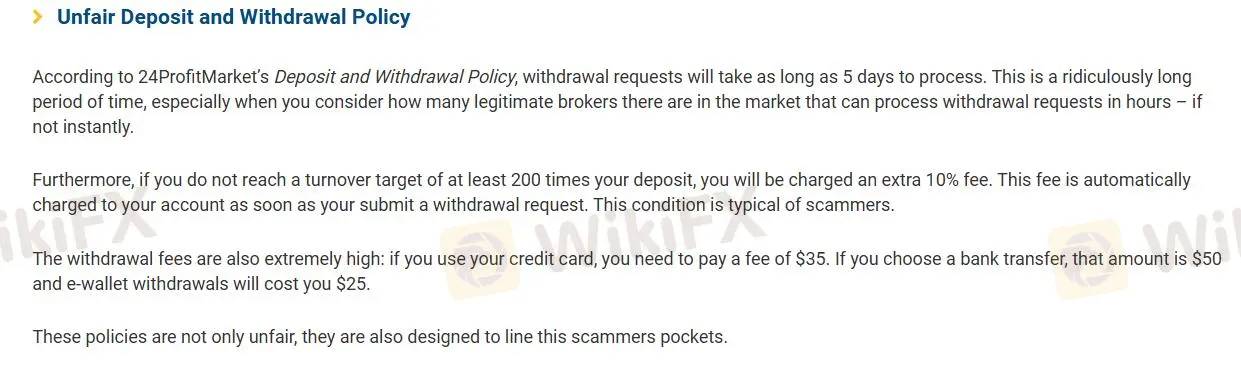

Withdrawal fees

The broker imposes high withdrawal fees of $35, and charges additional charges for not meeting certain trading volume requirements.

| Fee Type | Amount |

| Credit Card Withdrawal | $35 |

| Bank Transfer Withdrawal | $50 |

| E-wallet Withdrawal | $25 |

| Additional Fee for Not Meeting 200x Turnover | 10% of withdrawal amount |

Read more

Using Trendlines in Technical Analysis

Trendlines are a cornerstone of technical analysis, offering traders a visual guide to understanding market movements. By connecting specific price points, such as higher lows in an uptrend or lower highs in a downtrend, trendlines define the market’s trajectory.

Mastering Support and Resistance in Forex Trading Success

Know why support and resistance levels are crucial in Forex trading, the best tools to identify them, and how they impact trading success.

Hidden Forex Fees That Can Drain Your Profits

Many traders focus on profits when entering the forex market. However, the costs of trading can silently eat into those profits. Brokers often advertise low fees and tight spreads, but hidden costs can add up. Understanding these fees is crucial for managing your trading expenses.

Why Do Some Brokers Block Your Withdrawals?

Withdrawal issues are among the most frustrating experiences for traders. Many brokers operate smoothly, but some delay or refuse to release funds. These delays can be stressful, especially for traders who rely on timely access to their profits. Understanding why brokers act this way can help you avoid falling victim to such situations.

WikiFX Broker

Latest News

Top Regulated Forex Brokers with Prop Trading Options

Forex Regulators Around the World: Who’s the Strictest?

What Happens When a Broker Goes Bankrupt?

Woman Scammed Out of RM200,000 in Investment Fraud

XS.com Launches AI Insights to Transform Trading Behavior

Why Do Some Brokers Block Your Withdrawals?

FCA Cautions Against ALT-COINFX

Unlocking the Secrets of Prop Trading: How to Succeed in Proprietary Trading Firms

Tether’s $13B Profits in 2024 Amid UK Regulatory Scrutiny

Philippine Authorities Bust Manila Online Scam Farm, Arrest 100

Rate Calc