TFX Pro-Some Important Details about This Broker

Abstract:TFX Pro seems to be an investment platform registered in the United States, providing access to a massive financial market, such as Currency Pairs, Commodities, Currencies, Stocks and more. With the TFX Pro platform, three trading accounts are available, with the lowest required opening deposit being $250, and traders can employ a maximum leverage of 1:400 on their positions. TFX Pro is the trading brand owned and operated by Creative Trade Ltd, with registration number 233928 and registered address at House of Francis, 303, IIe Du Port, Mahe, Seychelle. However, when it comes to regulation, TFX Pro disappoints us as it is not authorized or regulated by any regulatory authority. Thats why WikiFX has given it an extremely low score of 1.09/10.

| Basic | Information |

| Registered Countries | United States |

| Regulation | No License |

| Company Address | Creative Trade Ltd., |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:400 |

| Minimum Spread | From 0.0 pips |

| Trading Platform | Web App |

| Trading Assets | Forex, Indices, Cryptocurrency, Commodities, Stocks |

| Payment Methods | N/A |

| Customer Support | Email & Phone support |

General Information

TFX Pro seems to be an investment platform registered in the United States, providing access to a massive financial market, such as Currency Pairs, Commodities, Currencies, Stocks and more. With the TFX Pro platform, three trading accounts are available, with the lowest required opening deposit being $250, and traders can employ a maximum leverage of 1:400 on their positions.

TFX Pro is the trading brand owned and operated by Creative Trade Ltd, with registration number 233928 and registered address at House of Francis, 303, IIe Du Port, Mahe, Seychelle.

However, when it comes to regulation, TFX Pro disappoints us as it is not authorized or regulated by any regulatory authority. Thats why WikiFX has given it an extremely low score of 1.09/10.

Market Instruments

Clients can get access to a wide selection of trading assets, five classes of trading assets covering up to 80 cryptocurrency pairs, currency pairs, indices, stocks, commodities all available through this brokerage platform.

Account Types

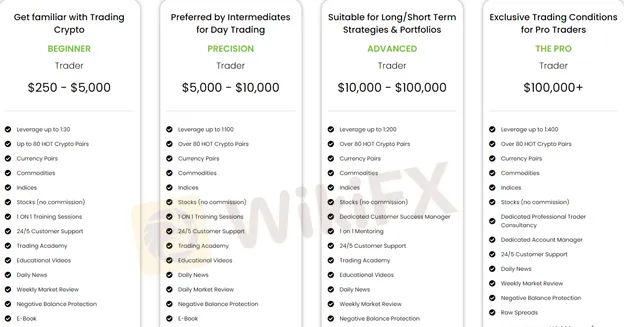

Beginner, Precision, Advanced and The Pro accounts are the available options for traders, making them accessible to both novice and experienced traders. However, the minimum deposit set by each account type is quite high in comparison to many brokers, with the Beginner ranging from $250 to $5,000, the Precision accounts ranging from $5,000 to $10,000, the advanced accounts ranging from $5,000 to $10,000, the Advanced accounts ranging from $10,000 to $100,000, and the Pro accounts requiring a deposit of over $100,000.

Spreads & Commissions

Trading accounts set the commissions and spreads. When it comes to the spreads offered, TFX Pro is not a good choice, for spreads offered by each account is quite wide, with the Beginner accounts from 3.0 pips, the Precision accounts from 2.5 pips, the Advanced accounts from 2.0 pips, the Pro account starting from 0.0 pips.

Leverage

Maximum leverage for major forex is 1:30 in Europe and Australia, and 1:50 in the U.S. and Canada, while TFX Pro enables its clients to use leverage of up to :400. This is crazily higher than the proper amount considered appropriate by most regulators.

Since leverage can amplify both gains and losses, it can result in devastating losses for investors who lack experience. If you're just starting out in the trading world, it's best to stick with the lower size.

Trading Platform

TFX Pro, this unregulated broker, fails to offer the MT4 or MT5 trading platform, and what it provides is the Web App and Mobile App.

Payment Methods

TFX Pro does not say much about its deposit and withdrawals. But in its withdrawal policies, we notice some withdrawal rules:

1. To request a partial or complete withdrawal of funds from your account, click on “withdrawal request” in your account.

2. This broker needs to take up to 7 business days to process clients withdrawal requests (Bear in mind that most legit brokers only takes up to 2 working days to process withdrawal requests).

3. Withdrawals must be performed only through the same bank account or credit/debit cards that you used to deposit the funds, when it comes to withdrawals, clients must be required to provide additional information and documents

4. Initial investments into the Crypto-AI trader and MAM accounts will be held in the clients TFX Pro trading account for a period of 30-days before withdrawals are permitted.

Overall, the withdrawal policy is not that friendly in comparison to most legit brokers. Please be aware of the risk involved.

Customer Support

Clients have any inquiries or trading-related issues can get in touch with this broker through the following contact channels:

Telephone: + 44 1795501562

Email: support@tfxpro.io

Company Address: 40 Bank Street Canary Wharf London

Post Code E14 5NR Floor 30

Also, a contact form for you to fill up some basic information and wait to be contacted.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Pros & Cons

| Pros | Cons |

| Multiple trading account options | No regulation |

| Limited trading assets | |

| High Deposit | |

| Unfriendly withdrawal policies | |

| Poor customer support |

Frequently Asked Questions

Is TFX Pro regulated?

No, TFX Pro is not regulated.

What is the maximum leverage provided by TFX Pro?

The maximum trading leverage provided by TFX Pro is up to 1:400.

What types of trading accounts doe TFX Pro provide?

TFX Pro provides four types of trading accounts, including Beginner, Precision, Advanced and The Pro accounts.

Read more

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

Teacher Lost Life Savings in WhatsApp Investment Fraud

A Malaysian teacher recently became the victim of an elaborate investment scam, losing more than RM200,000 after being lured into a fraudulent Bitcoin scheme through WhatsApp.

Unmasking a RM24 Million Forex Scam in Malaysia

Authorities in Malaysia have identified the prime suspect behind a foreign exchange (forex) investment fraud that has caused losses exceeding RM24 million.

How to Choose the Best Forex Pairs? Avoid Common Trading Pitfalls

Choosing the right forex pair is crucial for success. This guide explores volatility, trading sessions, and costs to help traders make informed decisions and maximize profitability.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Rate Calc