Grand Capital

Abstract:Grand Capital is a financial brokerage firm that offers a wide range of trading instruments, including forex, cryptocurrencies, stocks, indices, spot metals, energies, ETFs, and other CFDs. The company provides multiple account types tailored to different trading preferences and experience levels. While Grand Capital presents itself as a comprehensive trading platform, it is important to note that it lacks proper regulation, with no authorized license for operation. Traders considering Grand Capital should exercise caution and be aware of the associated risks of dealing with an unregulated entity.

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 5-10 years |

| Company Name | Grand Capital Ltd |

| Regulation | No Regulation |

| Minimum Deposit | $10 for Micro Account $100 for Standard, MT5, Swap Free, and Crypto Accounts $500 for ECN Prime Account |

| Maximum Leverage | Up to 1:500 for Standard, Swap Free, and Micro Accounts Up to 1:100 for ECN Prime and MT5 Accounts Up to 1:5 for Crypto Account |

| Spreads | Starting from 0.4 pips for commission-free accounts Commissions apply on certain account types |

| Trading Platforms | MetaTrader 4 (MT4) MetaTrader 5 (MT5) WebTrader |

| Tradable Assets | Forex, Cryptocurrencies, Stocks, Indices, Spot Metals, Energies, ETFs, CFDs on Soft Commodities, Grains, Bonds, and Meats |

| Account Types | Standard Account MT5 Account Micro Account ECN Prime Account Swap Free Account Crypto Account |

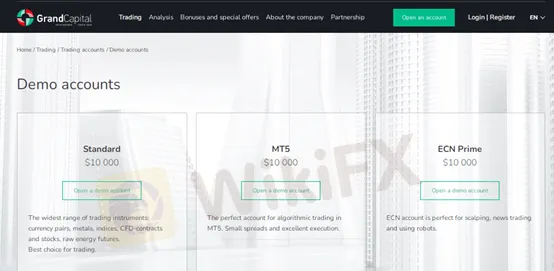

| Demo Account | Available with virtual funds of $10,000 USD for 30 days |

| Islamic Account | Available on Standard and Extended Swap-free accounts |

| Customer Support | Email, Phone, Chat Service, Callback Request, Regional YouTube Channels |

| Payment Methods | Bank Wire Transfer, Credit Cards, Debit Cards, Neteller, Skrill, Bitcoin, Help2Pay, Ethereum, FasaPay, Ripple, Perfect Money, and more |

Overview of Grand Capital

Grand Capital is a brokerage firm that provides traders with access to a diverse selection of financial instruments for trading. The platform offers over 50 currency pairs in the forex market, including major pairs like EUR/USD and GBP/USD, along with more than 60 cryptocurrency pairs, stocks from US, European, and Russian markets, 12 leading stock indices, spot metals such as gold and silver, energies like natural gas and crude oil contracts, seven popular ETFs, and various other CFDs. Additionally, binary options trading is available through their separate website, GC Option.

To cater to the needs of different traders, Grand Capital offers multiple account types. The Standard account is suitable for those interested in a wide range of assets, while the MT5 account is designed for algorithmic trading. The Micro account is tailored for beginners, the ECN Prime account caters to seasoned traders and scalpers, and the Crypto account is specifically for trading cryptocurrencies. Islamic swap-free accounts are also available for clients who adhere to Islamic finance principles.

It is important to note that Grand Capital operates without proper regulation. While it claims to have a license from a Common Financial Service License, the license type is “No Sharing,” and there is no information provided regarding the licensed institution's contact details or the effective and expiry dates of the license. The regulatory agency mentioned is the National Futures Association (NFA) in the United States, but Grand Capital is listed as unauthorized and exceeds the regulated business scope. Traders should exercise caution and carefully consider the risks associated with dealing with an unregulated broker.

Pros and Cons

Grand Capital offers several advantages to traders, including a diverse range of trading instruments and account types that cater to different preferences. Traders have access to popular trading platforms such as MetaTrader 4 (MT4), which provide comprehensive analysis tools and efficient trade execution. The company also supports multiple payment methods, making deposits and withdrawals for clients. However, one major drawback is the lack of regulation and authorized licensing, which raises concerns about the security and transparency of the brokerage. The absence of regulatory oversight means that traders may not have the same level of protection and recourse as they would with regulated brokers. It is crucial for potential traders to carefully consider these pros and cons before deciding to trade with Grand Capital.

Pros and Cons of Grand Capital:

| Pros | Cons |

| Diverse range of trading instruments | Lack of regulation |

| Multiple account options | Potential security and transparency concerns |

| Access to popular trading platforms | Limited trader protection |

| Support for various payment methods |

Is Grand Capital Legit?

Based on the information provided, Grand Capital is described as an unauthorized and unregulated entity. The broker, Grand Capital Ltd, is listed as having a Common Financial Service License, but it is mentioned that the license type is “No Sharing.” The website, address, email address, and phone number of the licensed institution are not provided, and there is no information about the effective date or expiry date of the license.

The regulatory agency mentioned is the National Futures Association (NFA) in the United States, and Grand Capital Ltd is listed with license number 0540363. However, it is stated that the official regulatory status is “Unauthorized.” The broker is also noted to exceed the business scope regulated by the NFA.

In summary, based on the information provided, Grand Capital does not appear to have valid regulation and is deemed unauthorized. It is important to exercise caution and consider the associated risks when dealing with an unregulated broker.

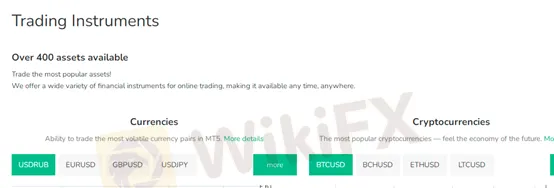

Market Instruments

Grand Capital offers a diverse range of market instruments for trading. Here is a brief overview of the popular instruments available:

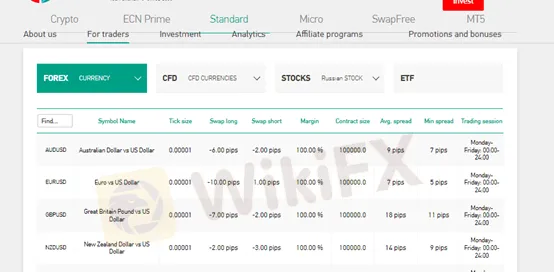

1. Forex: Grand Capital provides access to over 50 currency pairs, including major pairs like EUR/USD, GBP/USD, and USD/JPY.

2. Cryptocurrency: Traders can choose from over 60 cryptocurrency pairs, including popular options such as Bitcoin (BTC) and Ethereum (ETH).

3. Stocks: The platform offers trading opportunities in US, European, and Russian stocks. Traders can invest in well-known companies like Amazon and Apple.

4. Indices: Grand Capital covers 12 leading stock indices, including NASDAQ and FTSE 100, allowing traders to speculate on the performance of broader market segments.

5. Spot Metals: Precious metals like gold and silver are available for trading, providing an opportunity to take advantage of price movements in these commodities.

6. Energies: Traders can engage in energy trading with natural gas, as well as WTI and Brent crude oil contracts.

7. ETFs: Grand Capital offers access to seven popular exchange-traded funds (ETFs), including assets like QQQ.

8. Other CFDs: The platform also provides trading opportunities in soft commodities (e.g., coffee, sugar), grains (e.g., corn, wheat), bonds, and meats.

Additionally, Grand Capital offers binary options trading on their separate website, GC Option. This product covers more than 30 assets, including currency pairs, futures, and metals, offering call and put options with high payouts of over 85%.

| Pros | Cons |

| Wide selection of market instruments to trade | Limited availability of certain niche instruments |

| Access to diverse asset classes and markets | Higher risk associated with leveraged trading |

| Opportunities for portfolio diversification | Market volatility can result in potential losses |

| Potential for higher returns and profit opportunities | Limited educational resources for beginner traders |

| Binary options trading with high payouts | Dependence on market conditions and economic factors |

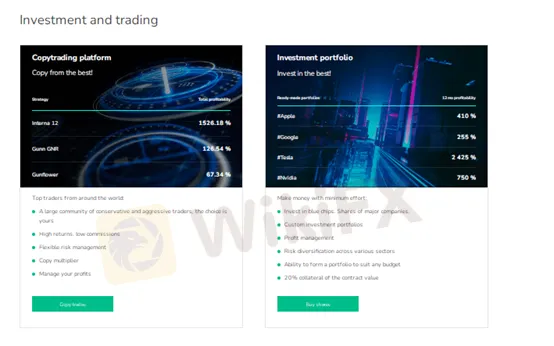

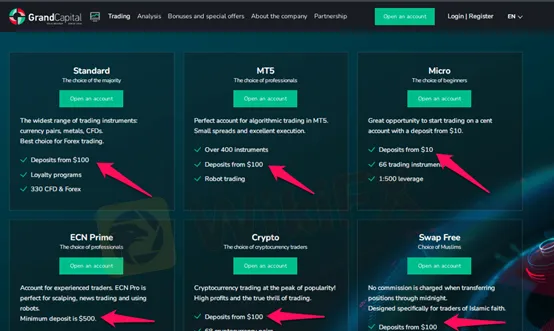

Account Types

Grand Capital offers a variety of account types to cater to the different needs and preferences of traders. Here is a brief description of each account type:

1. Standard Account: This account type is suitable for traders interested in a wide range of assets, particularly in the forex market. It requires a minimum deposit of $100 and offers the option to choose from eight different currencies as the account currency.

2. MT5 Account: Designed for algorithmic trading, the MT5 account is ideal for traders who prefer automated trading strategies. It requires a minimum deposit of $100 and operates on the MetaTrader 5 (MT5) platform.

3. Micro Account: The Micro account is tailored for beginners who want to start with smaller trade sizes and lower risk. It offers access to 66 popular instruments and requires a minimum deposit of $10.

4. ECN Prime Account: This account type is best suited for seasoned traders and scalpers who prioritize low spreads and fast execution. It requires a minimum deposit of $500 and provides an environment conducive to high-frequency trading.

5. Swap Free Account: Designed for Muslim traders, the Swap Free account eliminates overnight fees, making it compliant with Islamic finance principles. It requires a minimum deposit of $100 and offers trading without any interest charges.

6. Crypto Account: The Crypto account is specifically designed for trading cryptocurrencies. It provides access to 68 different cryptocurrencies and comes with the added benefit of an analyst to assist traders. The minimum deposit for this account type is $100.

Islamic Account:

Grand Capital provides Islamic swap-free trading accounts for clients who adhere to Islamic finance principles. The Islamic account option is available on both the Standard Swap-free and Extended Swap-free accounts. Clients from non-Islamic countries automatically receive the Extended Swap-free status on applicable trading accounts. This allows traders to engage in trading without incurring any swap or interest charges, making it compliant with Islamic principles.

Demo Account:

Grand Capital offers a free demo trading account, which is an excellent tool for beginners to practice trading in a risk-free environment. The demo account is designed to simulate real trading conditions, allowing users to experience the platform and test their strategies without using real money. The demo account is valid for 30 days, providing ample time for traders to familiarize themselves with the platform and gain confidence in their trading abilities. The demo account is preloaded with virtual funds of $10,000 USD, which can be used to place virtual trades and explore the features of the trading platform. Traders have full access to the trading terminal during the demo account period.

| Pros | Cons |

| Variety of account types tailored to different trading preferences | Lack of detailed information on specific features and benefits |

| Options for trading a wide range of assets and markets | Potential limitations or restrictions on certain account types |

| Availability of specialized accounts like MT5 and Crypto | Lack of transparency on account fees and charges |

| Islamic swap-free accounts available for adherents of Islamic finance principles | Limited information on trading conditions and leverage |

| Free demo account for practice and familiarization | Absence of specific benefits or advantages for certain accounts |

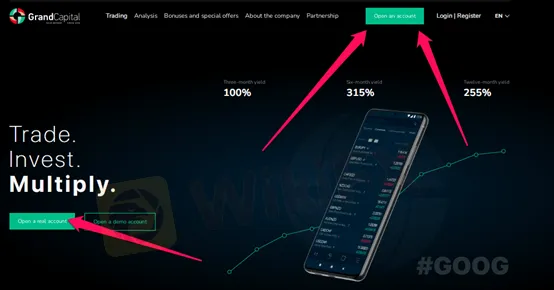

How to Open an Account?

Here is a step-by-step guide on how to open a Grand Capital account:

Step 1: Start Process

Visit the Grand Capital website's homepage and look for the option to “Open an account.” Click on it to begin the account opening process.

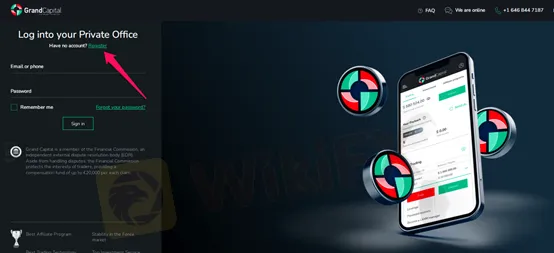

Step 2: Select Registration

On the following page, you will be presented with the options to either “Sign up” or “Register.” Choose the appropriate option to proceed.

Step 3: Complete Registration Details

Provide all the required personal information in the registration form. This may include your name, email address, phone number, country of residence, and any other requested details. Ensure that you enter accurate information.

Step 4: Verification of Account

After completing the registration process, an email will be sent to the email address you provided during registration. Check your inbox for this email and follow the instructions to verify your account. This step is crucial to activate your account and gain access to the trading platform.

Once your account is verified, you can log in to your Grand Capital account and start trading.

Leverage

Grand Capital offers varying leverage levels depending on the type of account.

For Standard, Swap Free, and Micro accounts, the leverage can go up to 1:500, with a 100% margin call and 40% stop-out level.

ECN Prime and MT5 accounts have leverage up to 1:100, with a 100% margin call and 80% stop-out level.

For Crypto accounts, the leverage is limited to 1:5, with a 100% margin call and 80% stop-out level.

Higher leverage can provide traders with increased buying power and the potential for higher profits, but it also carries a higher risk of larger losses. It's important for traders to carefully consider and manage their risk when utilizing leverage.

Fees & Spreads & Commissions

Grand Capital's fee structure includes both spreads and commissions. The spreads on the commission-free accounts, such as the Standard, Micro, and Swap-Free accounts, start at 0.4 pips, but they can go up to 1 pip on certain currency pairs. These spreads are considered relatively high compared to some other brokers.

Commissions are charged on several account types. The MT5 account has commissions ranging from $5 to $10 for forex, metals, indices, and energies. For CFDs on ETFs and stocks, the commission is 0.1%. Crypto accounts have a commission of 0.5%. ECN Prime accounts have commissions of $5 for forex and metals, $7 for indices, and 0.1% for CFDs on ETFs and stocks.

It's worth mentioning that the Micro account is an exception and does not charge any commissions. This account is suitable for traders who prefer commission-free trading.

It's important to consider both the spreads and commissions when evaluating the overall trading costs. The total trading costs for the EUR/USD pair on ECN accounts, taking into account the spread and commission, would amount to around 2.2 pips.

One positive aspect is that Grand Capital does not charge inactivity fees, which can be beneficial for traders who have periods of low trading activity.

| Pros | Cons |

| Commission-free trading on Micro accounts | Relatively high spreads on certain currency pairs |

| No inactivity fees | Commissions charged on several account types |

| No deposit or withdrawal fees | Total trading costs may be relatively high |

Deposit & Withdrawal

Grand Capital offers a range of deposit and withdrawal options. Here are the key points about deposit and withdrawal methods at Grand Capital:

Minimum Deposit: The minimum deposit requirement varies depending on the type of account. Most accounts require a minimum deposit of $100, except for the Micro account which has a minimum deposit of $10, and the ECN Prime Account which requires a minimum deposit of $500.

Deposit Methods: Grand Capital supports multiple deposit methods, including:

- Bank Wire Transfer

- Credit Cards

- Debit Cards

- Neteller

- Skrill

- Bitcoin

- Help2Pay

- Ethereum

- FasaPay

- Ripple

- Perfect Money, and more.

Withdrawal Methods: Traders can withdraw their funds using the same methods available for deposits. This ensures a streamlined process where funds are returned to the same source they were deposited from.

Processing Time: Deposits are usually processed instantly, and funds reflect in the trader's account within minutes. Withdrawals may take varying timeframes, typically between 1 to 5 business days, depending on the withdrawal method and the processing time of the financial institutions involved.

Trading Platforms

Grand Capital provides traders with a selection of trading platforms to cater to their preferences and trading needs. Here's a brief overview of the trading platforms offered by Grand Capital:

1. MetaTrader 4 (MT4) and MetaTrader 4 Mobile: MT4 is a widely recognized and popular trading platform among traders. It offers a comprehensive set of features and tools for efficient trading. With MT4, traders can access over 330 instruments, including currency pairs, spot metals, CFDs, stocks, indices, and futures. The platform is compatible with iOS and Android devices, allowing traders to trade on the go. It also supports a wide range of user indicators and expert advisors, enabling traders to customize their trading strategies.

2. MetaTrader 5 (MT5) and MetaTrader 5 Mobile: MT5 is the next generation of the popular MT4 platform. It retains the features that made MT4 successful while introducing new functionalities to meet the demands of modern traders. MT5 offers enhanced trading capabilities, including access to a broader range of financial instruments and advanced charting tools. It is considered a preferred terminal for professional traders.

3. WebTrader: Grand Capital also offers WebTrader, an online trading terminal accessible through web browsers. This platform allows traders to trade directly from their browser without the need for any software installation. WebTrader provides access to professional analytical tools, such as indicators and charts, enabling traders to make informed trading decisions.

These trading platforms offer a range of features, including real-time quotes, order execution, technical analysis tools, and risk management options. Traders can choose the platform that best suits their trading style and preferences, whether they prefer the versatility of MT4, the advanced capabilities of MT5, or the convenience of WebTrader.

| Pros | Cons |

| Wide selection of trading platforms, including MT4, MT5, and WebTrader | Steep learning curve for beginners on advanced platforms like MT5 |

| Availability of popular and widely used platforms | Limited customization options for WebTrader |

| Comprehensive set of features and tools for efficient trading | Lack of proprietary platform |

| Compatibility with iOS and Android devices for mobile trading | Limited number of available financial instruments on WebTrader |

| Access to professional analytical tools and indicators | Potential technical issues or connectivity problems with online platforms |

Promotions and Bonuses

Grand Capital offers various promotions and bonuses to its traders. Here are some of the promotions available:

Sign Up Bonus: Traders can receive a 10% bonus on the initial deposit into their trading account. This bonus can be renewed every six months by depositing 10% of the initial sum.

Trading Bonus: Grand Capital provides a trading bonus where traders receive 40% of their initial deposit. To claim the server bonus, traders need to actively trade and will receive $3 for each lot closed. The cash bonus can be withdrawn.

Payback Loyalty Program: The Payback loyalty program offers fee rebates to traders. Traders can earn cashback after trading for five consecutive days, and the rewards can be withdrawn without restrictions.

Other Promotions: Grand Capital also runs trading contests and offers partnership options for those interested in referring clients.

It's important to review the terms and conditions associated with these bonuses and promotions, as there may be certain usage and withdrawal restrictions, particularly with no deposit bonus deals.

Customer Support

Grand Capital provides reliable customer support to assist traders with their inquiries and concerns. Here are the available channels to contact their customer service:

Email: Traders can reach out to Grand Capital's customer support team via email at info@grandcapital.net. This allows for written communication and allows traders to provide detailed information about their queries or issues.

Phone: The broker offers a phone support line at +1 646 8447187. Traders can directly call this number to speak with a customer service representative and receive assistance over the phone.

Chat Service: A chat service is available on the Grand Capital website, allowing traders to engage in real-time conversations with the support team. This provides a quick and convenient way to get immediate responses to queries.

Callback Request: Traders also have the option to request a callback from the customer support team. This allows them to provide their contact details and request a call from a representative at a convenient time.

Regional YouTube Channels: Grand Capital maintains regional YouTube channels, which can serve as additional sources of information and support for traders.

The customer support services are available during business hours and traders can expect prompt responses to their inquiries. However, it's important to note that the availability of markets for trading may depend on the region and time zone, with cryptocurrency trading being available 24/7, including weekends.

Accepted Countries

Grand Capital accepts traders from various countries, including Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, and many other countries.

However, it's important to note that Grand Capital does not accept traders from the United States and Japan. Traders from these countries are unable to use the services provided by Grand Capital.

Conclusion

In conclusion, Grand Capital offers a wide range of trading instruments and account types to cater to different traders' needs. However, its main disadvantage lies in the lack of proper regulation and authorized licensing, which raises concerns about the safety and security of client funds. The absence of clear information regarding regulatory bodies and the limited transparency surrounding the company's operations make it a risky choice for traders. While Grand Capital provides access to various markets and trading opportunities, the potential disadvantages and associated risks of dealing with an unregulated broker should be carefully considered before engaging with the platform.

FAQs

Q: Is Grand Capital a regulated broker?

A: Based on the information provided, Grand Capital appears to be an unauthorized and unregulated entity. There are indications of a license, but it is stated as “No Sharing,” and there is a lack of comprehensive information about the regulatory agency and the effective dates of the license.

Q: What market instruments can I trade with Grand Capital?

A: Grand Capital offers a wide range of market instruments, including forex, cryptocurrencies, stocks, indices, spot metals, energies, ETFs, and other CFDs. They also provide binary options trading on their separate website, GC Option.

Q: What are the account types offered by Grand Capital?

A: Grand Capital offers several account types, including Standard, MT5, Micro, ECN Prime, Swap Free, and Crypto accounts. They also provide Islamic swap-free accounts for clients who adhere to Islamic finance principles.

Q: How can I open an account with Grand Capital?

A: To open an account with Grand Capital, visit their website and click on the “Open an account” or “Sign up/Register” option. Fill in the required personal information in the registration form and follow the instructions for verification to activate your account.

Q: What leverage is available with Grand Capital?

A: The leverage offered by Grand Capital varies depending on the account type. Standard, Swap Free, and Micro accounts offer leverage up to 1:500. ECN Prime and MT5 accounts have leverage up to 1:100, while Crypto accounts have limited leverage up to 1:5.

Q: What are the fees, spreads, and commissions at Grand Capital?

A: Grand Capital's fee structure includes spreads and commissions. The spreads start at 0.4 pips on commission-free accounts and can go up to 1 pip on certain currency pairs. Commissions vary depending on the account type and range from $5 to 0.1%. The Micro account is an exception and does not charge any commissions.

Q: What are the deposit and withdrawal methods at Grand Capital?

A: Grand Capital supports various deposit and withdrawal methods, including bank wire transfer, credit cards, debit cards, e-wallets (Neteller, Skrill, Perfect Money), cryptocurrencies (Bitcoin, Ethereum, Ripple), and more. Minimum deposit requirements range from $10 to $500, depending on the account type.

Q: Which trading platforms are available at Grand Capital?

A: Grand Capital offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and WebTrader as trading platforms. MT4 and MT5 are popular platforms known for their comprehensive features and analysis tools, while WebTrader is an online platform accessible through web browsers.

Q: Does Grand Capital offer any promotions or bonuses?

A: Yes, Grand Capital provides various promotions and bonuses, including a sign-up bonus, trading bonus, Payback loyalty program, trading contests, and partnership options. Terms and conditions apply to these offers, so it's important to review them carefully.

Q: How can I contact Grand Capital's customer support?

A: You can reach Grand Capital's customer support via email at info@grandcapital.net, by phone at +1 646 8447187, through the chat service on their website, or by requesting a callback. They also maintain regional YouTube channels for additional information and support.

Q: Which countries are accepted by Grand Capital?

A: Grand Capital accepts traders from numerous countries, including Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, and many others. However, they do not accept traders from the United States and Japan.

Read more

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Canada is striking back! If U.S. tariffs persist, Canada will impose retaliatory duties, escalating tensions in North American trade.

Admirals Resumes EU Client Onboarding After Pause in 2024

Admirals restarts EU client onboarding after a 2024 pause, enhancing compliance with CySEC regulations while aiming to boost its forex and CFD market presence.

Crypto vs Forex: Which is Better? Which Should You Choose?

The global financial landscape has been reshaped by two dominant trading markets: cryptocurrency and foreign exchange (forex). Each offers unique opportunities, risks, and rewards, leaving traders and investors divided on which market holds the upper hand. But when it comes to choosing between them, is there a definitive answer, or does it all boil down to personal preference and risk appetite?

Succedo Markets Broker Review

Succedo Markets is a relatively new player in the forex and CFD brokerage arena, with approximately 1–2 years of trading experience. Registered in Saint Lucia and operating in the UAE, this broker has quickly made headlines for its unconventional approach and risk profile.

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

TD Bank Appoints Guidepost Solutions for AML Compliance Oversight

Rate Calc