TANGO TRADING Information Revealed

Abstract: TANGO TRADING is an unregulated brokerage firm that offers a range of market instruments, including CFDs on shares, Forex, futures, indices, cryptocurrencies, and raw materials. However, the lack of regulation raises concerns about the safety and security of investments. Traders should exercise caution and consider the potential risks associated with trading through this broker. The platform provides different account types, multiple payment methods, and various trading tools, including real-time graphics, market vision, market projection, and an economic calendar. Educational resources in the form of a blog and market news section are also available. TANGO TRADING accepts clients from multiple countries, but there are restrictions in place for certain regions. Customer support is offered through phone, email, and social media platforms.

| Aspect | Information |

| Registered Country/Area | Mexico |

| Founded Year | Within 1 year |

| Company Name | TANGO TRADING |

| Regulation | No Regulation |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | Match Trader |

| Tradable Assets | CFDs on stocks, forex, futures, indices, cryptocurrencies, and raw materials |

| Account Types | PRICING-LOGO-1, PRICING-LOGO-2, PRICING-LOGO-3 |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Phone, email, Facebook, Instagram |

| Payment Methods | SENECA, FiarPay, Cobru, Moonpay |

| Educational Tools | Blog, market news |

Overview of TANGO TRADING

TANGO TRADING is a brokerage firm that operates without valid regulation, which raises concerns about the safety and security of investments. Traders should approach this broker with caution and carefully consider the potential risks involved. The lack of regulation means there is no oversight or guarantees regarding the handling of funds or adherence to industry standards.

Despite the absence of regulation, TANGO TRADING offers a variety of market instruments for trading, including CFDs on shares, Forex, futures, indices, cryptocurrencies, and raw materials. Traders have the opportunity to engage in speculative trading across different asset classes. However, it is important to note that trading in volatile markets can lead to potential losses, especially without the protection and safeguards provided by regulated brokers.

The broker provides different account types to cater to varying trader preferences, but there is limited information available about the features and benefits of each account. Traders should carefully review the account options and consider whether they align with their trading goals and risk tolerance. TANGO TRADING also offers a range of payment methods for deposits and withdrawals, emphasizing low commissions in their financial transactions.

While TANGO TRADING provides a trading platform called Match Trader, along with various trading tools such as real-time graphics, market vision, market projection, and an economic calendar, it is important to note that the platform may have limited customization options and advanced features. Additionally, the educational resources provided by TANGO TRADING are in the form of a blog and market news section, which may offer insights and analysis but lack interactive or multimedia educational tools.

In conclusion, TANGO TRADING operates without regulation, which raises concerns about the safety of investments. Traders should exercise caution and carefully consider the potential risks associated with trading through this broker. The available market instruments, account types, payment methods, trading platform, and tools provide options for traders, but it is crucial to thoroughly evaluate their suitability and the limitations of the services provided.

Pros and Cons

TANGO TRADING has both advantages and disadvantages. On the positive side, the broker offers leverage for potential gains, access to a diverse range of assets, and the ability to trade from any device. Additionally, TANGO TRADING provides educational resources and various trading tools to assist traders in making informed decisions. However, there are some drawbacks to consider. The lack of regulation raises concerns about the safety of investments, and market volatility can lead to potential losses. There is also a potential for high levels of market risk, as well as a lack of physical ownership of assets. Furthermore, there is limited information on account features and benefits, transparency on bonus terms and conditions, and customization options. Withdrawals may have delays or restrictions, and there is limited depth in some educational articles. These factors should be carefully considered before choosing to trade with TANGO TRADING.

| Pros | Cons |

| Options to trade from any device | Lack of regulation may pose risks |

| Access to a diverse range of assets | Market volatility can lead to losses |

| Access to educational resources | Lack of physical ownership of assets |

| User-friendly interface | Lack of detailed information on account features and benefits |

| Wide range of tradable instruments | Withdrawals may take up to five business days |

| Market Vision tool provides a comprehensive overview of the market | Limited transparency on terms and conditions for bonuses |

| Access to cash and online payments | Unclear definition of “protected operations” and their scope |

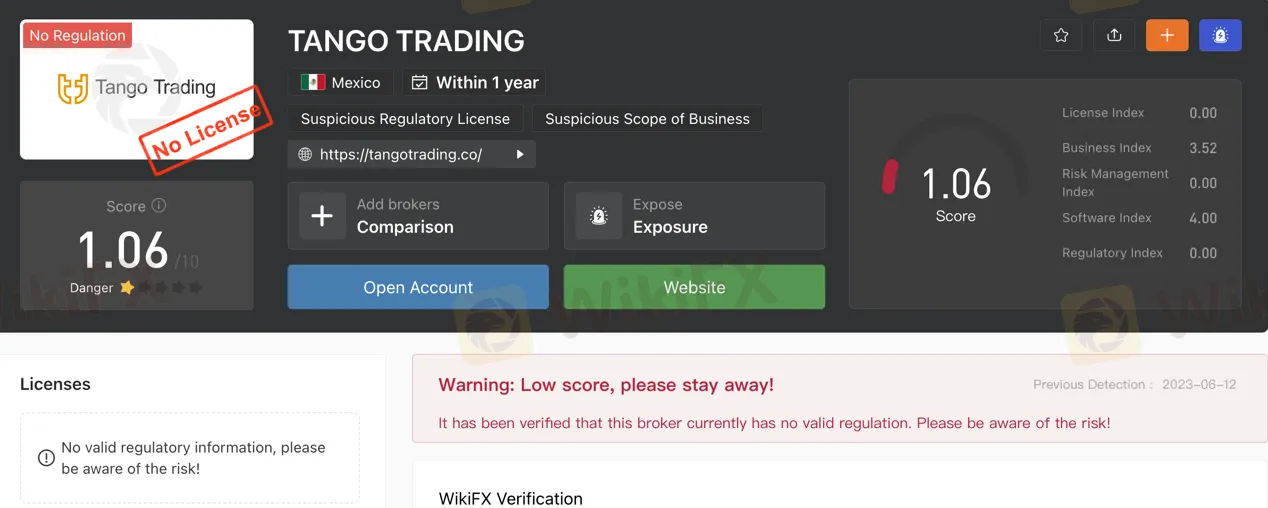

Is TANGO TRADING Legit?

TANGO TRADING is a brokerage firm that is currently not regulated. It is important to note that the lack of valid regulation raises concerns regarding the safety and security of your investments. As a result, it is strongly advised to exercise caution and consider the potential risks associated with trading through this broker. It is always recommended to opt for regulated brokers that comply with regulatory standards to ensure the protection of your funds and interests.

Market Instruments

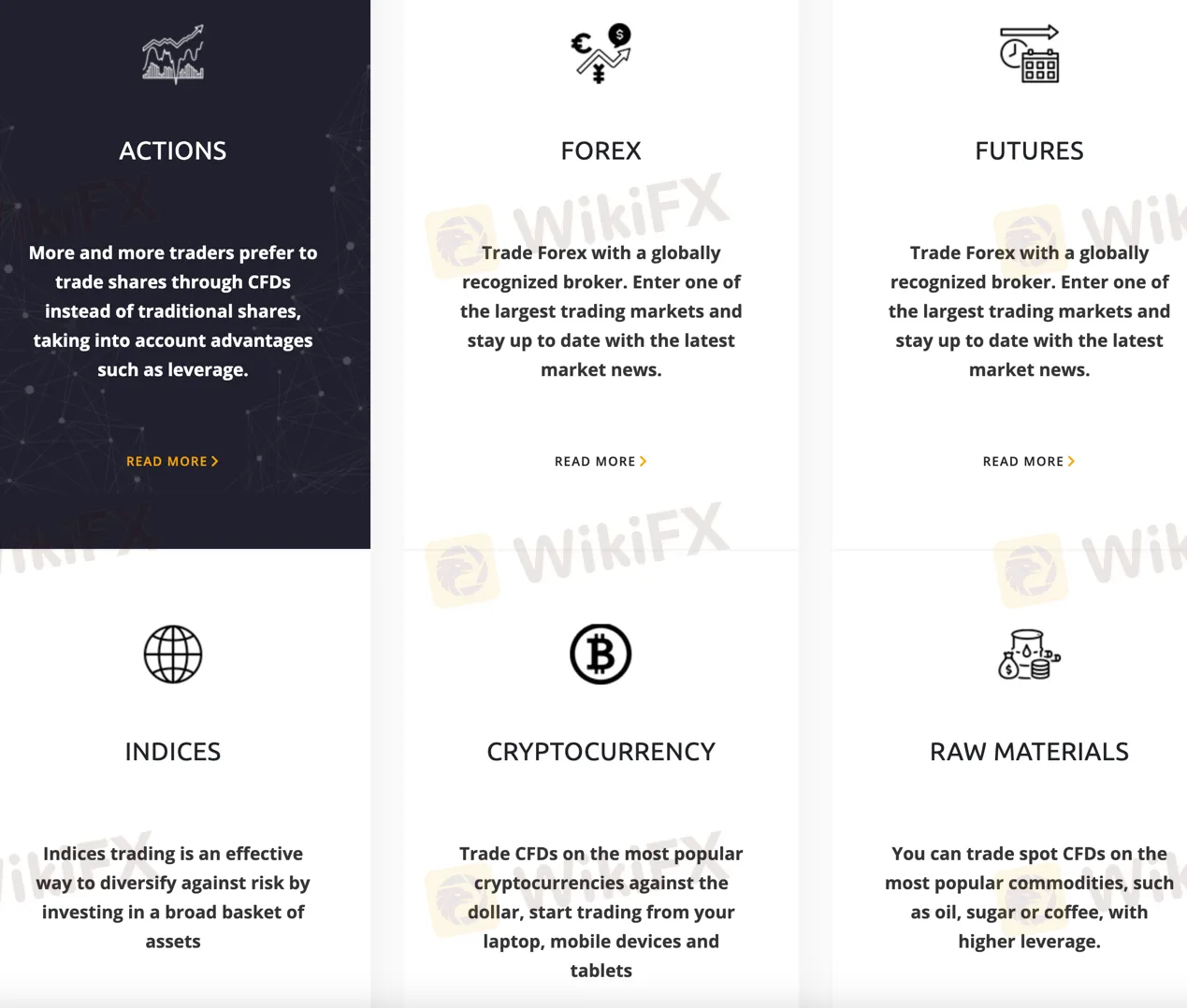

TANGO TRADING offers a range of market instruments to cater to different trading preferences. Here's a brief description of each market instrument:

ACTIONS:

TANGO TRADING allows traders to engage in trading shares through Contracts for Difference (CFDs) instead of traditional shares. This approach offers advantages such as leverage, which allows traders to potentially amplify their gains.

FOREX:

TANGO TRADING provides the opportunity to trade in the Forex market, which is one of the largest and most active trading markets globally. Traders can stay updated with the latest market news and take advantage of the fluctuations in currency exchange rates.

FUTURES:

TANGO TRADING also facilitates trading in futures contracts. By participating in the futures market, traders can speculate on the future price movements of various assets, including commodities, currencies, and indices.

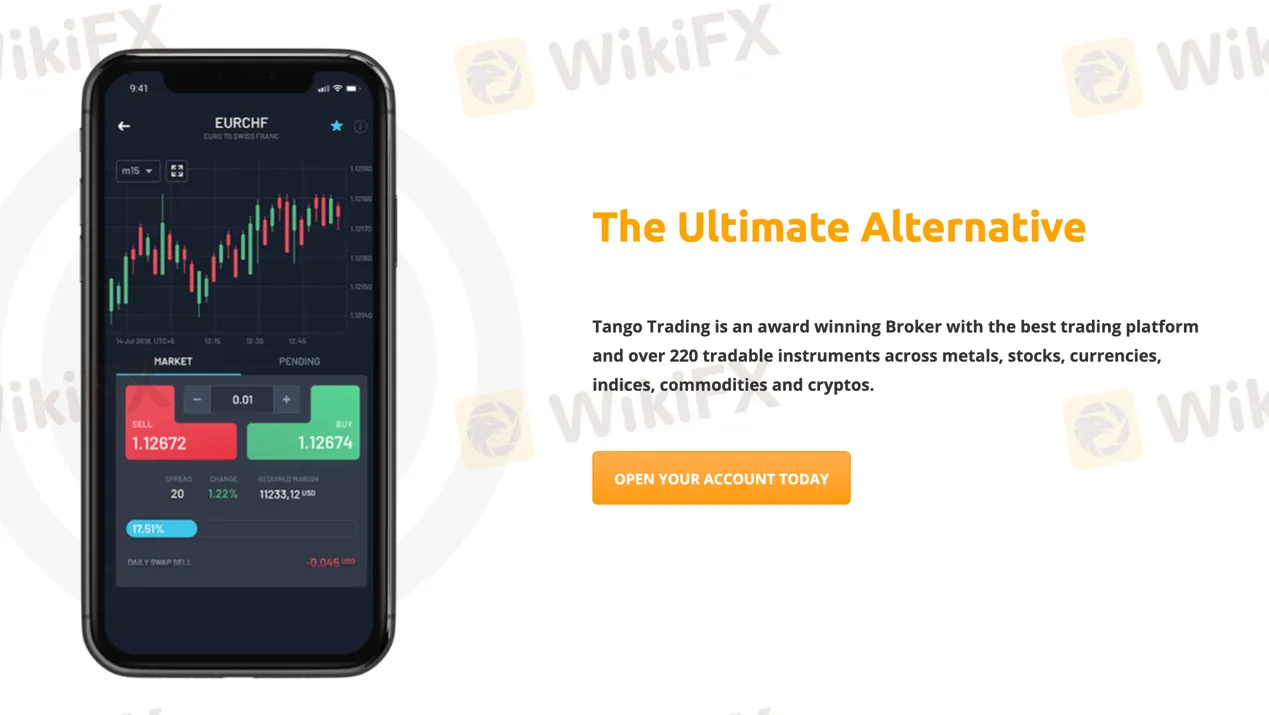

INDICES:

Indices trading is offered by TANGO TRADING as a means to diversify against risk. By investing in a broad basket of assets that make up an index, traders can potentially mitigate the impact of volatility in individual stocks and take advantage of market trends.

CRYPTOCURRENCY:

TANGO TRADING allows traders to engage in CFD trading on popular cryptocurrencies against the dollar. This provides an opportunity to participate in the crypto market and potentially benefit from the price movements of cryptocurrencies.

RAW MATERIALS:

TANGO TRADING offers spot CFDs on popular commodities such as oil, sugar, and coffee. Traders can trade these raw materials with higher leverage, potentially amplifying their trading positions.

| Pros | Cons |

| Offers leverage for potential gains | Lack of regulation may pose risks |

| Access to a diverse range of assets | Market volatility can lead to losses |

| Access to global markets | Potential for high levels of market risk |

| Options to trade from any device | Lack of physical ownership of assets |

Account Types

TANGO TRADING offers three different account types to cater to the varying needs and preferences of traders. These account types are:

PRICING-LOGO-1 ($250): The PRICING-LOGO-1 account type is designed for traders who prefer to start with a smaller initial investment. With this account, traders have control over their money at all times and can validate transactions in real-time. The account is accessible on mobile devices, allowing for trading on the go. Traders opening a PRICING-LOGO-1 account receive a 15% welcome bonus and have access to three protected operations. Additionally, they can participate in an introductory course on financial markets and benefit from the option to withdraw funds within 48 hours.

PRICING-LOGO-2 ($1000): The PRICING-LOGO-2 account type is suitable for traders looking to invest a slightly larger amount. Similar to the PRICING-LOGO-1 account, traders retain control over their funds and can validate transactions in real-time. The account is also accessible on mobile devices. Opening a PRICING-LOGO-2 account grants traders a 20% welcome bonus and provides access to five protected operations. Additionally, traders gain access to investment news and signals and receive professional trader assistance. Withdrawal of funds can be done within 24 hours.

PRICING-LOGO-3 ($5000): The PRICING-LOGO-3 account type is designed for more experienced traders or those who wish to invest a significant amount. Like the previous two account types, traders maintain control over their funds and can validate transactions in real-time. The account is accessible on mobile devices. Opening a PRICING-LOGO-3 account does not specify any additional benefits beyond the features mentioned for the previous account types.

| Pros | Cons |

| Trader assistance | Lack of detailed information on account features and benefits |

| Real-time transaction validation | Limited information on the PRICING-LOGO-3 account type |

| Mobile accessibility | No mention of specific perks or advantages for higher-tier accounts |

| Welcome bonuses for all account types | Limited transparency on terms and conditions for bonuses |

| Withdrawal of funds within specified timeframes | Possible withdrawal delays or restrictions |

| Access to educational resources | Lack of information on the quality and depth of educational materials |

| Limited information on account fees | Unclear definition of “protected operations” and their scope |

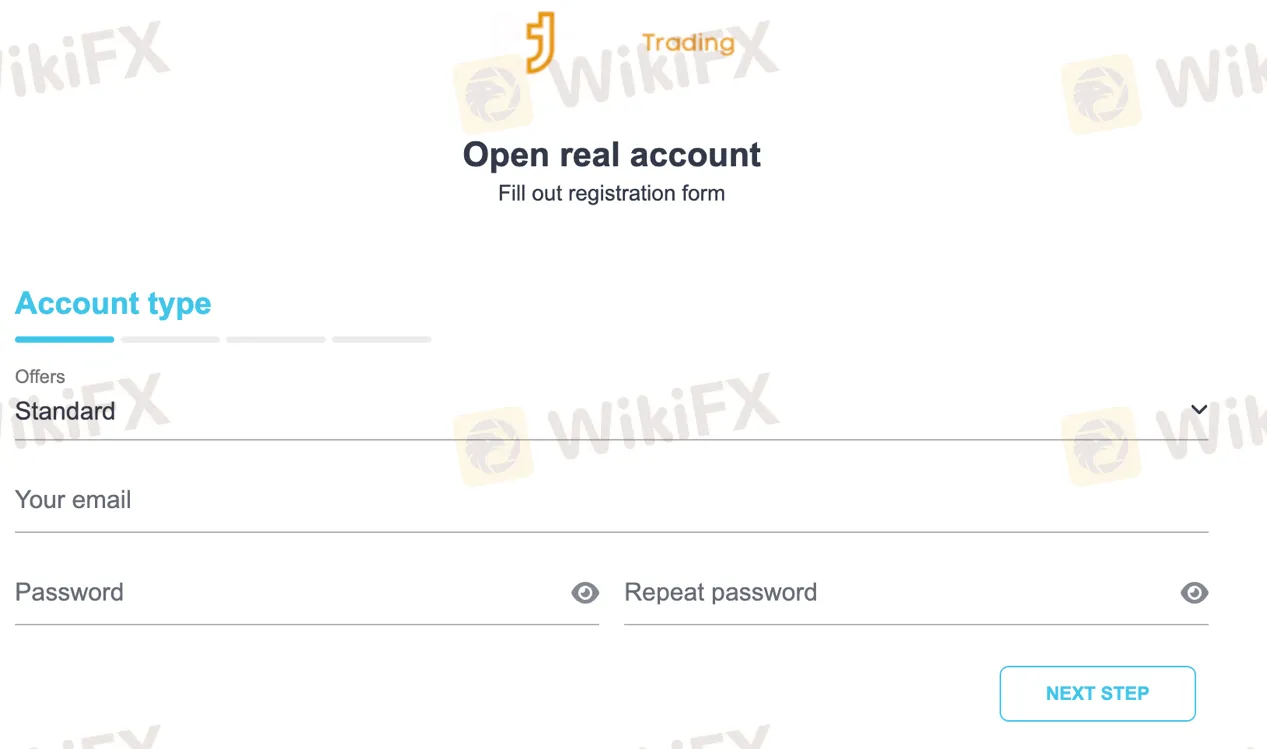

How to Open an Account?

To open an account with TANGO TRADING, you can follow these steps:

Visit the TANGO TRADING website and click on the “Open an Account” option, usually indicated by a button or link. Look for the TANGO TRADING logo to identify the correct section.

2. On the registration page, you will be required to fill out a registration form. Provide your email address and choose a password for your account. Repeat the password to confirm accuracy.

3. Once you have filled in the necessary information, click on the TANGO TRADING logo or button that says “Open Real Account” to proceed.

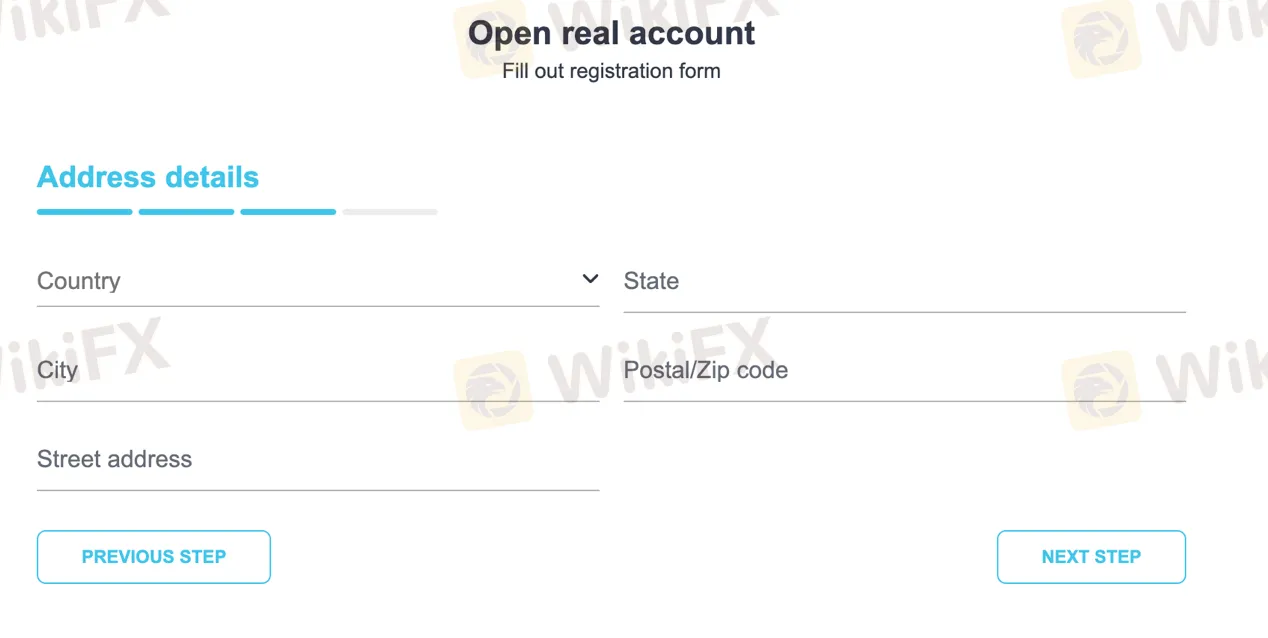

4. The next step involves providing your address details. Fill in your country, state, city, postal/zip code, and street address in the respective fields. Make sure to provide accurate information.

5. After completing the address details, you will likely see the TANGO TRADING logo or button that says “Open Real Account” again. Click on it to proceed to the next step.

6. The final step typically involves agreeing to the Terms and Conditions. Take the time to read through the Terms and Conditions thoroughly and ensure you understand them. If you agree, check the box or click on the button that indicates your agreement.

Deposit & Withdrawal

TANGO TRADING offers a variety of methods for depositing and withdrawing funds. These methods include SENECA, FiarPay, Cobru, and Moonpay. The broker emphasizes its acceptance of all means of payment and the ability to send payment links within seconds. This provides users with a quick way to access their cash and make online payments. Additionally, TANGO TRADING mentions low commissions in its deposit and withdrawal system.

WITHDRAWAL

Before submitting a withdrawal request, TANGO TRADING provides important information that users should be aware of. It is advised not to submit more than one withdrawal request at a time to avoid any issues, as multiple requests may lead to the cancellation of the pending withdrawal. Depending on the circumstances, additional documentation may be required for certain withdrawals, and users are encouraged to contact a customer service representative for further details. The broker states that all money withdrawals will be processed within a maximum of five business days.

| Pros | Cons |

| Acceptance of multiple payment methods | Lack of regulatory oversight |

| Access to cash and online payments | Potential requirement for additional documentation |

| Low commissions | Withdrawals may take up to five business days |

Trading Platforms

TANGO TRADING offers a variety of trading platforms to access the financial markets and trade different instruments. One of the available platforms is Match Trader, which is designed to facilitate access to financial markets. Users can trade numerous instruments, including metals, stocks, currencies, indices, commodities, and cryptocurrencies. Match Trader emphasizes the security of funds and aims to provide an intuitive and user-friendly interface for traders.

| Pros | Cons |

| User-friendly interface | Limited options for customization |

| Wide range of tradable instruments | Few advanced trading features |

| Platform navigation | Occasional technical glitches may occur |

| Allows easy access to financial markets | Limited educational resources |

Trading Tools

TANGO TRADING offers several trading tools to assist traders in making informed decisions. These tools include Real-Time Graphics, Market Vision, Market Projection, and an Economic Calendar.

REAL-TIME GRAPHICS:

TANGO TRADING provides real-time graphics that enable traders to visualize the movement of financial instruments. These dynamic charts display price fluctuations, trends, and patterns, allowing users to analyze market conditions and identify potential trading opportunities.

MARKET VISION:

The Market Vision tool offered by TANGO TRADING provides traders with a comprehensive overview of the market. It offers a broad range of information, including market sentiment, news updates, and analysis from expert traders. This tool helps users stay informed about market developments and make more informed trading decisions.

MARKET PROJECTION:

TANGO TRADING's Market Projection tool aims to predict future market movements based on historical data, technical analysis, and market trends. This tool assists traders in identifying potential price targets and forecasting market direction, helping them to plan their trading strategies.

ECONOMIC CALENDAR:

TANGO TRADING provides a real-time economic calendar that offers updates on important economic events, such as central bank meetings, economic indicators, and news releases. This calendar helps traders stay informed about significant events that could impact the financial markets and assists them in adjusting their trading positions accordingly.

| Pros | Cons |

| Real-time graphics aid in visualizing market movements and identifying trading opportunities. | Limited information on the accuracy of market projections. |

| Market Vision tool provides a comprehensive overview of the market. | Lack of customization options for Market Vision tool. |

| Economic calendar helps traders stay informed about important economic events. | Reliance on historical data and trends for market projection tool. |

| Limited advanced analytical features. |

Educational Resources

TANGO TRADING provides educational resources, including a blog and market news section. The blog covers various topics such as recent news and developments in the market. Some of the featured articles include discussions on Tesla's stock split, Apple's potential new iPhone launch, Warren Buffet's investments, Amex as a safe investment option, Fibonacci retracement levels in the stock market, Japanese candlesticks for understanding price action, and the profitability of investing in PepsiCo in the food and beverage sector. These resources aim to provide traders with valuable insights and knowledge to enhance their understanding of the market.

| Pros | Cons |

| Provides timely market updates and news articles | Lack of interactive or multimedia educational tools |

| Offers analysis of specific stocks and market forecasts | Limited depth in some educational articles |

| Covers a diverse range of topics and industries | Lack of structured courses or curriculum |

| Enhances traders' knowledge and trading skills | Reliance on personal research and analysis |

Trading Hours

TANGO TRADING's trading hours start on Sunday at 5:00 pm (GMT-5) and end on Friday at 4:30 pm (GMT-5). Regular trading hours are available on the Trading Conditions page, while information about holiday business hours can be found on the Holiday Calendar page. During the first few hours after trading begins and several hours before it ends, the frequency of incoming quotes may change temporarily due to decreased liquidity, which is a normal market behavior.

Accepted Countries

TANGO TRADING accepts clients from various countries; however, there are certain restrictions in place. Currently, the broker does not work with clients from the United States, Canada, Japan, Turkey, and Belgium. It is important for potential clients to be aware of these limitations before considering opening an account with TANGO TRADING. Traders from other countries may still have the opportunity to access the services provided by the broker, but it is recommended to verify the accepted countries directly with TANGO TRADING to ensure eligibility for account registration and trading activities.

Customer Support

TANGO TRADING offers customer support services to assist its clients. Traders can reach out to the support team through various channels, including phone, email, and social media platforms such as Facebook and Instagram. The company provides a support desk that is available for assistance from Monday to Friday, 24 hours a day. The contact details provided include a phone number for the Mexico City office and an email address for general inquiries. These contact options allow traders to seek assistance or resolve any issues they may encounter during their trading journey with TANGO TRADING.

Conclusion

In conclusion, TANGO TRADING is a brokerage firm that operates without regulation, which raises concerns about the safety and security of investments. It offers a range of market instruments such as CFDs on stocks, Forex, futures, indices, cryptocurrencies, and commodities, providing access to global markets. The platform offers different account types with varying benefits, and users can access their accounts from any device. TANGO TRADING accepts multiple payment methods for depositing and withdrawing funds, and withdrawals are processed within a specified timeframe. The broker provides trading platforms and tools to assist traders in making informed decisions. However, the lack of regulation and potential market volatility pose risks, and there is limited information available on account features, educational resources, and account fees. The quality and depth of educational materials are not clearly defined, and there may be occasional technical glitches on the platform.

FAQs

Q: Is TANGO TRADING a regulated brokerage firm?

A: No, TANGO TRADING is currently not regulated, which raises concerns regarding the safety and security of your investments.

Q: What market instruments are offered by TANGO TRADING?

A: TANGO TRADING offers trading opportunities in actions (through CFDs), Forex, futures, indices, cryptocurrencies, and raw materials.

Q: What are the available account types at TANGO TRADING?

A: TANGO TRADING offers three account types: PRICING-LOGO-1, PRICING-LOGO-2, and PRICING-LOGO-3. Each account type has different initial deposit requirements and benefits.

Q: How can I open an account with TANGO TRADING?

A: To open an account, visit the TANGO TRADING website, fill out the registration form, provide your address details, and agree to the Terms and Conditions.

Q: What are the deposit and withdrawal options available at TANGO TRADING?

A: TANGO TRADING accepts various payment methods, including SENECA, FiarPay, Cobru, and Moonpay. The broker emphasizes low commissions, and specifies a maximum of five business days for processing withdrawals.

Q: What trading platforms are offered by TANGO TRADING?

A: TANGO TRADING offers the Match Trader platform, which provides access to various financial markets and a wide range of tradable instruments.

Q: What trading tools are provided by TANGO TRADING?

A: TANGO TRADING offers real-time graphics, Market Vision, Market Projection, and an Economic Calendar as trading tools to assist traders in making informed decisions.

Q: Does TANGO TRADING provide educational resources?

A: Yes, TANGO TRADING provides a blog and market news section with articles covering various topics and industries to enhance traders' knowledge and trading skills.

Q: What are the trading hours of TANGO TRADING?

A: TANGO TRADING's trading hours start on Sunday at 5:00 pm (GMT-5) and end on Friday at 4:30 pm (GMT-5), with some temporary changes in quote frequency during the early and late trading hours.

Q: Which countries are accepted by TANGO TRADING?

A: TANGO TRADING accepts clients from various countries but has restrictions on clients from the United States, Canada, Japan, Turkey, and Belgium. It is advisable to verify the accepted countries directly with TANGO TRADING.

Q: How can I contact customer support at TANGO TRADING?

A: TANGO TRADING provides customer support through phone, email, and social media platforms such as Facebook and Instagram. The support desk is available 24/5, and contact details are provided on the website.

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

WikiFX Review: Is Fortune Prime Global Reliable?

Founded in 2011, Fortune Prime Global (FPG) is an Australia-registered broker that offers a wide range of investment products (Forex pairs, Commodities, Stocks, Cryptocurrencies, Indices, and so on). Today’s article will show you what it looks like in 2025.

Win $100,000 in XM Competitions: Trade for Cash Prizes!

Join XM Competitions from 20-27 Feb for a chance to win $100,000! Compete by skill or luck. No entry fees. Trade on a secure, award-winning platform.

WikiFX Broker

Latest News

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

RBI: India\s central bank slashes rates after five years

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Rate Calc