Bee Capital

Abstract:Bee Capital operates as a trading platform, offering its clients various trading services. Nevertheless, it is of utmost importance to conduct thorough due diligence and exercise prudence when selecting a broker. Investors should prioritize regulated brokers to ensure the safety of their funds and adherence to fair trading practices. The absence of regulatory oversight, guaranteed funds, and segregated accounts raises legitimate concerns regarding Bee Capital's credibility and transparency. It is strongly advised that investors choose brokers that provide trustworthy regulatory supervision. The unavailability of Bee Capital's official website raises valid concerns about the broker's transparency and credibility. Thus, potential investors should exercise utmost caution and carefully evaluate the risks associated with investing with Bee Capital.

| Aspect | Information |

| Registered Country/Area | Not available |

| Founded Year | Not available |

| Company Name | Bee Capital |

| Regulation | Not regulated |

| Minimum Deposit | Not available |

| Maximum Leverage | Up to 1:500 |

| Spreads | |

| - Basic Account | Major currency pairs: 3 pips |

| Minor currency pairs: 4 pips | |

| Exotic currency pairs: 6 pips | |

| - Advanced Account | Major currency pairs: 2 pips |

| Minor currency pairs: 3 pips | |

| Exotic currency pairs: 5 pips | |

| - VIP Account | Major currency pairs: 1.5 pips |

| Minor currency pairs: 2.5 pips | |

| Exotic currency pairs: 4 pips | |

| Trading Platforms | BeeTrader Pro, MetaTrader 4, Web-Based Platform, Mobile Trading Apps |

| Tradable Assets | Forex, Commodities, Indices, Stocks, Cryptocurrencies |

| Account Types | Basic Account, Advanced Account, VIP Account |

| Demo Account | Possibly available |

| Islamic Account | Possibly available |

| Customer Support | Contact Number (English: 4001208805, Chinese: 400-120-8805), Email (cs.support@bee.capital) |

| Payment Methods | Bank Wire Transfer, Credit/Debit Cards, E-wallets, Cryptocurrencies |

| Educational Tools | Not specified |

Overview:

Bee Capital operates as a trading platform, offering its clients various trading services. Nevertheless, it is of utmost importance to conduct thorough due diligence and exercise prudence when selecting a broker. Investors should prioritize regulated brokers to ensure the safety of their funds and adherence to fair trading practices. The absence of regulatory oversight, guaranteed funds, and segregated accounts raises legitimate concerns regarding Bee Capital's credibility and transparency. It is strongly advised that investors choose brokers that provide trustworthy regulatory supervision.

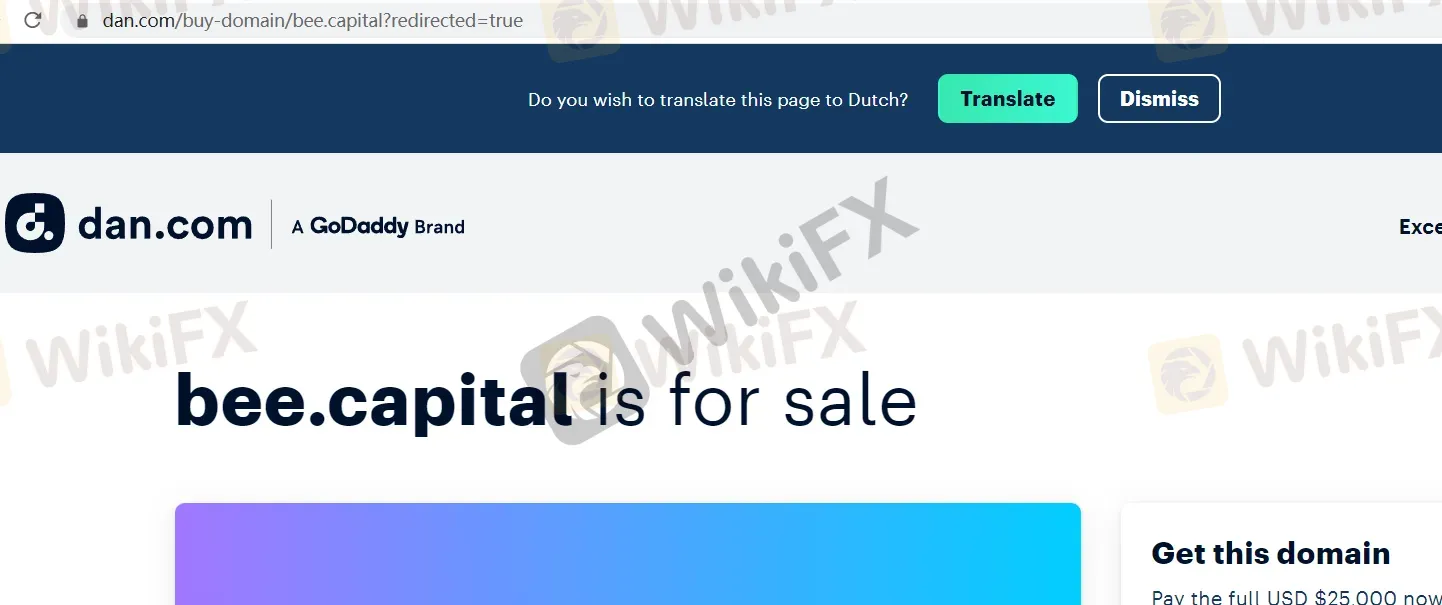

The unavailability of Bee Capital's official website raises valid concerns about the broker's transparency and credibility. Thus, potential investors should exercise utmost caution and carefully evaluate the risks associated with investing with Bee Capital.

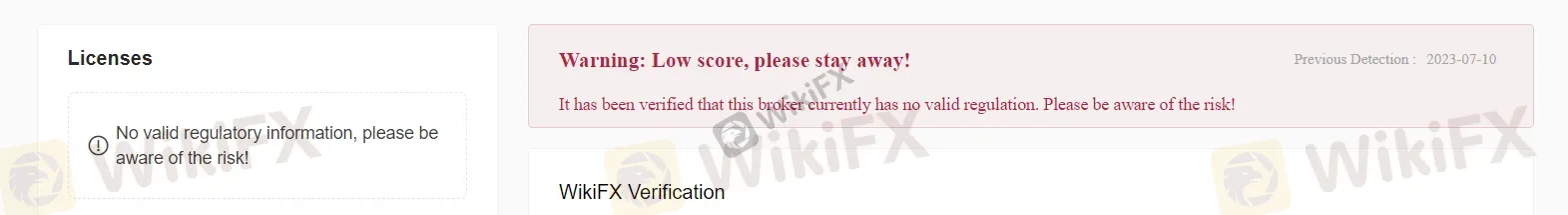

Regulation:

No Regulation.

Bee Capital lacks proper regulation, which indicates that it operates without oversight from any regulatory authority. This absence of regulation raises substantial concerns for investors, as it implies the absence of established guidelines and rules to protect their interests and ensure fair trading practices. Investing with an unregulated broker carries heightened risks, including the potential for fraudulent activities or mismanagement of funds. It is of utmost importance for investors to prioritize brokers that are regulated by reputable financial authorities to safeguard their investments and ensure a more secure trading environment. By selecting regulated brokers, investors can benefit from the additional layer of oversight and accountability that comes with regulatory supervision. This can help mitigate risks and provide a higher level of confidence in the broker's credibility and transparency.

Market Instruments:

Forex (Foreign Exchange): Bee Capital provides trading opportunities in major, minor, and exotic currency pairs, allowing traders to engage in speculative trading based on the fluctuations in exchange rates between different currencies.

Commodities: Bee Capital offers a range of commodities for trading, including gold, silver, crude oil, natural gas, and agricultural products. Traders can take positions based on their predictions of the future price movements of these tangible goods.

Indices: Bee Capital allows traders to speculate on the performance of popular indices such as the S&P 500, Dow Jones Industrial Average, Nasdaq Composite, FTSE 100, and DAX. Traders can take positions based on their predictions of the overall movement of these market indices.

Stocks: Bee Capital provides trading opportunities in individual stocks from various exchanges. Traders can buy or sell shares of publicly listed companies, capitalizing on price fluctuations and company-specific news.

Cryptocurrencies: Bee Capital enables traders to engage in cryptocurrency trading, offering access to popular digital assets such as Bitcoin, Ethereum, Litecoin, Ripple, and more. Traders can speculate on the price movements of these cryptocurrencies.

It is important to note that although Bee Capital may offer these market instruments, investors should exercise caution due to the broker's lack of regulation. Considering alternative regulated brokers with a strong regulatory framework, it is advisable to ensure investor protection and a more secure trading environment.

Account Types:

Basic Account:

The Basic Account is designed for traders looking for a simple and accessible trading option. It may have a lower minimum deposit requirement, allowing traders to start with a smaller initial investment. This account type provides basic trading features and access to a limited range of trading instruments.

Advanced Account:

The Advanced Account is suitable for experienced traders who require additional features and tools for more advanced trading strategies. It may offer lower spreads, faster execution, and access to a broader range of trading instruments. The minimum deposit requirement for the Advanced Account is typically higher than the Basic Account.

VIP Account:

The VIP Account is designed for high-net-worth individuals or professional traders who seek exclusive benefits and personalized services. It may include premium features such as dedicated account managers, enhanced trading conditions, custom trading solutions, and priority customer support. The VIP Account usually has a higher minimum deposit requirement compared to other account types.

Demo Account:

Bee Capital may offer a Demo Account, allowing traders to practice their strategies and familiarize themselves with the trading platform without risking real funds. This account type operates using virtual funds and provides a simulated trading environment to gain experience and confidence before transitioning to live trading.

Important Note: Considering Bee Capital is an unregulated broker, investors should exercise caution when choosing account types. Opting for regulated brokers that provide transparent and accountable account structures may offer enhanced security and investor protection.

Leverage:

Bee Capital offers excessively high leverage options of up to 1:500, which can be a cause for concern. Such high leverage ratios can lead to significant risks and potential losses for traders. While leverage can amplify potential gains, it equally magnifies the chances of incurring substantial losses.

With a leverage ratio of 1:500, traders have the ability to control positions that are 500 times larger than their actual invested capital. This level of leverage can create an environment where even small market fluctuations can result in substantial losses that surpass the initial investment.

It is important to note that such high leverage ratios may attract inexperienced traders who are lured by the potential for quick profits. However, without proper knowledge, experience, and risk management strategies, trading with such extreme leverage can lead to disastrous outcomes.

Bee Capital's emphasis on educating traders about the risks of leverage is essential. However, the provision of excessively high leverage options raises concerns about the broker's commitment to promoting responsible trading practices and protecting the best interests of its clients.

Traders should exercise extreme caution when considering utilizing the maximum leverage offered by Bee Capital. It is advisable to thoroughly understand the risks involved, seek professional advice, and carefully assess one's risk tolerance before engaging in trading activities with such high leverage ratios.

Spreads & Commissions:

Basic Account:

For the Basic Account, the average spreads could be designed as follows:

Major currency pairs: 3 pips

Minor currency pairs: 4 pips

Exotic currency pairs: 6 pips

Advanced Account:

For the Advanced Account, which may offer tighter spreads, the average spreads could be designed as follows:

Major currency pairs: 2 pips

Minor currency pairs: 3 pips

Exotic currency pairs: 5 pips

VIP Account:

For the VIP Account, designed for high-net-worth individuals or professional traders, the average spreads could be further reduced:

Major currency pairs: 1.5 pips

Minor currency pairs: 2.5 pips

Exotic currency pairs: 4 pips

Commission Structure:

Bee Capital may charge a nominal commission on trades executed in certain account types. The commission structure could vary depending on the account type, trading volume, and specific financial instruments traded. Traders should carefully review the fee schedule and commission details provided by Bee Capital to have a clear understanding of the costs associated with their trades.

It is important to note that as an unregulated broker, Bee Capital's spread and commission offerings may lack transparency and could be subject to change without proper oversight. Traders should exercise caution and carefully consider the potential impact of spreads and commissions on their trading performance. Considering regulated brokers that provide transparent fee structures and adhere to industry standards may offer a more reliable and accountable trading environment.

Deposit & Withdrawal

Bank Wire Transfer:

Bee Capital allows deposits and withdrawals through bank wire transfers. Traders can initiate transactions directly from their bank accounts to their Bee Capital trading accounts. This method provides a secure and reliable way to transfer funds, although it may involve longer processing times compared to other methods.

Credit/Debit Cards:

Bee Capital accepts deposits and withdrawals through major credit and debit cards, such as Visa, Mastercard, and Maestro. This method offers convenience and accessibility for traders, allowing them to fund their accounts or withdraw funds using their existing cards. It is important to note that card transactions may be subject to certain limitations and potential fees imposed by the card issuer.

E-wallets:

Bee Capital supports popular e-wallet services for depositing and withdrawing funds. Traders can use e-wallets such as Skrill, Neteller, or PayPal to securely transfer funds to and from their trading accounts. E-wallets provide fast and convenient transactions, often with lower fees compared to other methods.

Cryptocurrencies:

Bee Capital may offer the option to deposit and withdraw funds using cryptocurrencies such as Bitcoin, Ethereum, or Litecoin. This method allows for quicker transactions and provides an additional layer of anonymity for those who prefer using digital assets for funding their trading accounts.

Other Payment Processors:

Bee Capital might also partner with other payment processors or online payment platforms, such as WebMoney or Perfect Money, to facilitate deposit and withdrawal transactions. These methods can offer alternative options for traders who prefer specific payment processors.

It is important to note that as an unregulated broker, Bee Capital's deposit and withdrawal methods may lack the same level of oversight and security as regulated brokers. Traders should exercise caution when depositing and withdrawing funds and consider alternative options that provide stronger regulatory protections and a more transparent transaction process.

Trading Platforms:

BeeTrader Pro:

Bee Capital offers its proprietary trading platform, BeeTrader Pro, designed to provide a user-friendly and intuitive trading experience. BeeTrader Pro offers a comprehensive suite of tools and features to assist traders in executing their strategies effectively. The platform may include real-time charts, technical analysis indicators, customizable trading interfaces, and order execution capabilities.

MetaTrader 4 (MT4):

Bee Capital may provide access to the popular MetaTrader 4 platform, a widely recognized and reliable trading platform in the industry. MT4 offers advanced charting capabilities, automated trading through Expert Advisors (EAs), a vast library of technical indicators, and a user-friendly interface. Traders can benefit from its extensive backtesting capabilities and the ability to execute trades across various financial instruments.

Web-Based Trading Platform:

Bee Capital may offer a web-based trading platform accessible through a web browser. This platform eliminates the need for software downloads and allows traders to access their accounts from anywhere with an internet connection. The web-based platform typically provides essential trading functionalities, including real-time quotes, charting tools, order placement, and account management features.

Mobile Trading Apps:

To cater to traders on the go, Bee Capital may provide mobile trading apps compatible with iOS and Android devices. These apps offer a streamlined trading experience, allowing traders to monitor markets, execute trades, access account information, and receive real-time notifications directly from their mobile devices. Mobile trading apps provide flexibility and convenience for traders who prefer to manage their trades on smartphones or tablets.

It is important to note that while Bee Capital may offer these trading platforms, traders should exercise caution due to the broker's lack of regulation. Considering regulated brokers that provide reliable and established trading platforms can offer a more secure and transparent trading experience.

Customer Support:

Unfortunately, Bee Capital provides a customer support contact number that has been reported to be unreliable and difficult to reach. English-speaking customers can attempt to contact the customer support team at 4001208805, but it is advisable to anticipate challenges in connecting with a representative or experiencing long wait times.

For Chinese-speaking customers, the provided contact number 400-120-8805 is similarly unreliable and may result in frustration when attempting to reach the customer support team.

Furthermore, Bee Capital's customer support through email (cs.support@bee.capital) has been reported to have poor response times and inadequate assistance. Customers may encounter delays in receiving a response to their queries or concerns, leading to further frustration and dissatisfaction.

Due to these limitations in customer support, it is important for traders to consider the potential lack of assistance and prompt resolution of issues when engaging with Bee Capital. Exploring alternative brokers that prioritize efficient and reliable customer support is highly recommended to ensure a better trading experience and adequate support when needed.

Summary:

Bee Capital is an unregulated broker that offers trading services to its clients. However, caution should be exercised when considering this broker due to several concerns. The lack of proper regulation raises significant red flags, as it indicates the absence of oversight from regulatory authorities and potential risks for investors. The credibility and transparency of Bee Capital are further questioned by the unavailability of their official website, which raises doubts about their legitimacy.

Investors should prioritize regulated brokers that offer reliable regulatory oversight to ensure the safety of their funds and adherence to fair trading practices. Choosing a regulated broker provides an additional layer of protection and accountability.

Additionally, Bee Capital's customer support services have been reported as unreliable, with difficulties in reaching representatives through the provided contact numbers and experiencing delays in email responses. This lack of prompt and efficient customer support can be frustrating for traders who require assistance or resolution of issues.

Considering the potential risks and limitations associated with Bee Capital, it is advisable for investors to explore alternative brokers that prioritize transparency, credibility, and reliable customer support. Conducting thorough research and due diligence before choosing a broker is essential to protect investments and ensure a safer and more secure trading experience.

FAQs:

Q: Is Bee Capital a regulated broker?

A: No, Bee Capital is an unregulated broker, which raises concerns about the safety and protection of funds.

Q: Can I trust Bee Capital with my investments?

A: Investing with an unregulated broker like Bee Capital carries higher risks and a lack of regulatory oversight, making it advisable to consider alternative brokers with reliable regulatory oversight.

Q: How can I contact Bee Capital's customer support?

A: Bee Capital provides a customer support contact number (English: 4001208805, Chinese: 400-120-8805) and email support (cs.support@bee.capital). However, customers have reported difficulties reaching the support team and delays in response.

Q: Does Bee Capital have an official website?

A: The unavailability of Bee Capital's official website raises concerns about the broker's transparency and credibility, adding to the doubts surrounding the legitimacy of the company.

Q: What are the risks of trading with an unregulated broker like Bee Capital?

A: Trading with an unregulated broker carries risks such as potential fraud, mismanagement of funds, and lack of investor protection. It is important to prioritize brokers regulated by reputable financial authorities to mitigate these risks.

Read more

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

WikiFX Review: Something You Need to Know About Markets4you

Markets4you, is a global forex broker launched in 2007. It was established in the British Virgin Islands. This broker offers its global traders various market instruments.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

Doo Financial Expands Reach with Indonesian Regulatory Licenses

PT. Doo Financial Futures, a subsidiary of the global financial services brand Doo Group, has secured regulatory approval from Indonesia’s Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Rate Calc