KVB Prime

Abstract:KVB Prime, established in 2014 and based in Samoa, is an unregulated broker. They offer a Standard Account with a minimum deposit of $10 or R150, providing leverage of up to 1:800 on Forex trades with competitive spreads. Tradable assets span Forex, Commodities, Shares, Indices, and Cryptocurrencies, accessible through MetaTrader 4, KVB Prime Mobile App, and CopyTrade. While they offer a Demo Account, availability of an Islamic Account is unspecified. Customer support includes email, telephone, and live chat for Greater China and European regions. Payment methods encompass bank cards, NB deposits, and USDT deposits. Educational resources, such as a Forex Glossary, Trading for Beginners, FAQs, and educational videos, are available. Traders should note that KVB Prime operates without regulatory oversight.

| Aspect | Information |

| Registered Country/Area | Samoa |

| Founded Year | 2014 |

| Company Name | KVB Prime |

| Regulation | Unregulated |

| Minimum Deposit | $10 or R150 (Standard Account) |

| Maximum Leverage | Up to 1:800 (Standard Account) |

| Spreads | From 0.0 pips on EUR/USD (Standard Account) |

| Trading Platforms | MetaTrader 4, KVB Prime Mobile App, CopyTrade |

| Tradable Assets | Forex, Commodities, Shares, Indices, Cryptos |

| Account Types | Standard Account, Demo Account |

| Demo Account | Available through MetaTrader 4 |

| Islamic Account | Information not provided |

| Customer Support | Email, Telephone, Live Chat (Greater China and European regions) |

| Payment Methods | Bank cards, NB deposits, USDT deposits |

| Educational Tools | Forex Glossary, Trading for Beginners, FAQ, Education Videos |

Overview

KVB Prime, established in 2014 and based in Samoa, is an unregulated broker. They offer a Standard Account with a minimum deposit of $10 or R150, providing leverage of up to 1:800 on Forex trades with competitive spreads. Tradable assets span Forex, Commodities, Shares, Indices, and Cryptocurrencies, accessible through MetaTrader 4, KVB Prime Mobile App, and CopyTrade. While they offer a Demo Account, availability of an Islamic Account is unspecified. Customer support includes email, telephone, and live chat for Greater China and European regions. Payment methods encompass bank cards, NB deposits, and USDT deposits. Educational resources, such as a Forex Glossary, Trading for Beginners, FAQs, and educational videos, are available. Traders should note that KVB Prime operates without regulatory oversight.

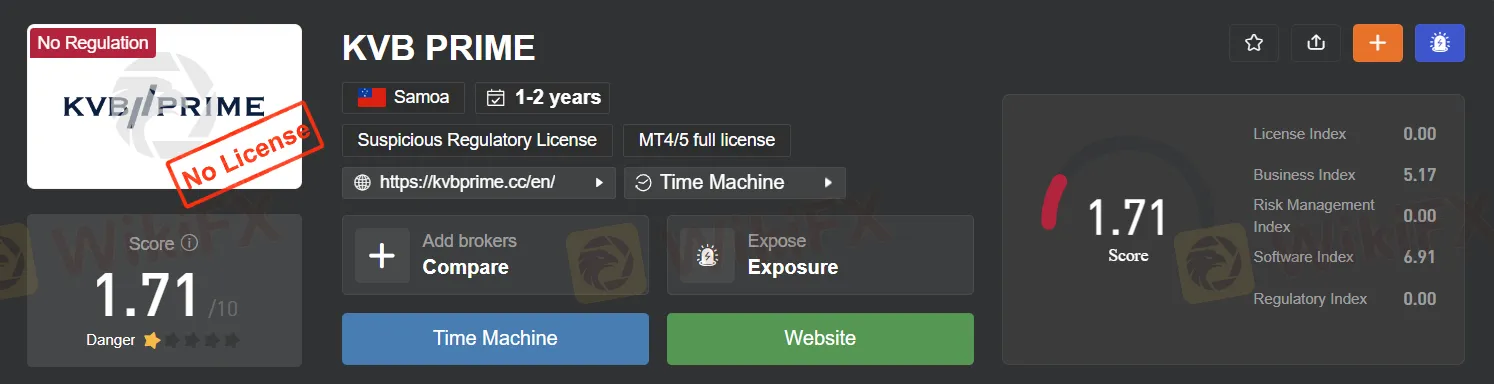

Regulation

KVB PRIME is an unregulated broker, meaning it lacks oversight from reputable financial regulators like the SEC or FCA. This absence of regulation raises concerns about the safety and fairness of its services. Unregulated brokers may not adhere to strict industry standards, potentially exposing clients to risks such as unfair practices or even financial scams. Caution and thorough research are advised for those considering KVB PRIME or any unregulated broker to protect their financial interests.

Pros and Cons:

| Pros | Cons |

| Diverse Range of Tradable Instruments | Unregulated Broker |

| Low Minimum Deposit | Lack of Regulatory Oversight |

| Competitive Spreads | Potential Safety and Fairness Concerns |

| High Leverage Options | Limited Transparency |

| Multiple Trading Platforms | Risk of Unfair Practices |

| CopyTrade Feature | Potential Financial Scams |

| Flexible Deposit & Withdrawal Methods | Lack of Regulatory Protections |

| Favorable Fee Structure | Lack of Islamic Account Option |

| Comprehensive Educational Resources | |

| Accessible Customer Support |

KVB Prime offers a diverse array of tradable instruments, competitive spreads, and high leverage options through its Standard Account. Multiple trading platforms, including MetaTrader 4 and the KVB Prime Mobile App, along with the CopyTrade feature, enhance trading versatility. The broker's flexible deposit and withdrawal methods, combined with a generally favorable fee structure, can benefit traders. The presence of comprehensive educational resources and accessible customer support indicates the broker's commitment to assisting traders at different levels.

However, it's important to consider the fact that KVB Prime operates as an unregulated broker. This lack of regulatory oversight raises concerns about potential safety, fairness, and regulatory protections for traders. Unregulated brokers may lack transparency and expose traders to risks such as unfair practices or financial scams.

In conclusion, while KVB Prime offers several positive features, the absence of regulatory oversight should prompt traders to carefully evaluate the potential risks and exercise caution when considering this broker for their trading activities.

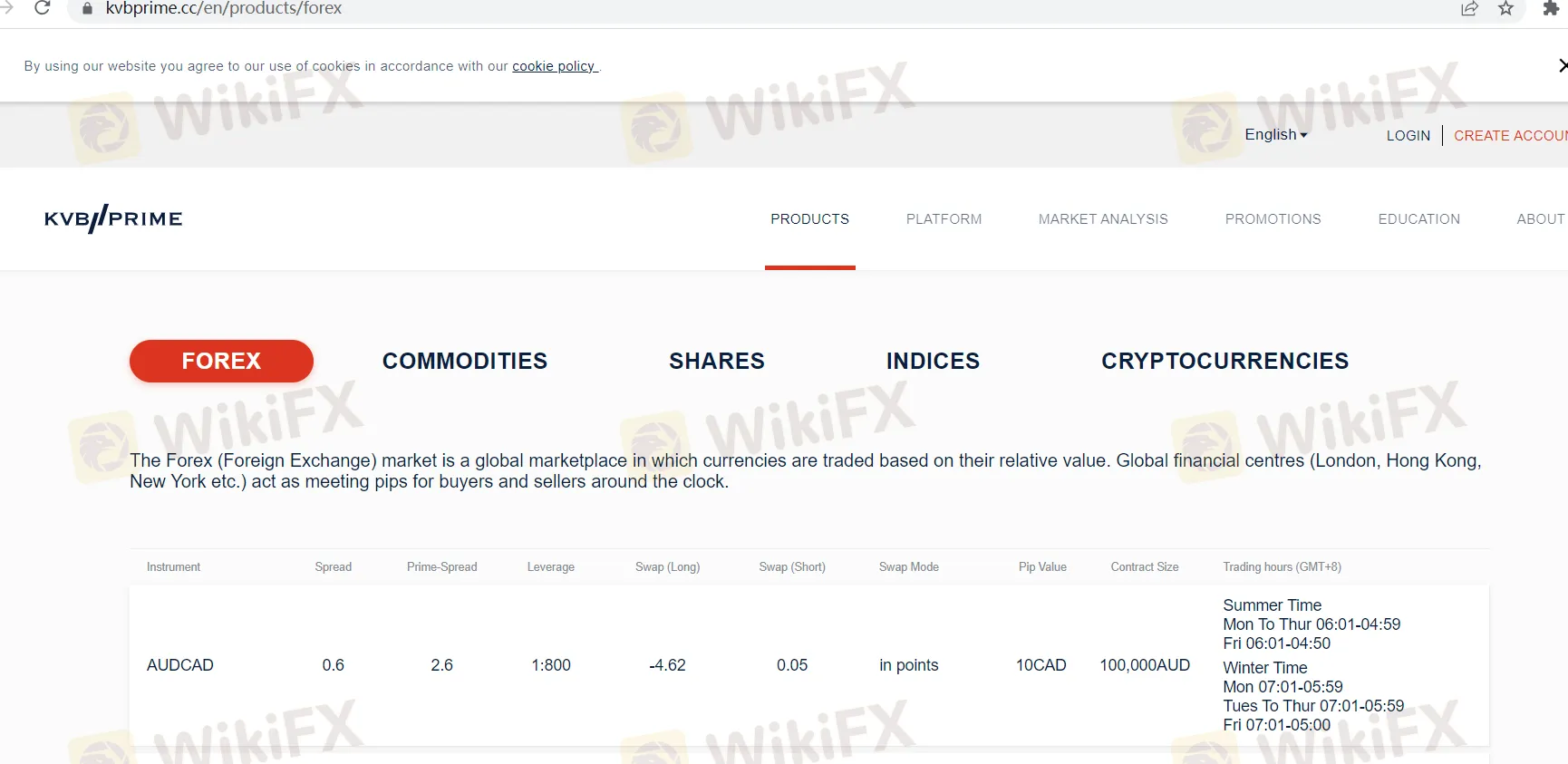

Market Instruments

The broker offers a diverse range of trading instruments, catering to the varied needs and preferences of traders and investors in the financial markets. These market instruments encompass four main categories: Forex, Commodities, Shares, Indices, and Cryptocurrencies.

Forex: Forex, short for foreign exchange, refers to the trading of currency pairs. This market is the largest and most liquid in the world. Traders can speculate on the price movements of major currency pairs, such as EUR/USD, USD/JPY, GBP/USD, and many others. Forex trading allows participants to take advantage of fluctuations in exchange rates, making it a popular choice for both short-term and long-term traders seeking exposure to global currencies.

Commodities: Commodities trading involves buying and selling raw materials or primary agricultural products. Commonly traded commodities include gold, oil, silver, and agricultural products like wheat and soybeans. Commodities can be a hedge against inflation and economic instability, making them a crucial asset class for diversification in a well-rounded investment portfolio.

Shares: Shares, also known as stocks or equities, represent ownership in a company. When investors buy shares, they acquire a stake in that company, entitling them to a portion of its profits and a say in corporate decisions. Shares can be traded on various stock exchanges around the world, and traders often speculate on their price movements based on company performance, economic factors, and market sentiment.

Indices: Indices are composed of a basket of stocks that represent a particular market or sector. They provide a snapshot of the overall performance of a group of companies and are used as benchmarks for evaluating the performance of individual investments. Traders can speculate on the future direction of indices, such as the S&P 500, NASDAQ, or FTSE 100, by taking positions in derivatives like index futures or CFDs.

Cryptocurrencies: Cryptocurrencies represent a relatively new and highly volatile asset class. These digital currencies, including Bitcoin, Ethereum, and many others, are based on blockchain technology and have gained popularity as speculative assets. Traders and investors often seek opportunities to profit from the price volatility of cryptocurrencies, but they should be aware of the risks associated with this emerging market.

Here's a detailed table summarizing the market instruments offered by the broker:

| Market Instrument | Description |

| Forex | Trading currency pairs, such as EUR/USD, GBP/JPY, etc. |

| Commodities | Trading raw materials like gold, oil, silver, and others. |

| Shares | Buying and selling ownership in publicly traded companies. |

| Indices | Speculating on the performance of market or sector indices. |

| Cryptocurrencies | Trading digital currencies like Bitcoin, Ethereum, etc. |

Please note that the availability of specific instruments may vary depending on the broker's offerings and the regulatory environment in which they operate. Traders and investors should carefully review the broker's instrument list and trading conditions before engaging in any financial activities.

Account Types

KVB Prime provides a range of trading account options, catering to the diverse needs of traders. These account types are designed to offer flexibility, competitive features, and various benefits. The broker offers three tiered trading account types, namely the Standard Account and the Demo Account.

Standard Account:

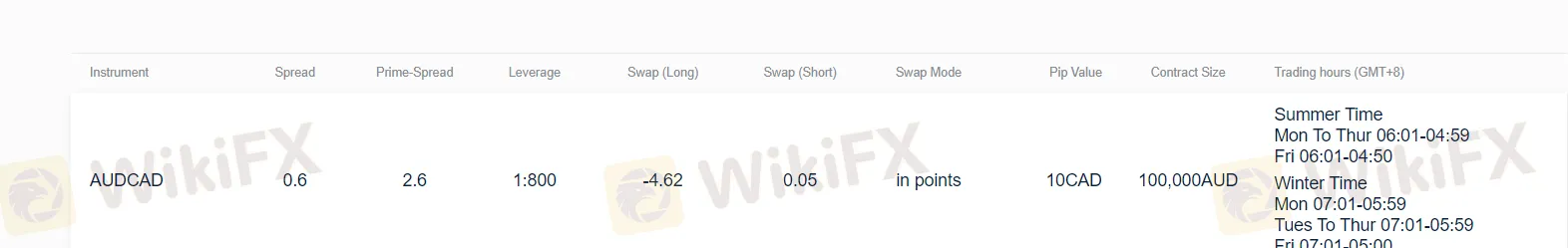

The Standard Account at KVB Prime serves as the entry-level choice for most traders. It features a low minimum deposit requirement of $10 or R150, making it accessible to a wide range of individuals. Traders using this account type can benefit from floating leverage, which can go up to a maximum of 1:800 on forex trading, allowing for greater trading flexibility. The account also offers competitive floating spreads that start from 0.0 pips on major currency pairs like EUR/USD.

Risk management is supported with a stop-out level and margin requirement set at 50%, helping traders maintain control over their positions. Market execution ensures swift trade execution, while access to a wide range of markets expands trading opportunities. Traders can choose between MetaTrader 4 and KVB Prime's mobile app for their preferred trading platform. Social trading opportunities through FOLLOWME CopyTrade, educational materials, and research tools are also provided. Moreover, traders qualify for a Double-Deposit Bonus of 100% with deposits ranging from $500 USD to a maximum of $10,000 USD, further enhancing trading potential. Micro lot trading is permitted from 0.01 lots.

Demo Account:

For traders looking to test the waters or develop their trading skills, KVB Prime offers a Demo Account. This account type is accessible through MetaTrader 4 by selecting the KVB Prime server. The Demo Account is an invaluable tool for exploring the MetaTrader 4 platform, refining and testing trading strategies, and practicing in a risk-free environment that mirrors real live market conditions without any capital risks.

Here's a summarized table outlining the key features of these account types:

| Account Type | Features and Benefits |

| Standard Account | - Low minimum deposit - Up to 1:800 leverage - Competitive spreads - 50% stop-out level/margin requirement - Market execution - Access to various markets - Choice of MetaTrader 4 or mobile app - Social trading via FOLLOWME CopyTrade - Educational materials and research tools - Double-Deposit Bonus opportunity - Micro lot trading from 0.01 lots |

| Demo Account | - Risk-free environment for practice - Real market conditions simulation - Ideal for strategy development - Use with MetaTrader 4 platform |

Leverage

KVB Prime offers a maximum trading leverage of up to 1:800. Leverage allows traders to control larger positions relative to their initial investment. This high leverage can amplify both gains and losses, making it important for traders to manage risk and consider their trading strategy carefully.

Spreads & Commissions

Spreads and commissions are crucial factors to assess when choosing a broker, and KVB Prime offers a diverse fee structure for traders.

Trading Fees: KVB Prime has a standard minimum deposit of 10 USD (150 ZAR) for real account registration. Spreads can be as low as 0.0 pips on major currency pairs like EUR/USD, with possible commissions on these spreads. Overnight fees vary based on factors such as the financial instrument, position size, and holding duration.

Non-trading Fees: KVB Prime is favorable in terms of non-trading fees. There's no inactivity fee for dormant accounts, no specified deposit or withdrawal charges, and no account management or maintenance fees. However, currency conversion fees may apply if deposit currencies differ from those accepted by KVB Prime.

In summary, KVB Prime provides competitive spreads and commissions, and its absence of certain non-trading fees can be advantageous for traders, though currency conversion fees may be relevant in some cases.

Deposit & Withdrawal

Deposit Methods:

Customers can fund their accounts using various deposit methods, including bank cards, NB (presumably referring to a specific payment or bank transfer method), and USDT deposits. To make a deposit, users can follow these steps:

Access the login page on the platform.

Navigate to the user center once logged in.

Select “Wallet” to access your financial account.

Click on “Deposit.”

Choose the desired deposit channel from the available options.

Input the amount you wish to deposit.

Proceed with the payment process.

Withdrawal Methods:

KVB PRIME provides three withdrawal methods for customers: NB, USDT, and bank card. To initiate a withdrawal, users can follow these steps:

Log in to their account and access the user center.

Click on “Wallet” to access the financial account.

Select “Withdraw” to begin the withdrawal process.

Choose your preferred withdrawal method from the available options.

It's important for users to ensure that they follow the platform's specific procedures for deposits and withdrawals to ensure smooth and secure transactions. Additionally, it's advisable to check for any associated fees or processing times associated with each method.

Trading Platforms

KVB Prime provides traders with a variety of trading platforms:

MetaTrader 4: MetaTrader 4 is a well-known and widely used trading platform. It offers extensive features, including advanced charting tools, a wide range of technical indicators, and support for expert advisors, making it a popular choice among traders.

2. KVB Prime Mobile App: The KVB Prime mobile app is available for both Android and iOS devices. It is a proprietary project management app that caters to traders of different experience levels. The app provides access to features such as charts, transaction history, account management, quick deposits and withdrawals, real-time market quotes, and more.

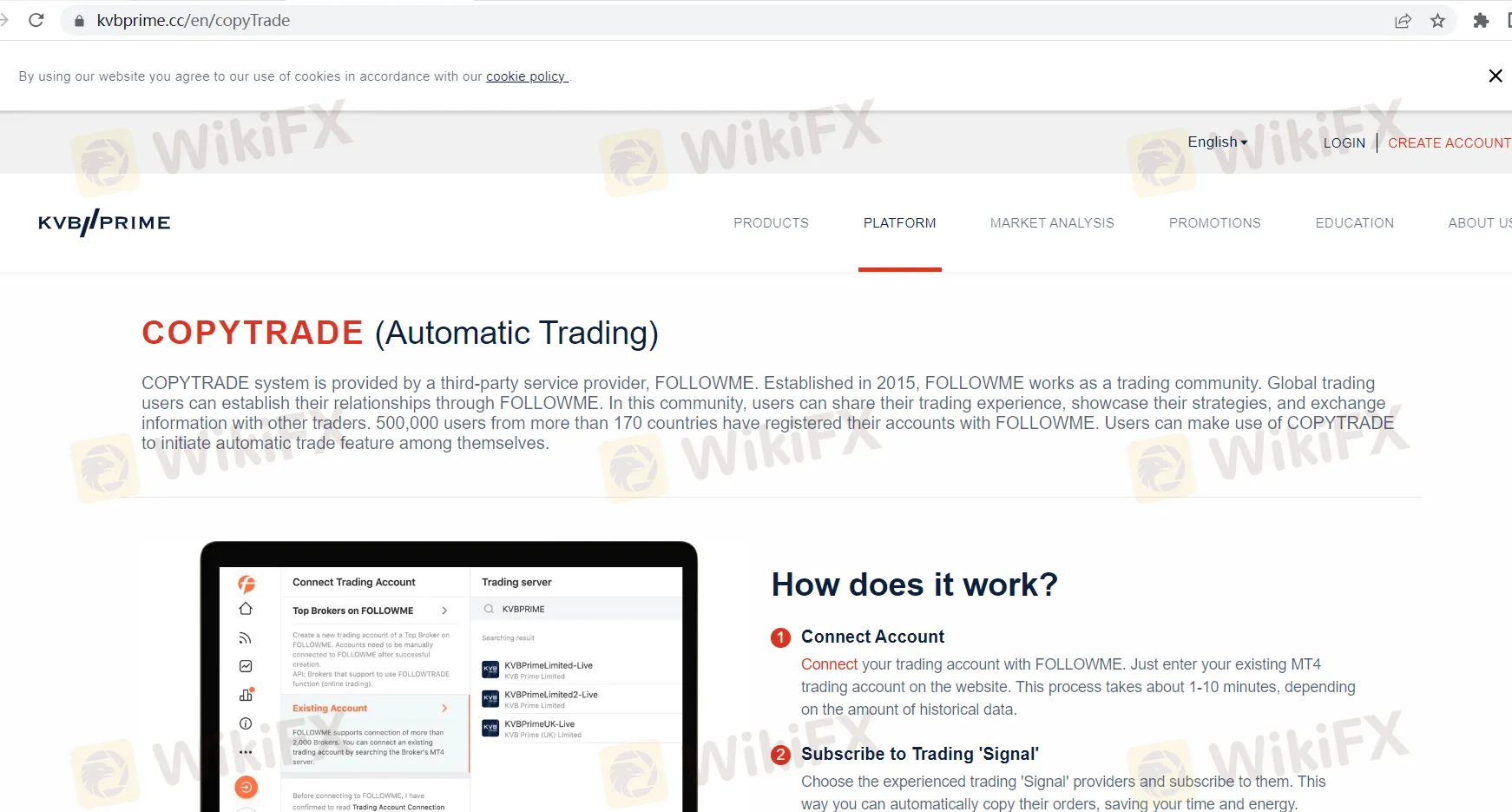

3. CopyTrade via FOLLOWME: KVB Prime has partnered with FOLLOWME, a third-party service provider. Through this partnership, traders can access copy trading. This feature allows traders to follow experienced experts and replicate their trading strategies and trades, offering an opportunity for those looking to leverage the expertise of seasoned traders.

These trading platforms offer a range of options to suit the preferences and needs of different traders.

Customer Support:

KVB Prime offers accessible customer support services for traders:

Greater China Customer Service:

E-mail: You can reach out to their support team via email at support@kvbprime.com.

Telephone: For direct assistance, you can contact them at 400 - 886 - 7005.

Service Hours: The support team is available during extended hours from 07:30 to 23:00 (UTC+8), ensuring coverage during peak trading times in the Greater China region.

European Customer Service:

E-mail: You can also reach the support team via email at support@kvbprime.com.

Service Hours: The European customer service team operates within the same generous hours, from 07:30 to 23:00 (UTC+8).

Live Chat Support: In addition to email and telephone support, KVB Prime offers live chat support, although it's worth noting that the information about live chat availability is not provided in the given text.

This comprehensive approach to customer support, with multiple contact options and generous service hours, demonstrates KVB Prime's commitment to assisting traders in both the Greater China and European regions, ensuring they have access to assistance when needed.

Educational Resources

KVB Prime provides a robust “Education” section, offering traders valuable resources to enhance their trading knowledge.

Forex Glossary: This glossary clarifies essential forex trading terms, aiding traders in understanding industry jargon.

Trading for Beginners: This section is tailored for newcomers, providing foundational knowledge on topics like market analysis, risk management, and trading strategies.

FAQ: A convenient resource for quick answers to common questions regarding account management, trading processes, and platform usage.

Education Videos: Visual and practical insights are offered through educational videos covering a wide range of trading topics, making learning engaging and accessible.

KVB Prime's “Education” section caters to traders of all levels, empowering them with essential knowledge to excel in their trading endeavors.

Summary

KVB Prime is an unregulated broker, which may raise concerns about safety and fairness for potential clients. The broker offers a diverse range of trading instruments, including Forex, Commodities, Shares, Indices, and Cryptocurrencies, catering to a variety of trading preferences. Traders can choose from multiple account types, with the Standard Account featuring competitive spreads and leverage options. KVB Prime provides access to popular trading platforms, including MetaTrader 4 and a mobile app, along with copy trading through FOLLOWME. The broker offers flexible deposit and withdrawal methods, and its fee structure is generally favorable, with no inactivity or management fees. KVB Prime's comprehensive educational resources and customer support options demonstrate its commitment to assisting traders at various levels. However, traders should exercise caution due to the absence of regulatory oversight.

FAQs

Q1: What is the minimum deposit required to open a KVB Prime Standard Account?

A1: The minimum deposit for a KVB Prime Standard Account is $10 or R150.

Q2: What is the maximum leverage offered on Forex trading with a Standard Account?

A2: With a Standard Account, traders can access leverage of up to 1:800 on Forex trades.

Q3: What trading platforms are available at KVB Prime?

A3: KVB Prime offers MetaTrader 4, the KVB Prime Mobile App, and CopyTrade as trading platforms.

Q4: Are there any fees for maintaining an inactive trading account with KVB Prime?

A4: No, KVB Prime does not charge an inactivity fee for dormant accounts.

Q5: What are the supported payment methods for deposits and withdrawals at KVB Prime?

A5: KVB Prime offers payment methods that include bank cards, NB deposits, and USDT deposits for both funding and withdrawing from trading accounts.

Read more

JustForex vs JustMarkets: A Comprehensive Comparison in 2025

Selecting the right forex broker can make the difference between trading success and frustration for most investors, especially retail investors. As retail traders gain unprecedented access to global markets, the choice between platforms like JustForex and JustMarkets becomes increasingly significant. Both brokers offer some shining features within the forex and CFD trading space, but their approaches differ in some areas.

CPT Markets Secures UAE SCA License for FX and CFDs Services

CPT Markets’ UAE subsidiary, CPT MENA, secures an SCA Category Five license, expanding its FX and CFDs services in the region. Learn more about its UAE growth.

FCA Warns of Trading212 Clone Scam Targeting Investors

FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

Vault Markets Review 2025: Live & Demo Accounts, Withdrawal to Explore

Vault Markets, a South African-based broker, has attracted much attention in recent days, particularly within its region. This online broker only offers access to focused trading opportunities on Indices, Currencies, Energies, and Metals, yet it shines on low minimum deposits plus various bonus programmes, which would encourage more investors, especially beginners, to trade with a small budget. However, Vault Markets operates outside of the authorized scope, so we don't consider it solid to trade with.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Rate Calc