GongPing Securities

Abstract:GongPing Securities, established in 2012 and registered in Hong Kong, China, operates under the regulation of the SFC (Securities and Futures Commission). The company offers a huge range of financial products, including stocks from Hong Kong and Mainland China, warrants, Callable Bull/Bear Contracts (CBBC), futures, and options. GongPing Securities provides services like margin stock service and operates with a commission structure ranging from HK$2 to HK$10. Their trading platforms include Ayers Security Code, HK Express, Fair Securities, Tele-Trend, and several other apps. Additionally, they offer a demo account for practice trading. Deposit and withdrawal options are tailored for Hong Kong users, featuring services like Fair Securities Limited Deposit Services and FPS (for Hong Kong bank accounts), and they provide securities deposit information in both Chinese and English. For customer support, GongPing Securities offers an online chat system.

| Aspect | Information |

| Company Name | GongPing Securities |

| Registered Country/Area | China (Hong Kong) |

| Founded Year | 2012 |

| Regulation | SFC |

| Products | Stocks(Hong Kong and Mainland),warrant, CBBC (Callable Bull/Bear Contracts),futures,option |

| Services | Margin stock service |

| Commissions | From HK$2 to HK$10 |

| Trading Platform | Ayers Security Code,HK Express,Fair Securities,Tele-Trend and other many apps |

| Demo Account | Available |

| Deposit&withdrawal | Fair Securities Limited Deposit Services, FPS (Hong Kong bank account only),Securities Deposit Information (Chinese),Securities Deposit Information (English), |

| Customer Support | Online Chat(message sent system) |

Overview of GongPing Securities

GongPing Securities, established in 2012 and registered in Hong Kong, China, operates under the regulation of the SFC (Securities and Futures Commission).

The company offers a huge range of financial products, including stocks from Hong Kong and Mainland China, warrants, Callable Bull/Bear Contracts (CBBC), futures, and options. GongPing Securities provides services like margin stock service and operates with a commission structure ranging from HK$2 to HK$10.

Their trading platforms include Ayers Security Code, HK Express, Fair Securities, Tele-Trend, and several other apps. Additionally, they offer a demo account for practice trading.

Deposit and withdrawal options are tailored for Hong Kong users, featuring services like Fair Securities Limited Deposit Services and FPS (for Hong Kong bank accounts), and they provide securities deposit information in both Chinese and English. For customer support, GongPing Securities offers an online chat system.

Is GongPing Securities Legit or a Scam?

The Securities and Futures Commission(SFC) of Hong Kong regulates Gong Ping Futures Limitedunder the license type for dealing in futures contracts. The current status of this license is 'Regulated.'

Gong Ping Futures Limited operates under the Hong Kong jurisdiction with the license number AXK956. This license became effective on November 22, 2011.

In a separate regulation, Gong Ping Securities Limited is regulated by the Securities and Futures Commission of Hong Kong for dealing in securities.

This license is currently in an 'Exceeded' status. The license, under the jurisdiction of Hong Kong, is identified by the number AVW221 and was initially effective from December 8, 2010.

Pros and Cons

| Pros | Cons |

| Enhanced Credibility | Regulatory Costs |

| Investor Protection | Operational Limitations |

| Market Integrity | Complexity in Compliance |

| Access to Markets | Penalties for Non-Compliance |

| Transparency | Market Constraints |

Pros:

Enhanced Credibility: Regulation by a respected authority like the Securities and Futures Commission of Hong Kong adds credibility to Gong Ping Futures Limited and Gong Ping Securities Limited, increasing investor confidence.

Investor Protection: Regulation ensures that these companies adhere to strict guidelines and standards, providing a higher level of protection to investors against fraud and malpractices.

Market Integrity: Being regulated helps in maintaining the integrity of the financial markets, as these companies are required to follow ethical practices and fair trading.

Access to Markets: Regulation allows these companies to legitimately access and operate in the Hong Kong financial markets, which is crucial for their business operations.

Transparency: Regulatory oversight ensures that these firms maintain transparency in their operations, which is vital for investor trust and market stability.

Cons:

Regulatory Costs: Compliance with regulations can be costly, as these companies need to invest in legal advice, compliance staff, and systems to ensure they meet all regulatory requirements.

Operational Limitations: Regulations can impose certain restrictions and limitations on the operations of these companies, potentially affecting their flexibility and innovation.

Complexity in Compliance: Navigating the complexities of regulatory requirements can be challenging and time-consuming, requiring dedicated resources and expertise.

Penalties for Non-Compliance: Failure to comply with the regulations can lead to penalties, fines, or even the revocation of licenses, posing significant risks to the business.

Market Constraints: Being regulated by a specific jurisdiction like Hong Kong may limit the companies' ability to expand their services freely in international markets, as they must adhere to the local regulatory framework.

Products

The products offered by Gong Ping Futures Limited and Gong Ping Securities Limited, as regulated by the Securities and Futures Commission of Hong Kong, typically include a range of financial instruments and services in the futures and securities markets.

Stocks (Hong Kong and Mainland): This encompasses a range of equities from both the Hong Kong and Mainland China stock markets, allowing investors to buy and sell shares of publicly listed companies in these regions.

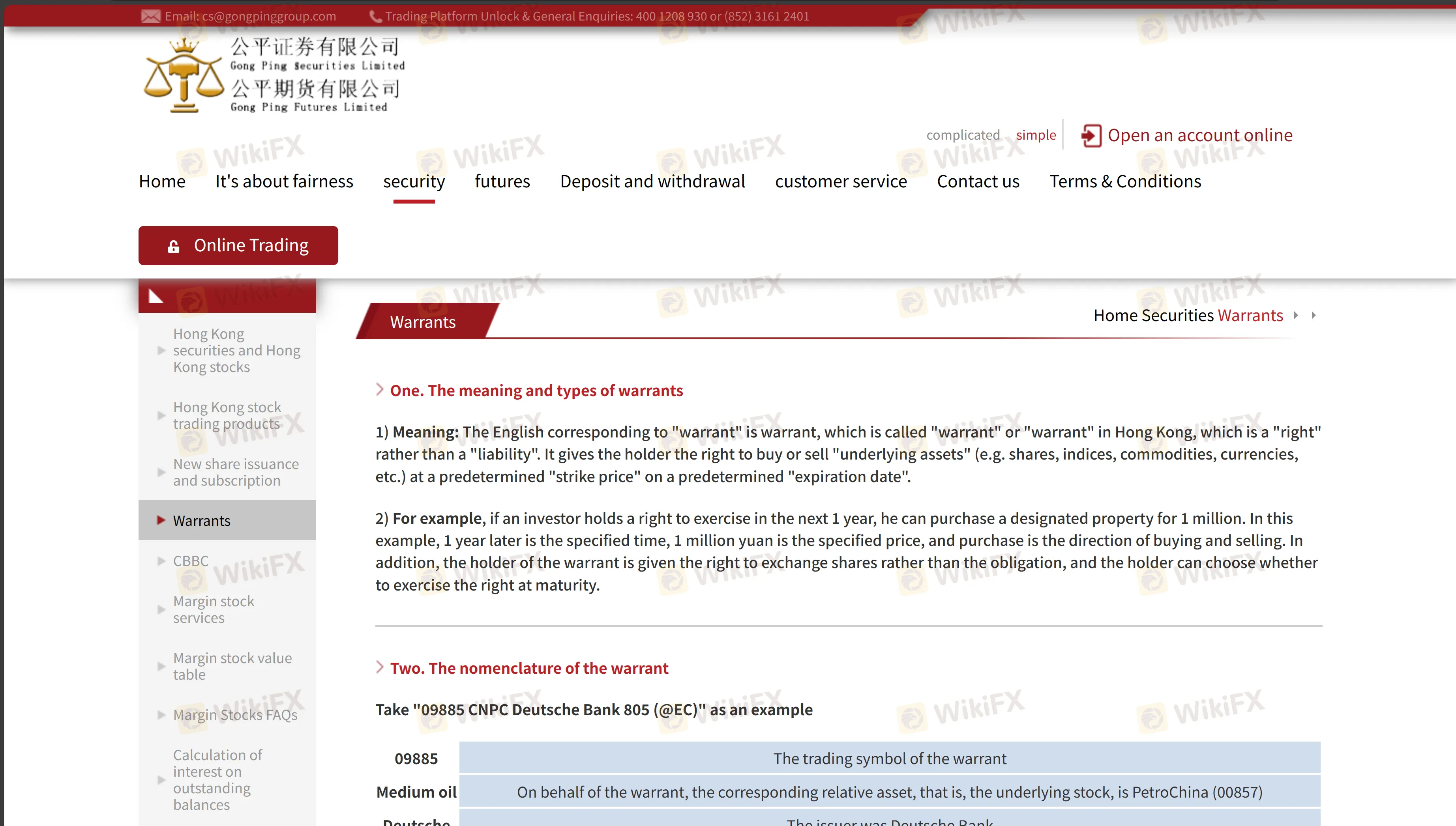

Warrants: These are derivatives that give the holder the right, but not the obligation, to buy or sell a security—most commonly an equity—at a certain price before the expiration date.

CBBC (Callable Bull/Bear Contracts): These are structured financial instruments that offer investors an opportunity to speculate on the rise (Bull) or fall (Bear) of the underlying asset or market index. They have a mandatory call feature that can be activated under certain conditions.

Futures: Futures contracts are agreements to buy or sell an underlying asset at a predetermined price at a specified time in the future. These can include a wide range of assets such as commodities, currencies, or financial instruments.

Options: Options are financial derivatives that provide the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price within a set time period.

These products allow for a variety of investment strategies, from direct equity investment to more complex derivative trading,meeting different investor profiles and risk appetites.

Service

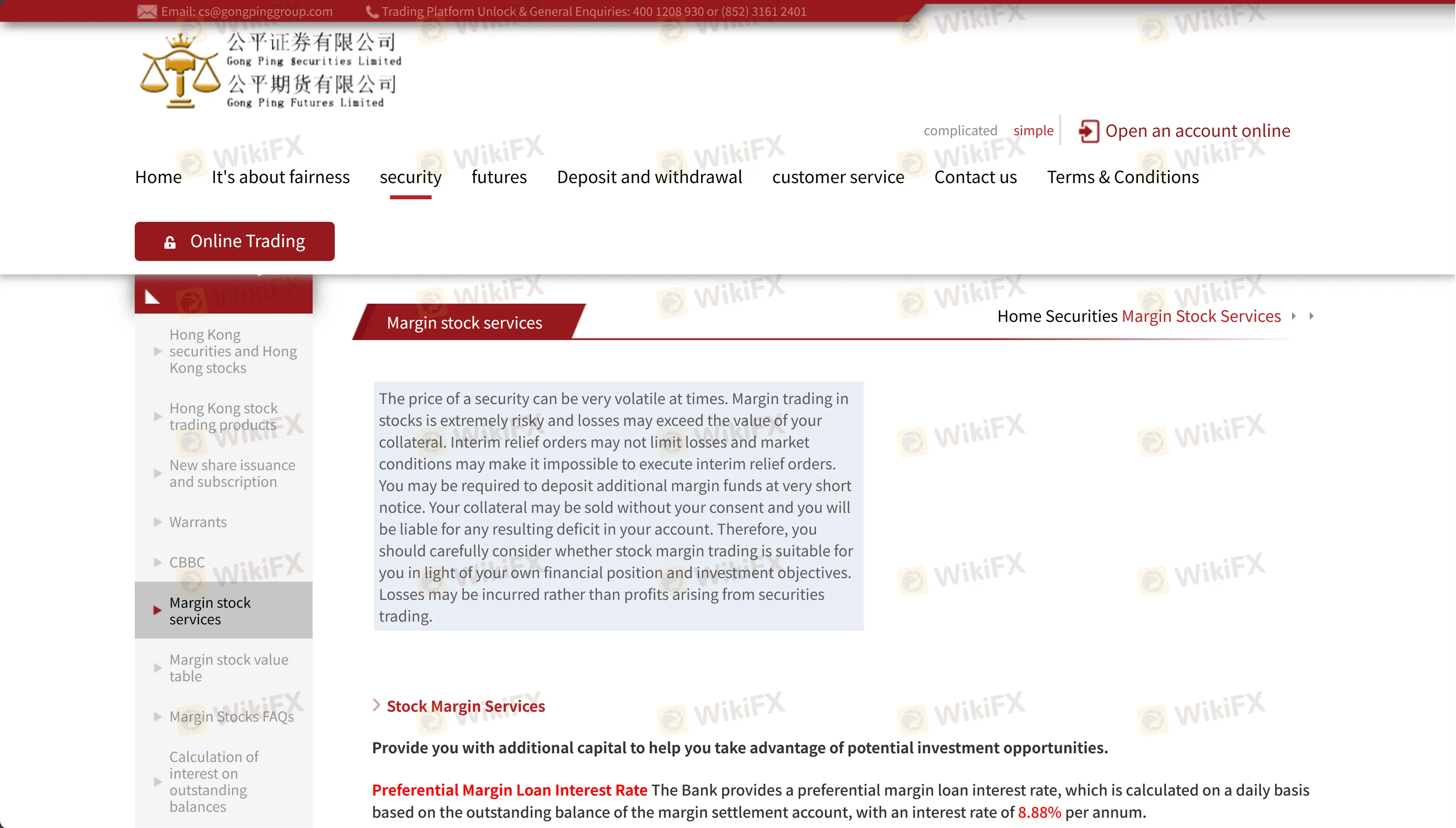

The services offered by Gong Ping (presumably a financial services company) is margin stock service.

Margin Stock ServiceThis service allows investors to borrow money to purchase stocks. The stocks themselves are used as collateral for the loan. This enables investors to leverage their positions, potentially increasing their return on investment, but also involves higher risks.

How to Open an Account?

Opening an account with a financial services company like Gong Ping typically involves a standard process. Here's a simplified overview of three steps:

Gather Required Documentation: Prepare essential documents such as personal identification (e.g., passport), proof of address, and financial information.

Complete the Application Form: Access and fill out the account opening application form on Gong Ping's website or at their office. Ensure all provided information is accurate.

Submit Application and Await Verification: Submit the completed form along with the necessary documents. Gong Ping will then verify your details and, upon approval, activate your account.

Spreads & Commissions

The commissions can be seperated to 2 parts:stocks and options.

Commissions for Stocks:

Transaction Levy: 0.0027% of each transaction amount, levied by the SFC (Securities and Futures Commission).

Hong Kong Exchange and Clearing (HKEX) Trading Fee: 0.00565% of each transaction amount.

Government Stamp Duty: 0.1% of each transaction amount (minimum HK$1 even for amounts less than HK$1), collected by the Hong Kong Government. Transactions below HK$1,000 are calculated as HK$1,000; stamp duties below HK$1 are rounded up to HK$1.

Central Clearing Charge: 0.007% of each transaction amount; maximum HK$200, minimum HK$5, collected by the Central Clearing House.

Levy by Financial Reporting Council: 0.00015% of each transaction amount.

Stock Buying and Selling Commission:

a. For online clients: 0.118% or a minimum of HK$68, whichever is higher, calculated per successful transaction.

b. For phone clients: 0.25% or a minimum of HK$100, whichever is higher.

Commissions for Options:

Hang Seng Index Options:

Online Trading: HK$40 for same-day square-off, HK$65 for non-same-day square-off.

Phone Trading: HK$65 for same-day square-off, HK$90 for non-same-day square-off.

Exchange Fee: HK$10.

SFC Transaction Levy: HK$0.54.

Mini Hang Seng Index Options:

Online Trading: HK$12.50 for same-day square-off, HK$22.50 for non-same-day square-off.

Phone Trading: HK$20 for same-day square-off, HK$32.50 for non-same-day square-off.

Exchange Fee: HK$3.50.

SFC Transaction Levy: HK$0.10.

H-Share Index Options:

Same as Hang Seng Index Options.

Mini H-Share Index Options:

Same as Mini Hang Seng Index Options.

Trading Platform

The company offers a range of trading platforms for various devices and needs:

Ayers Security Code APK: For Android users in Mainland China, featuring two-factor authentication (2FA) and password generation every 30 seconds, available in simplified/traditional Chinese and English.

Ayers Security Code (Android & iOS): Tailored for Hong Kong and Mainland China, offering similar security features across both operating systems.

Hong Kong Stocks Express Professional Version: A professional app with real-time Hong Kong stock quotes, expert analysis, and fee rebates based on trading volume.

Fair Hong Kong Stocks Express Standard Version: Provides real-time futures and delayed stock quotes for free.

Fair Securities & Fair Futures Download Versions: Dedicated platforms for securities and futures trading with real-time functionality.

Fair Trading Treasure (Tele-Trend) for Android & iOS: Offers real-time and delayed stock quotes.

Tele-Trend: Tele-Trend enhancing platform functionality on various Windows versions.

These platforms ensure secure, efficient, and versatile trading experiences for users with different preferences and needs.Also,there are other many third-party software of it,providing various services fot customers.

Deposit

GongPing offers deposit services seperatly to stocks traders and options traders.

Deposit Methods for Gong Ping Securities Ltd:

FPS (Fast Payment System) Transfer (Exclusive to Hong Kong Bank Accounts):

Open a personal online banking account (E-BANKING).

Enable the “transfer to third-party” function and set the transfer limit, selecting the “Fast Payment System (FPS)” option.

Use the FPS Identifier for Gong Ping Securities Ltd: 164531451.

Enter the deposit amount and choose real-time transfer.

Confirm the transfer.

After completion, fill in the deposit form, attach proof (e.g., screenshot), and email it to cs@gongpinggroup.com. The company will then credit the amount to your securities/futures account.

Securities Deposit Information:

Beneficiary Name: Gong Ping Securities Limited - Client's Account.

Beneficiary A/C no: (072)958502002810 for ICBC (Asia) Ltd, (035)802012918201 for OCBC Wing Hang Bank Limited, and (382)54202026979 for Bank of Communications (Hong Kong) Limited.

Payee's Bank Address: 33/F., ICBC Tower, 3 Garden Road, Central, Hong Kong for ICBC; 161 Queen's Road Central, Hong Kong for OCBC Wing Hang; G/F, 20 Pedder Street, Central, Hong Kong for Bank of Communications.

SWIFT Code: UBHKHKHH (ICBC), WIHBHKHH (OCBC Wing Hang), and COMMHKHK (Bank of Communications) for T/T only.

Bank Code: 072 (ICBC), 035 (OCBC Wing Hang), and 382 (Bank of Communications) for CHATS only.

Deposit Methods for Gong Ping Futures Ltd:

FPS (Fast Payment System) Transfer (Exclusive to Hong Kong Bank Accounts):

Open a personal online banking account (E-BANKING).

Enable the “transfer to third-party” function and set the transfer limit, selecting the “Fast Payment System (FPS)” option.

Use the FPS Identifier for Gong Ping Futures Ltd: 164226938.

Enter the deposit amount and choose real-time transfer.

Confirm the transfer.

After completion, fill in the deposit form, attach proof (e.g., screenshot), and email it to cs@gongpinggroup.com. The company will then credit the amount to your futures account.

Futures Deposit Information:

Beneficiary Name: Gong Ping Futures Ltd and Gong Ping Futures Ltd - Client's Account.

Beneficiary A/C no: 035802689881001 for OCBC Wing Hang Bank Limited and (382)54202029198 for Bank of Communications (Hong Kong) Limited.

Payee's Bank Address: 161 Queen's Road Central, Hong Kong for OCBC Wing Hang and G/F, 20 Pedder Street, Central, Hong Kong for Bank of Communications.

SWIFT Code: WIHBHKHH (OCBC Wing Hang) and COMMHKHK (Bank of Communications) for T/T only.

Bank Code: 035 (OCBC Wing Hang) and 382 (Bank of Communications) for CHATS only.

Customer Support

Gong Ping Group provides comprehensive customer support through various channels. Their office is located in Hong Kong at Room D, 8/F, Block B, Yee King Centre, 1 Wang Kwong Road, Kowloon Bay, Kowloon.

For general inquiries and trading platform assistance, customers can contact the main line at (852) 3161 2400 or the specific trading platform support at 400 1208 930 or (852) 3161 2401. For securities and futures trading queries, they offer dedicated lines at 400 1208 929 or (852) 3161 2480.

Account opening inquiries and online customer service can be reached at 400 1208 930 or (852) 3161 2490. They also provide a fax line at (852) 2377 1100 and an email contact at cs@gongpinggroup.com. The postal code for their Hong Kong office is 999077.

Conclusion

Gong Ping Group, with its headquarters in Kowloon Bay, Hong Kong, offers a range of financial services and customer support through various channels.

They provide dedicated phone lines for trading, platform support, and account inquiries, ensuring accessible and specialized assistance for their clients.

Their commitment to customer service is further emphasized by additional communication methods such as fax and email, offering the various needs of their global clientele.

This comprehensive approach underlines Gong Ping Group's dedication to providing efficient and reliable financial services.

FAQs

Q: What are the commission rates for Gong Ping Group's services?

A: Gong Ping Group charges varying commissions for securities and futures trading, including transaction levies, trading fees, government stamp duty, clearing fees, and specific rates for online and telephone clients.

Q: Where is Gong Ping Group's headquarters located?

A: Their headquarters is located at Room D, 8/F, Block B, Yee King Centre, 1 Wang Kwong Road, Kowloon Bay, Kowloon, Hong Kong.

Q: How can I contact Gong Ping Group for general inquiries?

A: For general inquiries, you can contact their main line at (852) 3161 2400 or for trading platform support at 400 1208 930 or (852) 3161 2401.

Q: Are there dedicated phone lines for securities and futures trading inquiries?

A: Yes, Gong Ping Group provides dedicated phone lines for securities and futures trading inquiries at 400 1208 929 or (852) 3161 2480.

Q: What financial products does Gong Ping Group offer?

A: Gong Ping Group provides securities trading, futures, warrants, Callable Bull/Bear Contracts (CBBCs), and options trading.

WikiFX Broker

Latest News

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

RBI: India\s central bank slashes rates after five years

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Rate Calc