CSLS

Abstract:CSLS, founded in 2009 and headquartered in Nigeria, offers a range of financial services, including institutional sales and trading, individual and private client services, corporate finance, corporate broking, and investor relations. The company provides educational resources such as research reports covering the Nigerian and Sub-Saharan African investment and economic landscape. However, CSLS is not regulated by any recognized financial regulatory authority, raising concerns about the safety and security of funds.

| CSLS | Basic Information |

| Company Name | CSLS |

| Founded | 2009 |

| Headquarters | Nigeria |

| Regulations | Not regulated |

| Products and Services | Institutional Sales & Trading, Individual & Private Client Services, Corporate Finance, Corporate Broking, Investor Relations |

| Fees | Lower brokerage commissions |

| Customer Support | Phone: 01-2713920-4, Email: cslservice@fcmb.com, cslcsu@fcmb.com |

| Education Resources | Research reports, periodicals on capital markets, politics, economics, and general news, weekly, quarterly, and annual investment strategy products, bespoke research reports |

Overview of CSLS

CSLS, founded in 2009 and headquartered in Nigeria, offers a range of financial services catering to both institutional and individual clients. Despite not being regulated by any recognized financial authority, CSLS provides services such as institutional sales and trading, individual and private client services, corporate finance, corporate broking, and investor relations. The company's focus on research-oriented, investor-focused solutions has earned it a reputation for providing comprehensive and unbiased intelligence on the Nigerian and Sub-Saharan African investment and economic landscape. However, its unregulated status raises concerns about the safety and security of funds, as well as the transparency of its business practices.

Is CSLS Legit?

CSLS is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Pros and Cons

While CSLS offers a diverse range of financial services catering to both institutional and individual clients, its unregulated status poses significant risks for traders and investors. On the positive side, CSLS provides comprehensive research reports and offers relatively lower brokerage commissions for equity trading. However, the lack of regulation raises concerns about the safety of funds and the transparency of the broker's operations. Traders should carefully weigh the potential benefits against the risks associated with trading with an unregulated broker before making investment decisions.

| Pros | Cons |

|

|

|

|

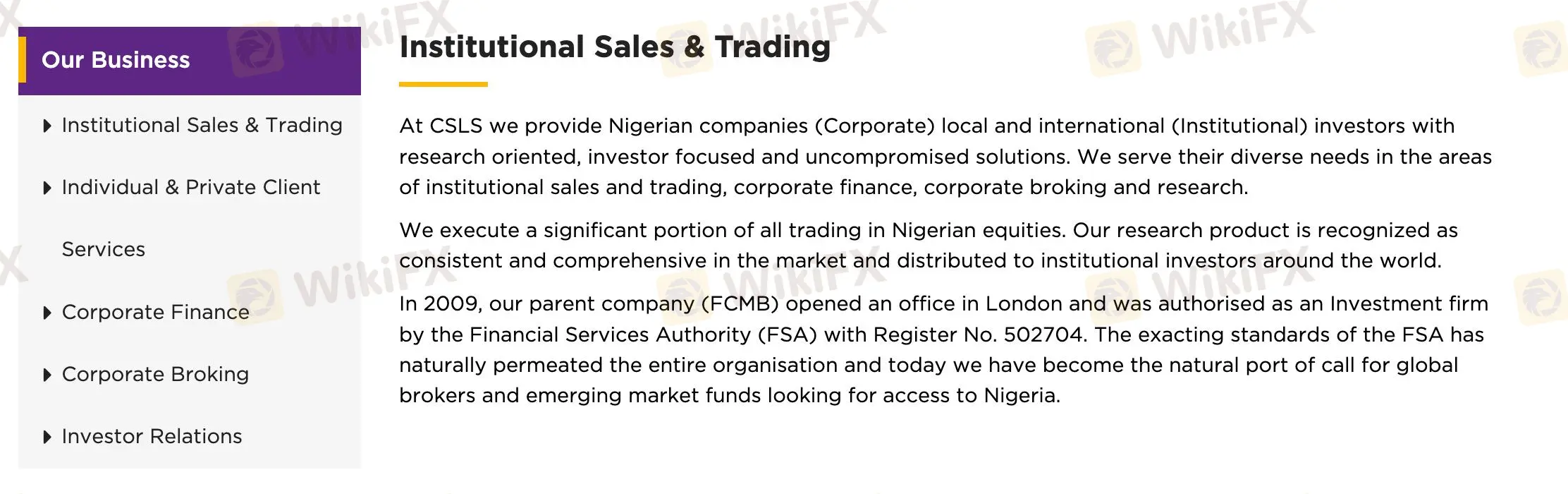

Products and Services

CSLS offers a range of financial services, including institutional sales and trading, individual and private client services, corporate finance, corporate broking, and investor relations.

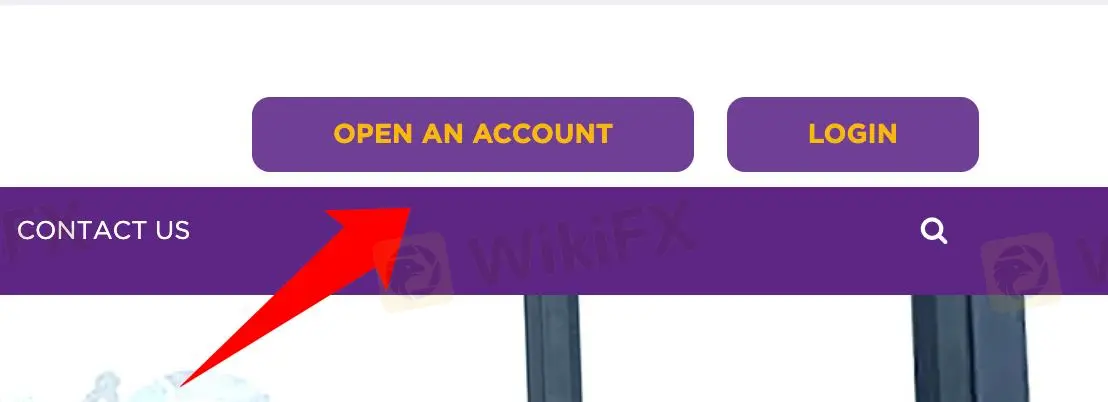

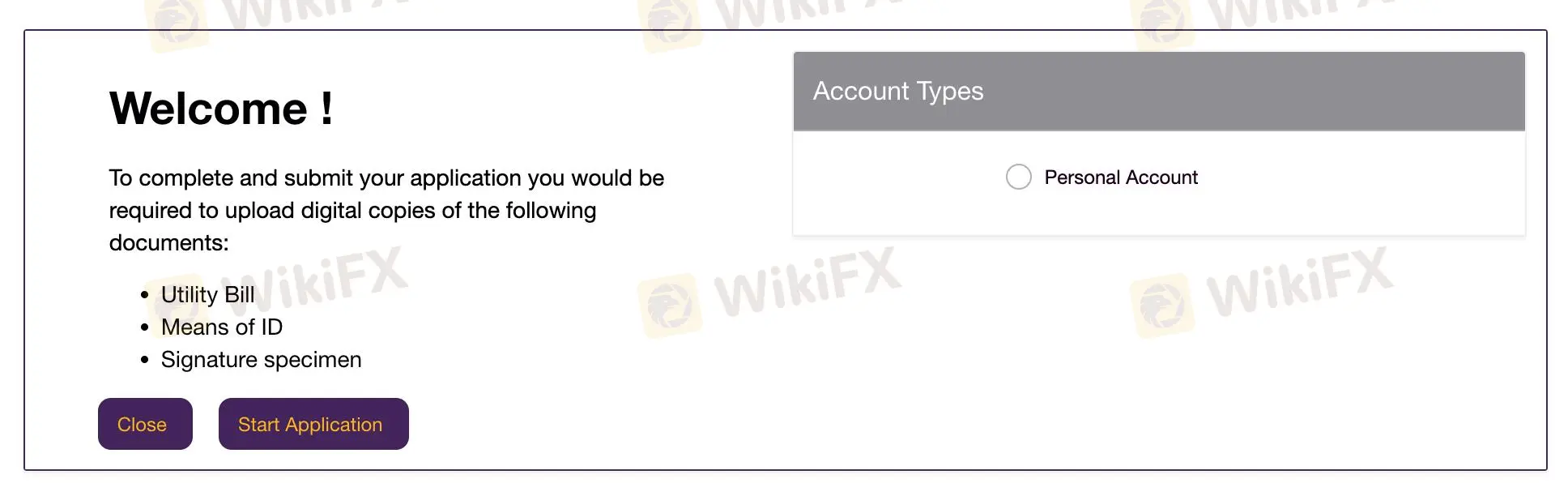

How to Open an Account

To open an account with CSLS, follow these steps.

Visit the CSLS website. Look for the “OPEN AN ACCOUNT” button on the homepage and click on it.

Complete and submit your application by uploading digital copies of the following documents:

Utility Bill

Means of ID

Signature specimen

Select the type of account you wish to open, such as a personal account.

Fees

CSLS charges relatively lower brokerage commissions for equity trading conducted through their online and mobile trading applications. They offer instant fund transfers and provide access to trade in all shares listed on the Nigerian Stock Exchange, with a start-up capital requirement of #20,000 for a new online account.

Customer Support

CSLS customer support can be reached at their office address on the 4th Floor, First City Plaza, Marina, P.O.Box 9117, Lagos State, Nigeria. You can also contact them by phone at 01-2713920-4 or via email at cslservice@fcmb.com or cslcsu@fcmb.com.

Educational Resources

CSLS provides educational resources like research reports covering the Nigerian and Sub-Saharan African investment and economic landscape, including periodicals on capital markets, politics, economics, and general news, along with weekly, quarterly, and annual investment strategy products and bespoke research reports.

Conclusion

In conclusion, CSLS offers a range of financial services and benefits such as comprehensive research reports and relatively lower brokerage commissions. However, its unregulated status raises significant concerns about the safety of funds and the transparency of its operations. Traders and investors should approach CSLS with caution, weighing the potential benefits against the risks associated with trading with an unregulated broker.

FAQs

Q: Is CSLS a regulated broker?

A: No, CSLS is not regulated by any recognized financial regulatory authority.

Q: What products and services does CSLS offer?

A: CSLS offers institutional sales and trading, individual and private client services, corporate finance, corporate broking, and investor relations.

Q: How can I open an account with CSLS?

A: To open an account with CSLS, you can visit their website and follow the instructions for account opening, including uploading required documents such as a utility bill, means of ID, and signature specimen.

Q: What are the fees associated with trading with CSLS?

A: CSLS charges relatively lower brokerage commissions for equity trading conducted through their online and mobile trading applications. They also offer instant fund transfers and provide access to trade in all shares listed on the Nigerian Stock Exchange.

Q: How can I contact CSLS customer support?

A: CSLS customer support can be reached at their office address on the 4th Floor, First City Plaza, Marina, Lagos State, Nigeria. You can also contact them by phone at 01-2713920-4 or via email at cslservice@fcmb.com or cslcsu@fcmb.com.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

FCA Warns of Trading212 Clone Scam Targeting Investors

FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

Vault Markets Review 2025: Live & Demo Accounts, Withdrawal to Explore

Vault Markets, a South African-based broker, has attracted much attention in recent days, particularly within its region. This online broker only offers access to focused trading opportunities on Indices, Currencies, Energies, and Metals, yet it shines on low minimum deposits plus various bonus programmes, which would encourage more investors, especially beginners, to trade with a small budget. However, Vault Markets operates outside of the authorized scope, so we don't consider it solid to trade with.

Australian Dollar Surges as Trade Surplus Hits 11-Month High: A Golden Opportunity for Forex Traders

Australia's trade surplus has surged to an 11-month high, reaching $5.62 billion in January 2025. The unexpected boost in trade surplus was primarily driven by a 1.3% month-over-month increase in exports, with non-monetary gold playing a starring role.

FBK Markets Review 2025: Live & Demo Accounts, Withdrawals to Explore

FBK Markets, a young South African forex broker, targets both beginners and experienced traders within this region. This broker shines at its low minimum deposit required, 100% deposit bonus, and flexible account options, yet we cannot consider it reliable as it operates without any regulation. Furthermore, it features an approximately 70% withdrawal failure rate.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Deutsche Bank Facing Record Fine from German Watchdog – What’s the Price

Oleg Mukhanov Steps Down as TradingView CEO Amid Leadership Shakeup

Rate Calc