WikiFX Broker Assessment Series | Bokefx: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Bokefx. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Bokefx. Our aim is to equip readers with essential information needed to make informed decisions about utilizing this platform.

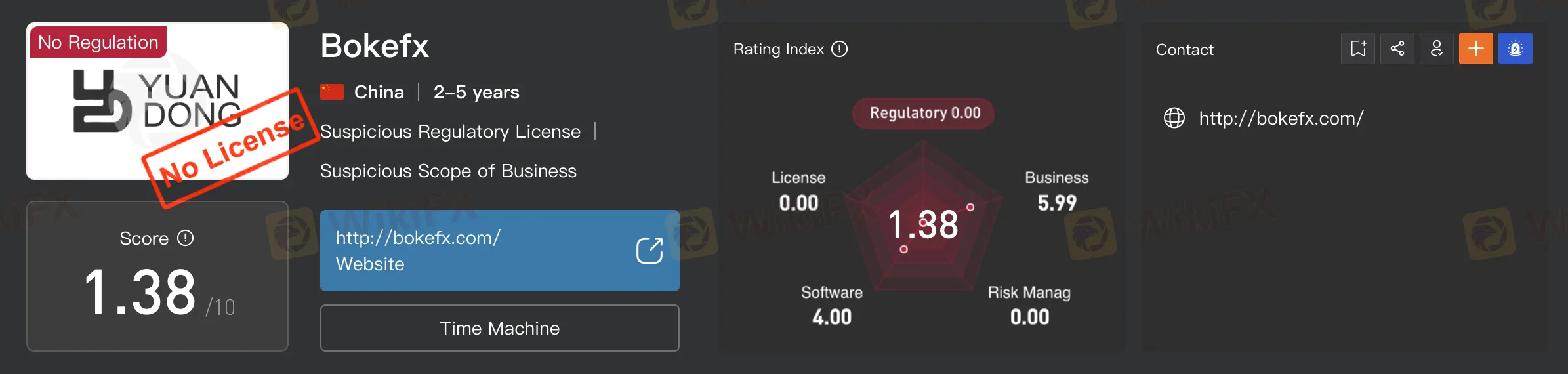

In the realm of online forex trading, identifying potential concerns is vital, and Bokefx has raised some notable issues. Marketed as an online forex broker, Bokefx lacks a crucial element – regulatory authorization. This sets Bokefx apart from reputable competitors, as it operates without the oversight necessary for a trustworthy online trading option.

The absence of regulatory authorization poses a significant problem. Regulatory bodies play a pivotal role in ensuring fair practices, setting standards, and facilitating issue resolution. Without this oversight, traders face potential risks of unethical practices with no proper recourse.

When assessing the legitimacy of a forex broker, the accessibility and reliability of its official website are paramount. Bokefx, however, adds to existing concerns by having its official website, bokefx.com, conspicuously unavailable. A reputable forex broker typically maintains a professional and easily accessible website, providing clients with a centralized platform for crucial information about services, policies, and regulatory compliance. The unavailability of Bokefx's website not only hinders potential traders from accessing vital details but also raises significant questions about the transparency of the broker's operations and the safety of clients' funds.

The sudden unavailability of Bokefx's website raises red flags, deviating from industry norms. Clients rely on brokers to deliver a secure and informative online environment, and the absence of Bokefx's website disrupts this essential aspect of the client-broker relationship. This unforeseen development heightens concerns about the broker's legitimacy, leaving clients uncertain about the safety and whereabouts of their funds. In the competitive forex trading landscape, where trust and transparency are paramount, Bokefx's missing official website cast doubt on its commitment to maintaining open communication and providing a secure trading environment for its clients.

Bokefx's status as an unlicensed and non-regulated online forex broker, coupled with the sudden unavailability of its website, serves as a clear warning to traders. Caution and thorough research are advised before selecting an online trading platform. In an industry where trust and transparency are of utmost importance, Bokefx's current circumstances underscore the significance of choosing brokers with a solid regulatory foundation and a commitment to clear communication and robust customer support.

Hence, WikiFX recommends that users exercise caution and consider exploring alternative brokers with a verified regulatory status from WikiFX's comprehensive database. Download your free WikiFX mobile app now!

Read more

Gold Prices Fluctuate: What Really Determines Their Value?

Gold prices have been fluctuating recently, influenced by multiple factors. Since the beginning of 2025, gold has risen by 11%, hitting new historic highs multiple times in the first quarter.

Investors Beware! A Trillion Naira Wiped Out in a Week

Market takes a hit: a trillion naira wiped out—what happened?

Dollar Under Fire—Is More Decline Ahead?

The dollar faces its biggest decline of the year, strong-dollar logic challenged.

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

What Impact on Investors as Oil Prices Decline?

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Rate Calc