INVDOM

Abstract:INVDOM is a newly-established broker registered in Australia, claiming to offer virtual currency CFD trading with demo accounts and leverage up to 1:100 via the industry-standard MT5 platform. However, currently it is not regulated.

| INVDOMReview Summary | |

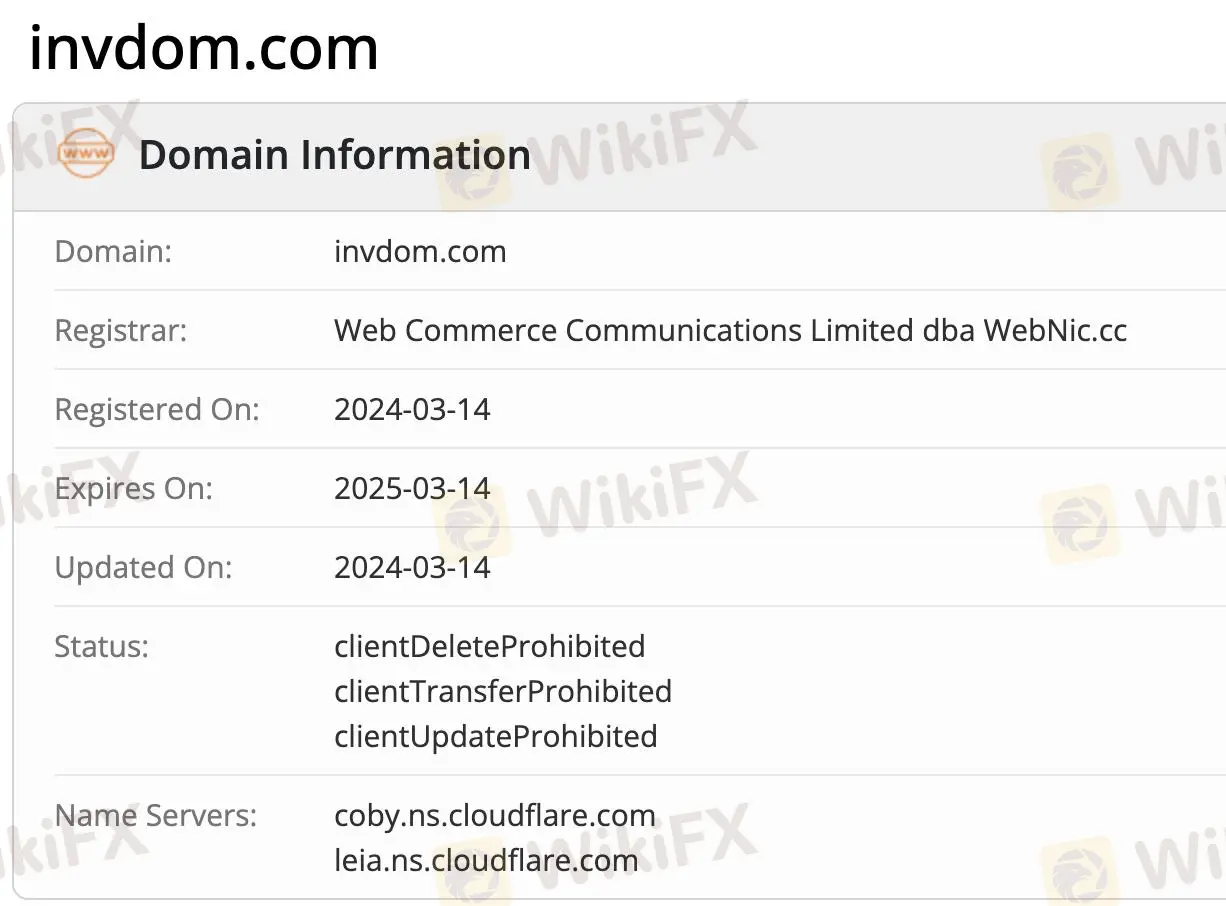

| Founded | 2024-3-14 |

| Registered Country/Region | Australia |

| Regulation | Not regulated |

| Market Instruments | Virtual currency CFD |

| Demo Account | ✅ |

| Leverage | Up to 1:100 |

| Spread | / |

| Trading Platform | MT5 |

| Min Deposit | / |

| Customer Support | Email: support@invdom.com |

| Address: Level 16 175 Pitt St, Sydney 2000, NSW. | |

INVDOM is a newly-established broker registered in Australia, claiming to offer virtual currency CFD trading with demo accounts and leverage up to 1:100 via the industry-standard MT5 platform. However, currently it is not regulated.

Pros and Cons

| Pros | Cons |

| Popular trading platform MT5 | Relatively new |

| Demo accounts offered | Not regulated |

| Limited trading assets | |

| Lack of transparency |

Is INVDOM Legit?

INVDOM operates without regulation. It is not supervised by any financial authorities. Traders should be cautious when choosing a broker.

What Can I Trade on INVDOM?

| Tradable Instruments | Supported |

| Virtual currency CFD | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

Account Type

INVDOM offers two account types: real account and demo account.

Leverage

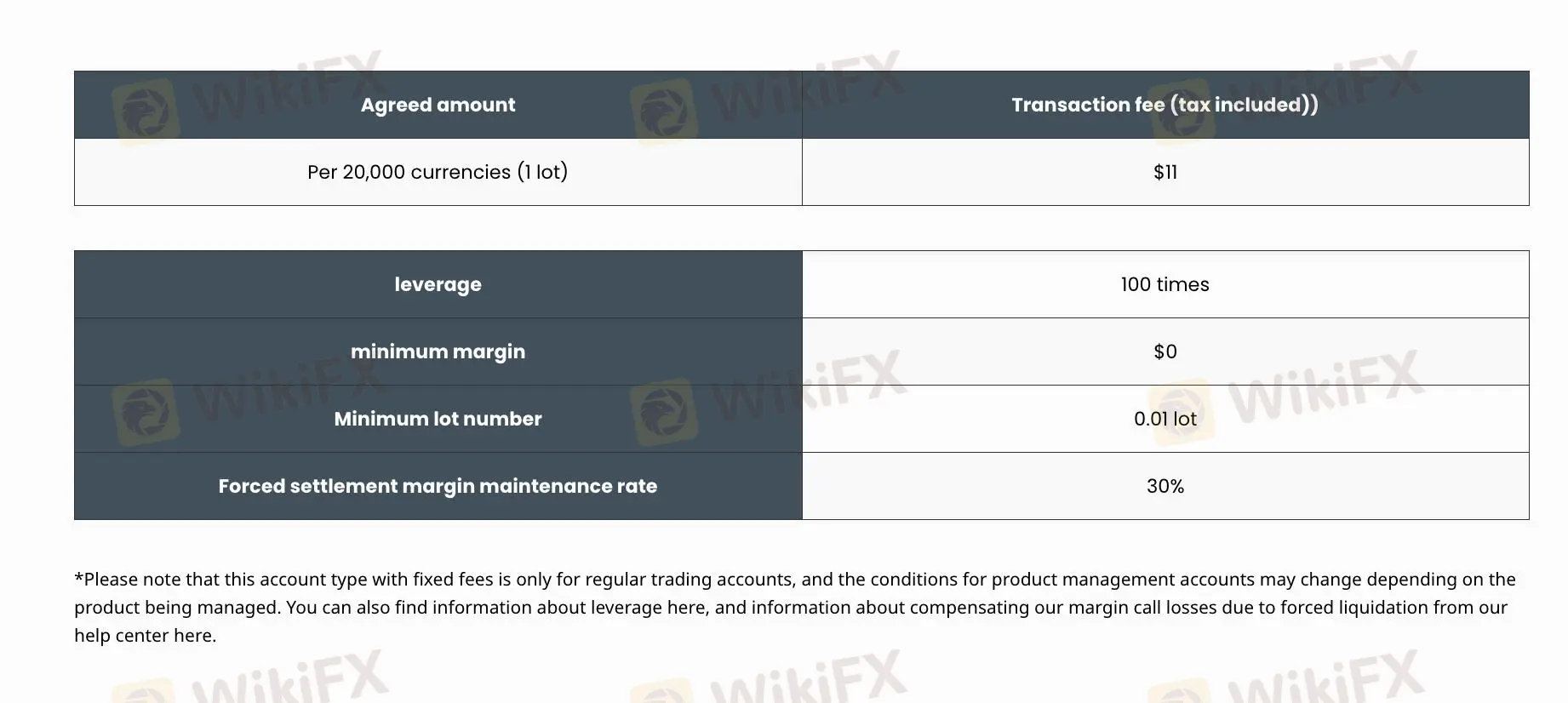

The leverage of INVDOM is up to 1:100. Note that high leverage comes with high gains and losses.

Commission

INVDOM charges $11 per 20000 currencies. The minimum margin is $0 and margin rate is 30%.

Other Fees

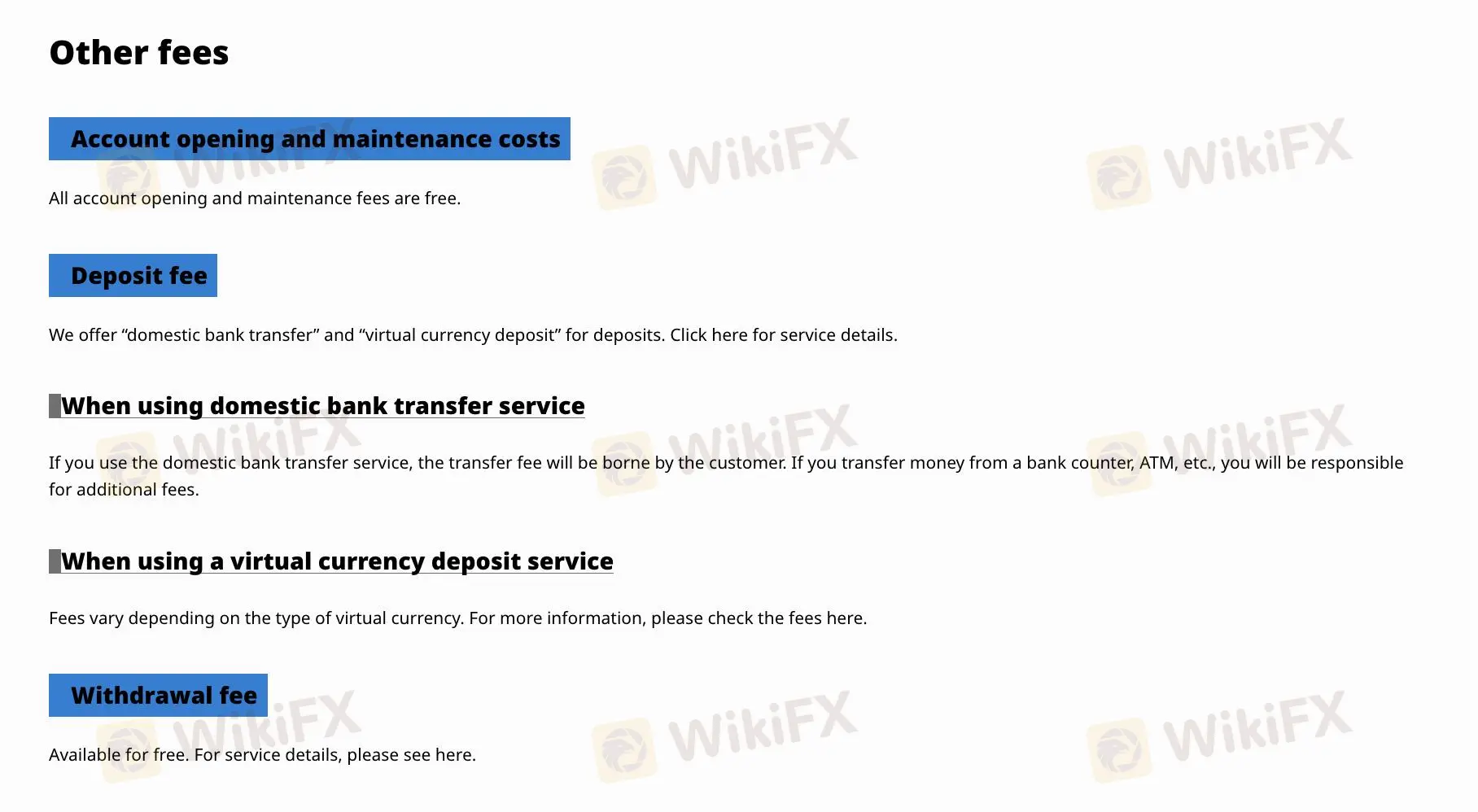

And all account opening and maintenance fees are said to be free of charge.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ❌ | / | Beginners |

| MT5 | ✔ | Web, Desktop, Web | Experienced traders |

Deposit and Withdrawal

Deposit Options

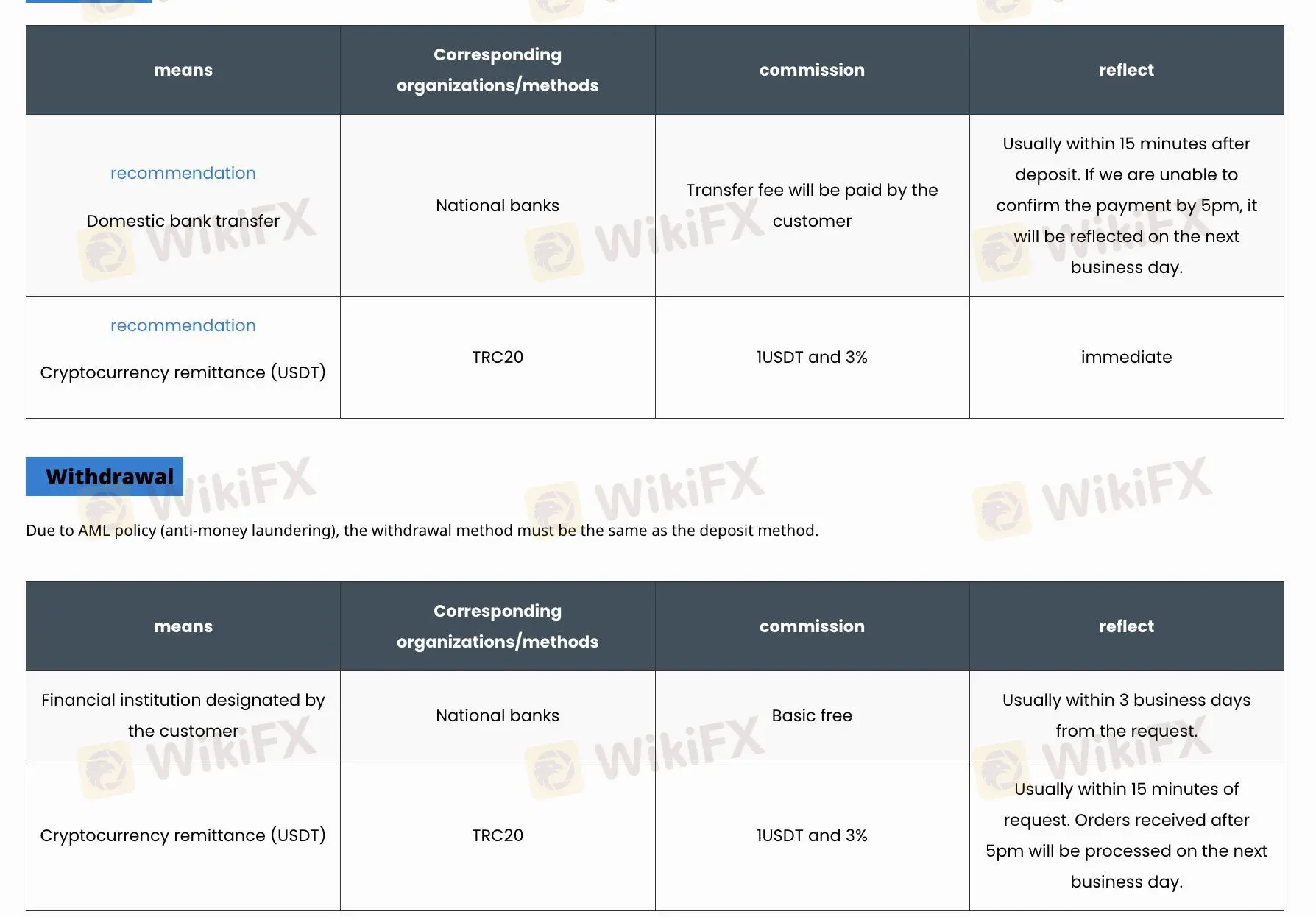

| Deposit Option | Fee | Processing Time |

| Domestic bank transfer | Transfer fee will be paid by the customer | Usually within 15 minutes after deposit. If the broker is unable to confirm the payment by 5pm, it will be reflected on the next business day |

| Cryptocurrency remittance (USDT) | 1 USDT and 3% | Immediate |

Withdrawal Options

| Withdrawal Option | Fee | Processing Time |

| Financial institution designated by the customer | Basic free | Usually within 3 business days from the request |

| Cryptocurrency remittance (USDT) | 1USDT and 3% | Usually within 15 minutes of request. Orders received after 5pm will be processed on the next business day |

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Italy’s Securities Regulator Consob Orders Shutdown of 6 Illegal Financial Service Websitese

Italy’s financial regulator, Consob, has ordered the shutdown of six unauthorized financial service websites to combat illegal financial activities and protect investors. This action is based on regulatory powers granted under the 2019 “Crescita Decree.” Since 2019, Consob has blocked 1,211 fraudulent websites. Investors can use WikiFX to verify compliance and avoid investment scams.

Win $100,000 in XM Competitions: Trade for Cash Prizes!

Join XM Competitions from 20-27 Feb for a chance to win $100,000! Compete by skill or luck. No entry fees. Trade on a secure, award-winning platform.

WikiFX Broker

Latest News

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

Valentine's Day Bonuses: Embrace Love and Wealth Together

Why Your Forex Trades Are Always Losing

Heartbreak and Empty Wallets: Romance Scams during Valentine’s

FCA Tightens Financial Promotion Rules, Withdraws Nearly 20,000 Ads in 2024

EmpiresX Founders Fined $130M for Crypto Investment Fraud

Understanding the New York Forex Trading Session Time in the Philippines

Rate Calc