Lloyds Capital

Abstract:Lloyds Capital was founded in 2020 and is registered in Switzerland. Its products for traders include Currencies, Commodities, Indices, Stocks, Cryptocurrencies. It also offers 4 types of accounts and 1 trading platform. At present, this brokerage is in an unregulated state, and the security is not guaranteed.

| Lloyds CapitalReview Summary | |

| Founded | 2020 |

| Registered Country/Region | Switzerland |

| Regulation | No regulation |

| Market Instruments | CurrenciesCommoditiesIndicesStocksCryptocurrencies |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | / |

| Trading Platform | WebTrader |

| Min Deposit | $ / € / £250 |

| Customer Support | Phone: +442086384460 |

| Email: support@lloyds-capital.net | |

| Physical Address: Europaallee 11,8004 Zurich, Switzerland | |

| Online chat: 24/5 | |

Lloyds Capital Information

Lloyds Capital was founded in 2020 and is registered in Switzerland. Its products for traders include Currencies, Commodities, Indices, Stocks, Cryptocurrencies. It also offers 4 types of accounts and 1 trading platform. At present, this brokerage is in an unregulated state, and the security is not guaranteed.

Pros and Cons

| Pros | Cons |

| 4 kinds of accounts | No regulation |

| No commission | MT4/5 is not supported |

| Many tradable products | Minimum deposit $/ €/ £250 |

Is Lloyds Capital Legit?

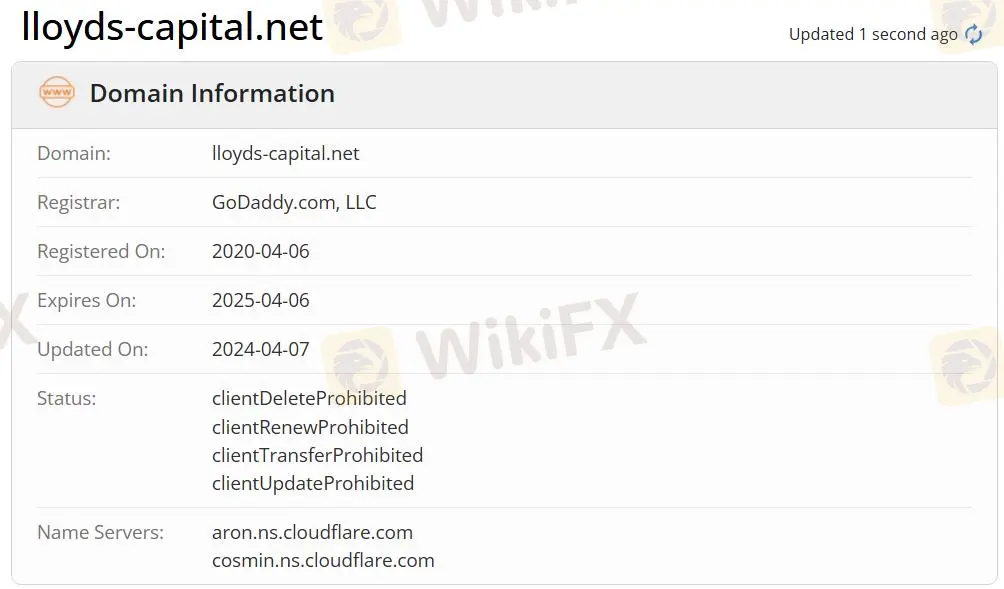

Lloyds Capital's official website, registered in 2020, is currently unregulated and insecure.

What Can I Trade on Lloyds Capital?

Lloyds Capital trades major currency pairs, including GBPUSD, AUDUSD and USDJPY, as well as various secondary currency pairs, including EURGBP, AUDJPY and EURJPY. A range of foreign currency pairs are also included, such as the USDMXN, USDTRY and USDZAR; It also offers a large number of commodity CFDS; Lloyds Capital also supports access to a large number of stocks from hundreds of global companies, including Amazon, Apple, Bank of America, and more;

In addition, the Standard & Poor's 500 Index, Germany's DAX, Hong Kong's Hang Seng Index, FTSE Index, etc., can be traded; Lloyds Capital offers the opportunity to directly trade various cryptocurrency pairs, such as BTC/ETH, BTC/XRP, and more. You can also trade cryptocurrency fiat pairs, such as USD/BTC. Most of the more popular cryptocurrencies are also offered, such as Bitcoin, Ripple, Litecoin, Ethereum, etc.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| ETF | ❌ |

Account Types

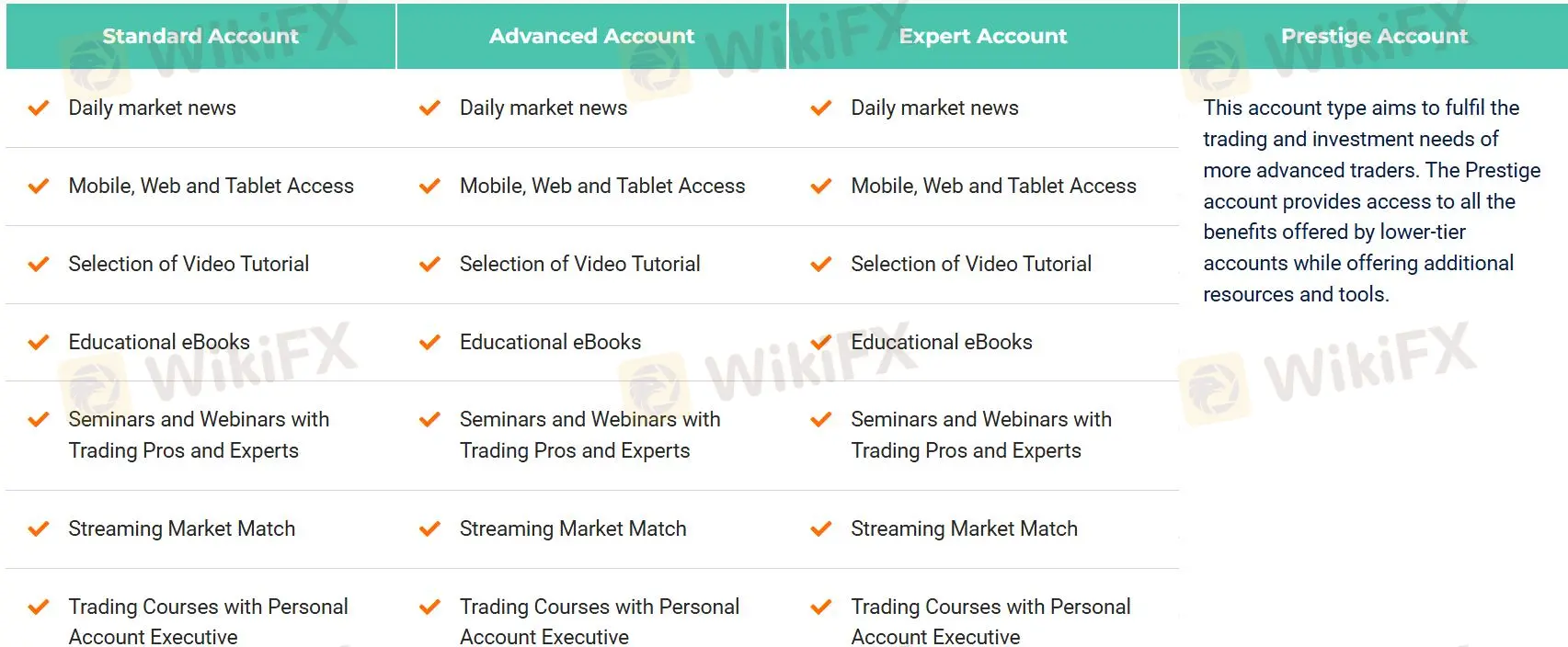

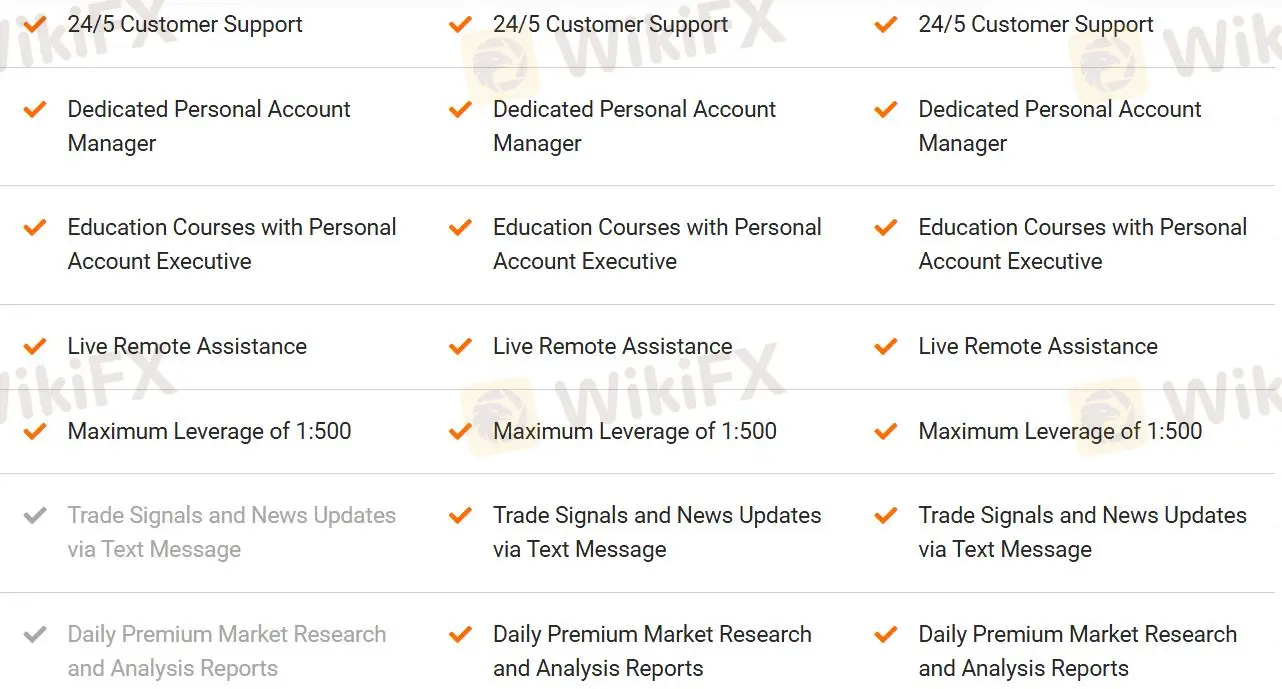

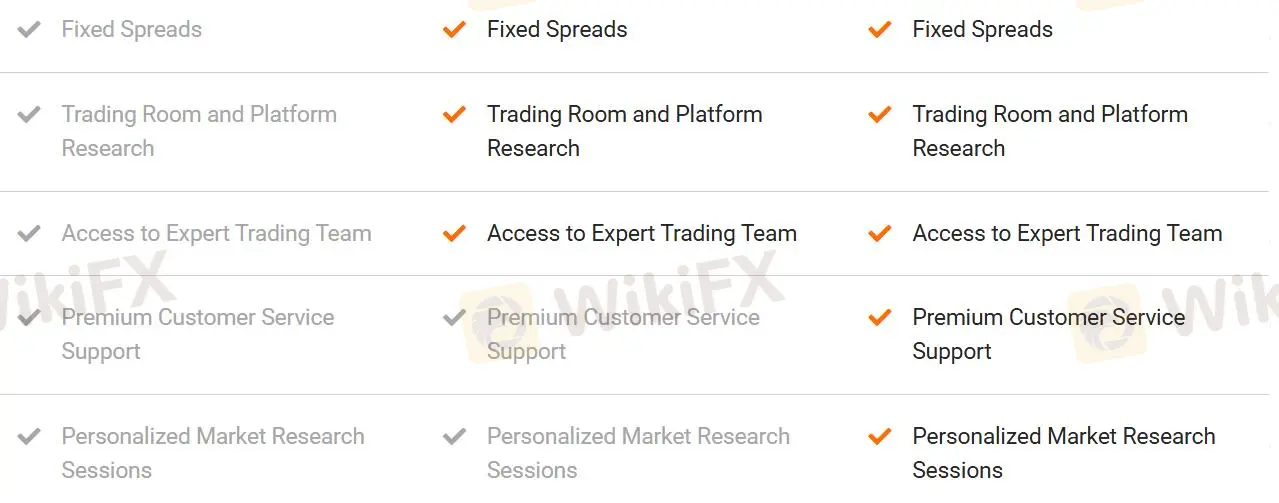

Lloyds Capital offers 4 types of accounts-Standard Account, Advanced Account, Expert Account and Prestige Account. The first three accounts all have a maximum leverage of 1:500 and are accessible on mobile devices, the Web, and tablets.

In addition, Lloyds Capital says Prestige accounts offer access to all the benefits offered by lower-tier accounts, while providing additional resources and tools.

Lloyds Capital Fees

Lloyds Capital says it provides fixed spreads with no comissions.

Trading Platform

Lloyds Capital provides a trading platform that allows traders to use it directly on the web.

| Trading Platform | Supported | Available Devices | Suitable for |

| WebTrader | ✔ | Web | All traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

Deposit and Withdrawal

This broker offers the following 4 payment methods to traders. Minimum deposit required is $/ €/ £250.

| Options | Processing Time |

| Credit and Debit Card | A few minutes |

| Local Bank Transfer | A few days |

| E-wallet | A few minutes |

| Wire / International Bank Transfer | 7 working days |

Read more

Admirals Resumes EU Client Onboarding After Pause in 2024

Admirals restarts EU client onboarding after a 2024 pause, enhancing compliance with CySEC regulations while aiming to boost its forex and CFD market presence.

How to Withdraw Funds from Pocket Option?

Pocket Option is considered a beginner-friendly trading platform, providing access to over 100 CFD instruments. Though not in an extensive range, 12 currency pairs, 10 cryptocurrencies, and stock indices are enough for focused and efficient trading. Particularly, forex trading starts at $10, perfectly fit for beginners' trading styles. Besides, Pocket Option provides a free demo account with virtual funds of $50,000 to give users risk-free practice. Though Pocket Option introduces commission-free option trading, they are less competitive in trading costs for other instruments.

OlympTrade Review 2025: Trading Accounts, Demo Account, and Withdrawal to Explore

OlympTrade is a relatively young online broker registered in Saint Vincent and the Grenadines, a shady spot with a booming of unlicensed entities. Tradable assets on the OlymTrade are not extensive, and this broker does not tell many essential trading conditions. As for trading platforms, I found trades can only operated on a simple web-based trading platform, no Metatrader platform at all.

WNS Trade Limit Broker Review

WNS Trade Limit, established in 2023, is a forex broker incorporated in Mauritius under registration number C200345. The company operates under the jurisdiction of the Financial Services Commission (FSC) of Mauritius, holding license number GB232201953.

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

TD Bank Appoints Guidepost Solutions for AML Compliance Oversight

Rate Calc