WikiFX Broker Assessment Series | GFS: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of GFS, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2013, Global Femic Services Limited (GFS) operates as an online brokerage specializing in the trading of CFDs, distinguishing itself through a commitment to offering competitive spreads. GFS is headquartered in Hong Kong, with a subsidiary, Global Femic Services Pty Ltd, registered in Adelaide, Australia.

GFS provides a diverse range of tradable assets, including currency pairs, share CFDs, commodities, global indices, and more.

Meanwhile, GFS offers an Introducing Broker (IB) program and an affiliate program, allowing individuals and businesses to earn commissions by referring new clients to the company.

It is important to note that, at present, GFS does not extend its services to the United States, Belgium, and North Korea.

Types of Accounts:

GFS does not specify the types of accounts it offers on its official website. Therefore, it can be concluded that GFS provides only one account type, with spreads as low as 0.0 pips, leverage up to 500x, and commissions of $10 per lot, with no withdrawal or deposit requirements.

Deposits and Withdrawals:

GFS accepts bank transfers, credit cards, and debit cards as payment methods. Further details are available only after the client has logged into their trading portal. While GFS states that it does not charge any commissions or fees for deposits and withdrawals, it is important to note that any fees imposed by third-party providers are the responsibility of the trading client.

The company is committed to processing all withdrawal requests within 24 hours on business days.

Trading Platforms:

GFS offers only the MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web. Renowned for its technological sophistication, MT5 provides access to a depth of market and various advanced solutions. It features buy and sell flexibility with six types of pending orders, 80 technical indicators, and 21 timeframes, offering a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macroeconomic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality all contribute to the platform's comprehensive and user-friendly trading experience.

Research and Education:

No educational resources are found on GFS official website.

Customer Service:

GFS provides customer service support in multiple languages via its live chat messenger service, including English, French, Japanese, Vietnamese, and more.

Clients can reach GFS through email at support@gfs-markets.com or by submitting an inquiry via the broker's online form. Additionally, trading clients have the option to contact GFS by phone at +852 3002 2272.

Conclusion:

To summarize, here's WikiFX's final verdict:

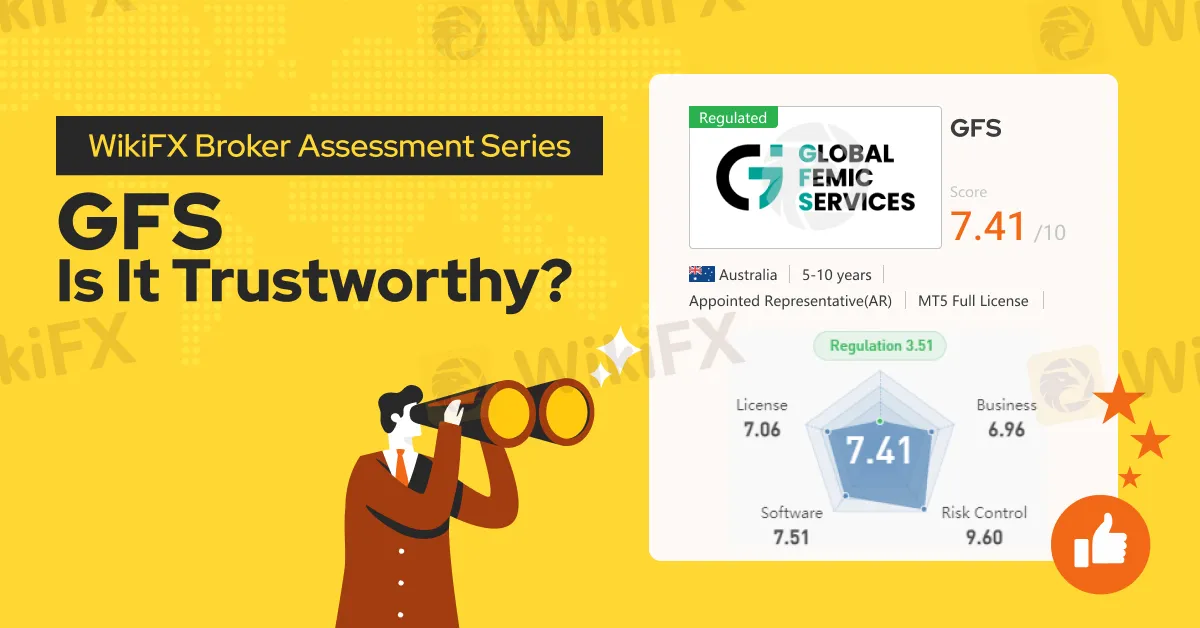

WikiFX, a global forex broker regulatory platform, has assigned GFS a WikiScore of 7.41 out of 10.

Upon examining GFS license, WikiFX found that the broker is regulated by the Australian Securities and Investment Commission (ASIC). WikiFX has also validated the legitimacy of the said license.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Rate Calc