Why a Broker’s Customer Service Matters More Than You Think

Abstract:Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Responsive customer service is not just a bonus; it is a sign of reliability. A broker that answers questions quickly shows they care about their clients. They help resolve issues like login errors, deposit delays, or sudden changes in trading conditions. On the other hand, brokers that fail to respond on time can leave traders stuck. This affects not just their trading performance but also their peace of mind.

Poor customer service can also violate traders rights. When issues are ignored, traders lose time and money. For example, if a trade gets stuck due to a technical glitch, every second counts. If the broker does not act fast, the trader may face losses. Over time, this could ruin their trading account.

Many traders underestimate this risk. They think regulation is the only thing that matters. But even regulated brokers can have slow or unhelpful support. This is why traders must do more research before choosing a broker.

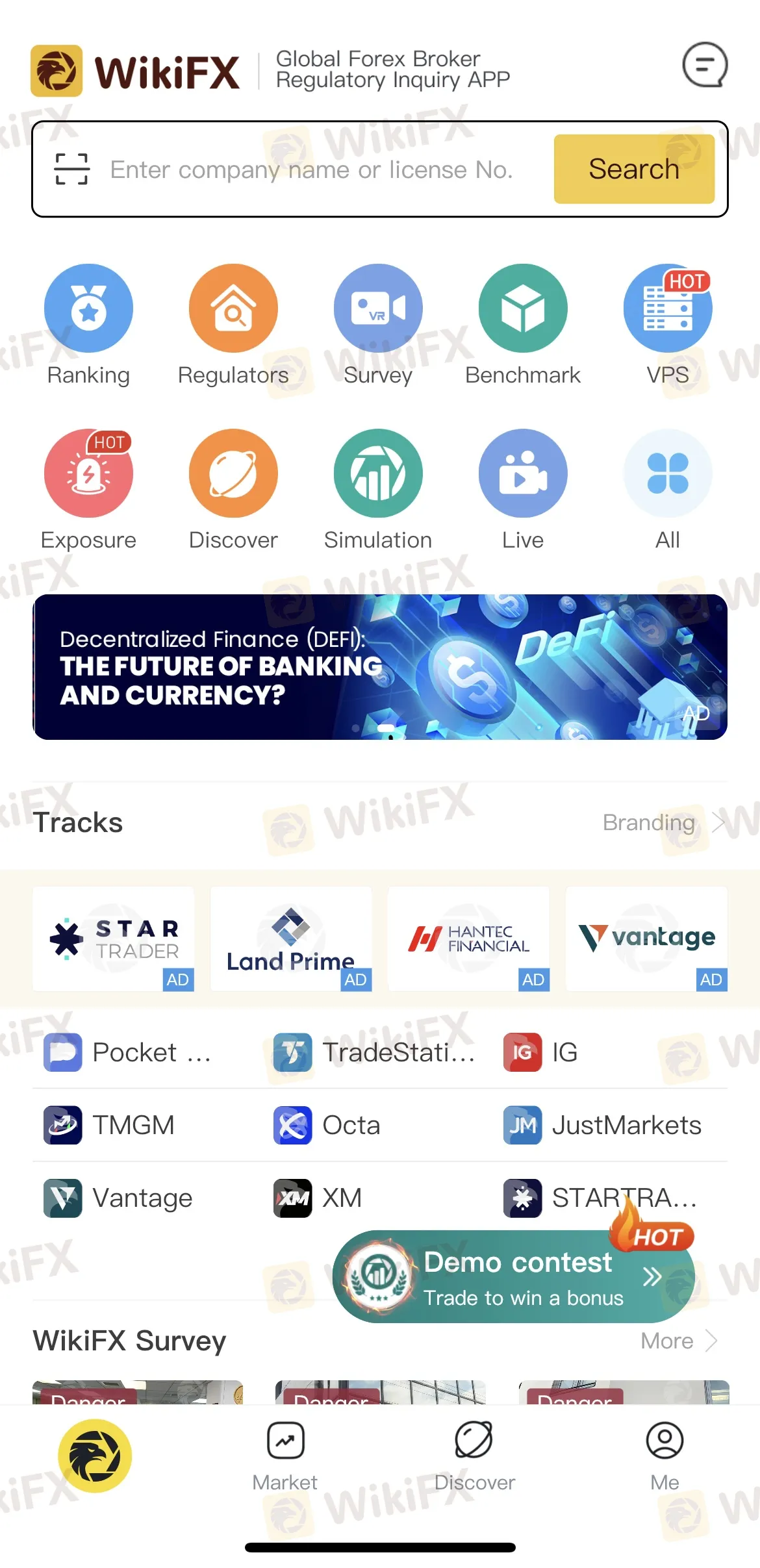

One of the easiest ways to check a brokers reliability is by using the free WikiFX mobile app. This app provides detailed reviews and ratings of brokers. It also shows whether a broker is regulated. More importantly, traders can see feedback from other users about customer service. This information helps traders make a better decision, at no cost.

Choosing a broker is a big step. Traders should not rush this process. A reliable broker with good support can make a huge difference. They can protect traders from unnecessary risks and help them perform better.

In conclusion, dont ignore customer service when picking a broker. A lack of support can lead to problems and even losses. Take the time to research brokers carefully. Use tools like WikiFX to check reviews and ratings. This simple step can save you a lot of trouble.

Read more

Understanding the New York Forex Trading Session Time in the Philippines

The forex market operates 24 hours a day, 5 days a week, with different trading sessions that overlap and offer various trading opportunities. One of the most active trading sessions is the New York session, which plays a crucial role in the global forex market. If you're in the Philippines, understanding when the New York session overlaps with local time is essential for maximizing your trading potential.

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

WikiFX Review: Is Fortune Prime Global Reliable?

Founded in 2011, Fortune Prime Global (FPG) is an Australia-registered broker that offers a wide range of investment products (Forex pairs, Commodities, Stocks, Cryptocurrencies, Indices, and so on). Today’s article will show you what it looks like in 2025.

WikiFX Broker

Latest News

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

RBI: India\s central bank slashes rates after five years

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Rate Calc