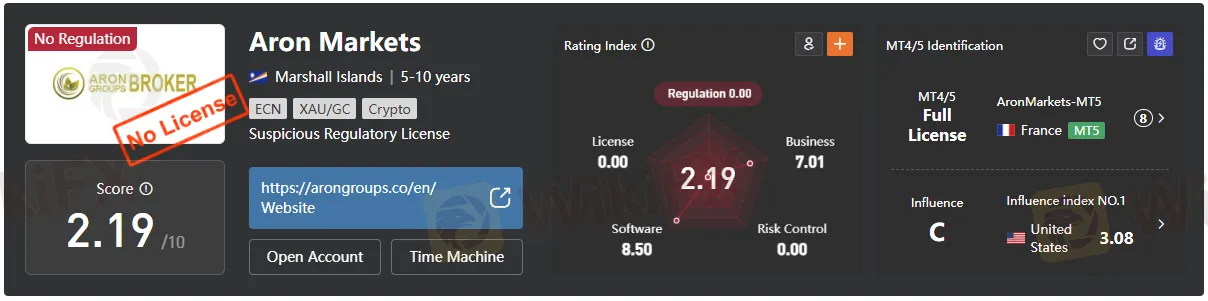

Aron Markets Review 2025: Is It A High-Risk Broker?

Abstract:Aron Markets is an unregulated offshore broker with high leverage and mounting risk warnings—read this 2025 review before depositing funds.

Introduction

In 2025, choosing a forex and CFD broker demands extreme vigilance: regulation, fund safety, and transparency are no longer optional. Offshore firms can expose traders to grave withdrawal delays, platform manipulation, and almost no legal recourse. Aron Markets (often linked with Aron Groups) stands out for its Marshall Islands registration, total lack of credible oversight, and a mounting chorus of industry alerts that flag it as high risk. This review assembles evidence—licensing gaps, offshore location, products, platforms, leveraged risk, and red flags—to decisively signal whether Aron Markets poses a threat to your capital.

Bottom Line Up Front

- Regulatory status: Unregulated; registered offshore under a Marshall Islands entity, details referenced in company materials and third‑party checks.

- Independent risk signals: WikiFX page lists “not regulated” with a low trust score; multiple reviewers flag high risk or “scam” concerns tied to offshore setup.

- Trading offer: MT5 access, multi‑asset CFDs, and headline leverage reportedly up to 1:1000 depending on account type, which significantly amplifies risk for retail traders.

- Verdict: This is a high-risk broker. The absence of recognized regulation, questionable offshore registration, and repeated industry warnings make Aron Markets an extremely unsafe option. Safer, fully regulated alternatives must be considered before risking funds here.

Company Profile and Licensing

Aron Markets/Aron Groups presents itself as a multi‑asset brokerage brand, with corporate disclosures stating incorporation in the Marshall Islands via “Aron Markets LTD” and listing a Trust Company Complex address and registry number in the site's legal pages. The Marshall Islands does not operate a dedicated forex regulatory framework, meaning such incorporation does not equate to client‑fund protections, prudential audits, or dispute‑resolution mechanisms associated with top‑tier regulators. Independent broker intelligence services repeatedly note that Aron Markets/Aron Groups is not authorized by any recognized financial authority and warn that investor protection is absent. These findings are echoed in broader risk analyses that advise avoiding unregulated or low‑tier jurisdictions when real funds are at stake.

Risk Rating and Red Flags

- Unregulated status: WikiFX explicitly lists Aron Markets as “not regulated,” a core risk indicator because client recourse is minimal if withdrawals are delayed or disputes emerge.

- Offshore registration: Marshall Islands registration is highlighted by reviewers as a warning, since the jurisdiction offers minimal oversight for retail trading firms.

- Industry warnings and allegations: Broker monitoring outlets and user‑exposure posts describe concerns about licensing claims, safety, and potential client harm, reinforcing a high‑risk profile.

- Very high leverage: Marketing and reviews cite leverage up to 1:1000 on certain accounts, which can rapidly magnify losses for inexperienced traders, especially without regulatory leverage caps.

- Trust score signals: WikiFX content references a low score and a lack of valid regulation, which together suggest elevated operational risk compared with regulated competitors.

Products, Platforms, and Conditions

Aron Markets promotes multi‑asset CFD trading that includes forex pairs, commodities, indices, cryptocurrencies, and shares, positioned through the MetaTrader 5 platform. WikiFXs broker summary cites flexible account structures with variable or fixed spreads and leverage extending to 1:1000 on “Nano” accounts, with floating spreads on standard and VIP tiers. While MT5 is a robust, widely used platform, platform quality does not substitute for licensing safeguards such as segregated client funds under strict supervision or access to recognized compensation schemes.

Deposits, Bonuses, and Promotions

The brand runs time‑bound promotions and bonuses, including a 2025 “comeback bonus” aimed at clients who experienced losses during a defined period, which signals ongoing marketing activity but does not change the regulatory picture. Bonus schemes at unregulated brokers often include restrictive terms on withdrawals or trading volume, so traders should scrutinize conditions carefully before accepting incentives.

Customer Experience Signals

Industry trackers and forum‑style journals have discussed Aron Groups operational terms—such as the ability to alter spreads in abnormal market conditions and policies around negative balance—details that can materially affect trading outcomes at an unregulated venue. Separate monitoring sites have also published investor complaints and accusations related to licensing and withdrawals, which, while anecdotal, align with the structural risks of operating without recognized supervision.

How Aron Markets Compares to Regulated Brokers

Top‑tier regulators like the FCA, ASIC, and others enforce stringent capital requirements, client‑money segregation, transparency in pricing/execution, robust complaint handling, and access to formal dispute resolution—protections that Aron Markets lacks due to its unregulated status. Reputable comparison resources therefore recommend prioritizing brokers supervised by top‑tier authorities and caution against depositing with offshore entities where remedies are limited.

Should Traders Use Aron Markets in 2025?

Given the absence of recognized regulation, offshore registration, and repeated warnings from multiple independent broker‑review sources, Aron Markets is best categorized as a high‑risk option in 2025. While MT5 access and broad market coverage may appear attractive, these features do not offset the critical deficiency of investor protections and the heightened probability of unfavorable outcomes at unregulated firms.

Conclusion

Aron Markets combines offshore registration, no recognized license, very high leverage, and persistent third‑party warnings—factors that collectively elevate risk far beyond acceptable levels for most retail traders in 2025. Those seeking forex and CFD exposure should favor brokers licensed by top‑tier regulators, where client funds, dispute processes, and operational standards are enforceable under law.

Dont get swayed by flashy marketing. Simply scan the QR code below to download the WikiFX app and quickly verify brokers right from your phone.

Read more

Emirates NBD Review: Pros and Cons Explained

Balanced Emirates NBD review covering pros, cons, FX services, transfers, customer support, and regulation status as a bank, not a broker.

IG Japan Expands 24-Hour US Stock and ETF CFD Trading

IG Securities Japan expands 24-hour and extended sessions for US stock and ETF CFDs from Oct. 6, 2025, with defined margin liquidation rules.

PU Prime Launches GAUUSD Gold Gram Trading

PU Prime debuts GAUUSD, a gold gram vs USD instrument that lets traders access gold priced per gram with a 0.01-lot minimum representing 100 grams.

Startrader Backs MENA Investment Congress in Abu Dhabi

Official sponsor STARTRADER supports MENA Investment Congress in Abu Dhabi, uniting 500+ finance leaders to discuss the future of investment and AI trends.

WikiFX Broker

Latest News

Taurex mobile trading app unveils upgrades, hits 250k downloads

WikiFX 2025 Content Creator Contest

WikiFX Golden Insight Award Unveils New Judging Panel

PU Prime Joins MoneyShow Toronto 2025 as Sponsor

PU Prime Review: Launch of Gold Trading by the Gram (GAUUSD)

Tickmill UAE Expansion: Mashreq Bank Partnership to Ease Local Payments

SEC halts QMMM trading after 959% surge

Angel One Review: Regulation, Fees, Platforms, and Risks Explained

MT5 Build 5320: What Traders Need to Know?

He Lost His Entire Life Savings in Just 1 Month!

Rate Calc