Why France's Boomers Will Delay Deficit Reduction Indefinitely

Abstract:France continues to fall short on fiscal consolidation. Recent data from Insee suggest that the heav

France continues to fall short on fiscal consolidation. Recent data from Insee suggest that the heavy reliance on direct transfers by certain social groups, particularly pensioners, combined with their growing electoral heft, may be a key constraint. These factors make it harder for the government to undertake significant fiscal adjustments without running the risk of political instability.

Based on these findings and given the proximity to local (1Q26) and presidential elections (2Q27), we continue to think there is a good chance the recently announced consolidation package of roughly €44 billion will target public services, rather than direct transfers. We cant dismiss the chance of it being substantially watered down.

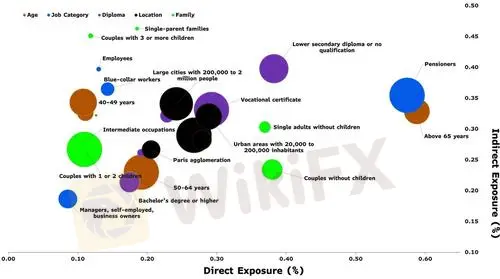

Social Groups Reliance on Public Transfers

Forces Hindering Fiscal Consolidation

France has historically struggled to reduce its fiscal deficit. One key reason: spending cuts tend to affect the groups with the most electoral influence. This was illustrated in late 2024, when then-Prime Minister Michel Barnier proposed delaying the price indexation of pensions in the 2025 budget. The aim was to save up to €4 billion, but his government was ultimately brought down by a censure motion which was backed by a majority of parties claiming to defend pensioners.

In a 1989 working paper, the authors (Alesina and Drazen) noted that social groups can indeed strategically postpone much-needed fiscal consolidation. These groups delay measures in the hope that the associated costs will eventually be borne by another group. In such settings, fiscal adjustments rely on less-vocal social groups, or are triggered by a crisis or an external shock, such as a loss of investor confidence.

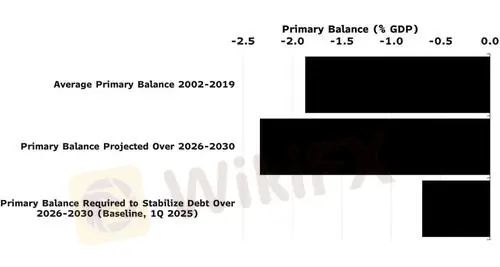

A Much-Needed Fiscal Adjustment

Deteriorating fiscal arithmetics and a sluggish growth outlook has made deficit reduction in France increasingly urgent. The primary balance required to stabilize the debt-to-GDP ratio between 2026 and 2030 is estimated at –0.7%. But Frances track-record is weak: the average primary balance from 2002 to 2019 reached -1.9%, and is projected to reach –2.3% on average over 2026-2030.

Meanwhile, the population remains deeply divided about how to reduce spending, despite becoming increasingly aware of the countrys risky fiscal outlook. Public debt has emerged as a top-five concern in opinion polls.

Large Consolidation Needed to Stabilize Debt

Mapping Affected Groups

To understand why spending-led fiscal consolidations are so hard to deliver, we use a recent dataset provided by the Insee to estimate the potential cost of austerity for different social groups. This dataset offers information on household total income, before and after direct and indirect public transfers.

Direct transfers include all monetary transfers such as pensions, unemployment benefits, and subsidies. Indirect transfers capture the imputed value of public services received, including healthcare, education, or housing assistance.

Based on this data, we construct two exposure metrics: (1) direct exposure, defined as the ratio of direct transfers to total income; (2) indirect exposure, defined analogously for indirect transfers. The higher a groups exposure, the more costly spending cuts would be for them.

We visualize these relationships using a bubble chart (see first chart), where the position of each social group reflects its exposure, and the size of each bubble corresponds to its share in the total population. These social groups are not mutually exclusive. The chart highlights which groups are more dependent on public redistribution and are therefore more likely to resist or delay a fiscal adjustment.

Vulnerable to External Shock

Under this framework, pensioners emerge as the social group that would bear the highest direct cost from any reduction in direct transfers, which account for nearly 60% of their total income. They are followed by individuals with lower secondary diplomas, for whom direct transfers, and notably unemployment benefits, represent close to 40% of their income.

Both groups also exhibit high levels of indirect exposure, with indirect transfers representing around 40% of their initial income (before redistribution). Across the population, however, the level of indirect exposure is lower and more evenly distributed.

These findings confirm that fiscal consolidation through cuts to public services may encounter less political opposition, as theres a smaller share of the population has high indirect exposure. On the other hand, targeting direct transfers (such as pensions) is likely to face strong resistance, given that boomers are among most affected and now account for more than 50% of the electorate.

All this hinders the government‘s ability to prevent fiscal slippage and leaves the country susceptible to external shocks, such as a loss of investor confidence.Still, there is a high risk that Prime Minister Francois Bayrou’s consolidation measures will be undercut by political concessions during the autumn parliamentary debates.

WikiFX Broker

Latest News

Stock Market Today: Nike, Eli Lily surge; Robinhood slips

MT5 Build 5320: What Traders Need to Know?

ADP Payrolls Unexpectedly Crater To -32,000, Worst Since March 2023 And Below All Estimates

He Clicked, He Transferred, and He Lost RM1.86 Million!

Treasury Secretary Bessent says U.S. GDP could take a hit from the government shutdown

Startrader Backs MENA Investment Congress in Abu Dhabi

How to Choose a Reliable Forex Broker in 2025

FCA Flags Copy-Paste Broker Websites: The Same Template, Many Different Names

The government shutdown is likely to cement additional Fed interest rate cuts

Hirose Halts UK Retail Trading Amid Market Shift

Rate Calc