MultiBank Group — recent exposures, complaints, and who runs the firm

Abstract:MultiBank Group presents itself as a global, highly regulated FX/CFD group with a long history and a large executive team. However, recently we found out that a string of independent exposures and user complaints has put the broker under renewed scrutiny.

MultiBank Group presents itself as a global, highly regulated FX/CFD group with a long history and a large executive team. However, recently we found out that a string of independent exposures and user complaints has put the broker under renewed scrutiny.

Recent negative issues and public exposures about the MultiBank Group

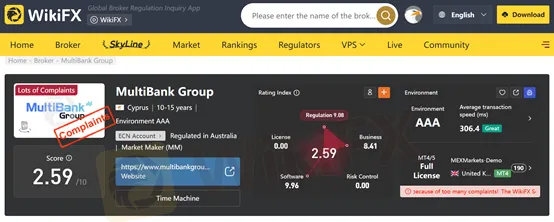

Multiple reports aggregated by WikiFX say complaints against MultiBank Group have surged, reaching hundreds of individual cases in a short period. WikiFXs recent coverage specifically lists more than 700 complaints, most of them alleging withdrawal problems, account blocking, and other service failures.

Common themes in the complaints include:

- Blocked or delayed withdrawals: Traders from Asia and the Middle East reported withdrawals taking weeks to months, frequent “processing” delays from support, and funds not arriving even after repeated follow-ups. WikiFXs warnings and news pieces on these issues make the withdrawal problem a recurring allegation.

- Historical Employee-pay problems: Earlier WikiFX reporting (from 2021) accused MultiBank of owing employees months of unpaid wages, a claim that has been cited again as part of the pattern of internal financial strain raised by critics. That earlier report described unpaid staff salaries and unresolved investor withdrawal issues.

- Regulatory claims under question: MultiBank‘s marketing stresses multiple global licenses and a broad regulatory footprint; at the same time, exposés note that some licenses or registrations are difficult to independently verify, and that some users have accused the group of exploiting people with aggressive bonus/withdrawal terms. That tension—between the company’s regulation claims and the complaints—appears throughout recent coverage.

Taken together, these reports do not prove fraud or criminality on their own, but they do create a clear picture of repeated customer service breakdowns and a high volume of complaints that prospective traders should consider before depositing funds.

Who runs MultiBank Group — the main characters

MultiBanks public materials and independent profiles show a mix of long-standing executives and newer hires. Below are the most prominent names that appear across company pages, whitepapers and press coverage:

- Naser Taher — Founder & Chairman.

Naser Taher is repeatedly presented as the group‘s founder and chairman. Company profiles and interviews with regional business outlets describe him as the group’s long-time leader and public face. He is regularly referenced in press releases and profiles about corporate strategy.

- Yahya Taher — Group CEO (listed in corporate materials).

Yahya Taher appears across corporate whitepapers and business profiles as a senior executive/Group CEO. Public professional profiles (e.g., LinkedIn) and third-party company summaries list him among the executive leadership.

- Kristina Pei — Group CFO (listed in whitepaper/team lists).

Company documentation and the group whitepaper list Kristina Pei as Chief Financial Officer in the core team roster. That whitepaper provides an extended senior-leadership list used in the companys investor and product materials.

- Dr. Salem Kattoura — Group COO (appears in team lists).

The whitepaper and company summaries name Dr. Salem (Salem Kattoura) as Chief Operating Officer. He is listed among the senior leadership responsible for operations.

- Abdelrahman Wafi — Head of Human Resources and Administration

- Sophie Squillacioti — Head of China Sales

According to the reports, Sophie Squillacioti joined MultiBank as Head of China Sales and Advisor to the Chairman.

- Other named executives & managers.

MultiBank's public materials list a large senior team, including roles such as CCO (Marc Aspinall), Chief Platform Officer, Global Head of Compliance, Heads of Payments and Trade Operations, and a number of regional CEOs and country managers. The groups whitepaper provides a fairly long “core team / senior leadership” roster.

Quick takeaway for traders

- High complaint volume: dozens to hundreds of recent complaints is a red flag worth attention.

- Check documents yourself: MultiBank publishes a long list of regulatory claims. If you‘re considering the broker, independently verify each regulator entry with the regulator’s public register.

- Watch withdrawal stories: multiple independent reports describe blocked or severely delayed withdrawals; That pattern matters more to retail traders than marketing statements.

Read more

Top Crimes This Year: Romance & Investment Scams

Statistics from January to September show that there were 47,850 cases with losses reaching RM2 billion, an increase of 93.89 percent compared to the same period in 2024.

Want to Trade Via Daicha Iconic Markets Ltd? Wait and Read This Review First!

Has your forex trading experience with Diacha Iconic Markets Ltd been abysmal with constant profit withdrawal denials? Have you also failed to recover your principal investment amount, let alone interest earnings? Failed to see any of the promises fulfilled by this Saint Lucia-based forex broker? You are not alone! These issues have become typical of this forex broker. As a result, many traders have complained online. In this article, we have shared Diacha Iconic Markets Ltd reviews. Read it out as we detail.

TemplerFX Review: Traders Report Fund Scams, Deposit & Transparency Issues

Have you fallen victim to financial scams triggered by TemplerFX’s manipulative trading practices? Does your deposit vanish the moment you put it into the trading account? Do you struggle to gain information regarding your TemplerFX trading account? It is advisable to recover all your capital from the broker, even if it means taking legal action against it. Several traders have even pursued legal action to recover their funds — highlighting the seriousness of the issue. Meanwhile, explore these TemplerFX trader reviews and see how closely their experiences mirror yours. Read on to know about them.

WikiFX Warning: 5 Scam Brokers Exposed in October 2025

Online trading scams continue to rise in 2025, and unsuspecting traders are losing millions to fraudulent forex brokers every month. According to the latest WikiFX investigation, several brokers with low trust scores and misleading regulatory claims have been flagged this October. If you are considering investing or opening a trading account, avoid these five scam brokers immediately. Each has a poor reputation, multiple user complaints, and serious regulatory concerns.

WikiFX Broker

Latest News

Stand a Chance to Earn $10 for Each Broker Review – Join Now!

FCA Warning list 2025: Unauthorised firms to Avoid

Traders Report Fund Scam & High Slippage at TD365: Read What They are Saying

Bank of America says investors are ignoring one major stock market risk

French PM backs freezing Macron\s pension reform to save government

Want to Trade Via Daicha Iconic Markets Ltd? Wait and Read This Review First!

WikiFX Warning: 5 Scam Brokers Exposed in October 2025

How to Spot a Forex Scammer Before You Invest

FCA Cracks Down on £1m Ponzi Scheme in UK

Freedom24 Review: License and Regulation

Rate Calc