Market Pro Trade Information Revealed

Zusammenfassung:Market Pro Trade, operated by EmTechvio Pro LLC, is an unregulated broker based in Saint Vincent and the Grenadines. The company offers trading opportunities in futures, options, forex, and CFDs, with leverage up to 1:400. While they provide the MetaTrader 4 (MT4) platform and customer support through phone and email, potential clients should exercise caution due to the lack of valid regulation, which raises safety and security concerns regarding investors' funds. Reviews also highlight potential issues with the company's website and customer service, raising doubts about its reliability.

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | EmTechvio Pro LLC |

| Regulation | No valid regulation |

| Minimum Deposit | $500 |

| Maximum Leverage | Up to 1:400 for major currency pairs |

| Spreads | Platinum: From 0.6 pips (EUR/USD), Gold: From 0.8 pips (EUR/USD), Silver: From 1.0 pips (EUR/USD) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Futures, Options, Forex, CFDs |

| Account Types | Platinum, Gold, Silver |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone: +442080979115, Email: support@marketprotrade.com |

| Payment Methods | Credit card, Debit card, Bank wire transfer, PayPal |

| Educational Tools | Not specified |

Overview of Market Pro Trade

Market Pro Trade is a company based in Saint Vincent and the Grenadines operating without any valid regulation. This lack of regulation raises concerns about the safety and security of investors' funds. The broker offers a range of market instruments, including futures, options, forex, and CFDs. However, potential clients should be cautious and aware of the risks associated with dealing with an unregulated broker.

The broker provides three account types: Platinum, Gold, and Silver. Each account type offers different leverage, spreads, and commissions. The maximum leverage available is 1:400 for major currency pairs. Deposits can be made via credit card, debit card, bank wire transfer, and PayPal, with a minimum deposit requirement of $500.

Market Pro Trade uses the MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and comprehensive set of tools. Customer support is available through a phone line and email. Reviews suggest some negative experiences, such as the company's website being down and concerns about withdrawal processing.

Pros and Cons

Market Pro Trade presents a mix of advantages and disadvantages for potential traders. On the positive side, it offers a diverse array of futures, options, forex, and CFD trading opportunities. Traders can also take advantage of high leverage of up to 1:400 for major currency pairs. Additionally, Market Pro Trade accepts various deposit methods. However, the absence of proper regulation raises safety concerns, and the website's current unavailability may suggest instability. Furthermore, some traders have reported negative experiences, including withdrawal issues and limited customer support. Additionally, the minimum deposit requirement of $500 might be considered relatively high for some users, and there is no demo account available for those who wish to test the platform beforehand. Overall, traders should carefully weigh the pros and cons before making their investment decisions.

| Pros | Cons |

| Offers a range of futures and options trading opportunities. | Operates without any valid regulation, raising safety concerns. |

| Provides forex trading with major currency pairs. | Vague trading fees and conditions |

| Offers CFD instruments for popular stocks. | High minimum deposit requirement of $500. |

| Leverage of up to 1:400 available for major currency pairs. | Website currently down, suggesting possible instability. |

| Multiple account types with varying features and fees. | No demo account available |

| User-friendly MetaTrader 4 (MT4) trading platform available. | Some negative experiences reported by users, including withdrawal issues. |

| Accepts various deposit methods, including credit/debit cards and PayPal. | Limited customer support |

Is Market Pro Trade Legit?

Market Pro Trade operates without any valid regulation, which raises significant concerns regarding the safety and security of investors' funds. Potential clients should exercise extreme caution and be fully aware of the inherent risks associated with dealing with an unregulated broker. Without proper oversight and accountability, there may be limited recourse in case of any disputes or fraudulent activities. It is essential to thoroughly research and consider alternative, regulated options to safeguard your investments effectively.

Market Instruments

FUTURES

Market Pro Trade offers a range of futures instruments, including E-mini S&P 500, E-mini Nasdaq 100, E-mini Dow Jones Industrial Average, and E-mini Russell 2000. These futures contracts allow traders to speculate on the future price movements of these respective stock market indexes without owning the underlying assets.

OPTIONS

The broker also provides options trading opportunities, such as S&P 500 options, Nasdaq 100 options, Dow Jones Industrial Average options, and Russell 2000 options. Options grant traders the right, but not the obligation, to buy or sell the underlying assets at a predetermined price within a specified time frame.

FOREX

Market Pro Trade facilitates forex trading with major currency pairs like EUR/USD, USD/JPY, GBP/USD, and USD/CAD. Forex trading involves the exchange of one currency for another, and traders profit from fluctuations in exchange rates between these currency pairs.

CFDs

Contract for Difference (CFD) instruments available on Market Pro Trade's platform include popular stocks like Apple, Amazon, Microsoft, and Tesla. CFDs enable traders to speculate on the price movements of these assets without owning them directly, providing an opportunity to benefit from both rising and falling prices.

| Pros | Cons |

| Diverse range of futures instruments available. | Lack of regulatory oversight for futures trading, raising safety concerns. |

| Options trading opportunities for major stock indexes. | Limited information on trading fees and conditions for options trading. |

| Forex trading with major currency pairs is facilitated. | Absence of detailed information on spreads and commissions for forex trading. |

Account Types

Platinum: This account type offers a leverage of 1:400 and provides spreads of 0.6 pips on EUR/USD and 0.8 pips on GBP/USD. Additionally, traders benefit from a reduced commission of $1 per round turn.

Gold: With a maximum leverage of 1:300, the Gold account type provides traders with spreads of 0.8 pips on EUR/USD and 1.0 pips on GBP/USD. The commission per round turn is set at $2, making it an option for traders looking for lower transaction costs. Moreover, the account requires a margin of 15% for Premium users.

Silver: The Silver account type offers a leverage of 1:200 and provides spreads of 1.0 pips on EUR/USD and 1.2 pips on GBP/USD. Traders using this account are subject to a commission of $3 per round turn. The account also requires a margin of 20%.

| Pros | Cons |

| High leverage options (up to 1:400) | No information on additional account benefits |

| Reduced commission of $1 per round turn for Platinum account. | Commission fees vary among account types |

| Margin requirements are relatively high for Silver account |

Leverage

Market Pro Trade offers leverage of up to 1:400 for major currency pairs. This means that for every $100 deposited, a trader can control a position worth up to $40,000. The maximum leverage available may vary depending on the account type and the currency pair being traded.

Spreads & Commissions

Market Pro Trade offers three account types with spreads starting from 0.6 pips on EUR/USD and 0.8 pips on GBP/USD for the Platinum account, 0.8 pips on EUR/USD and 1.0 pips on GBP/USD for the Gold account, and 1.0 pips on EUR/USD and 1.2 pips on GBP/USD for the Silver account. The commissions per round turn are $1, $2, and $3, respectively, with varying margin requirements for different account types.

Minimum Deposit

Market Pro Trade requires a minimum deposit of $500 to open an account. There are no other fees or charges associated with the minimum deposit.

Deposit & Withdrawal

Market Pro Trade accepts deposits via credit card, debit card, bank wire transfer, and PayPal. The minimum deposit amount is $500. Withdrawals are allowed via bank wire transfer and PayPal. The minimum withdrawal amount is $50. There is a $25 fee for wire transfers and a $0.30 fee for PayPal withdrawals. Credit card and debit card deposits are typically processed instantly, while bank wire transfers and PayPal withdrawals can take up to 3 business days to process.

Pros and Cons

| Pros | Cons |

| Accepts various deposit methods | High minimum deposit requirement of $500 |

| Credit/debit card deposits are instant | Fees of $25 for wire transfers and $0.30 for PayPal withdrawals |

| Allows withdrawals via bank wire and PayPal | Bank wire and PayPal withdrawals can take up to 3 business days |

Trading Platforms

Market Pro Trade provides the MetaTrader 4 (MT4) trading platform, a widely recognized and widely used platform among traders. MT4 offers a user-friendly interface and a comprehensive set of tools, making it suitable for both novice and experienced traders. With advanced charting capabilities, technical indicators, and real-time market data, MT4 allows traders to analyze and execute trades. Additionally, the platform supports automated trading with expert advisors, enabling traders to implement their strategies seamlessly.

| Pros | Cons |

| Utilizes widely recognized and widely used MetaTrader 4 (MT4) platform. | No mention of other available trading platforms, limiting user options. |

| User-friendly interface with a comprehensive set of tools. | No alternative platforms available |

| Advanced charting capabilities, technical indicators, and real-time market data. | Limited information on customer support options and response times. |

Customer Support

Market Pro Trade provides customer support through various channels. For English-speaking clients, they offer a phone line with the number +442080979115. Additionally, customers can reach them via email at support@marketprotrade.com, allowing for communication for any inquiries or concerns.

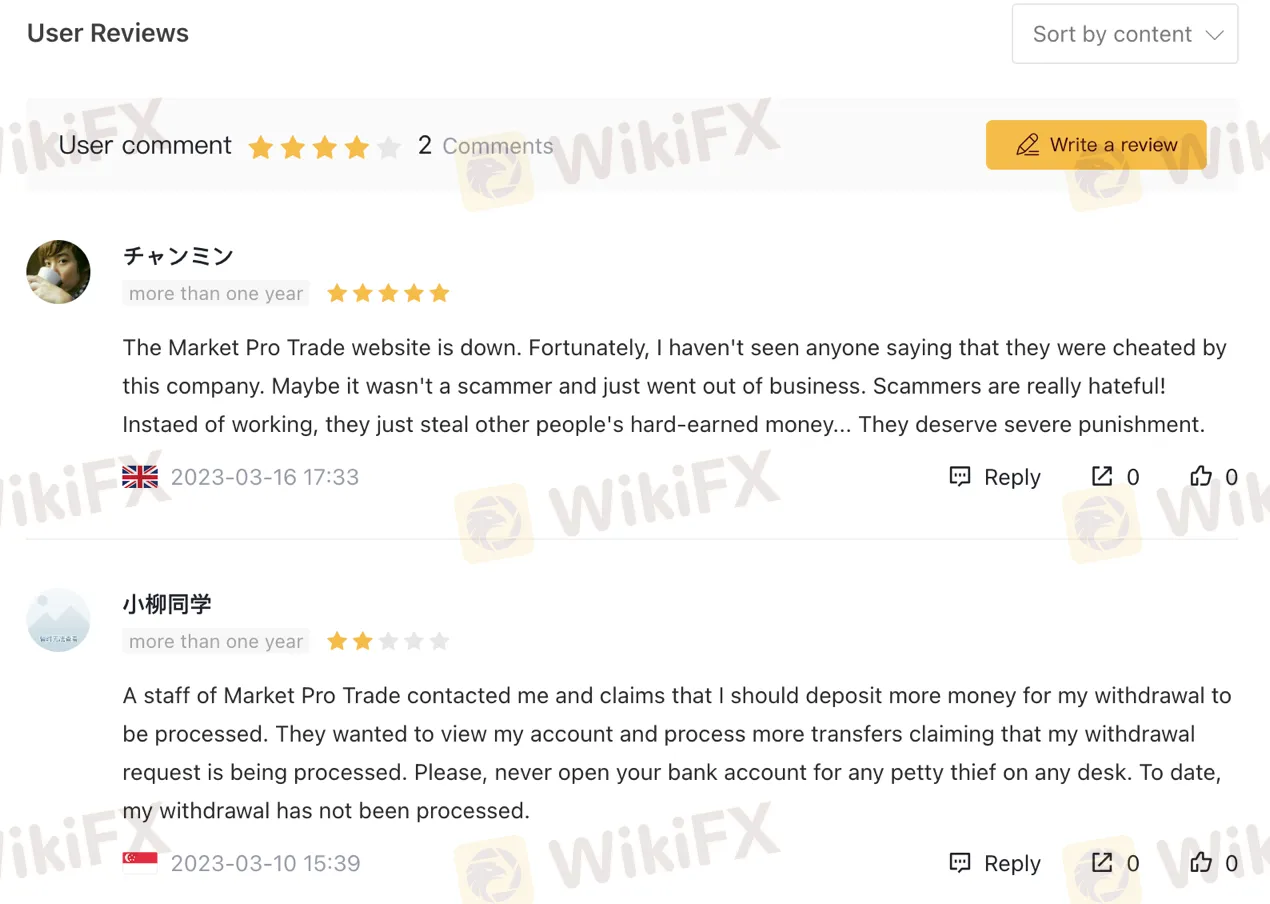

Reviews

According to reviews on WikiFX, there have been some negative experiences with Market Pro Trade. One user reported that the company's website is down, but there were no indications of being cheated, suggesting the possibility of the company going out of business rather than being a scammer. Another user mentioned that a staff member from Market Pro Trade requested additional money to process their withdrawal, leading to suspicions of dishonesty and delays in receiving their funds. These reviews indicate some concerns regarding the company's reliability and customer service.

Conclusion

Market Pro Trade presents both advantages and disadvantages to potential clients. On the positive side, the broker offers a variety of market instruments, including futures, options, forex, and CFDs, providing traders with diverse opportunities. Additionally, the availability of different account types with varying leverage and spreads may cater to traders with different risk appetites. Moreover, the use of the widely recognized MetaTrader 4 trading platform enables trade execution and analysis. However, on the downside, Market Pro Trade operates without any valid regulation, which raises significant concerns about the safety and security of investors' funds. The lack of oversight and accountability may pose risks to traders in case of disputes or fraudulent activities. Additionally, according to reviews, there have been negative experiences, including difficulties in accessing the website and concerns about withdrawal processes, which may affect the company's reliability and customer service.

FAQs

Q: Is Market Pro Trade a legitimate broker?

A: Market Pro Trade operates without valid regulation, raising concerns about the safety of funds. It is essential to exercise caution and research regulated alternatives.

Q: What market instruments does Market Pro Trade offer?

A: Market Pro Trade offers futures, options, forex, and CFDs for trading on their platform.

Q: What are the different account types available?

A: Market Pro Trade offers Platinum, Gold, and Silver account types with varying leverages and spreads.

Q: What is the maximum leverage offered by Market Pro Trade?

A: Market Pro Trade offers leverage of up to 1:400 for major currency pairs.

Q: What are the spreads and commissions for each account type?

A: Spreads start from 0.6 pips for EUR/USD in the Platinum account, 0.8 pips in the Gold account, and 1.0 pips in the Silver account. Commissions range from $1 to $3 per round turn.

Q: What is the minimum deposit requirement?

A: Market Pro Trade requires a minimum deposit of $500 to open an account.

Q: What are the deposit and withdrawal options?

A: Market Pro Trade accepts deposits via credit card, debit card, bank wire transfer, and PayPal. Withdrawals are allowed through bank wire transfer and PayPal.

Q: Which trading platform does Market Pro Trade use?

A: Market Pro Trade uses the MetaTrader 4 (MT4) platform, known for its user-friendly interface and comprehensive tools.

Q: How can I contact Market Pro Trade's customer support?

A: Customer support can be reached through a phone line and email for prompt communication.

Q: What do reviews say about Market Pro Trade?

A: Reviews mention concerns about the company's website being down and potential delays in withdrawals, indicating some issues with reliability and customer service.

WikiFX-Broker

Aktuelle Nachrichten

Ähnlich zum bedingungslosen Grundeinkommen? Donald Trump plant einen Staatsfonds

Verhandlungen bei japanischen Autobauern: Nissan zieht sich offenbar aus Fusionsgesprächen mit Honda zurück

Mindestlohn sorgt für weniger Lohngefälle und kleineren Niedriglohnsektor – doch die Bewährungsprobe steht jetzt erst bevor

Nach Unstimmigkeiten bei Strategie von Milliarden-Konzern: Wago entlässt mit sofortiger Wirkung seinen CEO

Er zeigt, wie deutsche Deeptech-Startups erfolgreich sein können

Neue VW-interne Überlegung: Wo der künftige 20.000-Euro-Stromer gebaut werden soll

Deutscher Multi-Millionär will mit Schach das große Geschäft machen – und legt sich mit dem Weltverband an

Experten: Paket-Stopp aus China bedeutet nicht das Ende von Shein und Temu in den USA

Überraschende Preissenkung bei Kaufland und Lidl: Butter jetzt günstiger

Bonk Preis-Prognose: Es werden 2,02 Billionen BONK-Münzen verbrannt

Wechselkursberechnung