ADiF Brokerage

Zusammenfassung:ADiF Brokerage was founded in 2002 as a spin-off of the Technical University of Munich. The company is headquartered in Munich, Germany, and has additional offices in Frankfurt, London, and New York. ADiF Brokerage is a member of the Deutsche Börse Group.

| ADiF Brokerage Review Summary | |

| Founded | 2002 |

| Registered Country/Region | Germany |

| Regulation | Unregulated |

| Market Instruments | Futures, stocks, options, ETFs, warrants, funds, and forex |

| Services | Asset management, Investment banking, Brokerage Services and Research |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | CQG trader, X_TRADER, NinjaTrader CQG and so on |

| Min Deposit | / |

| Customer Support | Contact form |

| Phone: +49 331 6473204 | |

| Email: info@adif.de | |

| Fax: +49 911 3084464576 | |

| Address: Am Irkales 11, 9490 Vaduz, Fürstentum Liechtenstein | |

ADiF Brokerage was founded in 2002 as a spin-off of the Technical University of Munich. The company is headquartered in Munich, Germany, and has additional offices in Frankfurt, London, and New York. ADiF Brokerage is a member of the Deutsche Börse Group.

Pros and Cons

| Pros | Cons |

| Multiple trading platforms | Not regulated |

| Complex fee structures | Limited payment options |

| Security measures offered |

Is ADiF Brokerage Legit?

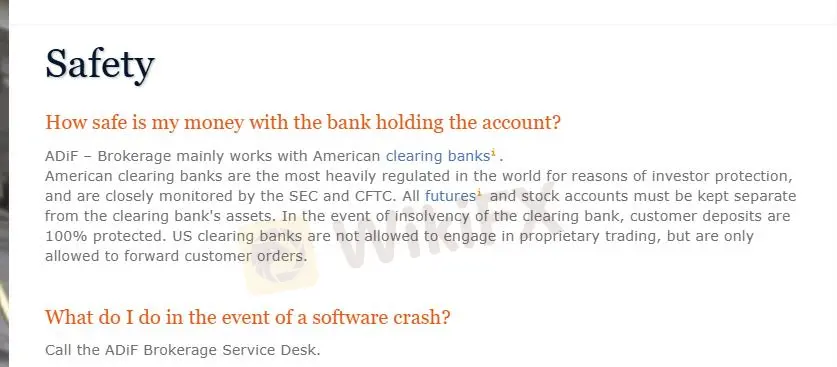

ADiF Brokerage primarily partners with American clearing banks, which are among the world's most heavily regulated entities due to stringent investor protection laws. These banks are closely monitored by the SEC and CFTC. In the unlikely event of clearing bank insolvency, customer deposits are fully protected.

Unlike these banks, which are prohibited from proprietary trading and limited to executing customer orders, ADiF Brokerage operates as an unregulated entity, exempt from oversight by any regulatory bodies or financial authorities.

What Can I Trade on ADiF Brokerage?

ADiF Brokerage offers futures, stocks, options, ETFs, warrants, funds, and forex trading.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Options | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Futures | ✔ |

| Warrants | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Fees Services

ADiF is a financial services company that provides a variety of services to institutional clients, including Asset management, Investment banking, Brokerage Services and Research.

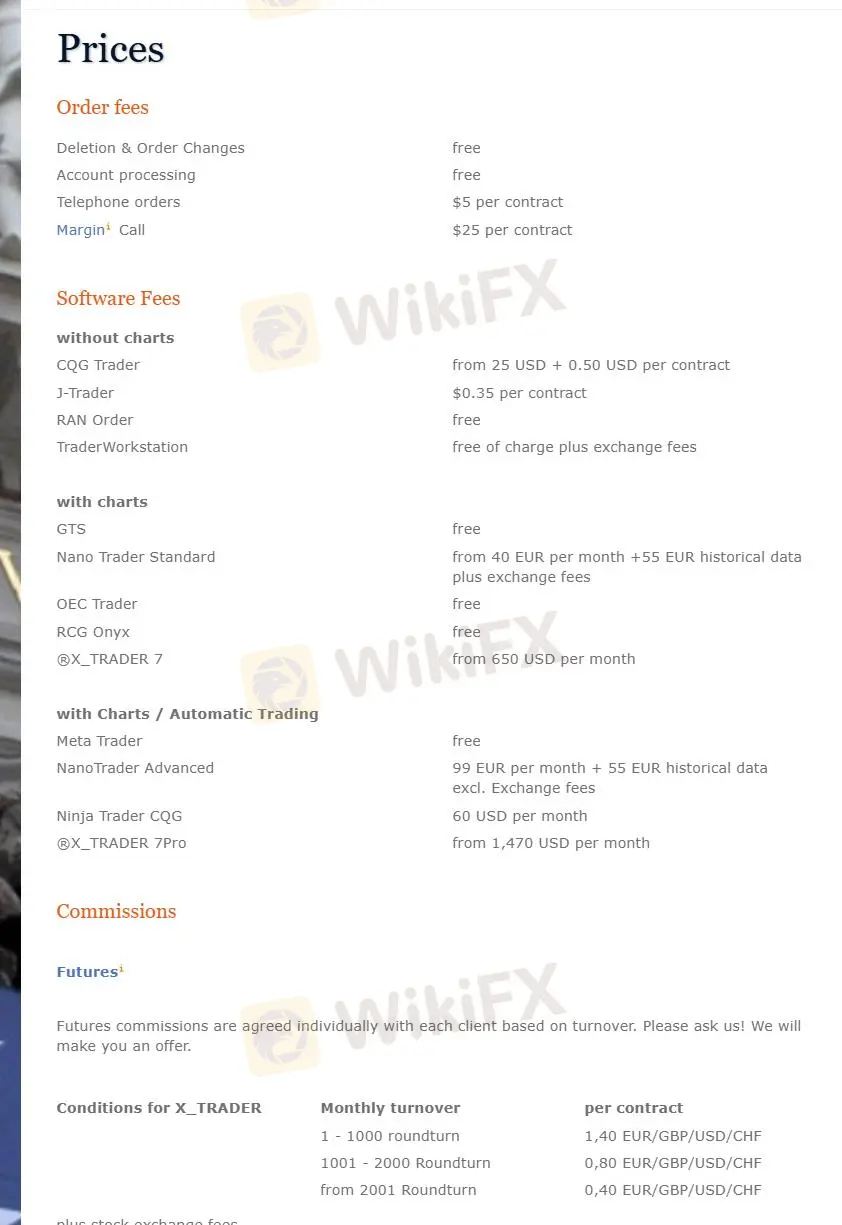

ADiF Brokerage Fees

ADiF Brokerage charges many types of fees including order fees, software fess, commissions and so on. The details are as follows:

Order Fees and Account Processing

| Service | Fee |

| Order Fees | ❌ |

| Deletion & Order Changes | ❌ |

| Account Processing | ❌ |

| Telephone Orders | $25 per contract |

| Margin Call | ❌ |

Software Fees

| Software | Without Charts | With Charts | With Charts / Automatic Trading |

| CQG Trader | $0.35 per contract | ❌ | - |

| J-Trader | ❌ | ❌ | - |

| RAN Order | Free of charge plus exchange fees | - | - |

| TraderWorkstation | ❌ | - | - |

| GTS | - | ❌ | - |

| Nano Trader Standard | - | ❌ | - |

| OEC Trader | - | ❌ | - |

| RCG Onyx | - | ❌ | - |

| ®X_TRADER 7 | - | ❌ | - |

| Meta Trader | - | - | ❌ |

| NanoTrader Advanced | - | - | 99 EUR per month + 55 EUR historical data excl. Exchange fees |

| Ninja Trader CQG | - | - | 60 USD per month |

| ®X_TRADER 7Pro | - | - | From 1,470 USD per month |

Futures Commissions

Futures commissions are agreed individually with each client based on turnover.

Conditions for X_TRADER

| Monthly Turnover | 1 - 1000 Roundturn | 1001 - 2000 Roundturn | From 2001 Roundturn |

| Per Contract | 1.40 EUR/GBP/USD/CHF | 0.80 EUR/GBP/USD/CHF | 0.40 EUR/GBP/USD/CHF |

Options Commissions

| Country | Fee per Contract |

| Australia | 7.90 AUD |

| Belgium | 4.90 EUR |

| Germany ODAX | 2.90 EUR |

| Germany Equities | 2.20 EUR |

| France | 1.90 EUR |

| Great Britain | 2.90 GBP |

| GB Liffe / ICE (USD contracts) | 4.90 USD |

| Hong Kong | 49 HKD |

| India | 90 INR |

| Japan | 790 JPY |

| Canada | 2.90 CAD |

| Netherlands | 2.90 EUR |

| Sweden | 29 SEK |

| Switzerland Equities | 2.90 CHF |

| Switzerland Index | 4.50 CHF |

| Spain | 2.90 EUR |

| South Korea | 0.25% of the share price |

| United States | $2.90 |

Stocks, ETFs, Warrants Commissions

| Country | Fee per Share |

| Australia | 0.15% |

| Belgium | 0.15% |

| Germany | 0.15% |

| Hong Kong | 0.15% |

| France | 0.15% |

| Great Britain | 0.15% |

| Canada | CAD 0.02 per share |

| India | 0.15% |

| Italy | 0.15% |

| Japan | 0.15% |

| Mexico | 0.25% |

| Austria | 0.15% |

| Switzerland | 0.15% |

| Sweden | 0.15% |

| Spain | 0.15% |

| USA (<500 shares) | $0.02 per share |

| USA (>501 shares) | $0.014 per share |

| USA (>1000 shares) | 0.01 |

Investment Fund Commissions

$19.95 per transaction

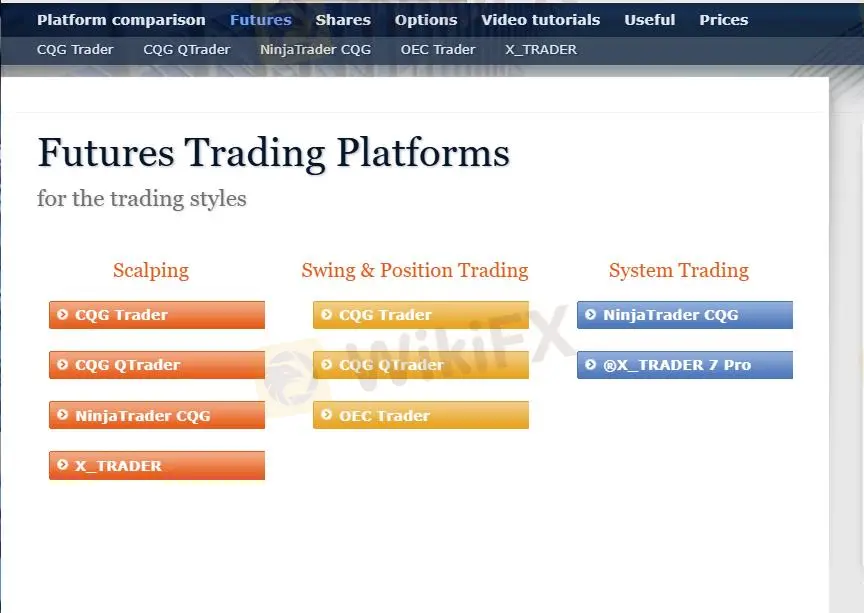

Trading Platform

ADiF provides platforms - CQG trader, X_TRADER, NinjaTrader CQG and so on to support futures, stock, and forex trading.

For traders who require comprehensive analysis, some platforms offer integrated charting capabilities.

Alternatively, for those who prefer using external analysis tools, ADiF also offers platforms without built-in charts.

System traders benefit from dedicated platforms optimized for deploying and managing trading algorithms and automated systems across various asset classes.

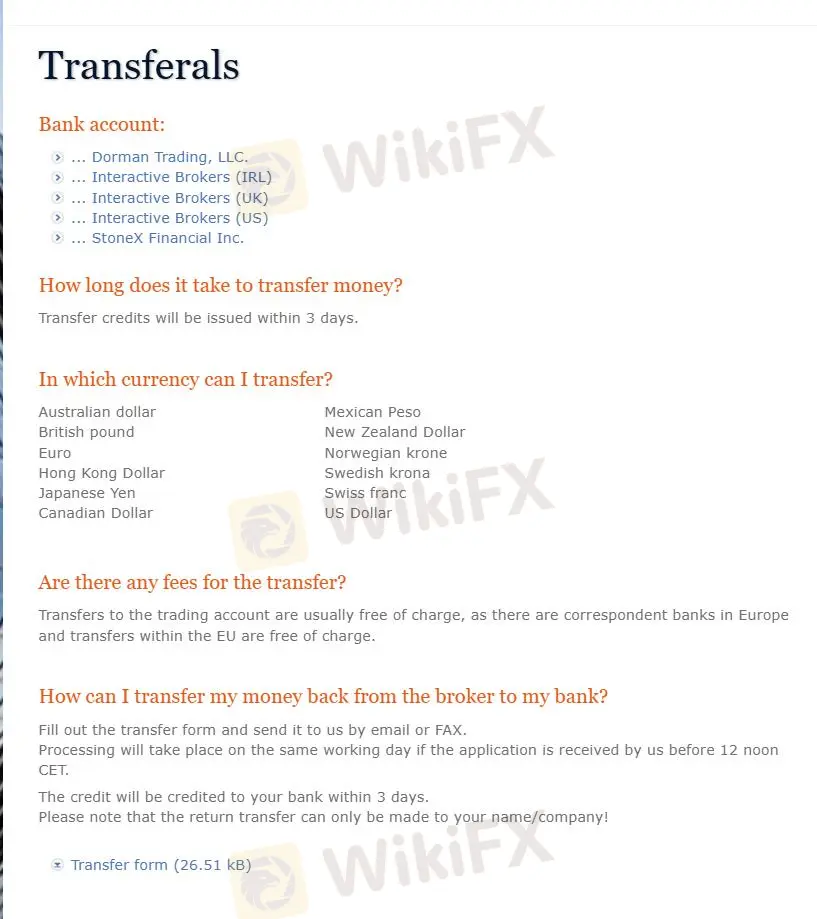

Deposit and Withdrawal

Deposit

Procedure: Transfer funds to your ADiF brokerage account via bank transfer.

Timeframe: The transfer will generally be credited within 3 days.

Currencies: Available in various currencies including Australian dollar, Canadian Dollar, Swiss Franc, Euro, and more.

Fees: Usually free for transfers to the trading account, especially within Europe where EU transfers are also free of charge.

Withdrawal

Procedure: Fill out the transfer form and send it to the broker via email or FAX. Applications received before 12 noon CET will be processed on the same working day.

Timeframe: Once processed, the credit will be transferred to your bank account within 3 days.

Note: The return transfer can only be made to the same name/company on your account!

WikiFX-Broker

Aktuelle Nachrichten

Metas CTO behauptet, er habe Deepseek vorausgesagt – und die chinesische KI sei nicht weltverändernd

Ähnlich zum bedingungslosen Grundeinkommen? Donald Trump plant einen Staatsfonds

Verhandlungen bei japanischen Autobauern: Nissan zieht sich offenbar aus Fusionsgesprächen mit Honda zurück

Mindestlohn sorgt für weniger Lohngefälle und kleineren Niedriglohnsektor – doch die Bewährungsprobe steht jetzt erst bevor

Nach Unstimmigkeiten bei Strategie von Milliarden-Konzern: Wago entlässt mit sofortiger Wirkung seinen CEO

Er zeigt, wie deutsche Deeptech-Startups erfolgreich sein können

Neue VW-interne Überlegung: Wo der künftige 20.000-Euro-Stromer gebaut werden soll

Experten: Paket-Stopp aus China bedeutet nicht das Ende von Shein und Temu in den USA

Überraschende Preissenkung bei Kaufland und Lidl: Butter jetzt günstiger

Bonk Preis-Prognose: Es werden 2,02 Billionen BONK-Münzen verbrannt

Wechselkursberechnung