ACDEX-Some Important Points about This Broker

Zusammenfassung:ACDEX is a brokerage firm that offers a range of trading instruments across different asset classes, including foreign exchange, precious metals, commodities, and indices. The company provides access to these markets through its trading platform, MT4. ACDEX emphasizes the availability of liquidity providers such as Bank of America Merrill Lynch, Barclays, RBS, UBS, Deutsche Bank, Credit Suisse, BNP Paribas, Nomura, Citibank, and JPMorgan Chase. Additionally, the broker offers an economic calendar and trading tools to assist clients in their trading activities. ACDEX is regulated by ASIC, a reputable regulatory authority.

Risk Warning

Trading online is risky, and you run the risk of losing all of your investment money. Not all traders and investors are suited for it. Please be aware that the risk factors should be considered and that the material on this website is intended to provide general advise.

General Information

| ACDEX Review Summary | |

| Registered Country/Region | Hong Kong |

| Regulation | ASIC |

| Market Instruments | Foreign exchange, Precious metal, Commodity, Index |

| Leverage | N/A |

| EUR/USD Spread | N/A |

| Trading Platforms | MT4 |

| Liquidity Providers | Bank of America Merill Lynch, BARCLAYS, RBS, UBS, Deutsche Bank, CREDIT SUISSE |

| Customer Support | telephone, email |

What is ACDEX?

ACDEX is a brokerage firm that offers a range of trading instruments across different asset classes, including foreign exchange, precious metals, commodities, and indices. The company provides access to these markets through its trading platform, MT4. ACDEX emphasizes the availability of liquidity providers such as Bank of America Merrill Lynch, Barclays, RBS, UBS, Deutsche Bank, Credit Suisse, BNP Paribas, Nomura, Citibank, and JPMorgan Chase. Additionally, the broker offers an economic calendar and trading tools to assist clients in their trading activities. ACDEX is regulated by ASIC, a reputable regulatory authority.

In the paper that follows, we'll look at this broker's qualities from a number of perspectives and provide you with structured, concise information. If you are interested, please read on. We'll also include a succinct summary at the end of the essay to assist you rapidly understand the broker's qualifications.

Pros & Cons

| Pros | Cons |

| • Regulated by ASIC | • Reports of withdrawal difficulties and scams |

| • Collaboration with established liquidity providers | • Lack of transparency regarding minimum deposit requirements |

| • Wide range of trading instruments available | • Lack of transparency regarding types of accounts |

| • Utilizes the popular MT4 trading platform |

ACDEX Alternative Brokers

There are many alternative brokers to ACDEX depending on the specific needs and preferences of the trader. Some popular options include:

Plus500 - A CFD service provider that offers a simple, user-friendly platform and a wide range of tradable instruments, making it suitable for those interested in CFD trading.

Forex.com - As a leading forex broker, it provides a wide range of currency pairs, a robust trading platform, and high-quality research tools, making it an excellent option for forex traders.

XTB - Known for its combination of educational materials, comprehensive market analysis, and a custom trading platform, it's an excellent choice for new and experienced traders alike.

Is ACDEX Safe or Scam?

ACDEX is regulated by ASIC (Australian Securities and Investments Commission). ASIC is a reputable regulatory authority known for its oversight of financial services providers in Australia. Being regulated by ASIC suggests that ACDEX operates under certain compliance and regulatory standards. ACDEX claims to have reputable liquidity providers, including well-known banks such as Bank of America Merrill Lynch, Barclays, RBS, UBS, Deutsche Bank, Credit Suisse, BNP Paribas, Nomura, Citibank, and JPMorgan Chase. Partnering with established financial institutions can add credibility to ACDEX's operations. However, it's important to consider reports of withdrawal difficulties and scams associated with ACDEX. Reports from users experiencing difficulties with withdrawals or encountering scams raise concerns and warrant careful consideration.

Market Instruments

The foreign exchange market is accessible through ACDEX, enabling dealers to purchase and sell several currency pairings. Trading foreign exchange entails making bets on changes in the exchange rates of two different currencies.

ACDEX also allows traders to invest in precious metals, such as gold, silver, platinum and palladium. These metals are considered safe-haven assets and are often used as a hedge against inflation or economic uncertainty.

Additionally, ACDEX provides trading possibilities in a wide range of commodities, including industrial metals like copper and aluminum, as well as agricultural items like wheat, corn, and soybeans, as well as energy products like crude oil and natural gas. Investors can speculate on these physical commodities' price changes through commodity trading.

Last but not least, the ACDEX gives traders access to an index that reflects a collection of companies in a specific industry or market. Without trading individual equities, traders may make predictions about how the index will perform. The S&P 500, Dow Jones Industrial Average, and FTSE 100 are some examples of indexes.

Trading Platform

ACDEX offers its clients the popular trading platform called MetaTrader 4 (MT4). MT4 is a widely recognized and widely used trading platform in the financial industry.

The MetaTrader 4 (MT4) platform provided by ACDEX offers a comprehensive and feature-rich trading experience. With its user-friendly interface, powerful charting tools, efficient order execution, and robust security measures, the MT4 platform enables traders to analyze the markets, implement trading strategies, and participate in various financial markets with confidence.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| ACDEX | MT4 |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

| Forex.com | MT4, Forex.com Web Platform, Forex.com Mobile App |

| XTB | xStation 5 |

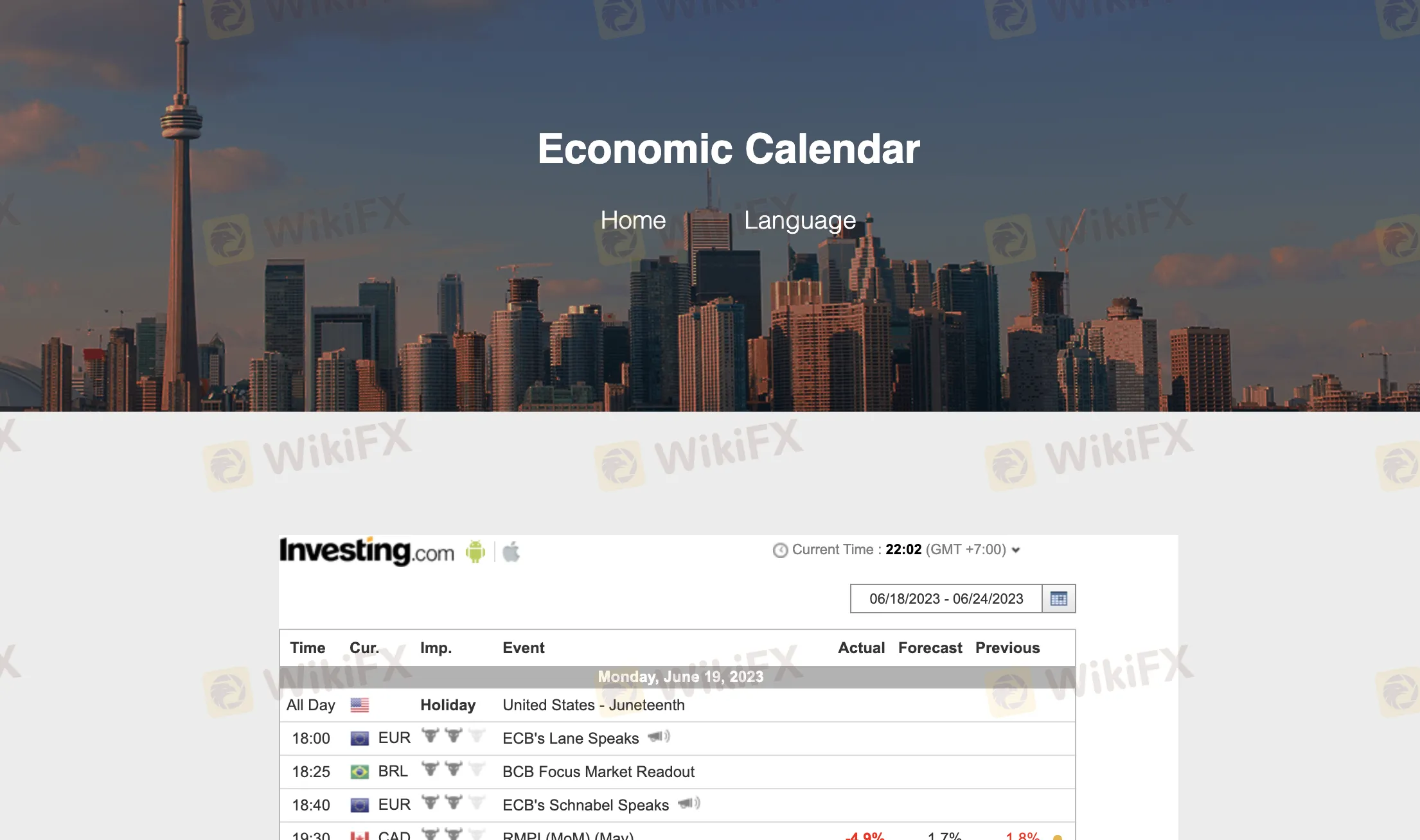

Trading Tools

ACDEX's economic calendar is a key tool for traders to stay informed about important economic events and announcements that can impact the financial markets. It provides a schedule of upcoming economic indicators, such as GDP reports, employment data, central bank meetings, and other relevant news releases. Traders can use this calendar to plan their trades, anticipate market volatility, and adjust their strategies based on the expected market impact of these events.

User Exposure on WikiFX

On our page, you may read stories about scams and withdrawal problems. Investors are advised to weigh the dangers of trading on an unregulated platform and carefully review the available information. You can check the facts on our website before investing. If you come across any such dishonest brokers or if you have been the victim of one, do let us know in the Exposure area. We would appreciate it, and our team of experts will do all possible to assist you in resolving the issue.

Customer Service

ACDEX provides a telephone helpline for customer support. Clients can contact the provided phone number, +886 2 27188877, to speak with a representative who can assist them with their questions or issues. Telephone support allows for direct and immediate communication, enabling clients to receive real-time assistance and guidance.

Email customer care is also provided by ACDEX. Clients can contact the company through email at service@acdexpty.io with any questions or requests. Clients may express their issues in detail and receive replies at their convenience via email support, which offers a convenient and asynchronous avenue for contact. This approach is especially helpful in instances that call for written documentation or non-urgent queries.

The Address: Room 1305, 13/F, Tower A, New Mandarin Piaza, 14 Science Museum Road. Tsim Sha Tsui, Kowloon, Hong Kong Area B, 15th Floor, No. 167, Dunhua North Road, Songshan District, Taipei City, Taiwan (R.O.C.)

Pros and cons of customer service of ACDEX make a table:

| Pros | Cons |

| • Direct telephone support for immediate assistance | • Limited availability of customer service channels (only telephone and email) |

| • Email support for asynchronous communication | • Lack of information on response times or service hours |

| • Lack of additional customer service channels (such as live chat or online support) |

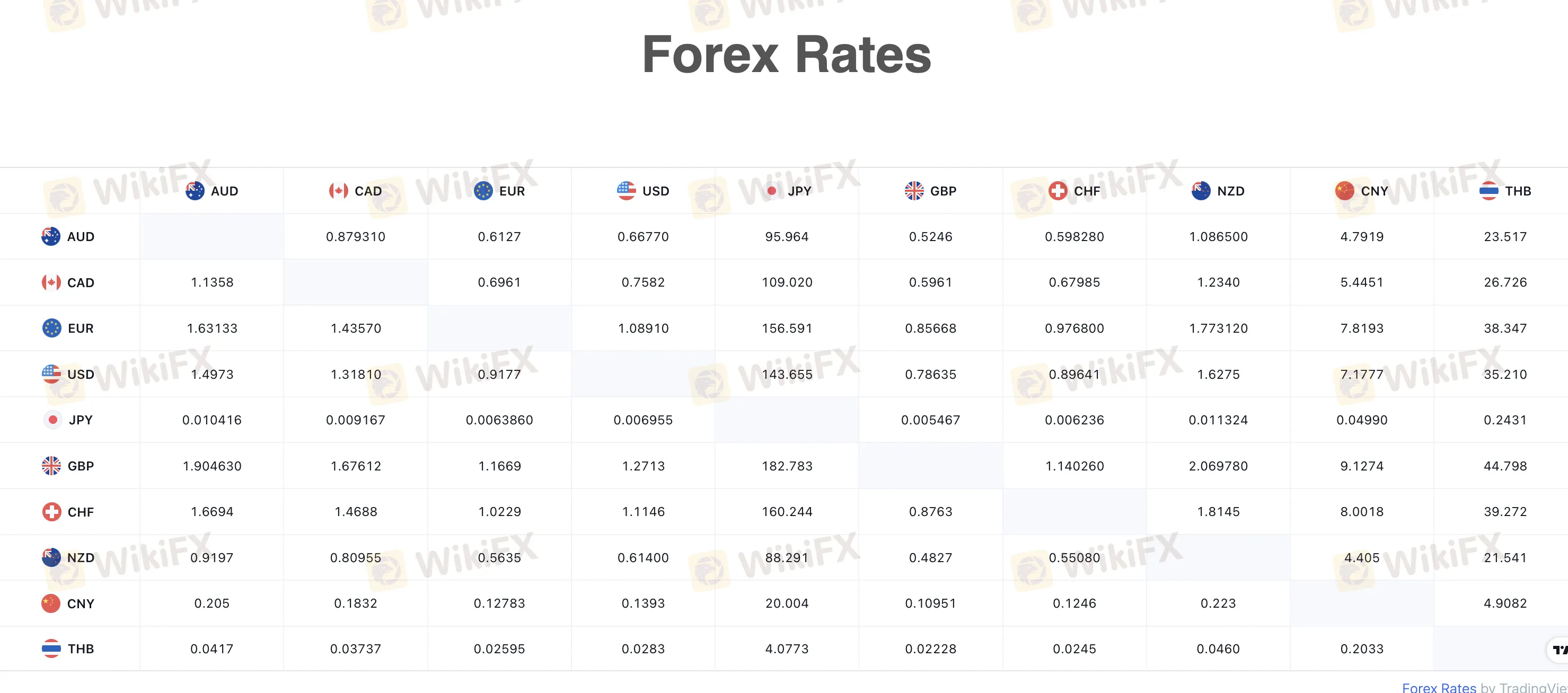

ACDEXForex Rates

According to the forex rated displayed on ACDEXs official website, the minimum rate of AUD vs CAD at 0.879310, AUD vs EUR 0.6127, AUD vs USD 0.66770, AUD vs JPY 95.964, EUR vs CAD at 1.43570, EUR vs USD at 1.08910, EUR vs JPY at 156.591.

These forex rates represent the exchange rates at a specific point in time and may fluctuate due to market conditions and currency dynamics. It's important to note that forex rates are subject to change, and it's advisable to check for real-time rates or consult with ACDEX for the most up-to-date information on currency exchange rates.

Liquidity Providers

ACDEX lists several prominent liquidity providers on its official website.

Bank of America Merrill Lynch is a well-known global investment bank and financial services provider. As a liquidity provider for ACDEX, they offer access to deep liquidity pools and trading services across various financial markets.

Barclays is a multinational investment bank and financial services company. As a liquidity provider, Barclays contributes to ACDEX's liquidity by offering competitive pricing and access to liquidity in different asset classes.

RBS, also known as the Royal Bank of Scotland, is a major banking institution. RBS serves as a liquidity provider for ACDEX, providing liquidity and market access for trading instruments across different asset classes.

UBS is a leading Swiss multinational investment bank and financial services company. As a liquidity provider for ACDEX, UBS offers access to their extensive liquidity network, allowing traders to access competitive pricing and execute trades efficiently.

Deutsche Bank is a global banking and financial services company. As a liquidity provider for ACDEX, Deutsche Bank contributes to the liquidity pool, facilitating smooth and efficient trade execution for ACDEX's clients.

Credit Suisse is a prominent Swiss multinational investment bank and financial services company. By acting as a liquidity provider, Credit Suisse supports ACDEX by offering liquidity and competitive pricing for a wide range of trading instruments.

BNP Paribas is a leading global banking and financial services institution. As a liquidity provider for ACDEX, BNP Paribas contributes to the liquidity pool, offering access to their extensive network and providing competitive pricing for various trading instruments.

Nomura is a prominent Japanese multinational financial services company. Nomura serves as a liquidity provider for ACDEX, facilitating access to liquidity and market depth for traders. Their involvement enhances the liquidity and trading capabilities available to ACDEX's clients.

Citibank, a subsidiary of Citigroup, is a major international bank providing a wide range of financial services. As a liquidity provider, Citibank contributes to ACDEX's liquidity pool, offering competitive bid/ask prices and helping to ensure smooth and efficient trade execution.

JPMorgan Chase is one of the largest financial institutions globally, offering a comprehensive range of financial services. As a liquidity provider for ACDEX, JPMorgan Chase provides liquidity and competitive pricing for the trading instruments available on the platform.

These liquidity providers play a crucial role in ensuring market liquidity and price stability for ACDEX's trading instruments. They contribute to the availability of competitive bid/ask prices, enabling traders to execute trades with minimal slippage and efficient order execution.

Conclusion

When considering ACDEX, it is important to weigh both the positive and negative aspects. The company's regulation by ASIC provides a level of credibility and oversight. The collaboration with reputed liquidity providers indicates the availability of deep liquidity pools. The wide range of trading instruments and utilization of the popular MT4 trading platform are also noteworthy advantages. However, reports of withdrawal difficulties and scams raise concerns and require careful consideration. Therefore, potential users of ACDEX should conduct thorough research, seek additional information, and exercise caution before making any decisions.

Frequently Asked Questions (FAQs)

Q1: What trading instruments does ACDEX offer?

A1: ACDEX offers trading instruments across various asset classes, including foreign exchange, precious metals, commodities, and indices.

Q2: Which regulatory authority oversees ACDEX?

A2: ACDEX is regulated by ASIC (Australian Securities and Investments Commission).

Q3: What trading platform does ACDEX use?

A3: ACDEX utilizes the MT4 (MetaTrader 4) trading platform.

Q4: Who are the liquidity providers for ACDEX?

A4: ACDEX lists liquidity providers such as Bank of America Merrill Lynch, Barclays, RBS, UBS, Deutsche Bank, Credit Suisse, BNP Paribas, Nomura, Citibank, and JPMorgan Chase.

Q5: Are there any reports of issues with ACDEX, such as withdrawal difficulties or scams?

A5: Yes, there have been reports of withdrawal difficulties and scams associated with ACDEX, which require careful consideration and due diligence.

WikiFX-Broker

Aktuelle Nachrichten

OpenAI-Chef Sam Altman: So stark sinken die Kosten von Künstlicher Intelligenz jedes Jahr

KI-Milliarden: Helsing und Mistral AI machen gemeinsame Sache

Tempo 30 bald in allen Städten? Was dafür spricht

„Stargate Europe? Sam Altman will KI auch in Europa voranbringen

Litecoin Preis Prognose: LTC Bullen streben nach höheren Höchstständen

BMW-Vorstand ist trotz Zöllen „optimistisch für US-Absatz – und kündigt Investitionen in Verbrenner und Hybride an

Konsumgüterhersteller Henkel verabschiedet sich von diesen Marken mit einem Umsatz von über 1 Milliarde Euro

15 schnelle Fragen an Christian Lindner: Der FDP-Chef zwischen Porsche, Moët und Döner

Rocket Pool Preisprognose: Anstieg um mehr als 40% - Open Interest Rekordniveau erreicht

Hanno Renner, Michael Wax, Julia Bösch: 316 Alumni des Münchner CDTM starten eigenen Fonds

Wechselkursberechnung