Mohicans markets:MHM Today’s News

Zusammenfassung:On Friday, October 7, because the non-farm payrolls data exceeded expectations, the dollar index rose for three consecutive days; It once rose above 112.90, which was a new high of more than a week and closed up 0.41% at 112.73. 10-year U.S. bond yields pulled up during the day, and quickly rose above 3.90% after the release of non-farm payrolls; 2-year U.S. bond yields quickly stood at 4.3%.

In order to further meet the needs of investors for real-time news of the international market and broaden the channels for investors to understand the market, MHMarkets launches heavily “Todays News” to provide investors with real-time market information.

October 10, 2022 – Todays News

Market Overview

-- Source: jin10 & Bloomberg

On Friday, October 7, because the non-farm payrolls data exceeded expectations, the dollar index rose for three consecutive days; It once rose above 112.90, which was a new high of more than a week and closed up 0.41% at 112.73. 10-year U.S. bond yields pulled up during the day, and quickly rose above 3.90% after the release of non-farm payrolls; 2-year U.S. bond yields quickly stood at 4.3%. By the end of the U.S. stock market, the 10-year U.S. bond yield was at 3.88% and the 2-year U.S. bond yield was at 4.31%.

Because the U.S. dollar and U.S. bond yields went higher hand in hand, spot gold plunged $20 in the short term, once approaching $1,690 per ounce; spot silver fell 3% during the session. By the close of trading, spot gold closed down 0.95% at $1694.52 per ounce; spot silver closed down 2.62% at $20.11 per ounce.

Crude oil closed up for five consecutive days for the first time in four months, with WTI crude closing up 4.97% at $93.54 per barrel; Brent crude closed up 3.78% at $99.48 per barrel; oil prices rose by more than 10% last week, which was the biggest weekly gain since early March. European natural gas futures prices fell 14%, falling below $1,550 per thousand cubic meters for the first time since July 21, and have fallen by more than half from their August highs. Traders are considering the factor of increasing winter gas stocks and waiting for more guidance from governments on possible price interventions.

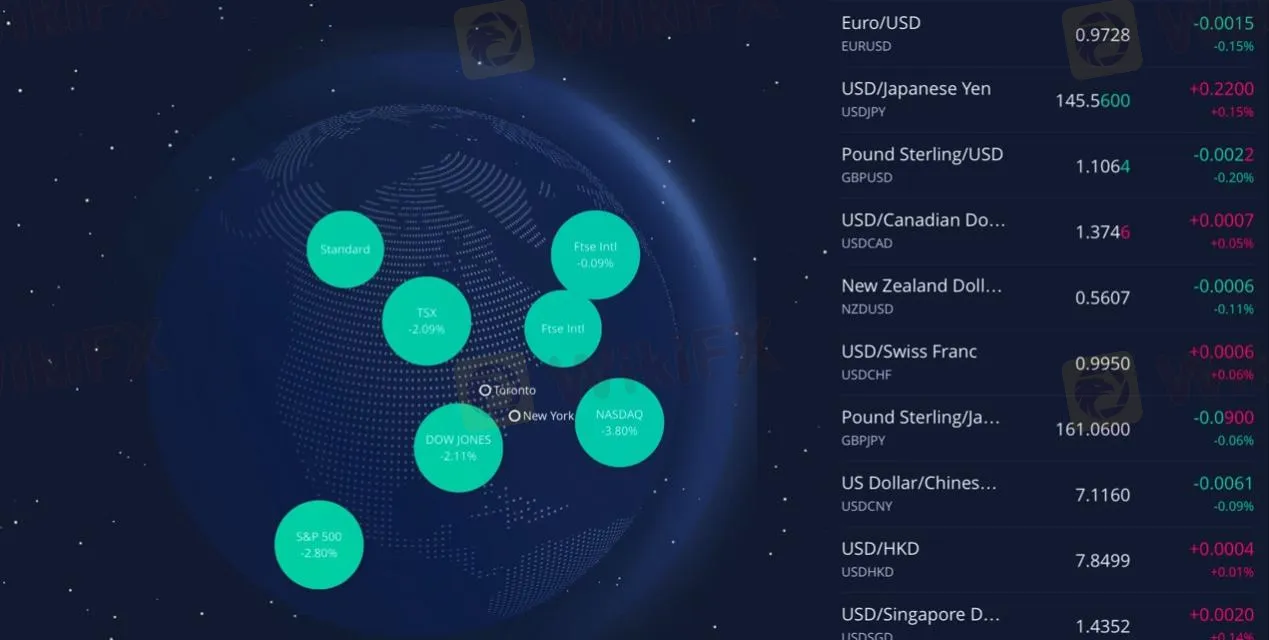

U.S. stocks opened lower, with the Dow closing down 2.11% and the Nasdaq and S&P 500 closing down 3.8% and 2.8%, respectively. Sectors such as semiconductors and large technology stocks dragged down the market. AMD closed down nearly 14% and Tesla closed down 6.3%. However, thanks to the big gains last Monday and Tuesday, especially last Tuesday, the major U.S. stock indexes all accumulated gains last week.

European stocks generally fell, and Germany‘s DAX30 index closed down 1.59%; Britain’s FTSE 100 index closed down 0.09%; France‘s CAC40 index closed down 1.17%; Europe’s Stoxx 50 index closed down 1.69%; Spain‘s IBEX35 index closed down 0.99%; Italy’s FTSE MIB index closed down 1.13%.

Hot Spots in the Market

——Source: jin10&Bloomberg

The Crimean Bridge exploded, Uzbekistan admitted to being responsible for the terrorist attack on the Crimean Bridge

After the quarterly adjustment in September, the non farm employment population in the United States increased by 263000, better than expected

Several French refineries were closed due to strike, Putin ordered to replace the operator of “Sakhalin 1” oil and gas project, and American enterprises were out of business

Europe's largest nuclear power plant was completely cut off due to shelling

The informal meeting of EU leaders failed to reach specific results on addressing the energy crisis

Institutional perspective

—— MHMarkets ETA

1. Daoming Securities: USD/Canadian dollar is expected to rise to 1.40 or higher this year

2. When will the strong dollar peak? Haitong Securities: We should focus on tracking US inflation indicators

3. UBS: If the Bank of Japan adjusts its policies, multinational bond markets may face huge impact

4. UBS: Britain faces political challenges, and the pound may remain weak

5. Imperial Bank of Canada: It is expected that the pound will be tested against the dollar again before the end of the year 1.08

6. Commerzbank AG: The energy crisis is still a burden on the euro, which may fall to the range of 0.92-0.91

7. Bank of America lowered the New Zealand dollar to 0.56 from 0.65 at the end of the year

Risk warning: The margin trading of financial derivatives and other products has high risks, so it is not suitable for all investors. The loss may exceed the initial investment. Please ensure that you fully understand the risks and properly manage your risks. Any opinion, news, research product, analysis, quotation or other information in this article does not constitute the following behavior: (1) In any case, MHM will not provide investment advice or recommendation to clients, nor will it express opinions on whether clients rely on or not to make investment decisions. MHM will never provide investors with trading advice or order trading business through WeChat, QQ or other channels; (2) In any case, any materials, information or other functions provided by MHM to clients through websites, investment platforms, marketing, training activities or other means are general information, which cannot be considered as suitable for clients or suggestions based on clients' personal conditions, and MHM will not bear any responsibility for losses caused by investment based on the above information; Investors should pay attention to the official article logo of MHM and the official channel of the brand, and pay attention to identifying fake websites.

WikiFX-Broker

Aktuelle Nachrichten

Abrechnung mit Ex-Chefredakteur Biesinger: RBB veröffentlicht Untersuchungsbericht zur Gelbhaar-Affäre

Diese Folgen fürchten Ökonomen durch die US-Zölle – und welche sie für wenig gefährlich halten

Donald Trump verhängt Zölle gegen die ganze Welt – EU spricht von „schwerem Schlag und bereitet Gegenmaßnahmen vor

Verband der Automobilindustrie reagiert auf US-Zölle: „Das wird Arbeitsplätze betreffen

IPO-Gerüchte: DeepL plant laut Medienberichten Börsengang für 2026

Wechselkursberechnung