Kwakol Markets Spreads, leverage, minimum deposit Revealed

Abstract:Kwakol Markets is a broker registered in the United States,and offering a range of trading instruments across various markets. This includes forex currency pairs, commodities, indices, and more. Kwakol Markets offers a wide range of trading account options to cater to different traders' needs. Whether you are a beginner or an experienced trader, you can choose an account type that suits your needs. Each account type may come with specific features, such as different minimum deposit requirements, spreads, and commission structures. The minimum deposit to open a standard account is $250, and this broker also provides an Islamic account with the minimum deposit of $1.

| Kwakol Markets | Basic Information |

| Registered Country/Region | United States |

| Founded in | N/A |

| Regulation | ASIC ( AR license) |

| Trading Instruments | forex, stocks, commodities, indices, cryptocurrencies, and CFDs |

| Trading Accounts | Multiple account types |

| Leverage | Up to 1:500 |

| Spreads | N/A |

| Trading Platforms | WebTrader, MT4, MT5, cTrader |

| Minimum Deposit | Vary depending on account types ($10 for most payment methods) |

| Customer Support | Email, Phone, Live Chat |

| Deposit & Withdrawal | Bank Card, Bank Tranfer, Bitcoin, Ethereum, Help2Pay, Litecoin, Match2Pay, Online Bank Tranfer, Ozow, PayPal, Sticpay, UPI, USDT. |

| Educational Resources | Courses, Classes, News, E-books |

| Trading Tools | Autochartist |

| Copy Trading | Supported |

*Please note that some specific details such as deposit and withdrawal options, spreads, commissions, and educational resources are not available. It is recommended to visit the official website or contact Kwakol Markets directly for more information and to verify the details.

Overview of Kwakol Markets

Kwakol Markets is a broker registered in the United States,and offering a range of trading instruments across various markets. This includes forex currency pairs, commodities, indices, and more.

Kwakol Markets offers a wide range of trading account options to cater to different traders' needs. Whether you are a beginner or an experienced trader, you can choose an account type that suits your needs. Each account type may come with specific features, such as different minimum deposit requirements, spreads, and commission structures. The minimum deposit to open a standard account is $250, and this broker also provides an Islamic account with the minimum deposit of $1.

One notable feature of Kwakol Markets is its generous leverage, which can reach up to 1:500. This high leverage allows traders to amplify their trading positions and potentially maximize their profit potential. However, it is important to note that higher leverage also entails increased risk, and traders should exercise caution and implement appropriate risk management strategies.

Kwakol Markets provides customer support to assist traders with their inquiries and concerns. The broker offers various channels to reach their support team, ensuring accessibility and responsiveness. Traders can typically contact customer support through email, phone, or live chat.

Kwakol Markets takes it a step further by offering copy trading. By incorporating copy trading into their trading experience, clients of Kwakol Markets can benefit from the wisdom and expertise of top traders in real-time, enhancing their chances of achieving profitable outcomes while also learning and improving their own trading skills along the way.

Pros and Cons

One of the standout features is its multiple trading account options, allowing traders to select an account that suits their individual needs and preferences. The generous leverage of up to 1:500 provided by Kwakol Markets is also noteworthy. Additionally, the availability of various trading platforms, including webtrader, MT4, MT5, and cTrader, offers traders the flexibility to choose a platform that aligns with their trading style. The inclusion of useful trading tools like Autochartist further enhances the trading experience by providing valuable market analysis and pattern recognition.

However, there are a few considerations to keep in mind when trading with Kwakol Markets. The limited customer support options, particularly the absence of live chat, may be a drawback for some traders who prefer immediate assistance. Additionally, the lack of educational resources might be a disadvantage for those seeking comprehensive learning materials and educational support to improve their trading skills.

| Pros | Cons |

| Multiple trading account options | No regulation |

| Generous leverage of up to 1:500 | High minimum deposit required by some account types |

| Multiple trading platforms to choose from (MT4, MT5, cTrader) | Potential variation in trading conditions across accounts |

| Availability of trading tools like Autochartist | Limited availability of educational resources |

| Low minimum deposit for Islamic account | No demo accounts available |

| Copy trading available | |

Market Intruments

Kwakol Markets provides an extensive array of trading instruments, allowing investors to access a wide range of financial markets.

Forex Trading: Forex, also known as foreign exchange, involves trading currency pairs in the global market. Traders can speculate on the relative value of different currencies and potentially profit from fluctuations in exchange rates.

Stock Trading: Stock trading allows investors to buy and sell shares of publicly traded companies. Traders can participate in the stock market and potentially benefit from the price movements of individual stocks.

Commodities Trading: Commodities refer to physical goods such as gold, silver, oil, and agricultural products. By trading commodities, investors can speculate on the price movements of these assets, which can be influenced by factors such as supply and demand dynamics and global economic conditions.

Indices Trading: Indices represent a group of stocks from a specific sector or region, providing a snapshot of the overall performance of the market. Traders can speculate on the direction of indices, such as the S&P 500 or FTSE 100, to potentially capitalize on broad market trends.

Cryptocurrency Trading: Cryptocurrencies are digital or virtual currencies that utilize cryptography for secure transactions. Kwakol Markets allows traders to engage in cryptocurrency trading, enabling them to buy and sell popular cryptocurrencies like Bitcoin, Ethereum, and Ripple.

CFD (Contract for Difference) Products: CFDs are derivative financial instruments that enable traders to speculate on the price movements of various underlying assets, such as stocks, commodities, or indices, without owning the assets themselves. CFD trading offers flexibility and the opportunity to profit from both rising and falling markets.

Account Types

Kwakol Markets caters to the diverse trading preferences of its clients by providing a rich selection of trading instruments across various account types. Traders can choose from an impressive array of account options, including standard account, no-swap account, pro account, gold account, platinum account, diamond account, premium account, and VIP account.

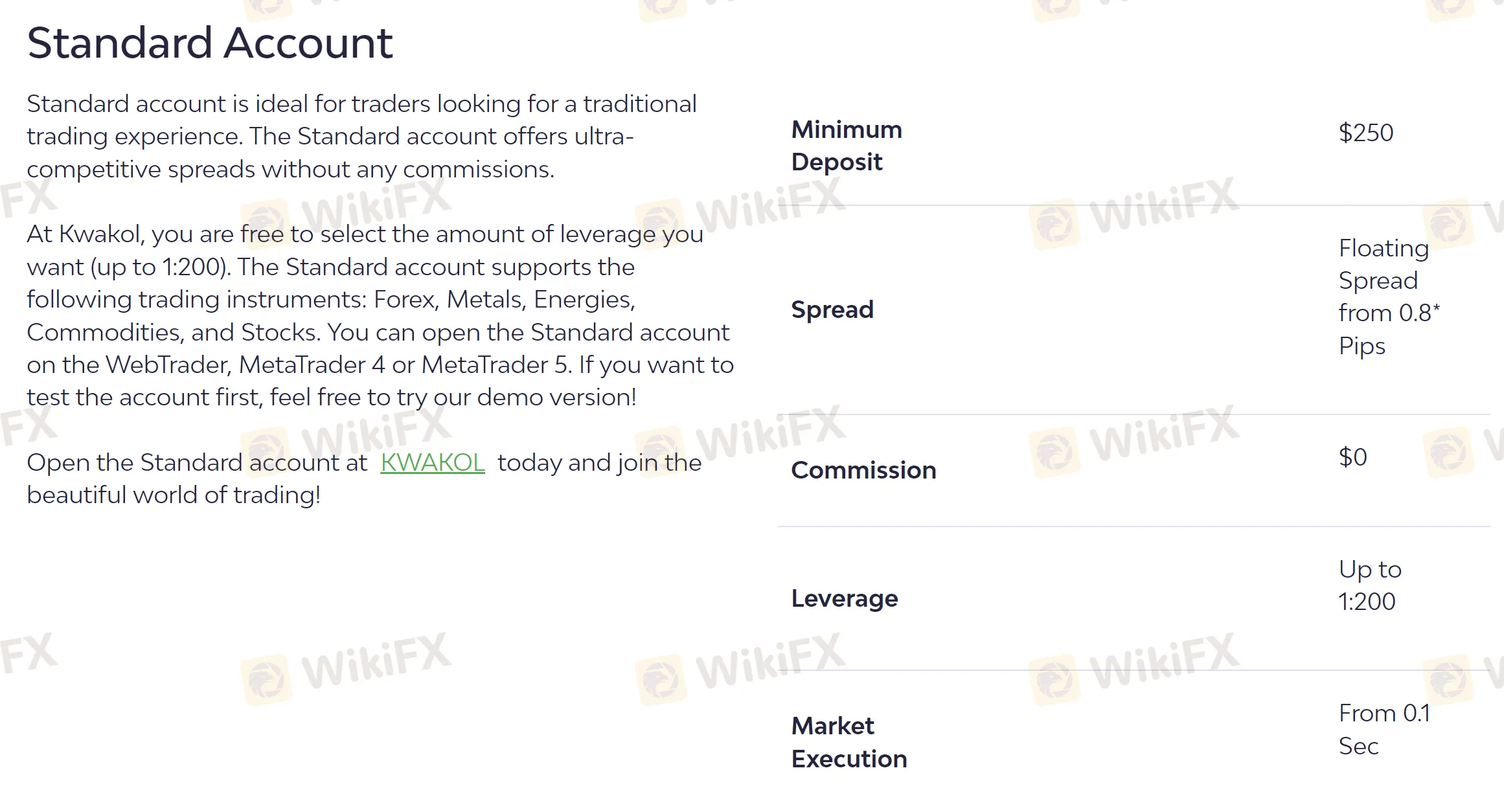

Standard Account

The standard account is suitable for traders looking for a traditional trading experience.

Minimum Deposit: The minimum deposit requirement for the Standard Account is $250.

Spreads: The spreads on the Standard Account are competitive, starting from 0.8 pips.

Leverage: The leverage available on the Standard Account is up to 1:200, providing traders with the opportunity to amplify their trading positions.

Islamic Account

The no-swap account is ideal for those who follow Islamic principles and require a swap-free trading environment.

Minimum Deposit: The No-Swap Account also requires a minimum deposit of $1.

Spreads: Similar to the Standard Account, the No-Swap Account offers competitive spreads starting from 1.6 pips.

Leverage: Traders utilizing the No-Swap Account can also take advantage of leverage up to 1:1000, enabling them to enhance their trading opportunities while adhering to Islamic principles.

Pro Account

The pro account is tailored for experienced traders seeking advanced trading tools and features.

Minimum Deposit: The Pro Account has a higher minimum deposit requirement of $10,000, catering to more experienced traders.

Spreads: The Pro Account features even tighter spreads, starting from 0.01 pips.

Leverage: Traders on the Pro Account can enjoy leverage up to 1:300, allowing for greater flexibility in executing trading strategies.

Gold Account

The Gold account is suitable for traders with a higher investment capital and more trading experience.

Minimum Deposit: The Gold Account requires a higher minimum deposit, typically starting from $10,000.

Spreads: Traders on the Gold Account can access even tighter spreads than the previous accounts, spreads from 0.01 pips.

Leverage: The Gold Account offers leverage up to 1:400, providing traders with ample opportunities to maximize their trading positions.

Platinum Account

The Platinum account is suitable for seasoned traders and institutional clients.

Minimum Deposit: The Platinum Account has a higher minimum deposit requirement, usually starting from $100,000.

Spreads: Traders on the Platinum Account can benefit from ultra-tight spreads, starting from 0.0 pips.

Leverage: The Platinum Account offers leverage up to 1:450, giving traders the flexibility to amplify their trading potential.

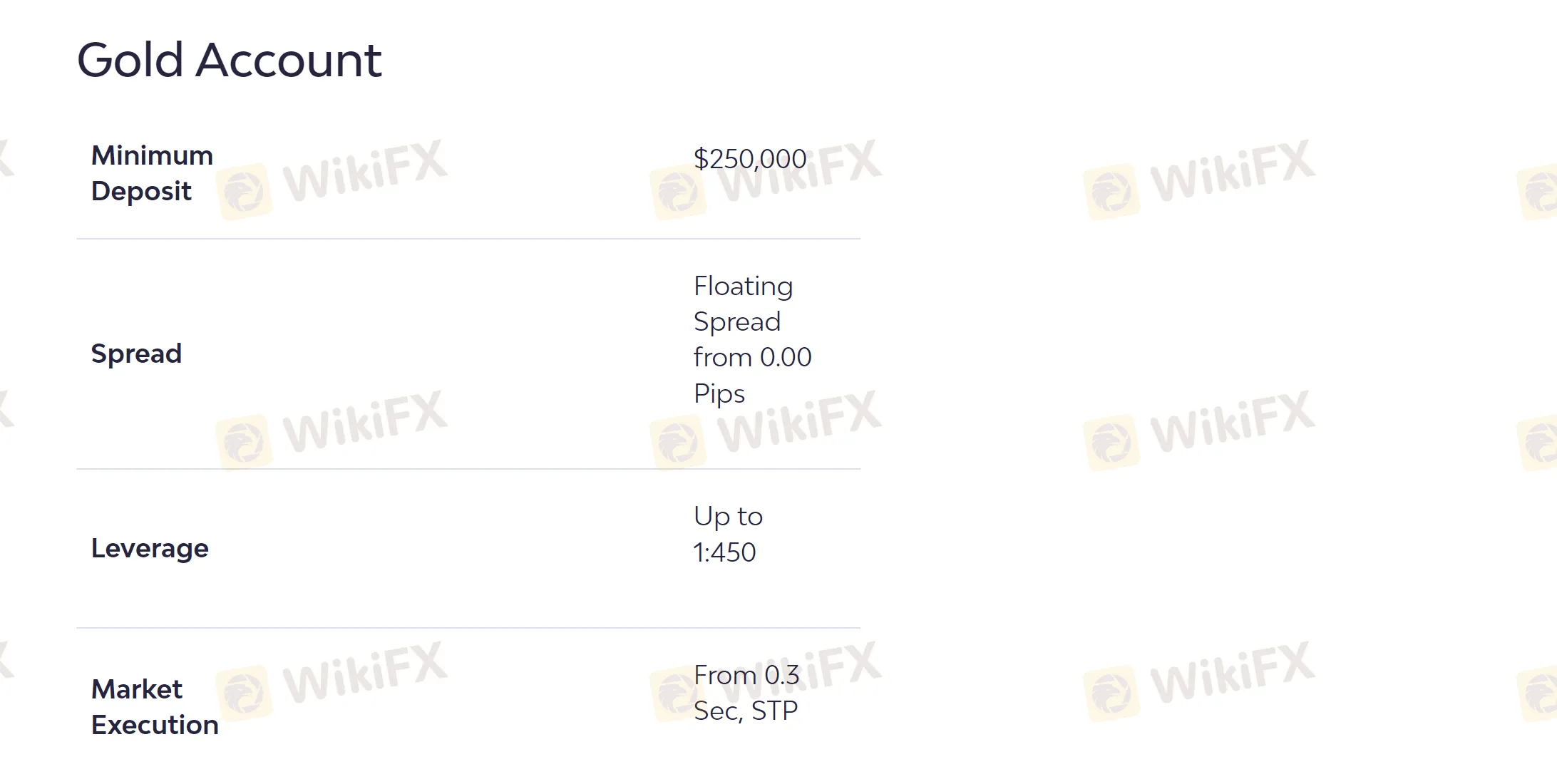

Gold Account

The Gold account is suitable for professional traders and high-net-worth individuals.

Minimum Deposit: The Gold Account requires a significantly higher minimum deposit, typically starting from $250,000.

Spreads: Traders on the Gold Account enjoy the tightest spreads available, starting from 0.0 pips.

Leverage: The Gold Account offers leverage up to 1:500, empowering traders to make the most of their trading opportunities.

Premium Account

The Premium Account is suitable for high-volume traders, institutional clients, and individuals with specific trading needs.

Minimum Deposit: The minimum deposit requirement for the Premium Account is $25,000.

Spreads: The Premium Account offers competitive spreads tailored to meet the specific needs of high-volume traders, starting from 0.01 pips.

Leverage: Traders on the Premium Account can access leverage up to 1:500, providing them with the flexibility and power to execute their trading strategies effectively.

VIP Account

The VIP account is suitable for high-volume traders, institutional clients, and individuals with specific trading needs.

Minimum Deposit: The minimum deposit requirement for the VIP Account is $1,000,000.

Spreads: Traders of this account can enjoy raw spreads from 0.0 pips.

Leverage: Traders on the VIP Account can access leverage up to 1:1000, providing them with the flexibility and power to execute their trading strategies effectively.

How to open an account?

1.Visit the Kwakol Markets website: Go to the official Kwakol Markets website. Click on “Open Account” or “Sign Up”: Look for the registration or account opening section on the website and click on the “Open Account” or “Sign Up” button.

2. Fill out the registration form: Provide the required information, including your personal details such as name, email address, phone number, and country of residence. You may also need to choose the type of account you wish to open.

3. Submit verification documents: As part of the account opening process, Kwakol Markets may require you to provide certain verification documents, such as a copy of your identification document (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement). Upload these documents as instructed.

4. Agree to terms and conditions: Read and understand the terms and conditions of Kwakol Markets. If you agree, tick the box or click the checkbox indicating your acceptance.

5. Account verification: Once you have submitted the registration form and verification documents, the Kwakol Markets team will review your application and documents. They may contact you for further information or clarification if needed.

6. Fund your account: After your account has been approved and verified, you can proceed to fund your trading account. Kwakol Markets typically offers various payment methods, such as bank wire transfer, credit/debit cards, or online payment processors. Follow the instructions provided by Kwakol Markets to deposit funds into your account.

7. Start trading: Once your account is funded, you can access the trading platform provided by Kwakol Markets and begin trading in the financial markets. Make sure to familiarize yourself with the platform, its features, and the available trading tools before placing any trades.

Leverage

Kwakol Markets offers generous leverage options for traders. The specific leverage levels may vary depending on the trading instrument and account type chosen. Typically, Kwakol Markets provides leverage up to 1:500, which means that traders can control a larger position in the market with a smaller amount of capital. Higher leverage can amplify both profits and losses, so it is important for traders to use leverage responsibly and understand the associated risks. Kwakol Markets may have specific leverage requirements or restrictions based on regulatory guidelines or the trader's level of experience. It is advisable to check with the broker directly or refer to their official website for the latest information on leverage offered for different trading instruments and account types.

Spreads & Commissions (Trading Fees)

The specific spreads can vary based on market conditions, liquidity, and the type of account. Generally, major currency pairs tend to have tighter spreads compared to exotic currency pairs or other financial instruments.

Commissions: Some trading accounts at Kwakol Markets may have commission-based pricing. This means that traders are charged a fixed commission on each trade they execute. The commission is usually calculated based on the traded volume or lot size. It's important to note that not all trading accounts may have commissions, and there may be alternative fee structures based on spreads or mark-ups.

Non-Trading Fees

Kwakol Markets imposes certain non-trading fees, which are charges not directly related to trading activities. These fees may include:

Deposit and Withdrawal Fees: Kwakol Markets may apply fees for deposits and withdrawals, depending on the payment method used. It is advisable to review the specific fee structure on their website or contact their customer support for detailed information.

Inactivity Fees: Kwakol Markets may charge inactivity fees if an account remains dormant or inactive for a certain period. The fee amount and duration of inactivity may vary, so it is important to refer to the broker's terms and conditions for specific details.

Conversion Fees: If you perform transactions in a currency different from your account's base currency, Kwakol Markets may charge conversion fees. These fees cover the cost of converting funds from one currency to another and are typically a percentage-based fee or a fixed fee.

Overnight Financing Charges: For positions held overnight, Kwakol Markets may apply overnight financing charges, also known as swap fees. These charges are associated with the cost of maintaining leveraged positions overnight and can be either positive or negative, depending on the trading instrument and the prevailing interest rates.

Trading Platform

Kwakol Markets provides a range of advanced trading platforms to cater to the diverse needs of traders. The broker offers the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface, comprehensive charting tools, and extensive range of technical indicators. MT4 is widely regarded as one of the most reliable and powerful trading platforms in the industry.

In addition to MT4, Kwakol Markets also offers the MetaTrader 5 (MT5) platform, which is the successor to MT4 and includes enhanced features and functionality. MT5 provides a more extensive selection of technical indicators, advanced charting capabilities, and a built-in economic calendar.

cTrader

For traders who prefer alternative platforms, Kwakol Markets also offers the cTrader platform. cTrader is known for its advanced trading capabilities, including fast order execution, depth of market (DOM) functionality, and a wide range of customization options.

These trading platforms are available for desktop, web, and mobile devices, allowing traders to access their accounts and trade from anywhere at any time. The platforms provide a seamless trading experience, with real-time market data, order management tools, and various trading features to support traders' strategies and analysis.

Deposit & Withdrawal

The minimum deposit required by most payment methods is $10. When it comes to payment methods, Kwakol Markets supports a wide range of options to cater to traders from different regions. These payment methods include Bank Card, Bank Transfer, Bitcoin, Ethereum, Help2Pay, Litecoin, Match2Pay, Online Bank Transfer, Ozow, PayPal, Sticpay, UPI, and USDT. These methods provide convenient and secure ways for traders to deposit and withdraw funds from their trading accounts.

The processing time for deposits and withdrawals may vary depending on the chosen payment method. Generally, deposits are processed instantly or within a few hours, allowing traders to fund their accounts quickly and start trading. Withdrawals are usually processed within 1 to 5 business days, depending on the specific payment method and any additional verification requirements.

It's important to note that some payment methods may have certain fees associated with them, such as transaction fees or currency conversion fees. Traders should review the details of each payment method to understand any applicable fees before making deposits or withdrawals.

Customer Support

Kwakol Markets offers multiple channels for customer support, allowing traders to choose the most convenient option for them. These channels include email support, live chat support, and telephone support. With email support, traders can send their queries or requests to the dedicated support email address and expect a prompt response from the customer support team. Live chat support offers real-time assistance, enabling traders to engage in instant messaging conversations with a support representative. Telephone support provides a direct line of communication, allowing traders to speak with a support agent directly.

Educational Resources

Kwakol Markets offers a range of educational resources designed to enhance traders' knowledge and skills in the financial markets. Traders can benefit from a variety of educational materials, including comprehensive courses, interactive free classes, up-to-date market news, insightful e-books, and more. These resources are carefully crafted to cater to both beginner and experienced traders, providing valuable insights, strategies, and techniques to help traders make informed trading decisions. By accessing these educational resources, traders have the opportunity to expand their understanding of the markets and improve their trading proficiency, ultimately empowering them to navigate the financial markets with confidence.

However, it's important to note that access to Kwakol Markets' educational resources, including courses, free classes, news, e-books, and more, is exclusively available through their online learning platform, known as Kwakol Markets Academy. By logging into the academy, traders can unlock these educational materials.

Conclusion

In conclusion, Kwakol Markets is a comprehensive online trading broker that offers a wide range of trading instruments, including forex, stocks, commodities, indices, cryptocurrencies, and CFDs. With multiple account types and competitive leverage options, traders have the flexibility to choose an account that suits their individual needs and trading preferences. The availability of popular trading platforms, such as MetaTrader 4 and MetaTrader 5, provides a user-friendly and feature-rich trading experience. Kwakol Markets also stands out with its diverse payment methods, ensuring convenient and secure deposit and withdrawal processes for clients. While the broker offers educational resources through Kwakol Markets Academy, it is important to note that access is limited to registered users. The customer support team is readily available to assist traders through various channels, including email and live chat. However, it is essential to consider the lack of regulatory oversight, as Kwakol Markets is not currently subject to any regulatory authority. Traders should exercise caution and conduct thorough research before engaging with this broker.

FAQs

Q: Is Kwakol Markets a regulated broker?

A: No, Kwakol Markets is not currently regulated by any financial regulatory authority.

Q: What trading instruments are available on Kwakol Markets?

A: Kwakol Markets offers a wide range of trading instruments, including forex, stocks, commodities, indices, cryptocurrencies, and CFDs.

Q: What are the available account types on Kwakol Markets?

A: Kwakol Markets provides various account types, such as standard account, no-swap account, pro account, gold account, platinum account, diamond account, premium account, and VIP account. Each account type has different minimum deposit requirements and trading conditions.

Q: What trading platforms does Kwakol Markets offer?

A: Kwakol Markets offers a selection of popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and WebTrader. These platforms provide advanced charting tools, technical indicators, and order execution capabilities.

Q: What payment methods are accepted for deposits and withdrawals?

A: Kwakol Markets accepts various payment methods, including Bank Card, Bank Transfer, Bitcoin, Ethereum, Help2Pay, Litecoin, Match2Pay, Online Bank Transfer, Ozow, PayPal, Sticpay, UPI, and USDT.

Q: What is the minimum deposit requirement for Kwakol Markets?

A: The minimum deposit requirement varies depending on the chosen account type. It is recommended to check the specific account details on the Kwakol Markets website for accurate information.

Latest News

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Rate Calc