EURUSD Regains Some Strength, Bond Yields Signal a Recession

Abstract:The EURUSD has pushed past the 1.1140 resistance line but traders will be eyeing German CPI and US PCE Core figures to strengthen their position. Worries about a recession have pushed long-term government yields around the world to the lowest level in years

Source: DailyFX, ForexLive

We could see the Dollar bulls regain some control throughout the day as continuing trade wars could see demand for the safe-haven dollar push the EURUSD lower. Focus will also shift towards US core inflation being released later today, as investors keep an eye out for signals that an increase in prices could lead to the Fed maintaining its patient stance.

Bond markets are sending a signal

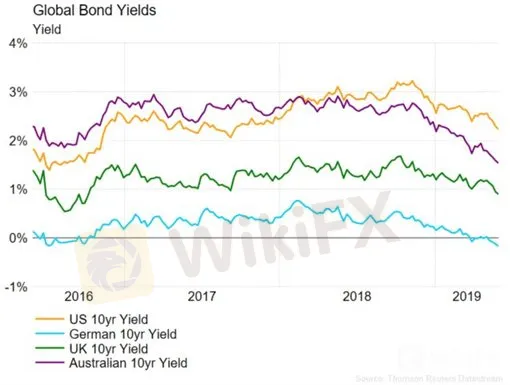

German 10-year bond yields are down to post-Brexit lows of -0.20% as slowing inflation expectations and stagnant growth prompt fears of a recessionary environment. And it is not just in the Eurozone where investors are worried, long-term yields have been falling around the world with some government bonds hitting their lowest levels in years.

Source: DailyFX, Thomson Reuters

When investors are concerned about the economy and equity markets they turn to government bonds because of their implied low risk. The purchase of bonds pushes bond prices higher which in turn leads to a fall in yields, the payment investors collect from their investment in bonds. Thus, falling bond yields can be seen as an indicator that a recessionary environment is coming, if not at least that investors concerns about the economic outlook are growing.

Eurozone Debt Crisis: How to Trade Future DisastersOf a bigger concern is that the increase in demand for longer-term bonds has pushed longer-term yields below shorter-term yields. The current yield on a 10-year yield Treasury note yields stands at 2.16% whilst a 3-year yield Treasury note currently yields 2.37%. This is known as a yield curve inversion and is of a big concern to investors as they have preceded recessions in the past. In stable market conditions, investors would demand a higher yield on longer-term bonds as they seek for greater compensation for having their money tied up for longer periods of time.

Source: DailyFX, Thomson Reuters

Upcoming Central Bank meetings

Worsening economic conditions and continuing trade wars between China and the US have dampened the economic outlook of the economy and markets are now signalling that they expect at least two rate cuts by the beginning of next year, despite the Fed announcing last week that they wish to keep rates unchanged for the foreseeable future. The next FOMC meeting is due to take place on June 18-19, and despite markets not pricing in a rate cut in June, they expect the funds rate to be cut in September.

Across the pond, the ECB is expected to meet next Thursday June 6, with recent remarks from ECB Board member Olli Rehn suggesting a continued dovish stance on monetary policy. Inflation in the Eurozone is expected to miss its 2% target for the next two years as forecasts show 1.3% for 2019, 1.5% for 2020 and 1.6% for 2021. A recent survey of 100 economists carried out by Reuters revealed that the ECB has no prospects of increasing interest rates throughout 2020. It comes on the back of ECB officials signalling that the Central Bank is willing to keep interest rates negative for as long as needed to ensure that the Eurozone economy avoids a recession. Current rates remain at -0.40%.

Recommended Reading

Hawkish vs Dovish: How Monetary Policy Affects FX Trading – David Bradfield, Markets Writer

Eurozone Debt Crisis: How to Trade Future Disasters – Martin Essex, MSTA, Analyst and Editor

KEY TRADING RESOURCES:

Just getting started? See our beginners guide for FX traders

{18}

Having trouble with your strategy? Heres the #1 mistake that traders make

{18}

See our Q3 forecasts to learn what will drive FX the through the quarter.

--- Written by Daniela Sabin Hathorn, Junior Analyst

Read more

Quiet Before the Storm? Markets Poised for a Relaxed Week

For June 2024, Canada's CPI rose by 2.7% year-over-year, down from 2.9% previously. This decrease in core inflation is driven by a combination of slower economic growth and moderated wage growth, even with a strong labor market. The FOMC meeting minutes from July 2024 indicated that the Federal Reserve decided to maintain the federal funds rate within the target range of 5.25% to 5.50% and revealed a shift in the Fed's focus. The latest data on U.S. Initial Jobless Claims, for the week ending...

Fed Pressured: Will CPI Data Fuels Calls for Rate Cuts?

The U.S Producer Price Index (PPI) for June showed a month-over-month increase of 0.2%, which was slightly above market expectations of 0.1%. The Reserve Bank of New Zealand (RBNZ) recently kept its Official Cash Rate (OCR) unchanged at 5.50% during its last meeting on July 2024, which was consistent with market expectations. As of June 2024, the U.S. Consumer Price Index (CPI) showed a modest increase of 3.0% year-over-year, weaker than market expectation and previous reading of 3.1% and 3.3%..

Gold Surge to All-time High

he U.S. equity market continued its rally in yesterday's session, with the Dow Jones approaching its all-time high near the 41,000 mark. The Russell 2000 (US2000) small-cap index surged more than 10% since last Thursday, suggesting that strategists have been rotating their exposure to small-cap counters, which are more sensitive to interest rate changes.

Inflation Watch: CPI Data Unveiled Across Countries

In May, Canada's Consumer Price Index rose by 0.6%, surpassing both market forecasts of 0.6% and the previous figure of 0.5%. Statistics Canada attributes this increase primarily to higher food prices, especially for wheat-based products, which exerted notable inflationary pressures. The latest U.S. retail sales data for May 2024 shows a modest 0.1% month-over-month increase, a slight improvement following the previous month's 0.2% decline. This growth is driven by a gradual rise in sales...

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc