GBP/USD Volatility Drops Sharply, USD/JPY Rises on BoJ Sources - US Market Open

Abstract:GBP/USD Volatility Drops Sharply, USD/JPY Rises on BoJ Sources - US Market Open

MARKET DEVELOPMENT –GBP/USD Volatility Drops Sharply, USD/JPY Rises on BoJ Sources

DailyFX 2019 FX Trading Forecasts

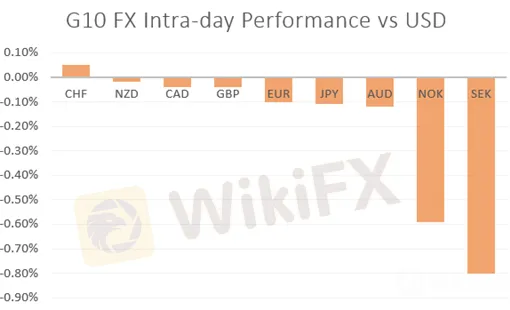

GBP: The Pound has edged up 0.2% and continues to hover around its best level in over a month as imminent Brexit risks have been diminished. That said, with parliament suspended and Boris Johnsons calls for a snap-election rejected, GBP implied volatility has dropped with both the 1D and 1W tenors dropping 2.9 and 1.4vols respectively. Elsewhere, the ONS showed that the labour market remains tight with the unemployment rate ticking lower, while wages pushed higher. As such, GBP/USD downside has been somewhat limited thus far.

JPY: Japanese Yen weakened on the back of source reports that BoJ policymakers could be open to a debate on further monetary easing, which would entail cutting rates deeper into negative territory. Consequently, this pushed USD/JPY to session highs, before gains had been capped yet again at the 107.50 handle.

SEK / NOK: The Scandies are notably weaker with the SEK dropping on the back of lower than expected inflation data (CPIF 1.3% vs. Exp. 1.5%), in turn, this raises questions as to whether the Riksbank can continue to signal that rates may rise at the backend of the year to Q1 2020. Elsewhere, while softer inflation data had also taken the shine away from the Norweigan Krona, the Norges Bank still remain set to raise interest rates in September with the Regional Network Survey highlighting that growth remained solid throughout the summer.

Source: DailyFX

WHATS DRIVING MARKETS TODAY

“EURGBP Price Outlook Tracks ECB Monetary Policy and Brexit News” by Nick Cawley, Market Analyst

“Gold Price and Silver Outlook: Will First Levels of Support Hold?” by Paul Robinson, Currency Strategist

“Crude Oil Price Analysis: Oil Boosted by New Saudi Energy Minister, Eyes on OPEC report” by Justin McQueen, Market Analyst

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

Read more

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

GemForex - weekly analysis

A week of consolidation Ahead amid renewed USD strength

British Pound Technical Analysis - GBP/USD. Trend to Resume or Reversal For Sterling?

GBP/USD Technical Analysis - the pair has bounced back after making a new low for the year. The Pound has seen increased volatility as it looks to hold ground. Will Sterling continue to be undermined and make fresh lows again?

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc