NovaTech FX Scams Revealed - Hard to Withdraw Money

Abstract:NovaTech, a trading platform that has recently gained considerable attention after its sudden collapse. The U.S. Securities and Exchange Commission (SEC) imposed penalties on the platform, its founders, and several major promoters. Here Let's explore this platform by examining its background and the underlying logic of its fraud scheme, and outline some key warning signs that investors should watch for when encountering similar platforms in the future.

NovaTech, a trading platform that has recently gained considerable attention after its sudden collapse. The U.S. Securities and Exchange Commission (SEC) imposed penalties on the platform, its founders, and several major promoters. Here Let's explore this platform by examining its background and the underlying logic of its fraud scheme, and outline some key warning signs that investors should watch for when encountering similar platforms in the future.

NovaTech FX-About the Company

Founded in 2019, Novatech FX Ltd. (“Novatech”) was registered in St. Vincent and the Grenadines, a jurisdiction known for its lax regulations and many unregulated brokers. Initially positioned as a promising trading platform for forex and cryptocurrencies, Novatech boasted its own trading platform with supposedly deep liquidity. Active primarily between 2020 and 2023, the company lured investors with the promise of consistent monthly returns ranging from 3% to 5%.

Company details are listed as below:

| Broker Name | Novetech FX |

| Logo |  |

| Founded in | 2019 |

| Registered in | St.Vincent and the Grenadines |

| Founders | Cynthia Petion (CEO), Eddy Petion (COO) |

| Regulations | Unregulated |

| Products | Cryptos and Forex |

| Account Type | PAMM Account |

| Platform | MetaTrader 5 |

| Payment | Cryptocurrency |

| Customer Support | support@novatechfx.io |

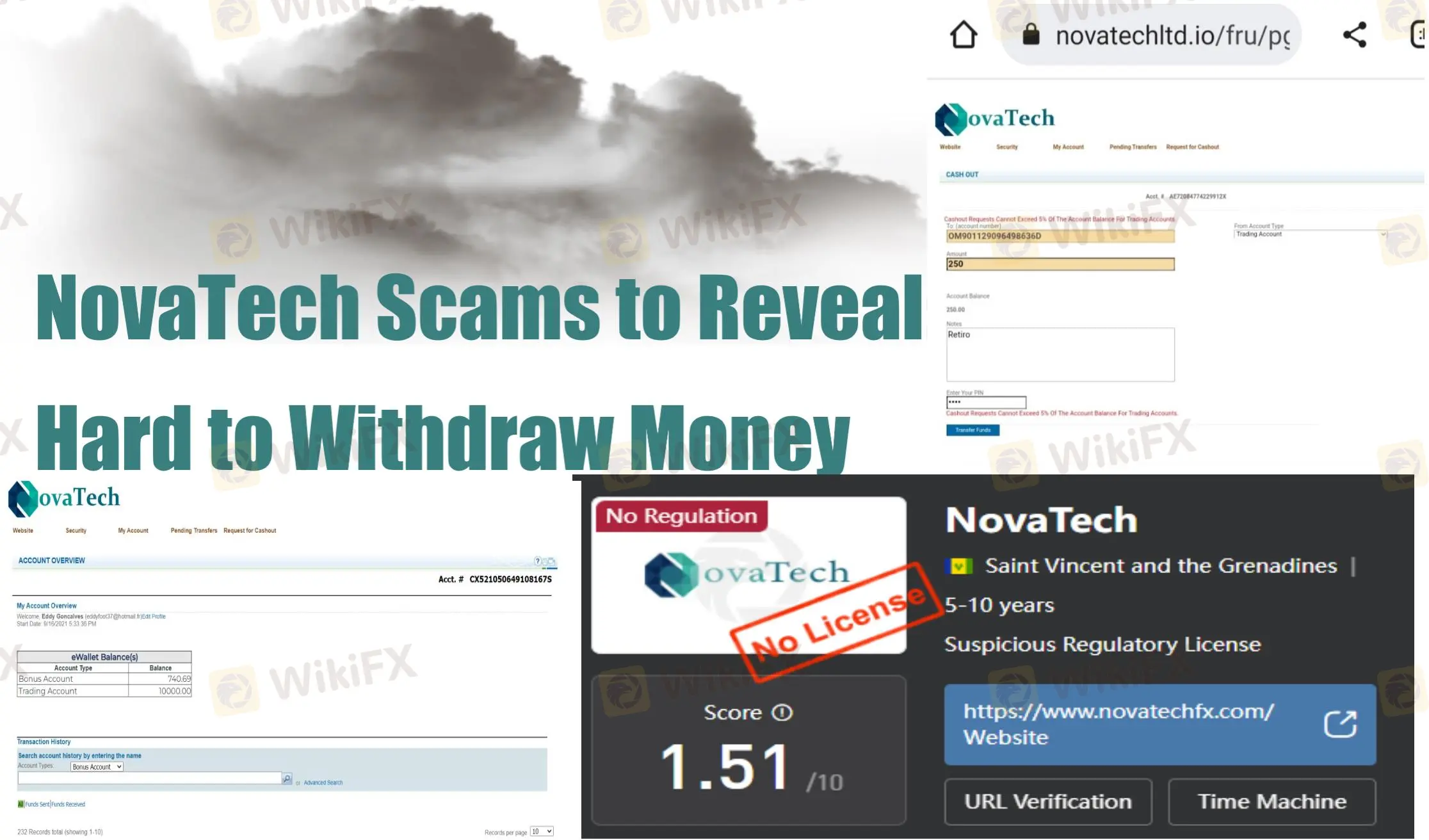

NovaTech FX Scams to Reveal

From 2019 to 2023, Cynthia and Eddie Petion aggressively promoted Novatech FX, claiming investors could easily achieve high returns in a short time through cryptocurrency and forex investments. To lure more victims, they employed multi-level marketing (MLM) tactics, recruiting new investors and emphasizing that 'profits begin on day one' by accessing invested capital instead of focusing on actual trading gains. To better conduct scams, some “eblobrate” tactics were designed to ensnare a large number of investors.

Magical PAMM Accounts

NovaTeach offered PAMM accounts, short for Percentage Allocation Management Module accounts, as a way for investors with limited trading experience to potentially earn passive income. By investing in a NovaTeach PAMM account, investors essentially pooled their funds with other investors into a master trading account. NovaTeach's “experienced team of traders” then managed these pooled funds, actively trading them in the market. In exchange, NovaTeach received a percentage of the trading profits, while investors were promised varying returns on their investment (ROI), typically advertised as around 3.0% per week.

Distinct Income Streams

NovaTech boasted a suite of enticing earning opportunities, claiming to offer seven distinct income streams. These included Direct and Indirect Referral Bonuses, Fast Track Bonuses, Weekly Check Matching, Residual Income, Rank Achievement bonuses (potentially reaching $100,000 USD), and Rank-Based Profit Sharing.

Novatech Compensation Plan

NovaTech touted a “one-of-a-kind” Hybrid Compensation Plan, specifically designed to help members build extensive networks. Whether participating part-time or full-time, the company claimed everyone could benefit, starting to earn both passive and residual income immediately.

Unrelistic Returns

On October 25th, 2023, the NovaTechFX team announced on their Telegram channel that they had to update the web address for their NovaTech 2.0 platform. Apparently, they encountered unfixable security vulnerabilities on the old address (https://Novatechfx.uk.com). According to the team, the new and only official website for NovaTechFX affiliates is now https://novatechfxuk.com/home/, where investors can supposedly submit withdrawal requests. However, there's a catch: to withdraw their initial investment, investors must first make a new deposit equal to 30% of their total account funds.

NovaTech FX-True Colors Showed Up

On February 5th, 2023, NovaTech abruptly announced a 60-day freeze on all trading account withdrawals. This was followed by a devastating announcement on May 22nd: all withdrawals from NovaTech were indefinitely suspended, with no indication of when, or even if, they would be reinstated. This sudden halt in withdrawals finally exposed the broker's true colors, as numerous traders found their withdrawal requests denied and their funds trapped within the platform.

The truth is chilling: NovaTech was a sophisticated Ponzi scheme that defrauded over 200,000 investors out of more than $650 million in cryptocurrency. Instead of investing funds as promised, NovaTech primarily used incoming money to pay existing investors and lavish commissions on its promoters. Top promoters built vast networks, recruiting investors and other promoters. NovaTech rewarded them handsomely for every new recruit, diverting a significant portion of investor funds towards these commissions. Only a fraction of the money was actually used for trading activities.To add insult to injury, the founders, Cynthia and Eddy Petion, siphoned off millions of dollars for their personal enrichment. This wasn't a legitimate investment platform. It was a carefully constructed scam designed to enrich the creators at the expense of unsuspecting investors.

On August 12th, 2024, the Securities and Exchange Commission (SEC) filed charges against Novatech FX, Cynthia and Eddy Petion, and several other promoters, alleging they operated a fraudulent scheme that raised over $600 million from investors.

Novetech FX - Tracking Its Illegeal Records

- Established in 2019 in Saint Vincent and the Grenadines, NovaTech FX positioned itself as a cryptocurrency and forex trading platform, primarily targeting investors in Royal Palm Beach, Florida. Importantly, this platform operated entirely outside of any regulatory framework.

- Around September 2019, Cynthia and Eddie Petion, the founders of NovaTech, began enticing investors to purchase unregistered securities in the form of Percentage Allocation Management Module accounts (PAMM Accounts).

- On February 5, 2023, Novatech issued a notice that they were temporarily freezing withdrawals from PAMM accounts for a period of 60 days.

- On May 22, 2023, NovaTech FX abruptly collapsed, effectively shutting down operations and leaving investors stranded, unable to withdraw their funds.

- On October 25th, 2023, the NovaTechFX team announced on October 25th, 2023, that their “new and only official” website for withdrawals was now https://novatechfxuk.com/home/. This came after citing “unresolvable security loopholes” at their previous address. However, there was a catch: to withdraw their initial investment, investors would need to make a suspicious additional deposit of 30% of their total account funds.

- On August 12, 2024, the SEC took action against NovaTech FX, its founders Cynthia and Eddie Petion, and some of their promoters on August 12, 2024. The SEC's complaint alleges that these individuals orchestrated a fraudulent scheme that defrauded over 200,000 investors out of more than $600 million.

Novetech FX Withdrawal Exposure

WikiFX has gathered testimonies from numerous victims, along with supporting evidence. A common theme among these accounts is the inability to withdraw funds, with many victims seeking help. Here, 3 have been selected to represent the core themes and events of the story.

Case 1:NovaTech has not paid pending withdrawals since May 2023

“NovaTech has not paid pending withdrawals since May 2023 and the capital associated with the trading account is kept frozen in the company's accounts.”

Prior to May 2023, NovaTech likely processed some small withdrawals to build trust, but after that date, they implemented a complete freeze on withdrawals. This is a classic pattern where fraudulent platforms first demonstrate their “reliability” with small payouts before stopping all withdrawals.

Case 2: NovaTech has withheld my money for two months now

“NovaTech has withheld my money for two months now, in May they told us that we could withdraw only 15 percent, the withdrawal was made but it has not arrived. In my account I have more than 10,000 dollars plus 1,500 that I put to withdraw and I can't get anything out. No withdrawals have arrived and nothing can be done on account. I need my full money back. Since I invested a lot of money and it is not possible that they want to keep our money, and they don't respond anymore, nobody says anything and the last message from more than three weeks ago was that we should wait and so far nobody says anything and there is no response.”

This victim's account reveals NovaTech's deceptive withdrawal tactics: imposing a 15% withdrawal limit that was never honored, leaving over $10,000 frozen, and ultimately cutting off all communication. This pattern of restricted withdrawals followed by complete silence is a telltale sign of a collapsing investment fraud scheme.

Case 3: No payments, no withdrawals FRAUD

“I stop paying the bonds, you can't withdraw your capital and they no longer answer messages. in december, overnight, they only said that you could withdraw 250 dls weekly if you combined them from the payment of your earnings, otherwise wait for them to come together so that you can withdraw them and the withdrawal of capital would be the first 5 days of every month, since when i joined this ”company“ one of the initiatives was that you could withdraw your capital whenever you wanted. saúl rodríguez, representing the company for the latin american area, always said that this change was not forever but until the payment gateway was expanded and now he complains that messages are sent to him to ask when there will be a response from the company and her friend ceo cinthia petition. totally a fraud NovaTech he left many of us trapped with the promise of payment of up to 3% weekly.”

This testimony reveals NovaTech's systematic withdrawal manipulation: shifting from promised unrestricted access to strict limits ($250 weekly), using payment gateway “issues” as an excuse, before completely halting withdrawals. Their initial promise of 3% weekly returns coupled with increasingly restrictive withdrawal policies is characteristic of investment fraud.

What should I do if I am scammed like this ?

It's baffling how NovaTech FX managed to defraud investors of over $600 million so quickly. Understanding the factors that contributed to this success is crucial. More importantly, we need to analyze this situation to identify preventative measures and ensure such scams don't happen again

Be Aware of Unreliable Returns

The financial markets (stocks, forex, crypto) are inherently volatile and unpredictable. Even the most experienced traders and sophisticated hedge funds experience losses and varying returns. When a platform promises steady and high returns (like NovaTech's 3-5% monthly), it's usually a red flag because it defies the fundamental nature of market behavior.

Besides, there's a basic principle in finance: higher returns typically come with higher risk. If someone promises high returns with little or no risk, they're likely misrepresenting their offering. Even “safe” investments like government bonds have relatively low returns precisely because they're low risk.

Verify Regulatory Information

Another is to verify regulations of the trading platform. A properly regulated platform must maintain segregated client funds, meet capital requirements, and undergo regular audits. This provides crucial investor protection through legal recourse and clear accountability mechanisms. Regulated platforms are required to maintain transparency in their operations, including fee structures, risk disclosures, and financial statements. You can turn to WikiFX, a platform that provides broker verification and rating services for forex traders. It is a global broker inquiry database designed to help traders verify the legitimacy and regulatory status of forex brokers.

Conduct Background Check

When choosing an online trading platform, conducting background checks is also crucial - particularly of the platform's founders and key executives. The case of NovaTech serves as a telling example: its founders, Cynthia and Eddy, had troubling financial histories including credit card defaults and foreclosed mortgages. This kind of personal financial mismanagement seriously calls into question their ability to handle investor funds responsibly. A comprehensive background check should examine the platform's operational history and the track record of its leadership team, including any past bankruptcies, legal troubles, or failed business ventures. After all, if the people running a trading platform can't manage their own finances, how can they be trusted to manage yours?

The Bottom Line

Overall, the NovaTech case provides a valuable lesson,which underscores the dangers of impulsive online trading and the allure of unrealistic profit promises. The market is not a get-rich-quick scheme and there is no such thing as a free lunch. Don't let yourself be the most valuable asset in the markets.

Read more

What Every Trader Must Know in a Turbulent Market

The global financial markets are no strangers to periods of uncertainty, and recent weeks have been a testament to their unpredictable nature. Heightened volatility across major indices, including the US stock market, has left traders reassessing their strategies as they face both opportunities and risks.

WikiFX Review: Something You Need to Know About MIFX

WikiFX created a comprehensive review to help you better understand this broker named MIFX. We will analyze its reliability based on specific information, regulations, etc. Let’s get into it.

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

BMO Capital Markets faces another SEC penalty, adding to its history of regulatory scrutiny and financial sanctions.

Forex Brokers vs. Crypto Exchanges: Which Is Safer for Traders?

The world of trading offers two major platforms: forex brokers and cryptocurrency exchanges. Both provide opportunities, but they also come with risks. Traders often wonder which is the safer option. While some lean towards traditional forex brokers, others trust the decentralised nature of crypto exchanges. Let us know if you are #TeamForex or #TeamCrypto!

WikiFX Broker

Latest News

Wolf Capital Exposed: The $9.4M Crypto Ponzi Scheme that Lured Thousands with False Promises

Confirmed! US December non-farm payroll exceeded expectations

Spain plans 100% tax for homes bought by non-EU residents

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

400 Foreign Nationals Arrested in Crypto Scam Raid in Manila

Rate Calc