iFourX: So Many Red Flags You Can’t Ignore

Abstract:Forex trading has become difficult nowadays due to the frequent frauds occurring every day. You can’t blindly trust any broker . They may appear genuine and authorized but end up being scams. That’s why it’s more important to stay aware. To stay alert and informed, you need to know about a particular FX broker called iFourX and recognize its red flags.

Forex trading has become increasingly difficult nowadays due to the frequent frauds occurring every day. You can‘t blindly trust any broker . They may appear genuine and authorized but end up being scams. Despite daily fraud alerts provided by financial regulators, investment scams continue to thrive. That’s why its more important to stay aware. To stay alert and informed, you need to know about a particular FX broker called iFourX and recognize its red flags.

1. Low Score

A Low score for any broker immediately raises concerns about its credibility. When we checked iFourX‘s score on WikiFX, it received a low score of 1.80 out of 10. This is one of the topmost red flags we’ve identified, and it's something you must not ignore.

2. No Regulation, No Safety

If a broker is not regulated, you cannot expect any kind of security from it. Only regulated brokers licensed by reputable authorities follow Forex trading rules and provide a safe environment for traders. Unregulated brokers often do not comply with any rules or standards and are far more likely to swindle your money.

Therefore, always avoid brokers that are not regulated by top authorities such as FCA, SEBI, or ASIC, among others.

3. Newly Built Website

Upon investigation, we discovered that this brokers website was only registered recently last year. This suggests that the broker is very new in the market and lacks sufficient experience. Newly launched websites, especially those without any verifiable trading history or client feedback, are red flags.

4. Tactic to Appear Legitimate

The broker attempts to appear credible by offering educational content, but it‘s nothing more than a superficial trick. On the website, there are two sections: one labeled “Education” and another called “Knowledge Base.” However, when you click on the Knowledge Base, you’ll find only a handful of words around 15 to 20 terms so-called glossary. In reality, its a tactic used by scam brokers to create an illusion of legitimacy without providing any real value.

5. Limited Information

One big concern is that the broker shares very little information about how it operates. This lack of transparency is not normal for trusted financial companies. iFourX seems to be hiding important details - common trick used by scam brokers.

6. WikiFX Issued Warning Against the Broker

During our investigation into this broker, we found that WikiFX has issued a warning against iFourX — a serious red flag you should not overlook. Warnings like this are crucial when choosing a broker, as they signal potential risk and unreliability. This kind of alert places iFourX in the category of potential Forex broker scams.

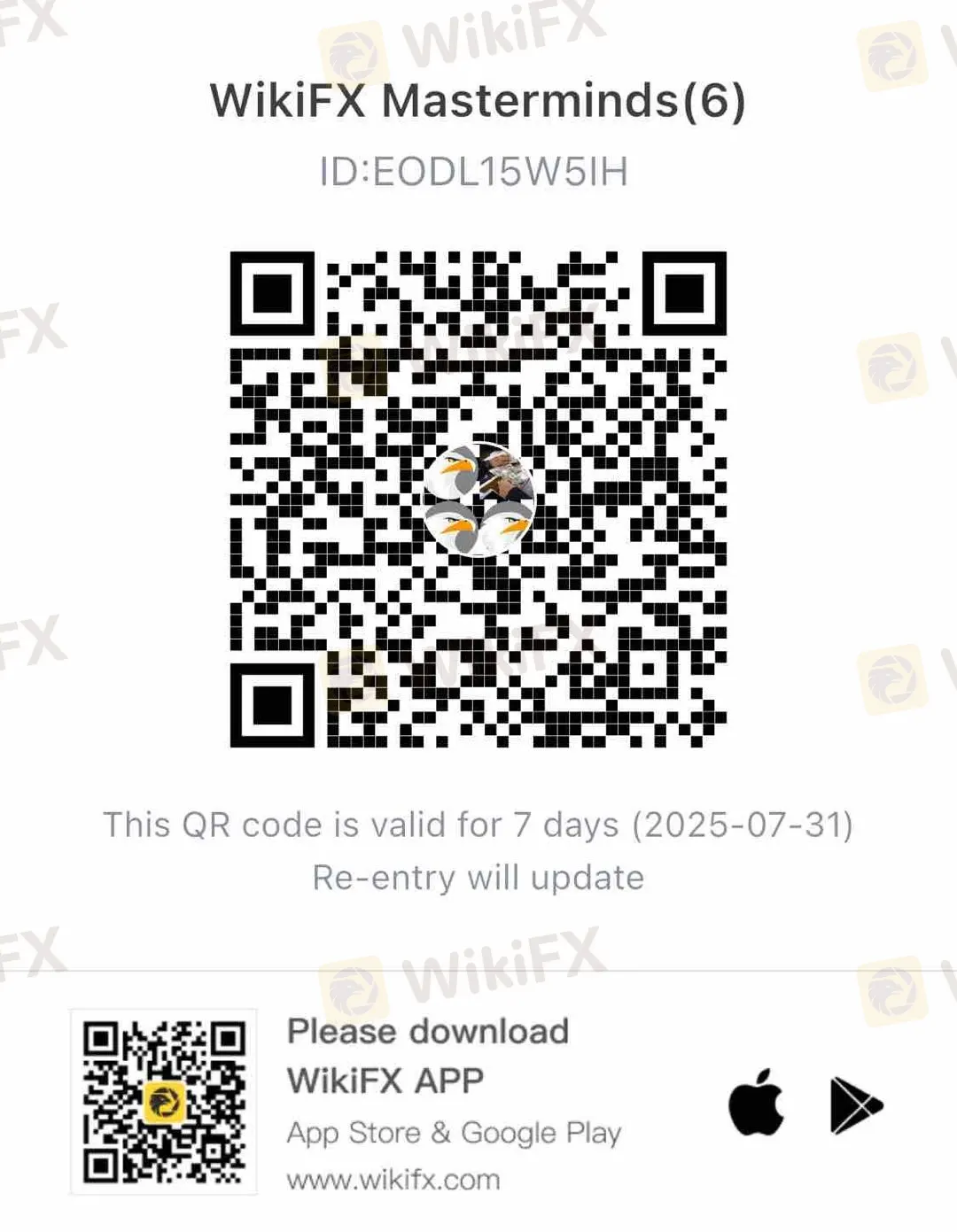

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

7 Common Mistakes Made by Indian Forex Traders

Forex trading has become very popular among Indian traders in recent years. Every month, thousands of new traders join this market. But sadly, majority of them lose their hard-earned money because of their common mistakes. Which are these mistakes? Read below.

What Does PrimeXBT's Offshore Regulatory Status Really Mean?

Understanding PrimeXBT's offshore regulatory status, its implications, and what it means for traders looking for transparency and reliability in their investments.

Five Unauthorised Brokers Warned by the FCA

UK’s watchdog, the Financial Conduct Authority (FCA), recently issued a fraud alert against brokers who are operating without a license but still offering financial services. The FCA has identified these scam brokers and is warning the public not to engage with them. Check out the names of those brokers below.

FXView: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about FXVIEW and its licenses.

WikiFX Broker

Latest News

Thailand-Cambodia War Pressures Thai Baht in Forex Market

Treasury yields tick lower as investors look ahead to Fed's interest rate decision

Does XS.com Hold Leading Forex Regulatory Licenses?

Chile Bumps Up Copper Price Forecast and Flags Lagging Collahuasi Output

A breakthrough and a burden? What the U.S.-EU trade deal means for the auto sector

Investors Accuse Duttfx Markets of Scam: What You Should Know

Treasury yields flat as investors look ahead to Fed's interest rate decision

Bitget Lists Caldera for Spot Trading | What Should You Know?

China's latest AI model claims to be even cheaper to use than DeepSeek

European stocks head for higher open with earnings and U.S. trade deals in focus

Rate Calc