Scam Alert: Know the Risky Side of InstaForex in India

Abstract:you should always Scam Alert in forex market. If something seems too good to be true, it often hides red flags behind it. Therefore, We reviewed InstaForex and reveal hidden risks associated with it. Whether you are an Indian trader, a potential user, or an existing client, it is crucial to understand the risks associated with InstaForex .

InstaForex heavily promotes itself through ads, promotional campaigns, and various offers targeted at traders and investors. But remember — not everything that glitters is gold. This is the era of sophisticated marketing techniques, and you should always Scam Alert in forex market. If something seems too good to be true, it often hides red flags behind it. Therefore,

We reviewed InstaForex and reveal hidden risks associated with it. Whether you are an Indian trader, a potential user, or an existing client, it is crucial to understand the risks associated with InstaForex .

5 Major Drawbacks of InstaForex

There are several concerns surrounding its operations—especially for Indian traders. Below, are the top 5 drawbacks of InstaForex India that every trader should be aware of.

1. Offshore Regulation Raises Concerns

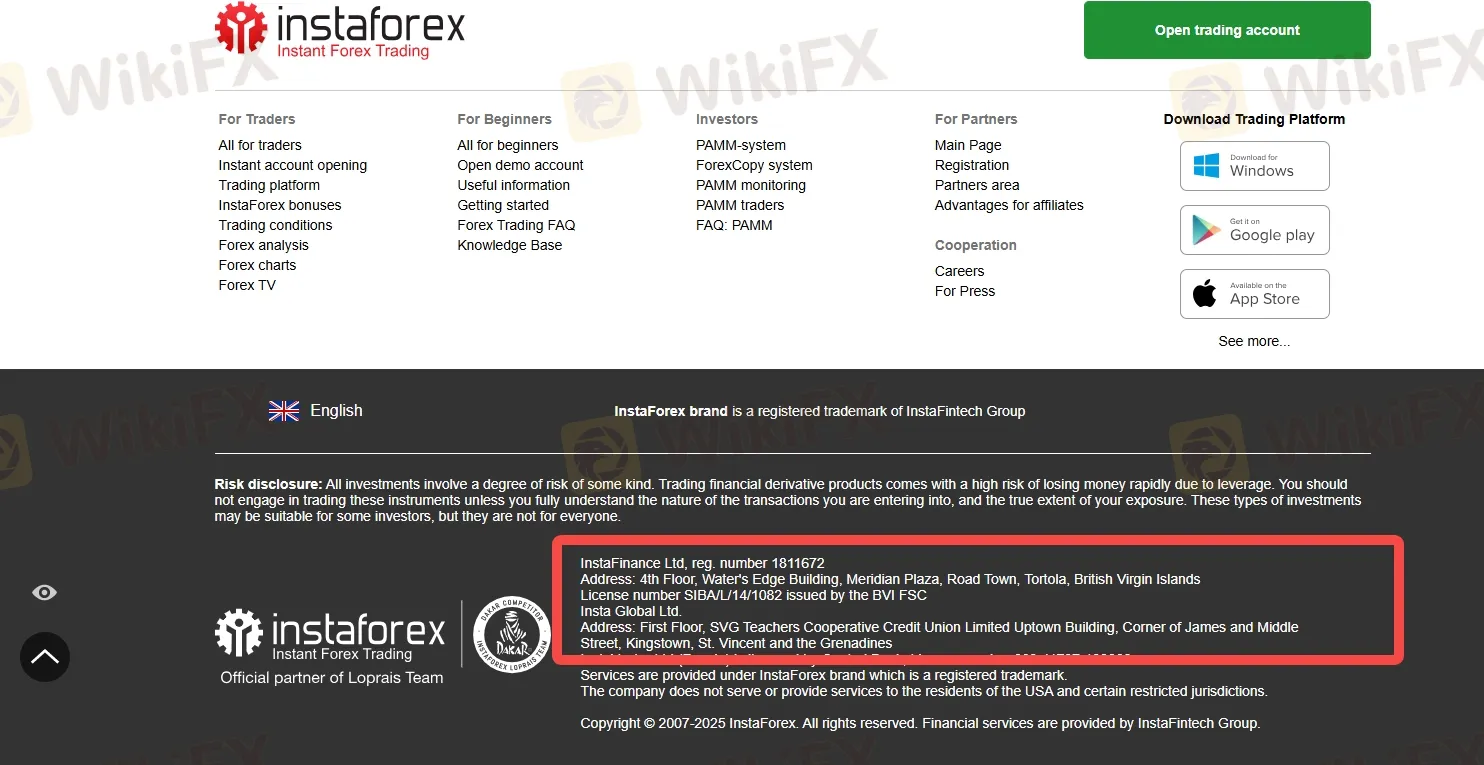

InstaForex operates under several offshore entities. Instant Trading Ltd. is licensed in the British Virgin Islands by the BVI Financial Services Commission (BVI FSC). Other associated companies, such as Insta Service Ltd. and Insta Global Ltd., are registered in St. Vincent and the Grenadines.

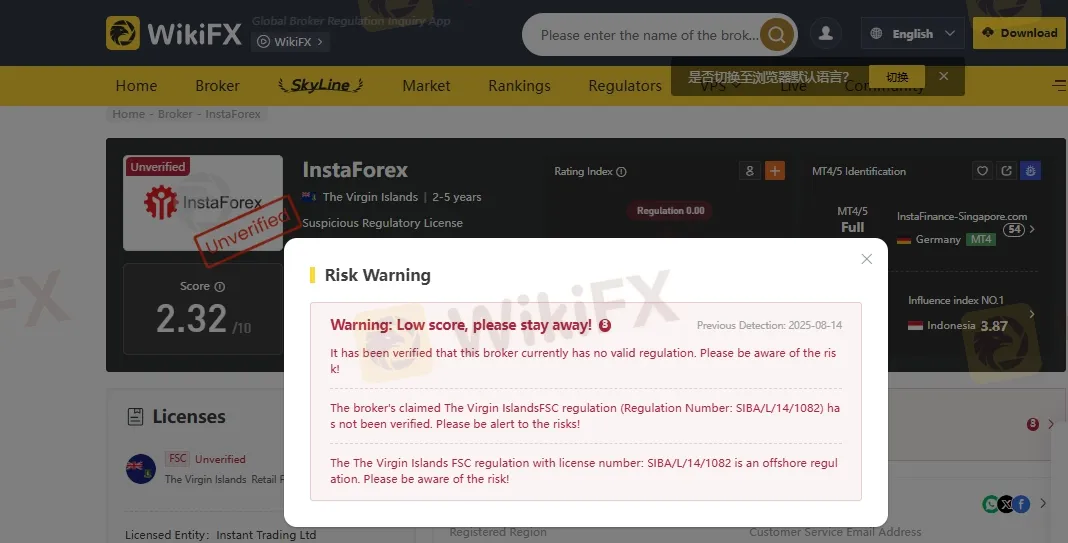

While these jurisdictions allow brokers to operate globally, they are known for lenient regulatory oversight compared to Tier-1 regulators like FCA (UK) or ASIC (Australia). This lack of strict regulation raises red flags for Indian investors looking for financial transparency and security.

2. Disappointing WikiFX Score

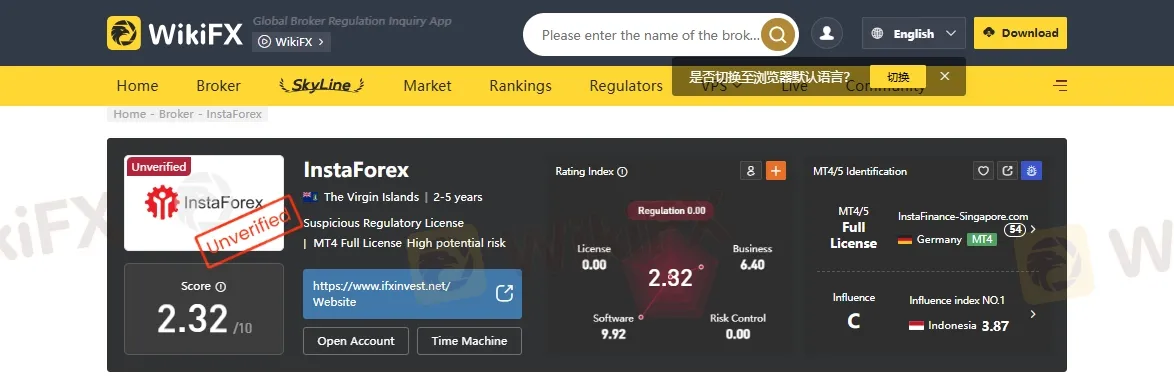

Another critical issue is InstaForexs low rating on WikiFX which is 2.32 out 0f 10. A poor WikiFX score often reflects potential problems with transparency, withdrawal issues, or overall service quality.

3. Restricted Jurisdictions

Another significant drawback of InstaForex is its limited availability in several jurisdictions. The broker explicitly states that it does not offer services to residents of certain countries, including the United States, United Kingdom, Japan, Belgium, Israel, and North Korea, among others. This restriction not only raises questions about the brokers regulatory compliance in major financial regions but also highlights its inability to meet the legal and financial standards required by top-tier regulators.

4. WikiFX Warning Issued

Another Red flag , is warning issued by WikiFX against InstaForex. Such warnings usually stem from unresolved customer complaints, lack of regulatory compliance, or questionable business practices. If you're an Indian trader looking for a secure and reputable broker, a WikiFX warning is a major red flag that shouldn't be ignored.

5. Limited Market instruments

Another drawback is the limited variety of trading instruments available on the InstaForex platform. While they do offer access to forex, CFDs, and a few commodities, the range of tradable assets is narrower compared to other leading platforms. Indian traders who are looking for exposure to a broader portfolio—including cryptocurrencies, bonds, ETFs, or local Indian stocks—might find the platform restrictive.

Conclusion

These five critical drawbacks about offshore regulation, low WikiFX rating, limited customer support, low market diversity, and a WikiFX warning—make it less appealing for Indian traders. Before investing your hard-earned money, its vital to consider brokers with strong regulatory backing, transparent policies, and a proven track record.

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

Going to Invest in FXCL? Move Back to Avoid Scams & Losses

Are FXCL officials calling you to make you a customer by promising a magical profit number? Stop! These officials follow this route to onboard customers and make them deposit at regular intervals. However, when you wish to withdraw, the officials will deny your request. This is nothing but a strong indicator of a scam forex broker. In this article, we will expose the wrongdoings of this Botswana-based broker.

Stunning Revelation: OXShare Disallows Withdrawals When Traders Make Profits

The revelation that OXShare disallows withdrawals to traders when they make profits is stunning but true. Many traders have complained about it on forex broker review platforms, but to no avail. They may receive assurances, but company officials do not live up to their promises. What’s more, these officials manipulate trades, forge vital details, and eventually scam traders who put their hard-earned capital on it. In this article, we will expose OxShare with proof. Read on to check them.

WikiFX Broker Assessment Series | Windsor Brokers: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Windsor Brokers, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

What Is Forex Trading Fee? A Beginner’s Guide

Understand forex broker fees and trading costs in detail. Explore fee comparisons, learn to reduce expenses, and maximize your profitability with practical forex trading tips.

WikiFX Broker

Latest News

How 3 Simple Steps Cost a Businessman INR 4 Crore in a Forex Scam

PrimeXBT Expands FSCA Licence and Enhances Crypto Services in 2025

Quotex Broker Review 2025: Is It a High-Risk Broker?

Is CBCX a Safe and Trustworthy Broker for Traders?

TopFX Launches Synthetic Indices Trading on cTrader Platform

Is TradeEU Reliable in 2025?

How Commodity Prices Affect Forex Correlation Charts

Professional Forex Trading: Skills, Tools, & Strategies for Success

Investing in OnFin? Absurd Withdrawal Conditions & Trade Manipulation May Spoil Your Trading Mood

Top 5 Warning Signs- Why You Should Avoid MTrading Broker?

Rate Calc