Quotex Broker Review 2025: Is It a High-Risk Broker?

Abstract:Quotex Review 2025: Unregulated binary options broker with numerous withdrawal complaints and warnings. Read this in-depth risk analysis before depositing.

Introduction

Quotex markets itself as a fast, user-friendly platform for binary options across forex, crypto, indices, metals, and energy, attracting global traders with low $10 minimums and web, desktop, and mobile access. Yet beneath the sleek interface lies a deeper risk profile: Quotex is not authorized by any major financial regulator, and complaint volumes about account suspensions and blocked withdrawals have surged into 2025. This review compiles verifiable evidence to assess whether Quotex is a high‑risk broker.

At a glance: What Quotex claims vs. what we found

- Products and access: Digital/binary options on multiple asset classes via proprietary WebTrader and mobile apps; demo accounts available; low minimum deposit around $10.

- Corporate/registration: Reported offshore registrations (e.g., Saint Vincent and the Grenadines/Seychelles) and operation without supervision by a recognized financial authority.

- Regulatory and public warnings: Not authorized by major regulators; subject to warnings from European authorities (e.g., CONSOB and CMVM) regarding unauthorized investment services.

- Complaints trend: Dozens of reports in 2024–2025 of frozen accounts, failed withdrawals, and altered/blocked trading, documented on third‑party watchdog platforms.

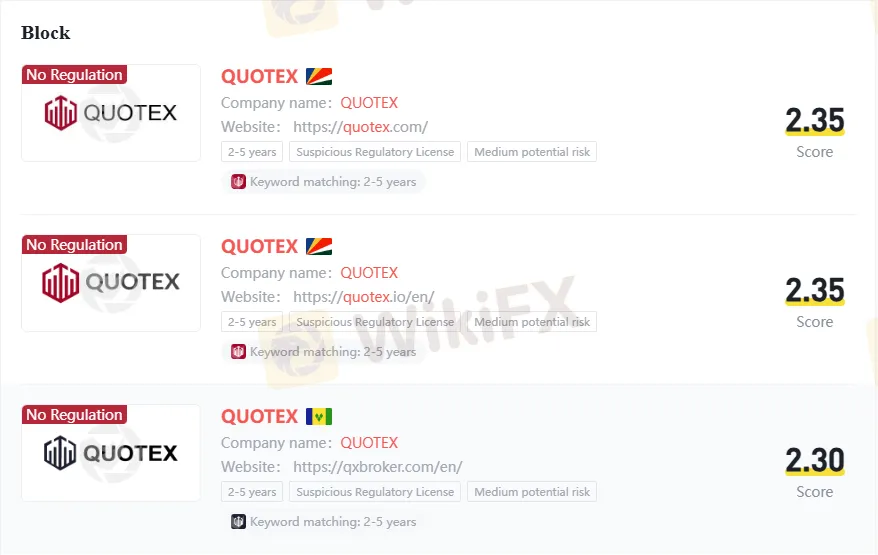

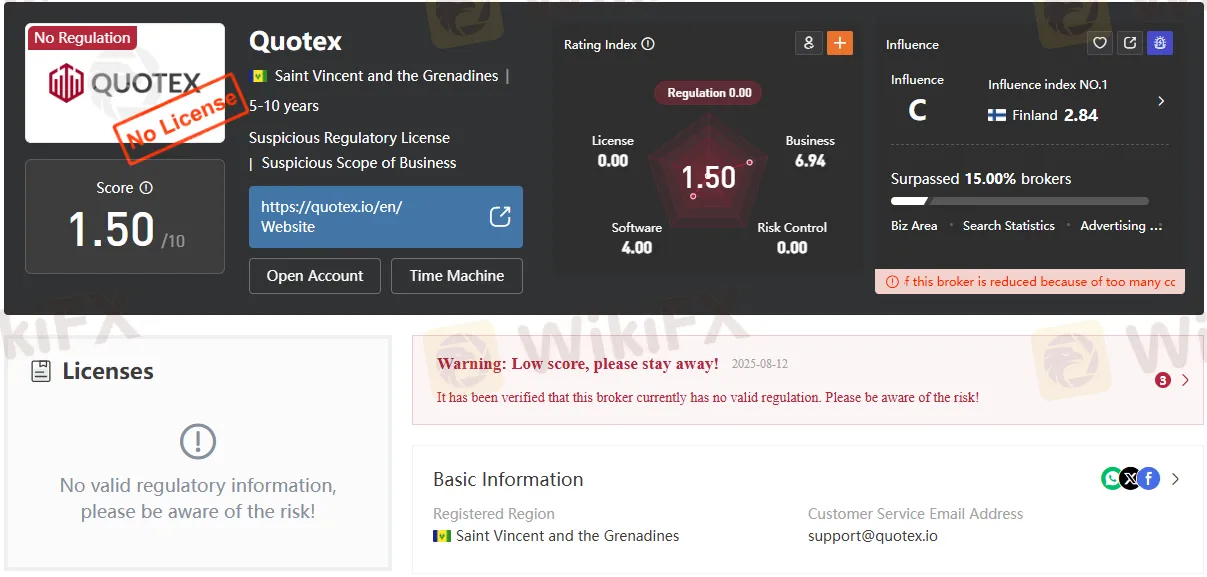

Regulatory status: Unregulated and warned against

Quotex “has not been authorized or regulated by any major financial regulatory body,” according to a 2025 watchdog review that also notes its offshore setup in Saint Vincent and the Grenadines where there is no effective oversight of forex/derivatives activity. European regulators have issued public warnings: Italy‘s CONSOB published an alert in December 2021 for offering services without required authorizations, and Portugal’s CMVM warned in January 2023 that Quotex is not authorized to provide financial intermediation in Portugal. These factors establish a clear “unregulated” status with added jurisdictional risk for client protection and recourse.

Platform, instruments, and terms

Quotex offers a proprietary web-based platform and mobile apps with binary options across forex pairs, stock indices, select cryptocurrencies, metals, and energies, with payouts commonly marketed up to the mid‑90% range depending on asset and expiry. It promotes quick onboarding, free demo balances, and small minimum deposits that lower entry barriers for new traders. While such accessibility is attractive, binary options are inherently high-risk due to all‑or‑nothing payoff structures and short expiries, and the absence of regulation compounds counterparty risk.

Complaints and risk signals in 2024–2025

Independent complaint boards and broker vetting sites show a pattern that intensified into 2025: accounts suspended once profitable, withdrawals delayed or denied, and communication lapses from support. One 2025 case report describes an account suspension during withdrawal after growing a balance to $43,000, alleging the broker “allows losses but blocks profitable accounts”. A consolidated exposure page documents users citing altered charts, emptied balances, and inability to confirm emails to process withdrawals during April 2025 incidents. Watchdog coverage in February 2025 states more than 40 complaints and emphasizes recurring withdrawal blocks as the “biggest problem” highlighted by traders. These reports are consistent with broader “unregulated/high‑risk” red flags.

Mixed public reviews vs. verifiable risks

Some directories and user forums include positive experiences about fast withdrawals, responsive support, and easy UI, reflecting that not every customer reports harm and that short‑term usage can appear smooth. However, positive testimonials do not offset the structural risk created by the lack of licensing and repeated regulator warnings, nor the concentration of credible exposure reports tied to suspended accounts and frozen funds in 2024–2025.

Ownership, jurisdiction, and enforcement gaps

Coverage links Quotex to offshore entities (e.g., Maxbit LLC/SVG or Seychelles registration), emphasizing that SVGs FSA does not license or supervise forex/derivatives brokers, leaving clients without strong legal protections or compensation schemes. Overseas entity switching and multiple domains reported by reviewers make recourse even more difficult for affected users, a common pattern among offshore binary options brands.

Who should consider Quotex?

- Experienced traders prepared to treat any deposit as fully at risk and able to verify withdrawals at very small test amounts may choose to experiment—but only after acknowledging the full absence of regulated safeguards.

- Newer traders seeking education, transparent costs, and dispute resolution should prioritize brokers licensed by tier‑1 regulators (e.g., FCA, ASIC, NFA/CFTC), which Quotex lacks according to 2025 watchdog reporting.

Practical risk‑management checklist

- Verify regulation directly with the named regulators register before depositing; if not found, treat as unregulated.

- Start with tiny test withdrawals and avoid scaling until multiple successful, timely payouts are confirmed under identical methods.

- Keep independent trade records and screenshots to challenge discrepancies; numerous users cite chart or execution disputes.

- Avoid large balances or bonus schemes that can introduce withdrawal conditions or give brokers pretexts to restrict funds.

- If problems occur, document everything and file with relevant national authorities and consumer protection portals used to aggregate exposures.

Verdict: Is Quotex a high‑risk broker in 2025?

Yes—Quotex is high‑risk in 2025 due to its unregulated status, prior regulator warnings, and a sustained pattern of public complaints about suspended accounts and blocked withdrawals. While some users report satisfactory experiences with the platform and payouts, the lack of supervision and concentrated exposure reports make Quotex unsuitable for anyone who requires robust fund protection and reliable recourse.

Conclusion

Quotexs appeal—simple onboarding, accessible platform, and broad binary options coverage—comes with material counterparty risk that is magnified by offshore registration and the absence of recognized regulatory oversight. Documented warnings from EU authorities and escalating 2024–2025 complaints over withdrawals and account suspensions tip the balance against treating Quotex as a safe venue for capital, especially for newer traders seeking durable protections. For those still considering Quotex, approach with extreme caution, test withdrawals early and often, and never deposit funds that cannot be afforded to lose entirely.

Dont be swayed by flashy marketing. Simply scan the QR code below to download the WikiFX App and quickly verify brokers right from your phone.

Read more

IVY MARKETS Exposure: Traders Allege Illegitimate Fees, Blocked Withdrawal Orders & No Refunds

Did IVY Markets deduct unfair fees from your deposit amount? Has your forex trading account been deleted by the broker on your withdrawal request? Failed to withdraw your funds after accepting the IVY Markets deposit bonus? Did the broker fail to address your trading queries, whether via email or phone? Such issues have been affecting many traders, who have expressed their displeasure about these on broker review platforms. In this IVY Markets review article, we have investigated some complaints. Keep reading to know the same.

Zenstox Review: Do Traders Face Withdrawal Blocks & Fund Scams?

Does Zenstox give you good trading experience initially and later scam you with seemingly illicit contracts? Were you asked to pay an illegitimate clearance fee to access fund withdrawals? Drowned financially with a plethora of open trades and manipulated execution? Did you have to open trades when requesting Zenstox fund withdrawals? You have allegedly been scammed, like many other traders by the Seychelles-based forex broker. In this Zenstox review article, we have investigated multiple complaints against the broker. Have a look!

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

WikiFX Broker

Latest News

Gold Holds Record Highs as Geopolitical Fractures Widen from Arctic to Middle East

USD/CAD Breaches 1.3900 as Loonie Succumbs to Oil Collapse and King Dollar

Oil Rout: Crude Plunges 3% as Geopolitical Risk Premium Evaporates

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

Geopolitical Risk: Trump Pauses Iran Strike, Markets Weigh "Tactical Delay" vs. De-escalation

US Inflation Stickiness and Geopolitical Rift Keep Dollar Firm; Gold Volatile

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Goldman Sachs 2026 Outlook: Dollar Overvalued by 15%, Tech 'Exceptionalism' is Key Risk

Trump tells Hassett he wants to keep him where he is; Warsh Fed Chair odds jump

Rate Calc