What Is Equity in Forex? The Definitive Guide for Traders

Abstract:Ultimately, understanding and monitoring your equity is about shifting your focus. You move from a static account history to a dynamic, real-time risk assessment. It moves you from being a passive scorekeeper to an active risk manager. By mastering your equity, you take a critical step toward mastering your trading.

A Core Concept

In forex trading, equity shows the real-time value of your trading account. It's your account balance plus or minus any profit or loss from trades you currently have open. Equity gives you the most accurate picture of your account's current financial health. It changes with every market tick for any trade you have running.

Understanding the difference between your account equity and your account balance is crucial for every serious trader. Many new traders only look at their balance. This can create a dangerously incomplete picture of their risk exposure.

This guide will explain what is equity in forex in simple terms. We'll break down the concept and show you exactly how it's calculated. You'll learn about its important relationship with margin and leverage. We'll also show you how to use equity as a powerful tool for managing risk effectively.

By the end, you'll understand the definition clearly. More importantly, you'll be able to use equity to make smarter, more informed trading decisions.

Equity Versus Balance

The biggest confusion for traders is the difference between account balance and equity. Understanding this difference isn't just academic. It's essential for survival and success in the markets. Let's break it down clearly.

Your “Balance” is the amount of money in your trading account from all your closed positions. It only changes in three situations:

1. You add money to your account

2. You take money out of your account

3. You close a trading position and lock in a profit or loss

Your balance is a historical record. It tells you how much money you started with and the results of your past trades. However, it doesn't tell you what your account is worth right now if you have open trades.

Your “Equity” is the live, “floating” value of your account. It's your balance adjusted for the current profits or losses of all your open positions. Equity shows the true, real-time value of your account at any moment.

This creates three key scenarios:

- When you have no open trades: Your equity equals your balance exactly

- When your open trades are making money: Your equity will be higher than your balance

- When your open trades are losing money: Your equity will be lower than your balance

Here's a comparison to help visualize this:

| Feature | Account Balance | Account Equity |

| Definition | Total cash in the account | Balance +/- floating profits/losses |

| When it Changes | Only on closed trades, deposits, withdrawals | Continuously, with every price tick on open trades |

| Represents | Historical account value | Real-time, current account value |

| Importance | A record of your starting capital and closed trade performance | The true measure of your account's health and risk level |

Imagine you have a $5,000 account balance. You open a trade on GBP/USD. The moment you open it, your balance stays at $5,000. If that trade quickly moves into a floating profit of $250, your equity rises to $5,250.

On the flip side, if the trade moves against you by $400, your equity drops to $4,600. Meanwhile, your balance remains unchanged at $5,000 until you close that position.

Calculating Forex Equity

Understanding the concept is the first step. Knowing the exact calculation helps you verify the numbers on your trading platform. It also helps you truly grasp your financial standing. The formula for equity is straightforward. Your trading terminal calculates it constantly.

Equity = Account Balance + Floating Profits/Losses

Let's break down each part of this essential formula to understand how it works in practice.

Account Balance: As we've established, this is your starting point. It's the cash in your account before accounting for any open trades. If you have $10,000 in your account and no open positions, your balance is $10,000.

Floating Profits/Losses (Unrealized P/L): This is the total of all profits and losses from all of your currently open positions. If you have one trade open with a profit of +$300 and another with a loss of -$120, your total Floating P/L is +$180.

These are often called “paper” profits or losses because they're not locked in yet. They only become “realized” and affect your balance once you close the trades.

A few other factors are included in the “Floating Profits/Losses” that traders must know about:

Swaps/Rollover Fees: If you hold a position open overnight, your broker will charge or credit you a small fee. This is called a swap or rollover fee. It's based on the interest rate difference between the two currencies in the pair. These fees directly add to or subtract from the floating P/L of the open position. Therefore, they directly impact your equity in real-time. A negative swap will slowly eat into your equity. A positive swap will slightly increase it.

Commissions: Some brokers charge a commission for opening and closing trades. This is especially true for ECN brokers. This commission is typically taken from your account balance the moment you start a trade. While it directly affects the balance, it's a cost of trading. You must factor it in when assessing overall profitability and its effect on your capital, which equity ultimately reflects.

In summary, the equity calculation includes:

- Your starting cash (Balance)

- The current market value of your open trades

- Any overnight fees that have built up (swaps)

Equity in a Live Trade

Theory is one thing, but seeing how equity behaves during an actual trade makes the concept real. Let's walk through a practical, step-by-step case study. We'll follow a hypothetical trader named Alex to show how equity, balance, and floating P/L work together.

Step 1: The Initial State

Alex decides to start trading and puts $2,000 into his new forex account. Before he places any trades, his account metrics are simple.

- Balance: $2,000

- Floating P/L: $0

- Equity: $2,000

At this stage, with no market exposure, his equity is identical to his balance.

Step 2: Opening a Trade

Alex analyzes the EUR/USD chart and decides to open a buy position of 1 mini-lot (0.1 lots). The moment he executes the trade, the broker's spread is applied. The spread is the difference between the buy and sell price. This means his trade starts with a small, immediate loss. Let's assume the spread costs him $2.00.

- Balance: $2,000 (The balance doesn't change yet)

- Floating P/L: -$2.00

- Equity: $1,998

His equity has instantly dropped below his balance because of the cost of entering the trade.

Step 3: The Trade Moves into Profit

The market rallies, and Alex's decision proves to be good. A few hours later, his open position shows a floating profit of $150. This profit includes overcoming the initial $2.00 spread cost.

- Balance: $2,000

- Floating P/L: +$150

- Equity: $2,150

Now, his equity is significantly higher than his balance. This $2,150 represents the amount of money he would have if he closed the trade right at this moment.

Step 4: The Trade Reverses and Swaps are Applied

The market sentiment shifts, and the price begins to fall. Alex's profitable trade reverses. It now shows a floating loss of -$50. He decides to hold the position overnight, hoping for a recovery. By holding it past the market close, he gets hit with a negative swap fee of $1.50.

- Balance: $2,000

- Floating P/L: -$51.50 (This is the -$50 from price movement combined with the -$1.50 swap fee)

- Equity: $1,948.50

His equity has now fallen below his initial deposit amount. This signals that his open position is dragging down his account's total value.

Step 5: Closing the Trade

The next day, the price continues to fall. Alex decides to cut his losses and closes the trade. At the moment of closing, the total floating loss is -$51.50. This “paper” loss is now “realized.” It's permanently taken from his account balance.

- Balance: $1,948.50 (The original $2,000 minus the realized loss of $51.50)

- Floating P/L: $0 (There are no more open trades)

- Equity: $1,948.50

With the trade closed and the loss locked in, his equity once again equals his new, lower balance. This cycle shows how equity serves as a dynamic, live indicator of account value. Meanwhile, the balance only updates after the fact.

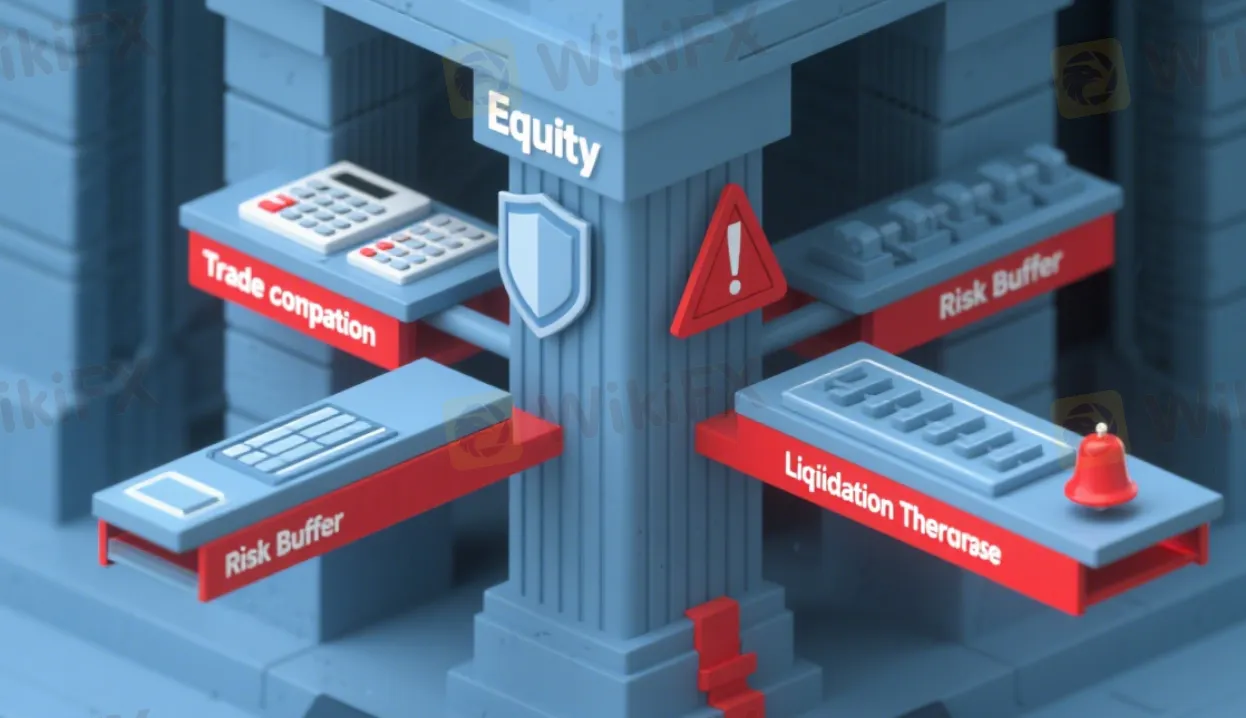

Equity, Margin, and Risk

Equity isn't an isolated number. It's the central pillar of your account's entire risk management system. It's the foundation your trading platform uses to calculate your capacity to open trades. It also determines how close you are to a forced liquidation. Understanding what is equity in forex is incomplete without understanding its connection to margin, free margin, and margin level.

Let's define these connected terms:

Margin (Used Margin): This is the amount of your account's capital that your broker sets aside to keep your current positions open. It's not a fee. It's a good-faith deposit that ensures you can cover potential losses. The amount of margin required depends on the currency pair, your trade size, and your account's leverage. This margin is “locked up” from your equity for the duration of the trade.

Free Margin: This is the money in your account that's available to open new positions. It's the difference between your equity and the margin being used for your current trades. The formula is simple and critical:

Free Margin = Equity - Margin

If your equity falls, your free margin falls. If your free margin is zero or negative, you can't open any new trades.

Margin Level: This is arguably the most critical real-time health metric on your trading platform. It's a percentage that shows the ratio of your equity to your used margin. It tells you how healthy your account is and how much of a “cushion” you have before you get into trouble. The formula is:

Margin Level (%) = (Equity / Margin) x 100

The higher your Margin Level percentage, the healthier your account. As your equity drops due to floating losses, your Margin Level percentage will also drop. This happens even if your used margin stays the same.

Brokers use the Margin Level to enforce risk rules. Typically, there are two important thresholds:

1.Margin Call (e.g., 100% Margin Level): When your Margin Level drops to a certain point (often 100%), it means your equity equals your used margin. At this point, you have zero free margin. Your broker will issue a warning, a “margin call.” This indicates you're at high risk. You can no longer open new positions. You may need to either add funds or close some losing trades to free up margin.

2.Stop Out (e.g., 50% Margin Level): If the market continues to move against you and your Margin Level falls to an even lower threshold (often 50%, but this varies by broker), the broker's system will start to automatically close your positions. It starts with the least profitable one. This is a “stop out.” It's a protective mechanism to prevent your account from going into negative balance.

Let's revisit Trader Alex. In Step 3, his equity was $2,150. Let's say the margin required for his 1 mini-lot EUR/USD trade was $200.

- Equity: $2,150

- Margin (Used): $200

- Free Margin: $2,150 - $200 = $1,950

- Margin Level: ($2,150 / $200) x 100 = 1075%

At this stage, his account is very healthy. He has plenty of free margin to open more trades and a very high margin level. This gives him a large buffer against losses.

A Key Health Metric

Understanding the definition of equity is just the beginning. The true mark of an experienced trader is using equity as a proactive tool for decision-making and risk management. While your balance shows your past, your equity shows your present reality and future capacity. Focusing on equity over balance is a crucial mental shift.

Here are actionable strategies for using equity to improve your trading:

A Real-Time Risk Gauge: A rapidly dropping equity is an immediate red flag. This is true even if your balance is high from previous wins. It's the market's way of telling you that your current open positions are collectively performing poorly. Your risk is escalating. A static balance can give you a false sense of security. A falling equity tells the unfiltered truth.

Informing the Decision to Close or Hold: Professionals watch their total equity, not just the P/L of one trade. A sound risk management strategy involves setting a limit on how much equity you're willing to see decline in a single day. For instance, you might decide to close all open positions if your total equity drops by more than 2% from the start of the day. This rule forces discipline and prevents a few bad trades from spiraling out of control and wiping out a week's worth of gains.

Preventing Margin Calls: Margin calls are triggered by low equity, not a low balance. By actively monitoring your Margin Level percentage, which is directly tied to your equity, you can take preventative action long before a margin call occurs. If you see your Margin Level dropping towards the 100% threshold, you know you need to take action. You can either reduce your position size, close a losing trade, or hedge your exposure to push that level back up to a safer zone.

Calculating True Drawdown: Many traders measure drawdown by looking at the peak-to-trough decline in their account balance. A more accurate and punishing measure of risk is “equity drawdown.” This measures the decline from the peak equity value to the lowest equity value. It reflects the true maximum pain your strategy endured. This includes large floating losses that may have eventually turned into smaller realized losses (or even wins). Analyzing equity drawdown gives you a much better understanding of your strategy's volatility and your own risk tolerance. A rule many experienced traders follow is to never let their total floating losses exceed a predefined percentage of their total capital. The floating losses are the difference between Balance and Equity. This forces an objective assessment of risk and prevents emotional decision-making.

Mastering Your Trading

By now, the answer to the question “what is equity forex” should be clear. It's far more than just a number on your screen. It's the lifeblood of your trading account and the most honest indicator of your performance and risk.

Let's recap the essential takeaways:

- Equity is your account's real-time value, calculated as your Balance plus or minus any Floating P/L

- It's the most accurate indicator of your account's present financial health

- It's fundamentally different from your Balance, which only reflects past, closed trades

- Equity is the foundation for calculating Free Margin and Margin Level, the metrics that govern your ability to trade and avoid a stop out

Ultimately, understanding and monitoring your equity is about shifting your focus. You move from a static account history to a dynamic, real-time risk assessment. It moves you from being a passive scorekeeper to an active risk manager. By mastering your equity, you take a critical step toward mastering your trading.

Read more

Find Out Why Trade Nation Is Facing Backlash from Users

Trade Nation is facing criticism from users for several reasons. Although it is a well-known broker with a good reputation among traders and Investors, many are now raising concerns. So, what are the reasons users are starting to dislike this broker? Let’s find out.

Top Reasons Why You Should Not Partner with Tradovate for Forex Trading

Struggling with an unoptimized platform of Tradovate? Dealing with slow-paced deposits and withdrawals? Have you been asked to pay a fee for market data access? Do you face copytrading struggles at Tradovate? You have chosen the wrong forex broker. Many have claimed foul play by Tradovate on several broker review platforms. In this article, we have highlighted the issues traders face with this broker.

Scam Alert: 7 Suspicious Brokers Banned by Trusted Authority

One of the Reputed Authority, the Financial Conduct Authority (FCA), has issued a warning against seven illegal brokers . These brokers are offering financial services to people with the intention to commit fraud.

Max Global FX Exposed: Traders Cry Foul Over Withdrawal Issues & Fake Guaranteed Profit Claims

Witnessing losses due to trade manipulation at Max Global FX? Scammed by the guaranteed profit claims made by its executives? Are your withdrawals pending for months? Take a strong legal action against Max Global FX by presenting proof of its foul play to the authorities. Many traders have raised concerns over unethical trading practices by Max Global FX, a Saint Vincent and the Grenadines-based forex broker. We have highlighted some pressing issues facing traders here. Take a look!

WikiFX Broker

Latest News

Will MultiBank Become the Next TriumphFX?

ACY Securities Enters Colombia with LatAm Expansion

SEC Flags Five More Unregistered Crypto Platforms in PH

Webull Brings Crypto Trading Back to App

Forex Lot Size Explained: A Complete Guide to Standard, Mini, & Micro Lots

What is Spread in Forex? How It Affects Your Trading Costs (A Complete Guide)

Forex Margin Trading Explained

Alchemy Launches Secure Copy Trading App

WikiFX Report: MultiBank Group’s Footsteps in the Philippines

High Impact News Forex Today: Interest Rate Watch

Rate Calc