Will MultiBank Become the Next TriumphFX?

Abstract:Traders are asking whether MultiBank’s token could become the next trap, repeating the chaos and losses seen in the collapse of TriumphFX.

In Southeast Asia, the scars of TriumphFX‘s collapse remain fresh. The once-popular broker drew thousands of traders into what later unfolded as one of the region’s most notorious money game schemes. Now, as MultiBank Group announces the launch of its very own token, questions are emerging: could history be about to repeat itself?

TriumphFX: The Crypto Coin That Triggered a Collapse

TriumphFXs downfall can be traced back to December 2022, when the company introduced its own cryptocurrency, the TFX coin, alongside the Triumph Exchange. What initially appeared to be an innovation soon turned disastrous.

Client deposits, previously held in USD, were automatically converted into TFX. The coin was advertised as being pegged 1 to 1 with USDT, a stablecoin widely tied to the US dollar. In reality, the value of TFX quickly plummeted, falling to just 0.214 USDT within weeks.

This meant that an investor who had doubled their funds over two years would have seen their account shrink to less than half its original deposit once converted into TFX. Those who joined late suffered even greater losses, watching their savings erode almost overnight.

Compounding matters, TFX could only be traded on TriumphFX‘s in-house exchange, giving the broker complete control over trading hours and liquidity. For many participants, withdrawals became impossible. The coin’s collapse ultimately served as a textbook case of how a broker-controlled cryptocurrency can trap investors, paving the way for an exit strategy by those behind the scenes.

Read more about TriumphFXs dark history from December 2022 here:

MultiBank Group: An Uncanny Resemblance?

Founded in 2005, MultiBank Group has long carried a controversial reputation across Asia. While it claims to hold multiple regulatory licences, investigations have revealed that several are invalid, fuelling distrust within trading communities.

Back in 2022, concerns grew when the broker officially expanded into Malaysia. Promotional campaigns encouraged traders to open accounts, while efforts were made to recruit introducing brokers to widen its reach. But by 2025, red flags started to reappear: its Malaysian Facebook page vanished, and its Instagram activity went silent for over 80 weeks.

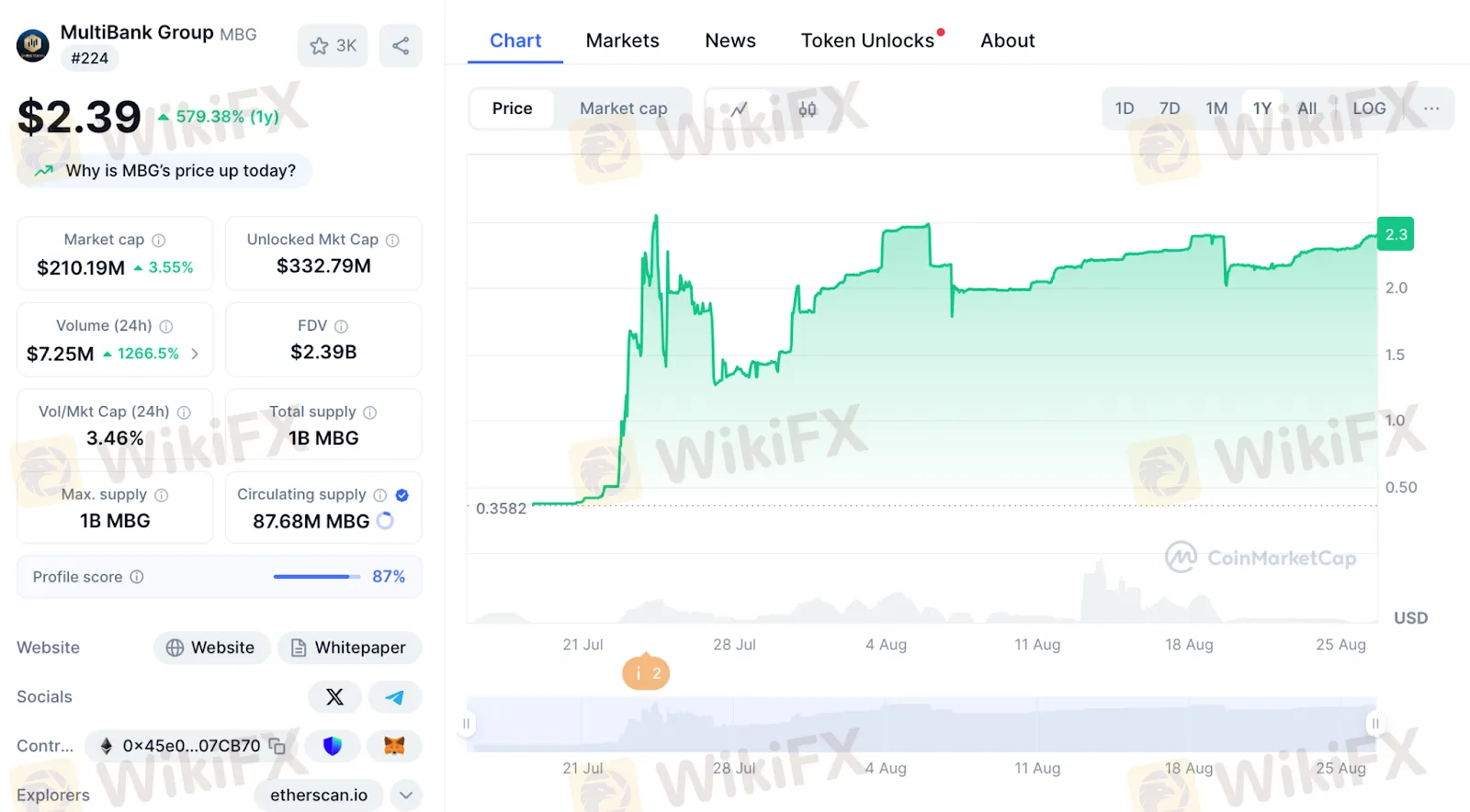

Then came the announcement in July 2025 that MultiBank Groups MBG Token was officially launched through a Token Generation Event.

Just one month after its debut, the company revealed another bold step: a strategic buyback and burn programme for its MBG Utility Token. Backed by strong first half 2025 results, reporting 209 million dollars in revenue, up 20 per cent year on year, and 170 million dollars in profit, the move was positioned as a way to enhance scarcity and increase long-term value for token holders. While such initiatives may appear reassuring, they also raise concerns that the firm is doubling down on its reliance on a self-created asset, further echoing the trajectory of TriumphFXs failed experiment.

The Similarities Are Hard to Ignore

The similarities between TriumphFX and MultiBank are hard to ignore:

- Both brokers carry controversial reputations and regulatory doubts.

- Both shifted towards launching their own crypto coins despite being primarily forex-focused.

- Both positioned their tokens as central to future growth, raising fears they may limit clients access to traditional withdrawals.

Read WikiFXs full review of MultiBank here: https://www.wikifx.com/en/dealer/0001326398.html

The Bigger Picture

The emergence of broker-issued tokens highlights a growing risk in the crossover between forex and cryptocurrencies. While such initiatives are marketed as innovation, they can also serve as mechanisms to trap liquidity, restrict withdrawals, and facilitate discreet exits when trust collapses.

TriumphFX‘s case remains a painful reminder of how quickly fortunes can be wiped out once a broker holds absolute control over client assets. MultiBank’s recent steps suggest that history could indeed repeat itself, unless regulators and traders remain vigilant.

The debate is now open: Is MultiBank setting the stage for the same outcome as TriumphFX? Will MultiBank become the next TriumphFX, or will it prove critics wrong?

If you have personally experienced an unpleasant incident with MultiBank Group, get in touch with WikiFX, as we are a renowned global broker regulatory query platform.

In addition to protecting traders through honest reviews, WikiFX has launched a global campaign called the “Real Stories, Real Voices” Broker Review Collection, designed to bring

transparency to the trading industry. With a prize pool of 3,330 US dollars, this initiative provides traders with a fair platform to share their experiences and hold brokers accountable. From 20 to 31 August 2025, participants can register, submit reviews via the WikiFX app, and stand a chance to win rewards simply by speaking honestly about their broker.

Every genuine review contributes to building a stronger community and ensures that bad actors are exposed, while reliable brokers receive the recognition they deserve. By taking part, you not only protect yourself and others but also play a role in shaping a safer and more transparent trading environment. Now is the time to make your voice heard.

Read the details of this event and join now:

WikiFX Broker

Latest News

Will MultiBank Become the Next TriumphFX?

ACY Securities Enters Colombia with LatAm Expansion

SEC Flags Five More Unregistered Crypto Platforms in PH

Webull Brings Crypto Trading Back to App

Pip Value Calculation Guide: How Much Is a Pip in Forex Really Worth?

Football Meets Finance: PSG Signs Global Partnership With WeTrade

Checkout List of 7 "FCA WARNED" Unauthorized Brokers

Why Are Investors Losing Trust in StoneX? What You Need to Know

Trader’s Way Exposed: Where Winning Trades Turn into Losses Overnight

Activity Upgraded! The 2025 WikiFX “Global Broker Review Contest” Grandly Launches!

Rate Calc