tastytrade Not Matching Its Traders’ Taste: Withdrawal Blocks, Account Opening Hassles & More

Abstract:Did tastytrade disallow you from opening a forex trading account? Did the broker fail to provide any reason for this hindrance? Have you faced deposit rejection issues with a US-based forex broker? Facing unfair charges and withdrawal blocks from tastytrade? Does the customer support team fail to address these queries? These strong claims from the trader have become increasingly common on broker review platforms. Let’s take a quick look through this review of tastytrade.

Did tastytrade disallow you from opening a forex trading account? Did the broker fail to provide any reason for this hindrance? Have you faced deposit rejection issues with a US-based forex broker? Facing unfair charges and withdrawal blocks from tastytrade? Does the customer support team fail to address these queries? These strong claims from the trader have become increasingly common on broker review platforms. Lets take a quick look through this review of tastytrade.

Glancing at the Top Complaints Against tastytrade

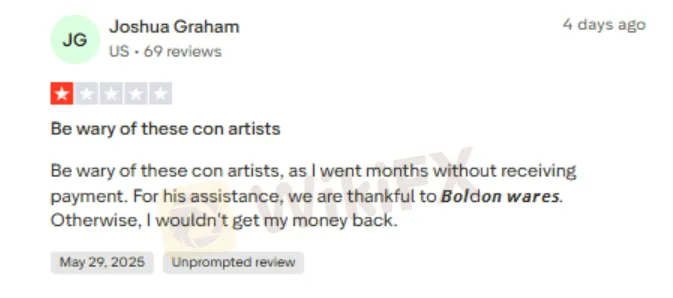

Lingering Withdrawal Blocks

The constant refusal from the broker to grant withdrawal access worries traders the most. It leaves them pondering about their stuck capital. Here are some negative reviews regarding withdrawal denials.

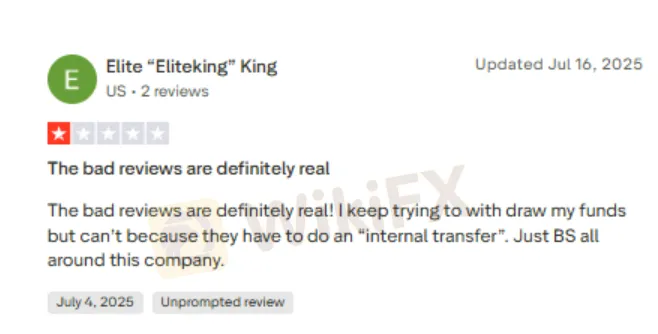

No Reason Offered Behind Account Opening Application Cancellations

Getting rejections for forex account opening applications is fine. However, as a responsible broker, tastytrade should give a valid reason for these. Unfortunately, it rejects without explaining the rationale, leaving traders worried. Here are some screenshots supporting this complaint.

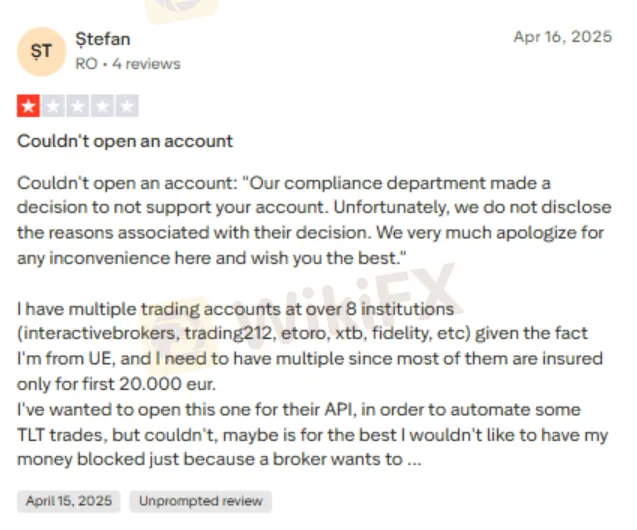

Unfair Charges & Withdrawal Hassles

This section covers a peculiar case where a trader was charged $45 on withdrawals since he was not a US-based client. As the trader attempted another withdrawal, he was charged $45 and a return fee of $30. Upon contacting the customer service team, the trader did not receive a satisfactory reply. The trader was confirmed by his bank of no payment receipt from tasytrade. This made the trader share negative reviews, as shown below.

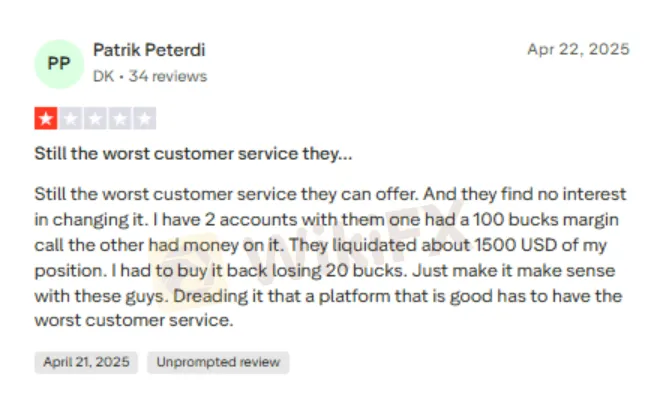

Bad Customer Support

The customer support team has been accused of not responding to traders queries. Some traders, including the one in the screenshot below, even label it as the worst. Take a look at the review.

WikiFX Shares the Review of tastytrade - Score & Regulation

The WikiFX team studied the trader complaints and tastytrades regulatory status and did not find it safe for forex traders. Upon intense investigation, tastytrade is found to be unlicensed, adding fuel to the fraud allegations imposed against it. As a result, the team assigned this broker a score of 1.43 out of 10.

Want to unlock more details about tastytrade and other forex brokers? Join WikiFX Masterminds (ID:EODL15W5IH).

Just these steps, and youre not part of the group.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.

Read more

Traders Flag DUHANI as a Scam Forex Broker: Withdrawal Denials, Account Termination & False Promises

Lured into the DUHANI trading platform courtesy of the bonus offer that never existed? Did the forex broker prevent you from accessing your account and take away all your profits? Being promised a swap-free account but ended up paying a charge on closing a position? These experiences have become synonymous with DUHANI traders. Frustrated by these incidents, traders have opposed the broker online, with some of them even claiming to have recovered their stuck funds using legal means. Let’s check their negative reviews to find out the pain they have had trading via DUHANI.

DNA Markets Review 2025: Is This Broker Regulated and Safe?

If you want to trade and earn, you should explore DNA Markets. But before investing your money with this broker, you should consider: Is this broker regulated? In this DNA Markets Review 2025, we will provide you with a complete evaluation of the broker.

A Guide to Determining the Optimum Forex Leverage

Want to gain a wider forex market position control by investing a minimal amount? Consider using leverage in forex. It implies using borrowed funds to raise your trading position more than your cash balance can let you do it. Forex traders usually employ leverage to churn out profits from relatively small currency pair price changes. However, there is a double-edged sword with leverage since it can multiply profits as well as losses. Therefore, using leverage in the right amount is key for traders. Forex market leverage can be 50:1 to 100:1 or more, which remains significantly greater than the 2: leverage usually offered in equities and 15:1 leverage in futures.

Webull Launches Corporate Bond Trading for U.S. investors

Webull debuts corporate bond trading in the U.S. with 0.10% spreads, $10 minimums, and S&P-rated IG and HY access on desktop and mobile platforms.

WikiFX Broker

Latest News

Online Trading Scams in Europe Surge as 1,400 Sites Shut

Slippage in Forex Explained: Key Facts to Improve Your Trading Strategy

FSMA Belgium Warning: 17 Fraudulent Platforms Exposed

VITTAVERSE Review: Traders Report Withdrawal Denials and Broker Negligence

Top Crimes This Year: Romance & Investment Scams

ASIC Licence: A Practical Step-by-Step Guide to Verifying Forex Brokers

Tariffs are pushing prices higher and consumers are feeling the hit, Fed's Beige Book shows

New York Factory Activity Surged In October, Jobs & Orders Jump

Lirunex Introduces Sharia-Compliant Islamic Trading Accounts

ECN Forex Trading Account Explained: Unlocking Key Details for a Seamless Trading Experience

Rate Calc