Warning: FinPros Finds New Excuses to Block Withdrawals

Abstract:Recently, reports have surfaced online exposing yet another withdrawal scandal involving FinPros, a forex broker that claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC). According to the report from the victim, FinPros froze her legitimate profit of USD 197, citing a bizarre reason: “suspected collusion with other violators during trading.”

Recently, reports have surfaced online exposing yet another withdrawal scandal involving FinPros, a forex broker that claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC). According to the report from the victim, FinPros froze her legitimate profit of USD 197, citing a bizarre reason — “suspected collusion with other violators during trading.”

This is not the first time FinPros has been accused of manipulating trading conditions or refusing withdrawals. In previous cases, traders have reported that the broker bundled bonus offers with impossible trading volume requirements, effectively setting traps that prevent clients from withdrawing profits. Once users show consistent profitability, FinPros allegedly tightens restrictions, introduces slippage, and finds pretexts to erode both profits and capital.

Rejected Withdrawals Twice Without Explanation

A trader named Lin states that she had already applied for a withdrawal in September, which was rejected for “unknown reasons.” Despite multiple follow-ups, FinPros never provided any explanation. When she approached customer support again in October, the broker flatly refused to release her funds, this time claiming that “some traders were manipulating the market,” and therefore no one would be allowed to withdraw profits.

The “Cyprus Regulation” Illusion

Both traders and brokers understand that a high-quality license is a key indicator of credibility and investor protection. Top-tier regulatory bodies such as the UK‘s FCA, US’s NFA, and Australias ASIC enforce stringent compliance requirements, making their licenses difficult to obtain and maintain.

However, many problematic brokers, including FinPros, seek the appearance of regulation without accepting real oversight. Cypruss CySEC, while part of the EU framework, is often perceived as a loophole license that offers lighter supervision compared to Tier-1 regulators.

According to FinPross official international website, the company claims:

“Finquotes Management LTD is a company incorporated in Cyprus under registration number HE433355, located at Agathangelos Court, 3rd floor, Flat 303, Georgiou Gennadiou 10, Limassol, Cyprus. It acts as a designated representative and distributor for regulated entities.”

Furthermore, FinPros advertises that it holds two licenses under different jurisdictions:

- FINQUOTES FINANCIAL (CYPRUS) LTD — a CySEC-regulated entity for European clients.

- FinPros Financial Ltd — a Seychelles-registered offshore company for international clients.

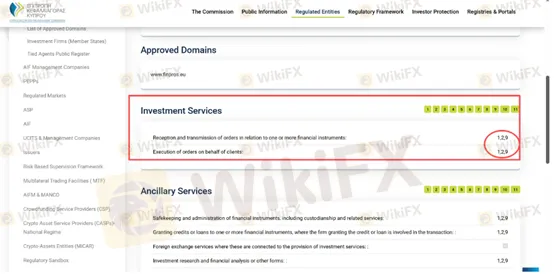

Upon checking CySECs official website, FINQUOTES FINANCIAL (CYPRUS) LTD is indeed listed, authorized for forex and CFD services under license categories 1, 2, and 9.

The Regulation

While FinPros does maintain a CySEC license, it segregates clients by jurisdiction. In reality, traders from China, Southeast Asia, and other non-EU regions are not onboarded under the CySEC entity.

Instead, their accounts are opened under FinPros Financial Ltd, the Seychelles company with license number SD087, registered at CT House, Office 9A, Providence, Mahé, Seychelles.

When searching “FinPros” in the MetaTrader 5 platform, only the Seychelles-based server appears for users in mainland China. This means that non-EU clients are trading under an offshore entity, far removed from the CySEC-regulated structure they were promised.

Offshore regulation is notorious in the forex industry for its minimal oversight, low accountability, and weak investor protection. Once funds are transferred to such entities, retrieving them becomes nearly impossible.

High Leverage, High Risk

The broker advertises various account types, including one that requires only a $10 minimum deposit but offers leverage up to 1:1000.

While high leverage may seem attractive to new traders, it significantly amplifies the risk of account blowouts — and also enables brokers to manipulate price feeds more easily. Combined with FinPross history of withdrawal denials and “technical justifications,” this makes the platform an especially dangerous environment for retail investors.

Conclusion

FinPros‘s repeated excuses for blocking withdrawals, misuse of offshore entities, and misleading regulatory claims point to a pattern of deceptive conduct. Despite showcasing its CySEC license, the broker’s operational reality suggests a two-tier system designed to evade real supervision while exploiting traders outside the EU.

Traders are urged to exercise extreme caution and verify which legal entity actually holds their funds before depositing with FinPros. If you are already affected, consider filing a complaint with CySEC and reporting the incident to WikiFX or your local financial regulator.

Read more

Masari Capital Review — Is MasariCapital.com Legit?

If you're considering trading with Masari Capital, it's crucial to approach with caution. Reports from users and financial watchdogs have raised serious concerns about its legitimacy. The broker's website certificate issued by the Financial Services Authority has been canceled, indicating potential risks. Read the Masari Capital review .

US and UK Sanction Cambodia-Based Prince Group Over $16B Scam

US and UK impose sweeping sanctions on Cambodia's Prince Group transnational criminal organization behind $16B online scams and money laundering.

Expert Option Review – Is It Really Regulated?

Expert Option is not regulated by any major authority. It operates offshore with only Financial Commission membership, not full broker regulation.

SEC Warns Public Against Bitcoin and Consumer Goods Scams in Agusan del Sur

SEC Butuan warns Filipinos about Christabel Arroyo and De Guzman Consumer Goods Trading scams offering fake bitcoin and goods investments.

WikiFX Broker

Latest News

UAE Launches Sixth 'Caution' Campaign to Combat Forex and Online Investment Fraud

US and UK Sanction Cambodia-Based Prince Group Over $16B Scam

OctaFX Forex Brokerage $318 million Fraud Case in India: Authorities Arrest Pavel Prozorov!

How Filipinos Can Recover Funds from Crypto Scams Abroad

Top Tips to Avoid Forex Margin Calls and Protect Your Capital

FCA Daily Alert: Checkout FCA Consumer Warning List

Kato Prime Under Fire: What Traders Should Know Before It’s Too Late

Warning: FinPros Finds New Excuses to Block Withdrawals

Is Exnova Legit? Is the Exnova App Legal in India?

SEC Warns Public Against Bitcoin and Consumer Goods Scams in Agusan del Sur

Rate Calc