Lack of Internet Access Hindering Your Cashless Payments? Embrace RBI’s Offline Digital Rupee

Abstract:The Reserve Bank of India (RBI) has introduced the Offline Digital Rupee (e₹), a groundbreaking initiative that facilitates secure real-time digital payments without mobile or Internet connectivity. It is a move aimed at deepening the country’s digital financial ecosystem. Launched at the Global Fintech Fest 2025, the move adds a significant feather to India’s continual journey toward a cashless and financially inclusive economy.

The Reserve Bank of India (RBI) has introduced the Offline Digital Rupee (e₹), a groundbreaking initiative that facilitates secure real-time digital payments without mobile or Internet connectivity. It is a move aimed at deepening the country‘s digital financial ecosystem. Launched at the Global Fintech Fest 2025, the move adds a significant feather to India’s continual journey toward a cashless and financially inclusive economy.

Access Digital Payments Without Internet

Contrary to UPI and other online payment systems requiring Internet connectivity and linked bank accounts, the new initiative facilitates direct transfers within wallets, a financially defining moment for rural and remote locations with limited banking infrastructure or network access. With no reliance on online networks for payments, millions of unbanked and underbanked citizens can enjoy secure digital transactions.

Technologies Behind the Financial Masterpiece

The new initiative, i.e., e₹, incorporates two transformative technologies for seamless offline digital payments - Near Field Communication (NFC) and Telecom-Assisted Payments. While NFC allows instant fund transfers within NFC-enabled devices using a simple tap, telecom-assisted payments facilitate transactions even under the least network availability. All these ensure simple, seamless, and universal digital transactions.

15 Participating Banks for e₹

Users can seamlessly access e₹ through the digital wallets of 15 participating banks. The bank list includes the State Bank of India (SBI), ICICI Bank, and HDFC Bank. Here are the salient features of this initiative.

- No need for a minimum balance

- Daily transaction up to ₹50,000 or 20 transfers

- Maximum wallet balance - Up to ₹1 lakh

- Protection for user funds amid device loss or theft with secure recovery mechanisms

Users can access wallets through official banking apps.

Programmable Money for Targeted Use

The new initiative comes with a new dimension - Programmable Money - by which funds can be geofenced for use within certain areas, remain time-bound for usage within a set period, or be limited to specific needs. These features make the e₹ especially beneficial for government welfare schemes, benefit reimbursements, and corporate payrolls. This ensures that funds are utilized as intended, boosting accountability and transparency.

What Does the RBI Governor Have to Say on e₹?

RBI Governor Sanjay Malhotra hailed e₹ as a transformative step in India‘s digital evolution. He stated that the Offline Digital Rupee enhances India’s digital public infrastructure by providing a secure, reliable, and inclusive payment solution to citizens across the country. The initiative helps India enter into a select group of countries having witnessed a successful Central Bank Digital Currency (CBDC) with offline functionality.

Financial Inclusion to Strengthen Further

According to experts, this RBI initiative will aid in financial inclusion, especially among rural and low-income populations with network or banking barriers. Other likely benefits include reduced reliance on cash, improved payment experience, and smart government transfers and corporate settlements.

Summing Up

The launch of the Offline Digital Rupee (e₹) marks a significant milestone in Indias digital finance revolution. By enabling seamless payments without Internet or mobile connectivity, the RBI has addressed one of the most critical barriers to financial inclusion. With advanced technologies like NFC and telecom-assisted payments, and features such as programmable money, the e₹ stands as a forward-looking solution that bridges the digital divide. As the initiative expands through leading banks and gains public adoption, it is poised to redefine the way India transacts—empowering every citizen to be part of a truly cashless and connected economy.

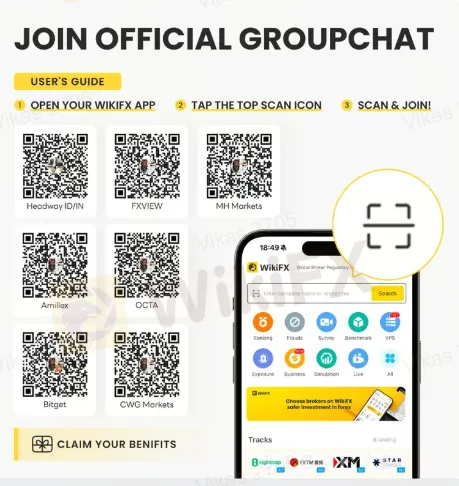

For more insights on forex brokers, trader ratings, and key market updates, join our official chat groups — your gateway to a remarkable forex trading journey - through any of the below QR codes or ID:EODL15W5IH.

Read more

Geopolitical Risk: Israel Sets New "Missile Red Line" for Iran

Global markets are on alert for potential supply-side shocks in energy markets as tensions between Israel and Iran escalate significantly. Israeli officials have signaled a lower threshold for preemptive military action, shifting their "red line" from nuclear development to the reconstitution of Iran’s conventional ballistic missile arsenal.

NFA Files Complaint Against Forex Wizard Japan

NFA charges Forex Wizard Inc. and Mitsuaki Kataoka with undisclosed forex pool operations, delayed withdrawals, and misleading regulatory claims.

Ringgit hits five-year high against US dollar in holiday trade

The Malaysian ringgit extended its rally, reaching a five-year high against the US dollar, trading in a narrow range of RM4.04-RM4.05.

Best Brokers Offering Trade Demo Accounts

Get hands‑on with the best forex demo accounts from top brokers, designed to help beginners and pros practice trading securely.

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Ringgit hits five-year high against US dollar in holiday trade

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc