Trive Investigation: High Score, Hidden Risk - The Profit Paradox

Abstract:A disturbing pattern has emerged regarding the broker Trive. Despite holding a high WikiFX score (7.91) and valid licenses in South Africa and Australia, recent investor reports suggest a significant disconnect between the platform's reputation and its treatment of profitable clients. While the regulatory paperwork appears in order, our data indicates that traders are facing sudden account freezes and accusations of "trading abuse" precisely when they attempt to withdraw profits. This report investigates why a seemingly "safe" broker is generating high-risk complaints.

Abstract: A disturbing pattern has emerged regarding the broker Trive. Despite holding a high WikiFX score (7.91) and valid licenses in South Africa and Australia, recent investor reports suggest a significant disconnect between the platform's reputation and its treatment of profitable clients. While the regulatory paperwork appears in order, our data indicates that traders are facing sudden account freezes and accusations of “trading abuse” precisely when they attempt to withdraw profits. This report investigates why a seemingly “safe” broker is generating high-risk complaints.

Anonymity Disclaimer: All cases cited in this report are based on real complaints lodged with the WikiFX Exposure Center. To protect the privacy and safety of the victims, specific names and exact locations have been anonymized.

The “Profit” Paradox: Winning Traders Locked Out

For many African investors, the primary fear in the Forex market is encountering a “fly-by-night” operation—a platform with no history and no regulations. Trive does not fit this profile. Established in 2013 and holding a highly respected license from the Financial Sector Conduct Authority (FSCA) in South Africa, Trive presents itself as a fortress of stability.

However, a deeper investigation into the WikiFX complaint logs reveals a troubling narrative that contradicts this image. The issue is not that Trive disappears; it is that they appear to actively penalize success.

The $5,000 “Abuse” Accusation

The most alarming case currently under investigation involves an investor who managed to generate a profit of approximately $5,000. According to the records, the trading environment seemed normal until the moment the user requested a payout.

Instead of processing the withdrawal, Trive allegedly canceled the profits and accused the user of “trading abuse.” When the investor requested specific details—evidence of what trade violated which rule—the broker reportedly refused to provide any data, simply citing a violation of terms.

This is a critical red flag known as “The Black Box Rejection.” Legitimate brokers will point to specific timestamps or arbitrage patterns if terms are violated. When a broker withholds funds but refuses to show evidence of the violation, it suggests the “abuse” may simply be that the trader was too profitable.

The Bonus Trap

Another investor reported a sophisticated issue involving trading bonuses. Bonuses are often used as marketing tools to attract African investors looking to boost their margin. However, this user reported that the “bonus” was effectively a trap.

The complaint details that the platform used the terms of the bonus to aggressively close out positions—likely a “stop-out” manipulation where the bonus funds are removed during a drawdown, causing the user's own capital to be liquidated immediately. The user described the bonus as “fake,” noting that it served only to accelerate the loss of their principal investment rather than support their trading.

Regulatory Reality Check: The License Isn't Always Enough

Why would a broker with a 7.91 score and an FSCA license engage in this behavior? The answer often lies in Jurisdiction Arbitrage.

While Trive holds a license in South Africa (which provides comfort to African investors), it also operates through offshore entities. When you sign up, your account may not be contracted with the highly regulated South African entity, but rather with the entity in the Virgin Islands, where protections are significantly weaker.

Here is the full regulatory breakdown of Trive, based on WikiFX's database:

| Regulatory Body | Country/Region | License Status | Meaning for Investors |

|---|---|---|---|

| FSCA (Financial Sector Conduct Authority) | South Africa | Regulated | High safety for SA residents. This is a legitimate, strong license. |

| ASIC (Australian Securities & Investments Commission) | Australia | Regulated | Top-tier regulation. Very strict protections. |

| FSC (Financial Services Commission) | Virgin Islands | Offshore | Lower Protection. This is a common jurisdiction for global clients. Regulations here are looser regarding dispute resolution. |

| MFSA (Malta Financial Services Authority) | Malta | Regulated | Specific to European operations. |

| FCA (Financial Conduct Authority) | United Kingdom | Unverified | High Risk. The broker fails to verify a valid status here, despite the UK being a major financial hub. |

| BAPPEBTI | Indonesia | Unverified | High Risk. The broker does not appear to hold valid authority in this region. |

The Critical Disconnect:

The presence of “Unverified” statuses alongside “Regulated” ones creates a confusing environment.

- The FCA Red Flag: The WikiFX system marks the UK FCA status as Unverified. The FCA is one of the world's strictest regulators. If a broker claims or implies a connection to the UK markets without a verified license, it casts doubt on their overall transparency.

- The Offshore Loophole: The complaints we are seeing likely stem from accounts registered under the Virgin Islands (FSC) license. While legal, this jurisdiction allows brokers more leeway to enforce “Abuse Clauses” that would never hold up under FSCA or ASIC supervision.

Analyzing the “Abuse” Tactic

The $5,000 case mentioned earlier highlights a growing trend in the industry: Generic Abuse Clauses.

In the Terms and Conditions of many brokers, there are vague clauses prohibiting “abusive trading strategies.” Legitimate brokers use this to stop latency arbitrage (cheating the system speed). However, high-risk brokers use these clauses to cancel profits from:

- News trading (profiting from major economic announcements).

- Scalping (holding trades for short periods).

- High-leverage trading that results in a quick win.

If you are an African investor asking “Is Trive safe?”, you must ask yourself: Does my trading style fall into a category they might cancel? The evidence suggests that if you win too quickly or too much, Trive may invoke these clauses to invalidate your success.

WikiFX Intervention

Upon receiving these serious complaints regarding withdrawal problems and fund withholding, the WikiFX exposure team attempted to reach out to Trive's representatives through the contact channels listed (including their South African and UK lines).

Status: No verifiable resolution has been provided for the $5,000 withholding case at the time of writing. The broker has not publicly addressed why the specific evidence of “abuse” was not shared with the client.

Final Verdict: High Score, Hidden Risk

Trive presents a complex case for the African investor. On paper, they appear robust—operating since 2013, offering MT4/MT5 platforms, and holding an FSCA license. This explains their high WikiFX score of 7.91.

However, a high score is based on verified data, not future intentions. The recent influx of complaints regarding profit cancellation indicates a shift in operational behavior.

WikiFX advises the following caution:

- Check your Entity: If you trade with Trive, ensure your account is registered under the South African (FSCA) entity, not the Virgin Islands entity. You have significantly more legal recourse in South Africa.

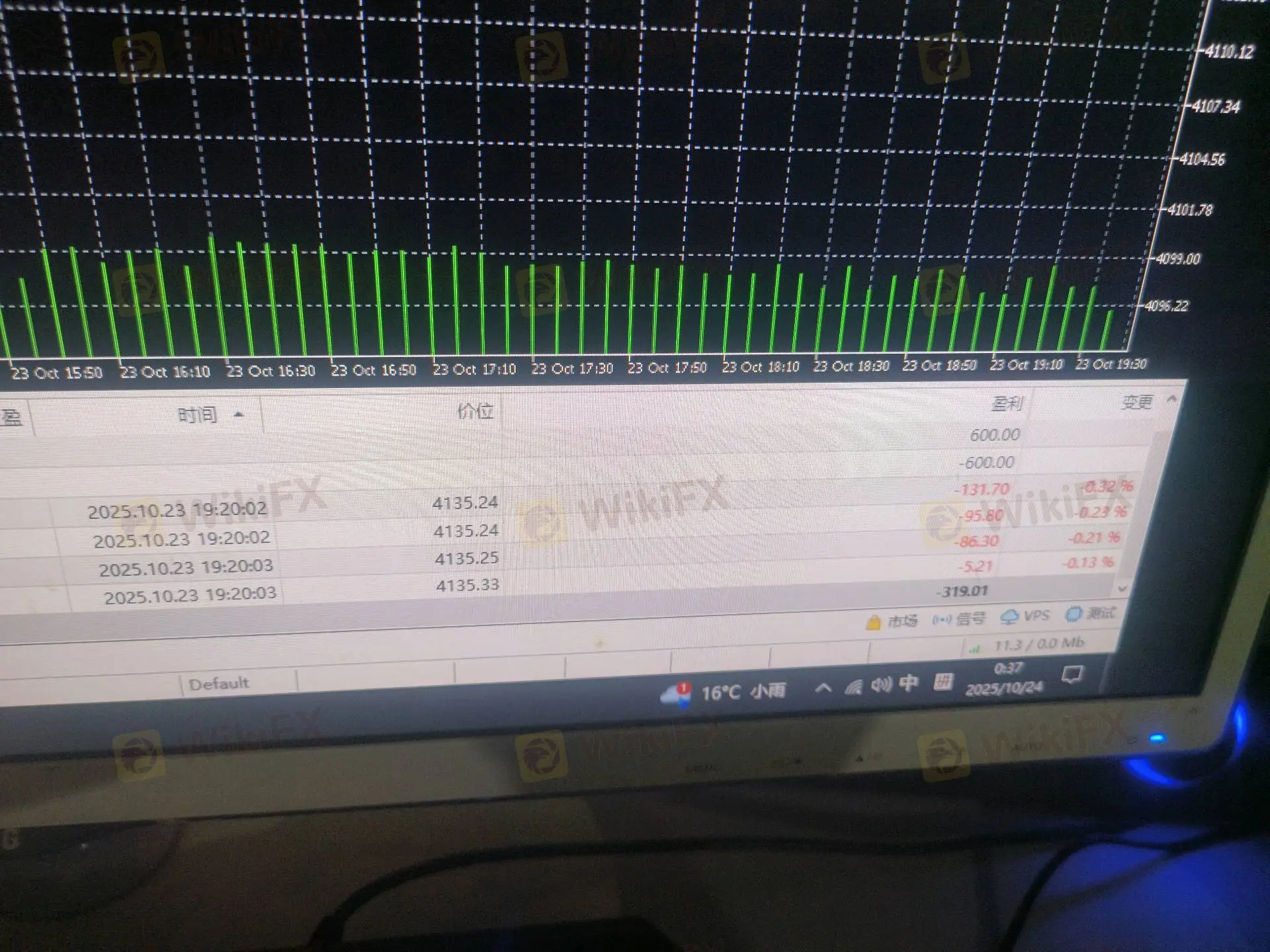

- Document Everything: If you are profitable, take screenshots of your trade execution times and the charts. If you are accused of abuse, you will need this evidence.

- Test Withdrawals: Do not let profits accumulate. Withdraw frequently to ensure liquidity channels remain open.

While Trive is not an unregulated platform, the user experiences suggest that for profitable traders, the risks may currently outweigh the benefits of their regulatory status.

WikiFX Risk Warning

Forex and CFD trading involve a high level of risk and may not be suitable for all investors. The leverage associated with these instruments can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you could sustain a loss of some or all of your initial investment. WikiFX provides broker information for reference purposes only and does not constitute financial advice.

Read more

Merin Regulation Review 2025: Is Merin a Safe and Legitimate Broker?

The online trading industry is filled with both regulated brokers and high-risk offshore platforms. Among them, Merin is a forex broker that recently attracted public attention. As more traders look into Merin, a key question arises: What is the Merin regulation status, and is Merin safe or a potential scam?

Seaprimecapitals Withdrawal Problems: A Complete Guide to Risks and User Experiences

Worries about Seaprimecapitals withdrawal problems and possible Seaprimecapitals withdrawal delay are important for any trader. Being able to get your money quickly and reliably is the foundation of trust between a trader and their broker. When questions come up about this basic process, it's important to look into what's causing them. This guide will tackle these concerns head-on, giving you a clear, fact-based look at Seaprimecapitals' withdrawal processes, user experiences, and trading conditions. Most importantly, we'll connect these real-world issues to the single most important factor behind them: whether the broker is properly regulated. Understanding this connection is key to figuring out the real risk to your capital and making a smart decision.

iFX Brokers Review: Do Traders Face Withdrawal Issues, Deposit Credit Failures & Free Coupon Mess?

Have you had to pay several fees at iFX Brokers? Had your trading profit been transferred to a scamming website, causing you losses? Failed to receive withdrawals from your iFX Brokers trading account? Has your deposit failed to reflect in your trading account? Got deceived in the name of a free coupon? Did the broker officials not help you in resolving your queries? Your problems resonate with many of your fellow traders at iFX Brokers. In this iFX Brokers review article, we have explained these problems and attached traders’ screenshots. Read on!

NinjaTrader Exposed: Why Traders are Calling Out NinjaTrader’s Lifetime Plan & Chart Data

Did NinjaTrader onboard you in the name of the Lifetime Plan, but its ordinary customer service left you in a poor trading state? Do you witness price chart-related discrepancies on the NinjaTrader app? Did you have to go through numerous identity and address proof checks for account approval? These problems occupy much of the NinjaTrader review online. In this article, we have discussed these through complaint screenshots. Take a look!

WikiFX Broker

Latest News

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

Bessent believes there won't be a recession in 2026 but says some sectors are challenged

Is GGCC Legit? A Data-Driven Analysis for Experienced Traders

B2BROKER Gains Investment Bank Status in Labuan

In-Depth Review of INZO Trading Conditions and Product Offering – A Data-Driven Analysis

Merin Regulation Review 2025: Is Merin a Safe and Legitimate Broker?

Rate Calc