In-Depth Review of Stonefort Securities Withdrawals and Funding Methods – What Traders Should Really

Abstract:For any experienced forex and CFD trader, the mechanics of moving capital are as critical as the trading strategy itself. The efficiency, security, and transparency of a broker's funding procedures form the bedrock of a trustworthy, long-term trading relationship. A broker can offer the tightest spreads and the most advanced platform, but if depositing funds is cumbersome or withdrawing profits is a battle, all other advantages become moot. This review provides a data-driven examination of Stonefort Securities withdrawals and funding methods. We will dissect the available information on payment options, processing times, associated costs, and the real-world user experience. Our analysis is anchored primarily in data from the global broker regulatory inquiry platform, WikiFX, supplemented by a critical look at publicly available information to provide a comprehensive and unbiased perspective for traders evaluating this broker.

For any experienced forex and CFD trader, the mechanics of moving capital are as critical as the trading strategy itself. The efficiency, security, and transparency of a broker's funding procedures form the bedrock of a trustworthy, long-term trading relationship. A broker can offer the tightest spreads and the most advanced platform, but if depositing funds is cumbersome or withdrawing profits is a battle, all other advantages become moot.

This review provides a data-driven examination of Stonefort Securities withdrawals and funding methods. We will dissect the available information on payment options, processing times, associated costs, and the real-world user experience. Our analysis is anchored primarily in data from the global broker regulatory inquiry platform, WikiFX, supplemented by a critical look at publicly available information to provide a comprehensive and unbiased perspective for traders evaluating this broker.

Stonefort Securities: A High-Level Overview and Critical Regulatory Scrutiny

Before delving into the specifics of funding, it is essential to understand the operational and regulatory framework of Stonefort Securities. According to WikiFX, the broker has been operating for 1-2 years and is primarily registered in Saint Lucia, a well-known offshore jurisdiction. This offshore status immediately raises the bar for due diligence.

The broker's regulatory profile is complex and presents significant red flags that any serious trader must consider. WikiFX data highlights that Stonefort Securities holds an “Investment Advisory License” (No. 20200000226) from the Securities and Commodities Authority (SCA) in the United Arab Emirates. However, WikiFX issues a stark and critical warning:

“This broker exceeds the business scope regulated by the United Arab Emirates SCA(license number: 20200000226)Investment Advisory Licence Non-Forex License. Please be aware of the risk!”

This is not a minor discrepancy. An Investment Advisory License typically permits a firm to offer financial advice and consultations. It is fundamentally different from a full brokerage license, which is required to hold client funds, execute trades as a principal or agent, and operate as a forex and CFD provider. By offering trading services under an advisory license, the broker is operating outside its regulated permissions. This implies that trader funds may not be subject to the protections, such as segregated accounts or compensation schemes, that a proper brokerage license would mandate.

This regulatory overreach is a primary contributor to the broker's alarmingly low WikiFX score of 3.09 out of 10, accompanied by the explicit advice: “Warning: Low score, please stay away!”

Public information from the broker's own web presence reveals a multi-entity corporate structure, including entities registered in Mauritius (FSC), Saint Lucia (SLC), and St. Vincent and the Grenadines (SVG), in addition to the UAE entity. While a Mauritius FSC license is mentioned on some platforms, the primary registration highlighted by WikiFX is in Saint Lucia, and the most significant regulatory issue remains the misuse of the UAE SCA license. For an experienced trader, this complex web of offshore and mismatched licenses is a significant indicator of heightened counterparty risk.

Unpacking Stonefort Securities' Funding Methods: A Study in Opacity

A transparent broker provides a clear, detailed, and easily accessible list of its funding and withdrawal options, including associated fees and processing times. When examining Stonefort Securities, we encounter a notable lack of clarity.

The detailed broker information on WikiFX, our primary data source, lists the “Depositing Method” and “Withdrawal Method” fields as blank (“--”). This means that as of the latest update, there is no verified, third-party data available on the specific payment channels supported by the broker. For a professional trader, this information gap is a considerable concern, as it prevents a full assessment of the broker's operational infrastructure.

To find any information, we must turn to the broker's own marketing materials and website. According to these public sources, Stonefort Securities claims to offer a range of convenient payment options. Their website states: “Deposit and withdraw funds with ease. Mastercard, Visa, bank transfers and much more. Log in to your client portal for a full list.”

Based on these claims, we can construct a table of purported funding methods, but it must be viewed with caution.

| Funding Method | Claimed Availability (Broker's Website) | Verified by WikiFX |

| Credit/Debit Cards (Visa, Mastercard) | Yes | No Data Available |

| Bank Wire Transfer | Yes | No Data Available |

| E-Wallets / Other Digital Payments | Implied (“so much more”) | No Data Available |

The discrepancy between the broker's marketing promises and the lack of verified data is significant. Experienced traders understand that the client portal is the final source of truth, but the refusal to publicly disclose this fundamental information is a deviation from industry best practices and a potential red flag for transparency. It forces prospective clients to register an account simply to discover basic operational details.

Cost-related Discrepancies

The practical aspects of funding an account— transaction fees and processing times—are critical factors in a trader's decision-making process. Here again, the information surrounding Stonefort Securities is fraught with contradictions and omissions.

Transaction Fees and Commissions

Transparency on costs is non-negotiable for professional traders. The WikiFX data provides no information on deposit or withdrawal fees. Traders should therefore assume that standard costs may apply, including:

• Third-Party Processing Fees: Charges from credit card companies, banks, or e-wallet providers.

• Intermediary Bank Fees: Costs associated with international wire transfers.

• Potential Broker-Side Fees: Without a clear fee schedule, traders cannot rule out the possibility of the broker imposing its own charges on withdrawals.

Processing Times

Official processing times for deposits and withdrawals are not specified in the WikiFX database. Deposits via credit/debit card are typically instant or near-instant with most brokers, while bank transfers can take several business days. Withdrawal times are a more critical metric of a broker's health and integrity. The only available insights into Stonefort's withdrawal speeds come from user-generated reviews, which present a complex and conflicting picture.

The Stonefort Securities Withdrawal Experience: A Tale of Two Narratives

The secondary keyword for this analysis is the “Stonefort Securities funding options withdrawal experience,” and this is where the evaluation becomes most polarized. The available information presents two completely contradictory stories.

Narrative 1: The Glowing (But Unverified) User Reviews

A scan of the user reviews section on Stonefort's WikiFX profile reveals a stream of overwhelmingly positive feedback, with a particular focus on the ease and speed of withdrawals. Comments include:

• “So far, traders find withdrawal issues the most concerning with a broker, and so far, Stonefort has been very smooth in withdrawals.”

• “The platform is smooth, spreads are competitive, and withdrawals are quick and hassle-free.”

• “The payout system is reliable and fast — something every IB truly values.”

• “good broker. fast payouts. quick support.”

• “Stoneforts a great platform, easy to use, packed with assets, and withdrawals are hassle-free.”

These reviews, originating from traders in the UAE, India, and Indonesia, paint a picture of a highly efficient and reliable broker when it comes to processing payments. However, there is a critical caveat that cannot be overlooked: WikiFX marks every single one of these positive reviews as “Unverified.”

This “Unverified” status means that the platform has not been able to confirm that the reviews originate from genuine, funded clients of the broker. While they may be authentic, they could also be part of a coordinated marketing campaign or fabricated entirely. Experienced traders know to treat unverified, anonymous praise with a healthy dose of skepticism, especially when it contradicts objective data.

Narrative 2: The Sobering Reality of Regulatory Risk

The second, more concerning narrative is told by the hard data. The positive withdrawal experiences, even if genuine, exist within the context of a broker with a very low trust score and a major regulatory warning.

The core issue remains: Stonefort Securities appears to be offering forex/CFD brokerage services while its primary listed license (UAE SCA) is for advisory services only. This means that in the event of a dispute over a withdrawal, a trader may have little to no regulatory recourse. The offshore registrations in St. Lucia and St. Vincent and the Grenadines offer notoriously weak investor protection, leaving clients vulnerable if the broker chooses to delay or deny a withdrawal request.

Therefore, the “withdrawal experience” must be viewed through two lenses. The day-to-day experience might be smooth, as the unverified reviews suggest. However, the structural, long-term experience is one of significant risks. A broker's true test is not when things are going well, but when a problem arises. With Stonefort's regulatory setup, a trader facing a withdrawal issue would likely find themselves in a very difficult position. Prudent traders should always cross-reference user reviews with the broker's regulatory status and overall score on platforms like WikiFX to get a complete and balanced picture of the risks involved.

Final Analysis for the Experienced Trader: Weighing Convenience Against Capital Safety

When synthesizing this information, a clear but troubling picture of Stonefort Securities' funding processes emerges. The broker's marketing projects an image of simplicity and efficiency, an image seemingly supported by a chorus of unverified user reviews praising fast payouts.

However, the foundational elements that guarantee long-term safety and reliability are either missing or compromised.

Potential Positives (To Be Viewed with Extreme Caution):

• MT5 Platform: The broker offers the full-license version of the popular MetaTrader 5 platform.

• Positive User Feedback: Unverified reviews consistently highlight a positive customer support and withdrawal experience.

Significant Risks and Red Flags:

• Critical Regulatory Warning: The broker is flagged by WikiFX for operating outside the scope of its UAE license, a major compliance failure.

• Low Trust Score: A WikiFX score of 3.09/10 is a strong quantitative indicator of high risk.

• Offshore Domicile: Primary registration in St. Lucia and other offshore jurisdictions offers minimal protection for client funds.

• Lack of Transparency on Funding: No officially verified list of deposit and withdrawal methods is publicly available.

• Unverified Reviews: The sole source of positive information on withdrawals lacks verification, reducing its credibility.

For the experienced trader, the conclusion is stark. The perceived convenience of “hassle-free withdrawals” is overshadowed by profound structural risks. The lack of regulatory legitimacy for its brokerage activities, the opacity surrounding its funding methods, and the conflicting information on basic account parameters are all hallmarks of a high-risk environment.

While some users may have had positive short-term experiences, the potential for a catastrophic failure in fund safety is substantial. The decision to trade with a broker should never be based on unverified praise alone, especially when it flies in the face of objective regulatory data. Before committing any capital, prudent traders should consult the comprehensive broker profile on WikiFX, where they can examine the latest regulatory updates, user feedback, and detailed scoring to make a fully informed decision. In the case of Stonefort Securities, the data strongly suggests that the risks to capital far outweigh any purported benefits of its funding process.

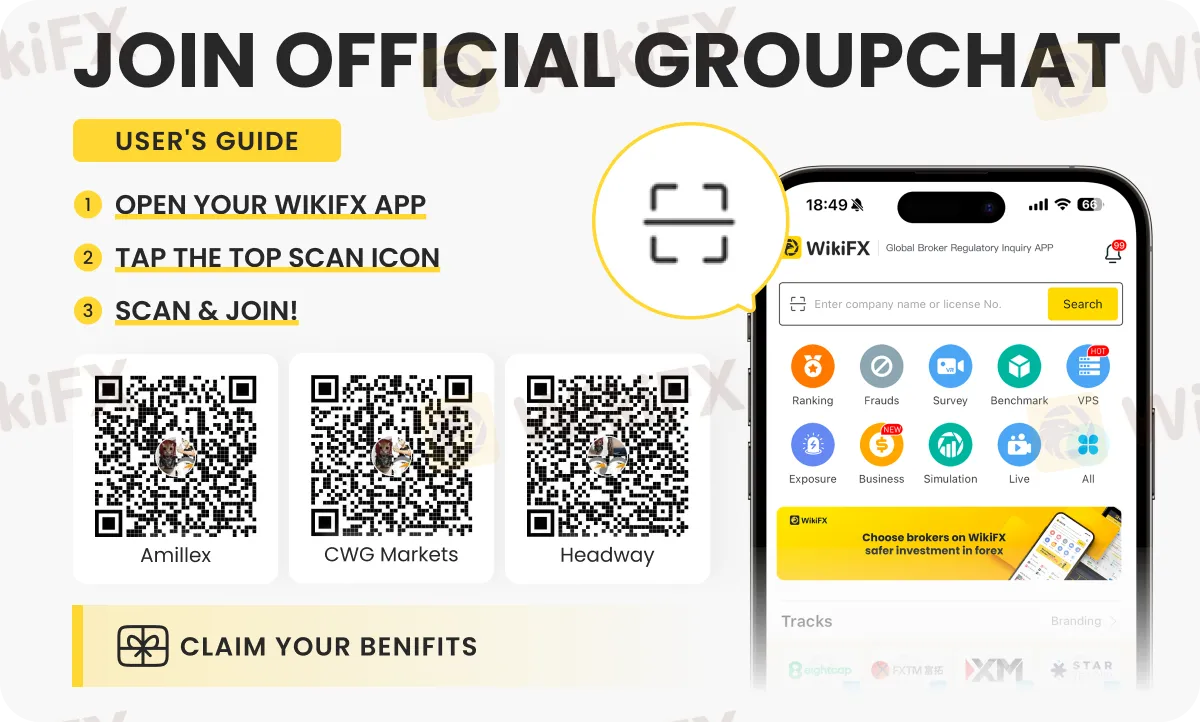

Want to gain the latest forex updates, tips and insights? Join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

Garanti BBVA Securities Exposed: Traders Report Unfair Charges & Poor Customer Service

Have you been financially ruined through chargebacks allowed by Garanti BBVA Securities? Do you have to wait for hours to get your queries resolved by the broker’s customer support official? Did the same scenario prevail when you contact the officials in-person? Failed to close your account as Garanti BBVA Securities officials remained unresponsive to your calls? Many have expressed similar concerns while sharing the Garanti BBVA Securities review online. In this article, we have shared some complaints against the broker. Take a look!

MH Markets Deposits and Withdrawals Overview: A Data-Driven Analysis for Traders

For any experienced trader, the integrity of a broker is not just measured by its spreads or platform stability, but by the efficiency and reliability of its financial plumbing. The ability to deposit and, more importantly, withdraw capital without friction is a cornerstone of trust. This review provides an in-depth, data-driven analysis of the MH Markets deposits and withdrawals overview, examining the entire fund management lifecycle—from funding methods and processing speeds to fees and potential obstacles. MH Markets, operating for 5-10 years under the name Mohicans Markets (Ltd), has established a global footprint. With a WikiFX score of 7.08/10, it positions itself as a multi-asset broker offering a range of account types and access to the popular MetaTrader platforms. However, for a discerning trader, the real test lies in the details of its payment systems and the security of their funds. This article dissects the MH Markets funding methods withdrawal experience, leveraging pr

GAIN Capital Review: Exploring Complaints on Withdrawal Denials, Fake Return Promises & More

Is your forex trading experience with GAIN Capital full of financial scams? Does the broker disallow you from withdrawing your funds, including profits? Have you been scammed under the guise of higher return promises by an official? Does the GAIN Capital forex broker not have an effective customer support service for your trading queries? Concerned by this, many traders have shared negative GAIN Capital reviews online. In this article, we have discussed some of them. Read on!

Zenswealth Broker Review and Regulation Warning

Zenswealth Broker flagged as unregulated. FCA warns investors in latest review.

WikiFX Broker

Latest News

The 350 Per Cent Promise That Cost Her RM604,000

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

"Just 9 More Lots": Inside the Endless Withdrawal Loop at Grand Capital

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

Rate Calc