Kraken Review: A Tale of Unsolved Withdrawal Issues & Poor Customer Support Service

Abstract:Does Kraken disallow you from withdrawing your trading capital, including profits? Does it demand extra deposits in exchange for fund withdrawals? Is the customer support service inept in solving your forex trading queries involving deposits and withdrawals? In this Kraken review guide, we have discussed these complaints. Read on to explore the complaints against the US-based forex broker.

Does Kraken disallow you from withdrawing your trading capital, including profits? Does it demand extra deposits in exchange for fund withdrawals? Is the customer support service inept in solving your forex trading queries involving deposits and withdrawals? In this Kraken review guide, we have discussed these complaints. Read on to explore the complaints against the US-based forex broker.

Explaining the Top Forex Trading Complaints Against Kraken

A Long and Failed Fund Withdrawal Process

A trader recently reported being approached by Kraken‘s officials on completing a series of trading tasks. Each task completion had a certain commission attached to it. The task changed over time from zero to minimum margin requirements. Secondly, to withdraw, you need to keep investing without actually knowing whether you would be able to access your funds. The long trail concerning fund withdrawals understandably left the trader annoyed. The trader vented out by sharing the Kraken review on WikiFX, the world’s leading forex regulation inquiry app. Check out the complaint screenshot below.

Deposit 20% of Total Assets for Withdrawals, The Trader Alleges

A trader even alleged that, to secure fund withdrawals, one needs to deposit as much as 20% of total assets in the Kraken forex trading account. Imagine if the total asset count remains humongous, the 20% deposit amount would be massive in absolute numbers too. Check the complaint screenshot below for confirmation.

Alleged Scams Through Activities

The broker is accused of deceiving traders through activities involving a gift to them. As per a trader, it is simply a ploy to trick traders into depositing funds. After a successful deposit, the Kraken customer support service would say that withdrawal access is possible as deposit requirements are met, and the transaction amount is 50% of the trading account balance. However, despite meeting these requirements, traders never see withdrawals! A trader shared a painful story through this Kraken review.

The Fund Scam Complaint Against Kraken

A trader imposed serious allegations against Kraken, saying that the broker took a heavy 12,000 USD from his bank account and was about to siphon another $5,000 before the client‘s bank stopped it from doing so. The event has also led to the loss of the trader’s earnings worth $5,005. Here is the full complaint against Kraken.

The Poor Customer Support Service Does Not Help Traders Either

The alleged lacklustre approach of Kraken‘s customer support service on pending withdrawals hurt traders the most. Recently, a trader complained that the broker locked his funds despite his verified account. The concerned customer service executive seemed to have swayed away by saying that the department will escalate an email to get his queries resolved. However, as per the trader’s admission, he could not find any emails.

Even after a year, the trader is struggling to catch up with the right executive and is somewhat annoyed with seemingly cliched AI bot messages. Here is a painful recount of the trading journey.

Kraken Review by WikiFX: Score & Regulatory Supervision Status

The above complaints point to a serious operational glitch that often stems from a lack of oversight by competent financial regulators. While investigating Kraken, the WikiFX team found that it is unregulated, proving many traders bad experiences with the broker. The team thus gave Kraken a score of 1.57 out of 10.

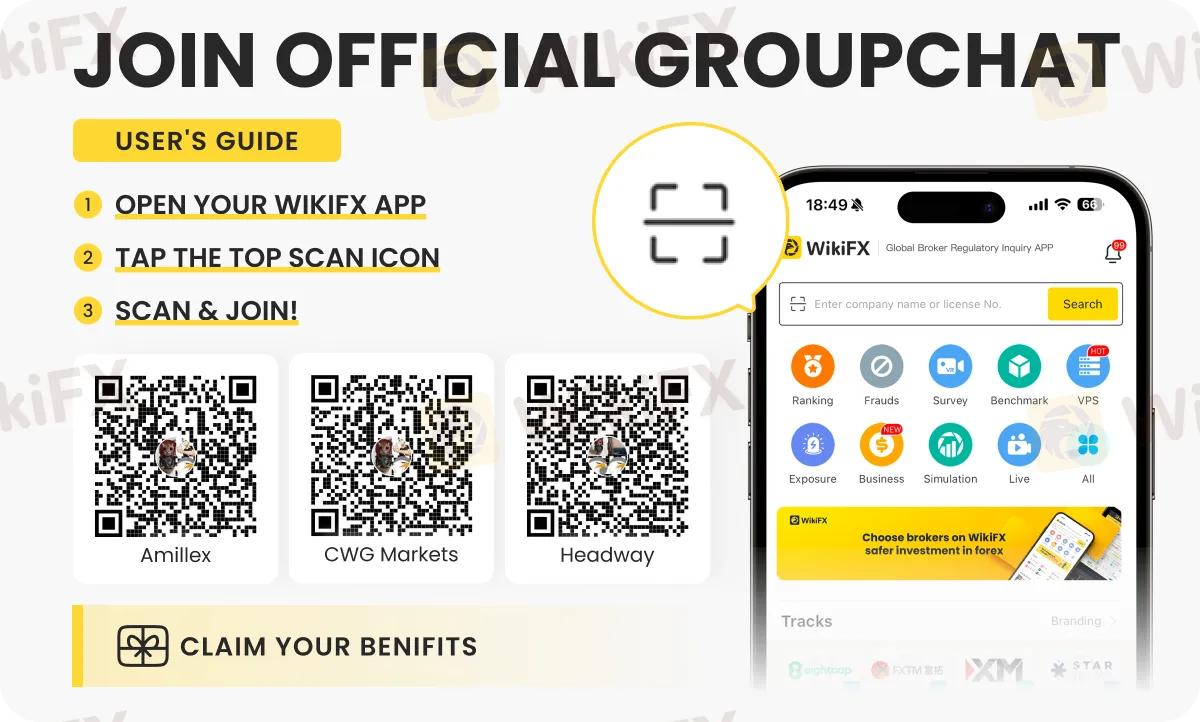

For more forex updates, news, insights and tips, follow us on these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Details of how to join these groups are shown below.

Read more

Check Yourself: The Costly Trading Habits Every Trader Must Fix

Are the trading habits you barely notice the very ones quietly destroying your profits, and could a single overlooked mistake be costing you far more than you realise?

Scandinavian Capital Markets Exposed: Traders Cry Foul Play Over Trade Manipulation & Fund Scams

Does Scandinavian Capital Markets stipulate heavy margin requirements to keep you out of positions? Have you been deceived by their price manipulation tactic? Have you lost all your investments as the broker did not have risk management in place? Were you persuaded to bet on too risky and scam-ridden instruments by the broker officials? These are some burning issues traders face here. In this Scandinavian Capital Markets review guide, we have discussed these issues. Read on to explore them.

Deriv Withdrawal Issues: Real Client Cases Exposed

Deriv exposed via client cases of withdrawal issues, 13‑month refund delays, severe slippage, and disabled accounts despite multiple “regulated” licenses.

Uniglobe Markets Deposits and Withdrawals Explained: A Data-Driven Analysis for Traders

For any experienced trader, the integrity of a broker isn't just measured in pips and spreads; it's fundamentally defined by the reliability and transparency of its financial operations. The ability to deposit and, more importantly, withdraw capital seamlessly is the bedrock of trust between a trader and their brokerage. When this process is fraught with delays, ambiguity, or outright failure, it undermines the entire trading relationship. This in-depth analysis focuses on Uniglobe Markets, a broker that has been operational for 5-10 years and presents itself as a world-class trading partner. We will move beyond the marketing claims to scrutinize the realities of its funding mechanisms. By examining available data on Uniglobe Markets deposits and withdrawals, we aim to provide a clear, evidence-based picture for traders evaluating this broker for long-term engagement. Our investigation will be anchored primarily in verified records and user exposure reports to explain the Uniglobe Mar

WikiFX Broker

Latest News

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

How to Become a Profitable Forex Trader in Pakistan in 2025

CFTC Polymarket Approval Signals U.S. Relaunch 2025

Zipphy Exposed: No Valid Regulation, Risk Warning

KEY TO MARKETS Review: Are Traders Facing Withdrawal Delays, Deposit Issues & Trade Manipulation?

FCA Consumer Warning – FCA Warning List 2025

Australia’s Fraud-Intel Network Exposes $60M in Scams

Malaysia’s SkyLine Guide Top 25 Brokers Are Out!

Rate Calc