KKR Exposed: Traders Allege Fund Scams, Withdrawal Denials & Regulatory Concerns

Abstract:Do you witness a negative trading account balance on the KKR broker login? Does the broker prevent you from withdrawing your funds after making profits? Do you need to pay an extra margin for withdrawals? These trading issues have become common for traders at KKR. In this KKR broker review article, we have elaborated on the complaints. Take a look!

Do you witness a negative trading account balance on the KKR broker login? Does the broker prevent you from withdrawing your funds after making profits? Do you need to pay an extra margin for withdrawals? These trading issues have become common for traders at KKR. In this KKR broker review article, we have elaborated on the complaints. Take a look!

Top Trading Complaints Against KKR You Must Check

The Negative Trading Account Balance Allegation Against KKR

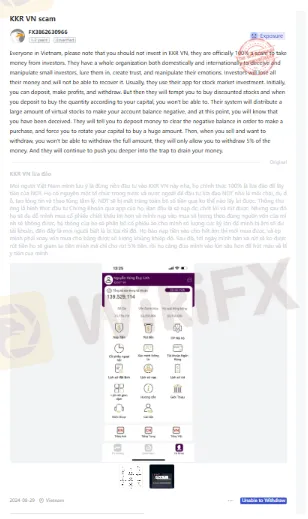

A trader reported that KKR officials let traders deposit funds, make profits and withdraw. Thereafter, these officials will tempt traders to buy discounted stocks. Somehow, you are able to buy the required quantity based on your capital reserve. Knowing this, the officials will distribute a large number of stocks to push your trading account balance into the negative zone. The trader alleged that, at this point, KKR tells traders to deposit to clear the negative balance and make a fresh purchase. Check out the comprehensive KKR review by the trader.

Withdrawal Denials After Making Profits, Say the Trader

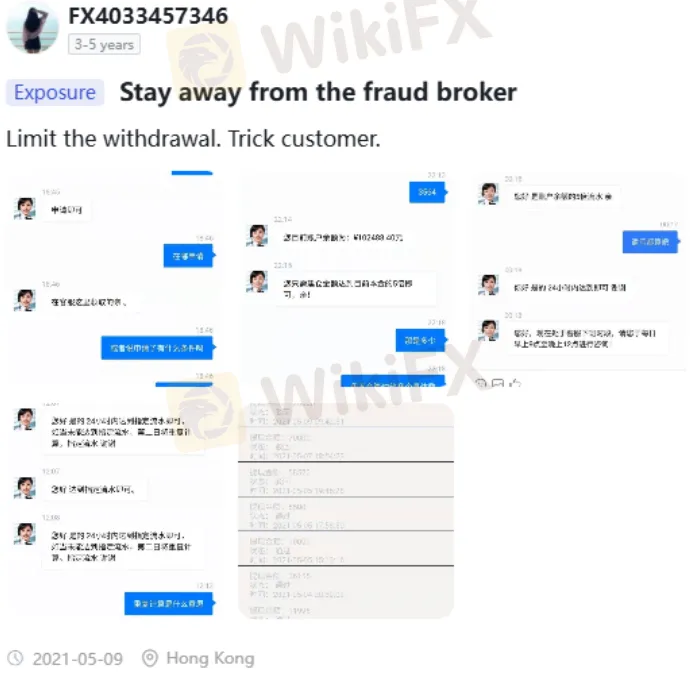

A trader complained that KKR did not allow him to withdraw funds after earning profits. Imagine the numerous strategies and the swift approach the trader had employed to earn those profits. Hearing NO for withdrawals after all these efforts annoyed the trader, who vented out by sharing this complaint on WikiFX, a leading forex broker regulation inquiry app. Check out the complaint below.

The Limited Withdrawal Access Claim

In another revelation, a trader alleged that KKR tricks many traders into investing on its platform. To make it complicated, the broker limits the withdrawal access. Meted out an experience of this kind, the trader shared the KKR broker review online. Lets check it out!

KKR Broker‘s Dubious Stance on Regulatory Supervision

The KKR broker is alleged to have a dubious stance on the company’s regulatory status. According to a trader, its officials sometimes claim that the FCA regulates it. Other times, the officials say that it is regulated by the CBRC, the trader said. However, the trader acknowledged that Wiki Global has detailed its regulatory status. You can know about this right below.

KKR Broker Review: Check Score & Regulatory Status

The complaints against the KKR broker point to a serious operational glitch that stems from a lack of regulatory oversight. The investigation by the WikiFX team found no license for KKR despite its operational presence spanning more than five years. As a result, the team gave the KKR broker a score of 1.54 out of 10.

Want to stay updated about the latest forex trends and news? Join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) today.

Read more

Saxo Bank Review 2025: Regulatory Status and Safety Score

Saxo Bank, established in 2001, is a prominent financial services provider with a significant global footprint. With a high WikiFX Score of 8.02 and an Influence Rank of AA, the broker is one of the more established players in the market. The company operates with a heavy focus on multiple jurisdictions, offering support in over 38 languages.

IUX Review 2025: Regulatory Status and Withdrawal Complaints

IUX (also known as IUX Markets) is a forex and CFD broker established in 2019 with its headquarters in Mauritius. The broker has gained visibility in regions such as the UAE, Australia, Brazil, and parts of Europe, achieving a WikiFX Score of 6.08. While the broker holds licenses from reputable authorities like ASIC and FSCA, recent data indicates a significant volume of user complaints regarding fund security and operational issues.

Trive Review 2025: Is This Broker Safe or a Scam Warning?

Trive (formerly known or associated with Trive International Ltd) is a Virgin Islands-based brokerage established in 2013. With over a decade of history, the broker markets itself as a multi-asset trading provider offering global access to financial markets. The platform holds a corporate score of 7.91, suggesting a relatively established market presence.

SixTrading Review 2024: Is This Unregulated Broker Safe?

SixTrading is a forex and CFD broker established in 2021 and headquartered in China. The company positions itself as a digital-first trading provider offering multiple account tiers to suit different investment levels. However, despite its modern branding, the broker holds a WikiFX score of 1.53/10, a rating that typically indicates significant risk due to a lack of verified regulatory oversight.

WikiFX Broker

Latest News

Libertex Investigation: When "Expert Advice" Leads to Total Ruin

Change Review: The Broker Faces Massive Complaints on KYC Goof-ups and Fund Blocks

FINRA Imposes $150,000 Fine on Kingswood Capital Partners Over Supervisory Failures

A Collapse In Germany's Chemical Sector Is A Bad Omen

Is CICC Broker Safe? CICC Regulation Check & In-Depth Review

Deriv Review: Is This Popular Broker Legit or Risky?

EZINVEST Exposure: When a "Personal Advisor" Becomes Your Portfolio’s Worst Enemy

FXORO Under the Microscope: Revoked Licenses and The "Advisory" Trap

XXLMARKETS Review: Regulatory Status and Trading Conditions

IUX Review 2025: Regulatory Status and Withdrawal Complaints

Rate Calc