MIFX Regulation, Is This Indonesian Broker Safe?

Abstract:MIFX is a regulated Indonesian broker with STP licenses from BAPPEBTI, JFX, and ICDX. Learn how its oversight protects traders and ensures compliance.

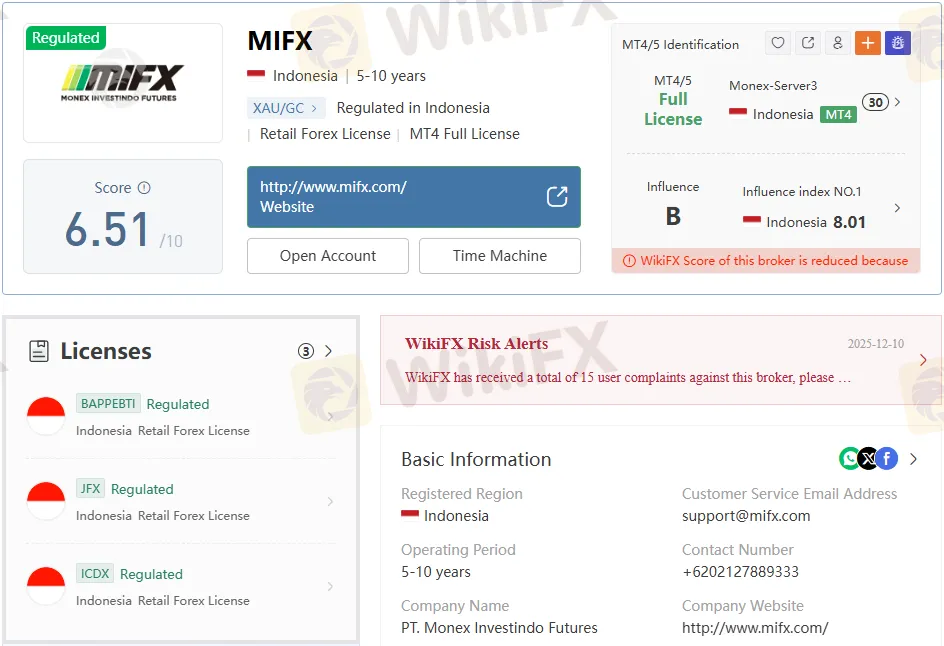

Monex Investindo Futures (MIFX) is a regulated Indonesian futures broker operating under the oversight of three major regulatory bodies: BAPPEBTI, the Jakarta Futures Exchange (JFX), and the Indonesia Commodity and Derivatives Exchange (ICDX). Founded in 2000, MIFX has built a reputation for legal compliance and operational transparency in the Indonesian financial markets.

Regulatory Licenses and Oversight

Holds multiple licenses that reinforce its legitimacy:

- BAPPEBTI License

- License No.: 178/BAPPEBTI/SI/I/2003

- Issue Date: January 28, 2003

- Regulatory Status: Active

- Jakarta Futures Exchange (JFX)

- License No.: SPAB-104/BBJ/12/03

- Issue Date: December 19, 2003

- Indonesia Commodity and Derivatives Exchange (ICDX)

- License No.: 036/SPKB/ICDX/Dir/III/2010

- Issue Date: March 19, 2010

These licenses confirm MIFXs compliance with Indonesian regulatory standards, making it one of the few brokers with triple oversight.

MIFX Broker Profile and Domain Transparency

- Company Name: PT. Monex Investindo Futures

- Website: monexnews.com

- Domain Registered: Indonesia (.com domain)

- Email: support@monexinvestindo.com

- Phone: +62-21-3150607

- Office Address: Menara Ravindo Lt. 8, Jl. Kebon Sirih Kav. 75, Jakarta 10340

Regulation is backed by long-standing domain presence and consistent regulatory updates.

Account Types and Trading Conditions

MIFX offers two distinct live account types:

| Account Type | Min Deposit | Spread From | Leverage | Platform | Commission/Lot |

| Ultra Low | $500 | 0.3 pips | 1:100 | MT4/MT5 | $10 |

| Standard | $500 | 1.8 pips | 1:100 | MT4/MT5 | $1 |

Trading Instruments and Market Access

MIFX provides access to:

- Forex: Major, minor, and exotic pairs

- Gold & Silver: Competitive spreads on precious metals

- Oil: Crude oil and energy derivatives

- Indices: Global index trading

This diversified product suite positions MIFX competitively against regional brokers.

Platform Availability and App Support

MIFX supports MetaTrader 4 across:

- Windows

- Mac

- iOS

- Android

This cross-platform compatibility ensures traders can operate seamlessly across devices.

Pros and Cons of MIFX

Pros:

- Triple regulation (BAPPEBTI, JFX, ICDX).

- Competitive spreads on Pro Account.

- MT4 platform with full device support.

- Transparent licensing and office documentation.

Cons:

- High minimum deposit for Pro Account ($10,000).

- Fixed spreads on the Standard Account may deter scalpers.

Competitor Comparison

Compared to other Indonesian brokers:

- MIFX offers broader regulatory coverage than single-license brokers.

- Its Pro Account spread (0.2 pips) is tighter than many regional competitors.

- MT4 support is standard, but MIFXs mobile app integration is more robust.

Bottom Line: MIFXs Regulatory Strength

Monex Investindo Futures stands out in the Indonesian brokerage landscape due to its triple regulatory licensing, transparent operations, and competitive trading conditions. For traders seeking a regulated broker with diverse instruments and platform flexibility, MIFX Regulation offers a strong value proposition.

Its long-standing presence since 2000 and consistent oversight by BAPPEBTI, JFX, and ICDX make MIFX a legitimate and safe choice for futures trading in Indonesia.

Read more

B2CORE Update Enhances Forex Broker Operations and CRM Systems

B2BROKER updates B2CORE CRM with new features and improved UX for forex brokers, offering better mobile access and multilingual support.

CMC Markets Expands with Warsaw Office and Bermuda Licence

CMC Markets strengthens global presence with new Warsaw office, Bermuda licence, and vigilance amid rising phishing scams in Australia.

Is Classic Global Ltd Safe? A Simple Risk Review

Classic Global Ltd says it's a modern online trading company that lets people trade currencies and other financial products available worldwide. But like any financial company, especially ones that work only online, we need to ask important questions: Can we trust them? Is our capital safe with them? This article will give you a clear and fair look at the risks associated with Classic Global Ltd. We'll check if it is properly licensed, look at the company background, and see what other users have said about them using information anyone can find online. Our goal isn't to judge quickly, but to dig deep into the facts and highlight possible dangers for people thinking about using this trading platform.

Is Classic Global Ltd Regulated? Finding Out the Truth About Their License Claims

Selecting a regulated broker is the first and most crucial step for any trader seeking financial security. Regulation creates rules for accountability, protects clients’ capital, and resolves disputes. Classic Global Ltd is an online forex and CFD broker that makes certain claims about following rules and being registered. However, these claims need careful and independent checking. This article examines the company's registration, its claimed regulatory oversight, and what independent reviews and user experiences show. Taking an active approach to research is essential in today's market. A simple Classic Global Ltd license check can be the difference between a safe trading experience and losing a lot of capital. This investigation aims to provide the clarity needed to make a smart decision.

WikiFX Broker

Latest News

The "Arbitrage" Accusation: How Winning Trades Turn Into Account Reviews at ACY Securities

IC Markets Formula 1 Partnership Debuts at Abu Dhabi GP 2025

The TikTok Scam That Cost a Retiree Nearly RM470,000

QuickTrade Review: Multiple Reports of Account Freezes and Login Failures by Users

Is Tauro Markets Safe? A 2025 Deep Look into Its Risks and Openness

CommSec Regulation, Login Information & User Review : A Comprehensive Review

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

FCA Waning list of Unauthorised firms

The "Invalid Profit" Trap & The Withdrawal Maze: A Deep Dive into MultiBank Group

BLITZ finance Review 2025: Is It a Scam? License and Safety Evaluation

Rate Calc