Equiti Regulation: Compliance and Licensing Info

Abstract:Equiti regulation includes CySEC, Cyprus, FCA UK, and FSA Seychelles. Review broker accounts, leverage, and platforms.

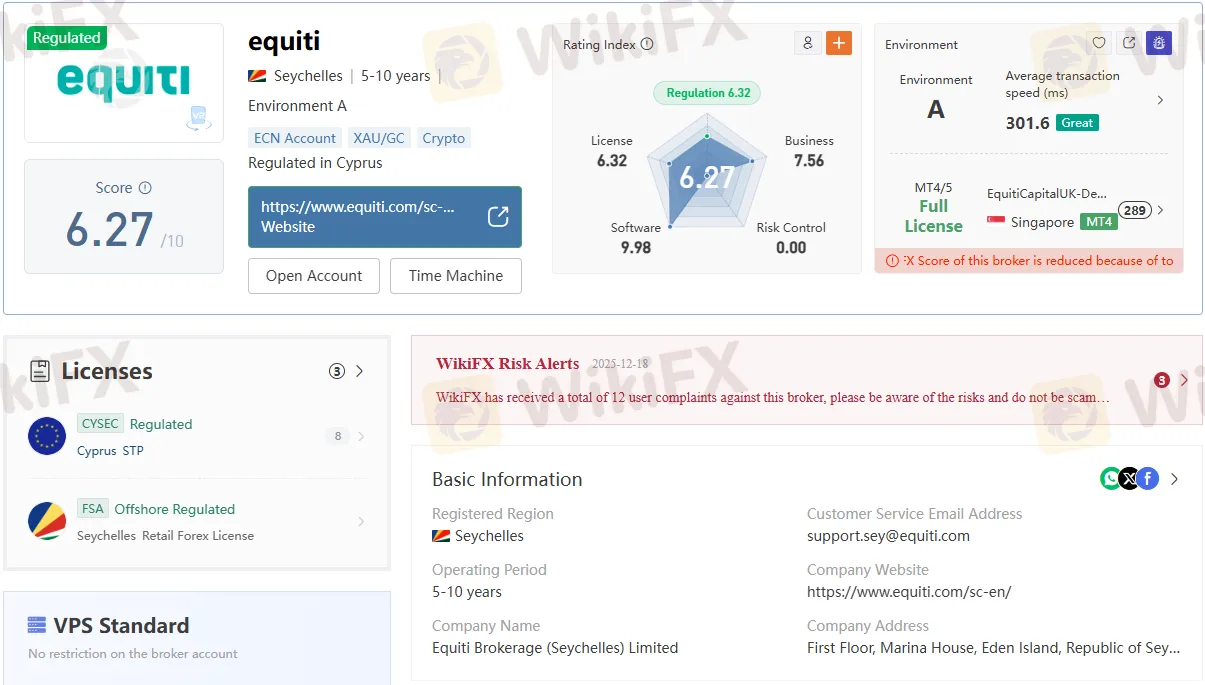

Equiti Regulation combines EU, UK, and offshore licences, giving the broker broad market access but exposing clients to different levels of protection depending on which entity they use. The latest FCA register extract confirms that Equiti Capital UK Limited is fully authorised, correcting earlier claims that its UK status was unclear.

Equiti Regulation Overview

Equiti Global Markets Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) as a Straight Through Processing (STP) broker under licence 415/22, with permissions passported into several EU and EEA countries. The Cypriot office is located at Spyrou Kyprianou 82, EUROHOUSE Building, Limassol, and has been physically verified in 2024 inspections.

Equiti Brokerage Seychelles Ltd holds a Retail Forex Licence from the Seychelles Financial Services Authority (FSA) under number SD064, operating from the First Floor, Marina House, Eden Island. Site checks in 2022 confirmed the Seychelles office exists, but as an offshore regulator, the FSA offers weaker investor safeguards than CySEC or the FCA.

FCA Authorisation: Equiti Capital UK Limited

The updated FCA Financial Services Register entry shows Equiti Capital UK Limited as an authorised firm with reference number 528328. Its registered address is 1st Floor, 11 Ironmonger Lane, London EC2V 8EY, with contact email compliance@equiti.com, phone +44 20 7070 7042, and website www.equiticapital.co.uk.

The firm has held authorised status since 27 April 2011 and is listed as “Regulated”.

Corporate Footprint and Domains

Equiti Brokerage Seychelles Limited is incorporated under Seychelles law with registration number 8428558‑1 and markets itself as a global provider of bespoke Forex and CFD liquidity. Group‑related domains include equiti.com and various regional extensions such as equiti‑me.com and equiti‑sey.investments, indicating a multi‑hub structure centred on Seychelles but complemented by Cypriot and UK regulatory gateways.

Trading Instruments and Platforms

Across the group, Equiti Broker offers CFDs on forex pairs, indices, commodities (including gold and energy), digital currencies, shares, and ETFs, with no support for bonds, options, or mutual funds. Trading is delivered primarily through MetaTrader 4 and MetaTrader 5, plus mobile applications like Equiti Trader and Equiti Gold, backed by more than 30 MT4/MT5 servers and average execution speeds around 132.59 ms.

Both MT4 and MT5 follow the New York close, running on GMT+3 in summer and GMT+2 in winter, and are available on desktop, web, and mobile, with integrated analytics, news, and push notifications. This infrastructure puts Equiti Broker in line with other high‑leverage CFD providers that focus on MetaTrader as their main platform.

Account Types and Trading Conditions

Equiti offers two main live accounts: Standard and Premier.

- The Standard account has no minimum deposit, average spreads from 1.4 pips, leverage up to 1:2000, zero commission, and access to MT4, MT5, and MQ WebTrader, aimed at new to intermediate traders.

- The Premier account requires a $100 minimum deposit, offers spreads from 0.0 pips, the same 1:2000 maximum leverage, and a commission of $3.5 per lot per side, targeting high‑volume or professional users.

A free MT5 demo account with $10,000 in virtual funds and a 90‑day validity allows traders to test strategies under live‑market conditions without risking capital.

Funding, Fees, and Client Money

Clients can fund Equiti accounts via credit cards (Visa, Mastercard), international and local bank transfers, Neteller, Skrill, and various local and crypto solutions, in a wide range of currencies from USD and EUR to ZAR. Deposits are generally instant for cards and e‑wallets, while bank transfers may take one to five working days; withdrawals typically complete within one to three working days, with bank withdrawals sometimes attracting fees of up to $30.

Equiti states that client funds are kept in segregated bank accounts in line with FSA rules and are not used for operational purposes, a standard separation that supports Equiti Regulation claims about safeguarding client money.

User Complaints and Practical Risk

Despite its regulatory footprint, Equiti Broker has accumulated a notable number of negative user reports focused on withdrawals and balance adjustments. Traders describe withdrawal channels being disabled after submitting requests, long delays with no substantive response from customer service, and account debits attributed to “system abuse” without detailed explanations, including one case citing a $2,365.41 deduction and trading privileges being revoked.

Out of 22 reviews referenced, 14 are labelled exposure or complaint cases, mostly from clients in China with one to five years of trading experience, signalling an elevated operational‑risk perception in some regions. These reports do not prove misconduct, but they warrant caution, especially when dealing with the Seychelles entity, where recourse options are more limited than under CySEC or the FCA.

Pros and Cons Under Equiti Regulation

Pros

- Tri‑jurisdictional oversight: CySEC (EU), confirmed FCA authorisation in the UK, and FSA Seychelles for offshore operations.

- Competitive conditions with up to 1:2000 leverage, tight spreads on Premier accounts, and $0 minimum on Standard accounts.

- Strong platform offering via MT4/MT5 and proprietary apps, with reasonably fast execution and broad CFD coverage.

Cons

- Significant volume of complaints about withdrawals and unexplained balance changes, with slow or absent customer support in some cases.

- An offshore FSA licence provides weaker investor protection compared with CySEC and FCA standards, particularly around dispute resolution.

- Very high leverage increases the likelihood of rapid losses for inexperienced clients, despite the formal Equiti Regulation framework.

Bottom Line on Equiti Broker

Equiti Regulation now clearly includes a fully authorised FCA entity, Equiti Capital UK Limited, alongside CySEC and FSA Seychelles licences, giving the group a more robust regulatory profile than many offshore‑only brokers. Nevertheless, the concentration of withdrawal‑related complaints and the reliance on an offshore structure for some operations mean traders should carefully choose which entity they sign with, verify the exact protections available, and start with limited exposure until service reliability is proven over time.

Read more

GMI Markets Announces Global Closure After 16 Years of Operation

GMI Markets, an FCA‑regulated forex broker, will cease global operations on Dec 31, 2025. Clients must withdraw funds by January 31, 2026.

TrueFX Review: Traders Report Inaccurate Forex Signals & Regulatory Issues

Losing trades due to misleading forex signals on the TrueFX platform? Followed all the instructions, yet you received losses? Have you been lured into trading with TrueFX because of the NFA-registered claim on its website? Many have reported these trading concerns online. In this TrueFX review article, we have discussed these complaints. Take a look!

SquaredFinancial Ends CySEC CIF License Operations

Cyprus broker SquaredFinancial winds down CySEC CIF license, shifting FX broker and CFDs clients amid regulatory transition.

GMI to Stop Global Operations from Dec 31, 2025; Don’t Miss the Final Withdrawal Deadline

Taking the financial market by surprise, GMI, one of the leading global forex and CFD brokers, announced its intention to close its global operations from December 31, 2025. Since the official shutdown announcement, traders have been concerned about the status of fund deposits and withdrawals. They have understandably been searching for answers to these questions amid this announcement made by the group. Read on as we share with you key details emerging from the development.

WikiFX Broker

Latest News

The "Broker Group" Abyss: How OmegaPro Trapped Thousands in a Digital Dead End

FXORO Under the Microscope: Revoked Licenses and The "Advisory" Trap

XXLMARKETS Review: Regulatory Status and Trading Conditions

IUX Review 2025: Regulatory Status and Withdrawal Complaints

Saxo Bank Review 2025: Regulatory Status and Safety Score

AmariFX Review: Traders Annoyed by Slippage, Login & Withdrawal Issues

Vida Markets Regulation and Broker Review

Headway Broker Regulation and User Reviews

MBFX Review: Withdrawal Denials, Fund Scams & Poor Customer Support Service

Show This to Your Elderly Loved Ones | Online Scams Are Emptying Seniors’ Life Savings

Rate Calc