Common Questions About Plus500: Safety, Fees, and Risks (2025)

Abstract:When you look for a broker with global recognition, Plus500 usually pops up near the top of the list. Founded in 2010 and boasting a massive international footprint, they are one of the most visible brands in the online trading space. However, flashing banners and sports sponsorships don't always equate to a smooth experience for the average retail trader.

When you look for a broker with global recognition, Plus500 usually pops up near the top of the list. Founded in 2010 and boasting a massive international footprint, they are one of the most visible brands in the online trading space. However, flashing banners and sports sponsorships don't always equate to a smooth experience for the average retail trader.

With a high WikiFX Score of 8.11, the data suggests Plus500 is a legitimate heavy hitter in the industry. But big corporations often come with strict bureaucratic hurdles. Is their proprietary platform right for you, or is it too restrictive? And why are some users complaining about “stuck” funds? We reviewed the regulatory data and user feedback to give you a clear picture.

Is Plus500 actually regulated?

Yes, Plus500 is heavily regulated. In fact, they hold arguably one of the strongest regulatory portfolios in the entire CFD industry.

Unlike many brokers that rely solely on a single Caribbean license to operate globally, Plus500 has secured authorization from top-tier watchdogs across multiple continents. According to regulatory filings, their entities include:

- United Kingdom: Authorized by the FCA (Financial Conduct Authority) - License No. 509909.

- Australia: Regulated by ASIC - License No. 417727.

- Cyprus: Regulated by CySEC - License No. 250/14 (covering Europe).

- Singapore: Licensed by the MAS.

- Japan: Regulated by the FSA.

- Others: Israel (ISA), Canada (CIRO), New Zealand (FMA), Dubai (DFSA), and the UAE (SCA).

Why does this matter to you?

Holding licenses from the FCA and ASIC is the “gold standard” of fund safety. These regulators enforce strict rules on Segregation of Funds. This means Plus500 must keep your trading capital in separate bank accounts from their own operational funds. If the company were to go bankrupt, your money cannot be used to pay their debts.

Additionally, top-tier regulators require brokers to participate in compensation schemes (where applicable by local law) and maintain strict capital reserves. While Plus500 does have offshore entities in the Bahamas (SCB) and Seychelles (FSA) for certain global clients, the heavy oversight from the UK and Australia provides a significant “halo effect” of legitimacy to the brand.

What problems are users reporting?

Despite the high safety score and regulatory status, user feedback paints a picture of friction, particularly regarding withdrawals and account verification. A recurring theme in the complaints is that Plus500s strict compliance protocols often feel like “stalling” to the end user.

The “Endless Verification” Loop

One serious complaint involves a user from China/Hong Kong who has been waiting over a month for a withdrawal. The user reported that after providing income proof, Plus500 demanded further documents, including bank flow statements and address proof. Even after complying, the audit process dragged on without a clear timeline.

Bonus and Promotion Confusion

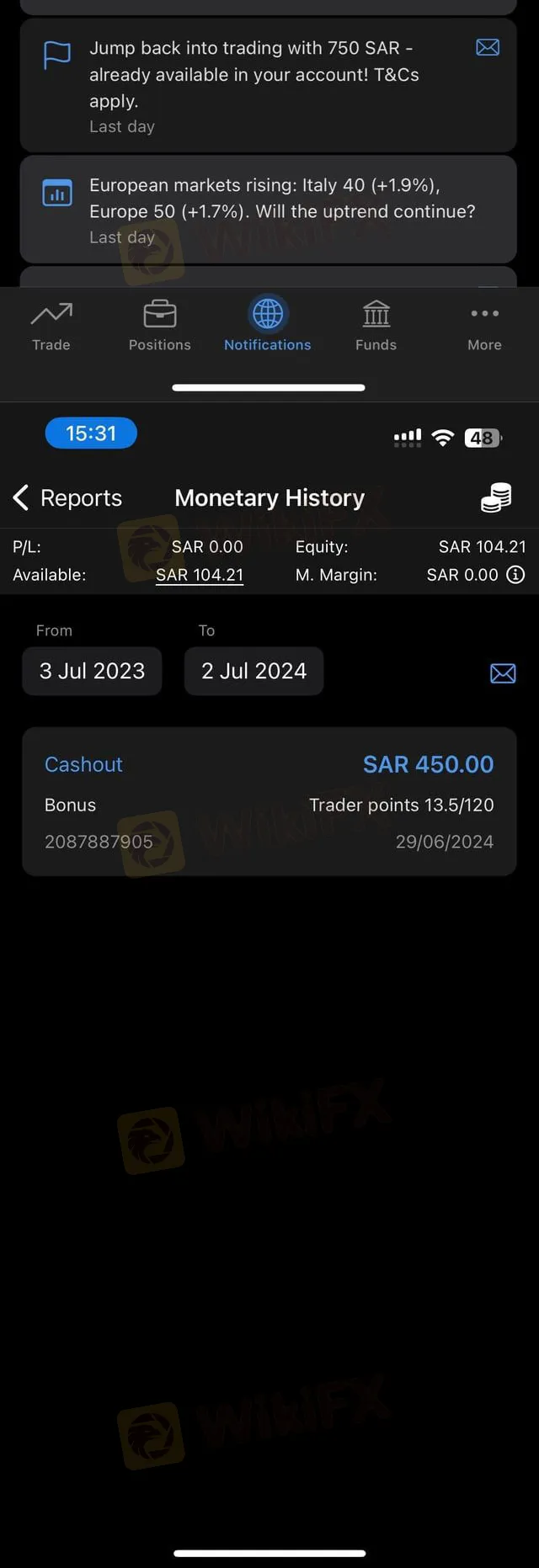

Another user from the United States labeled the broker a “scam” due to a discrepancy in promotional funds. The user claimed they were promised 750 Sr (approx. $200) for trading and gaining points, but only 450 was deposited. When they queried the difference, they felt the support team was evasive. This highlights the importance of reading the fine print on trading bonuses—terms are often complex and tied to volume requirements holding legitimate withdrawals back.

Withdrawal Blocks

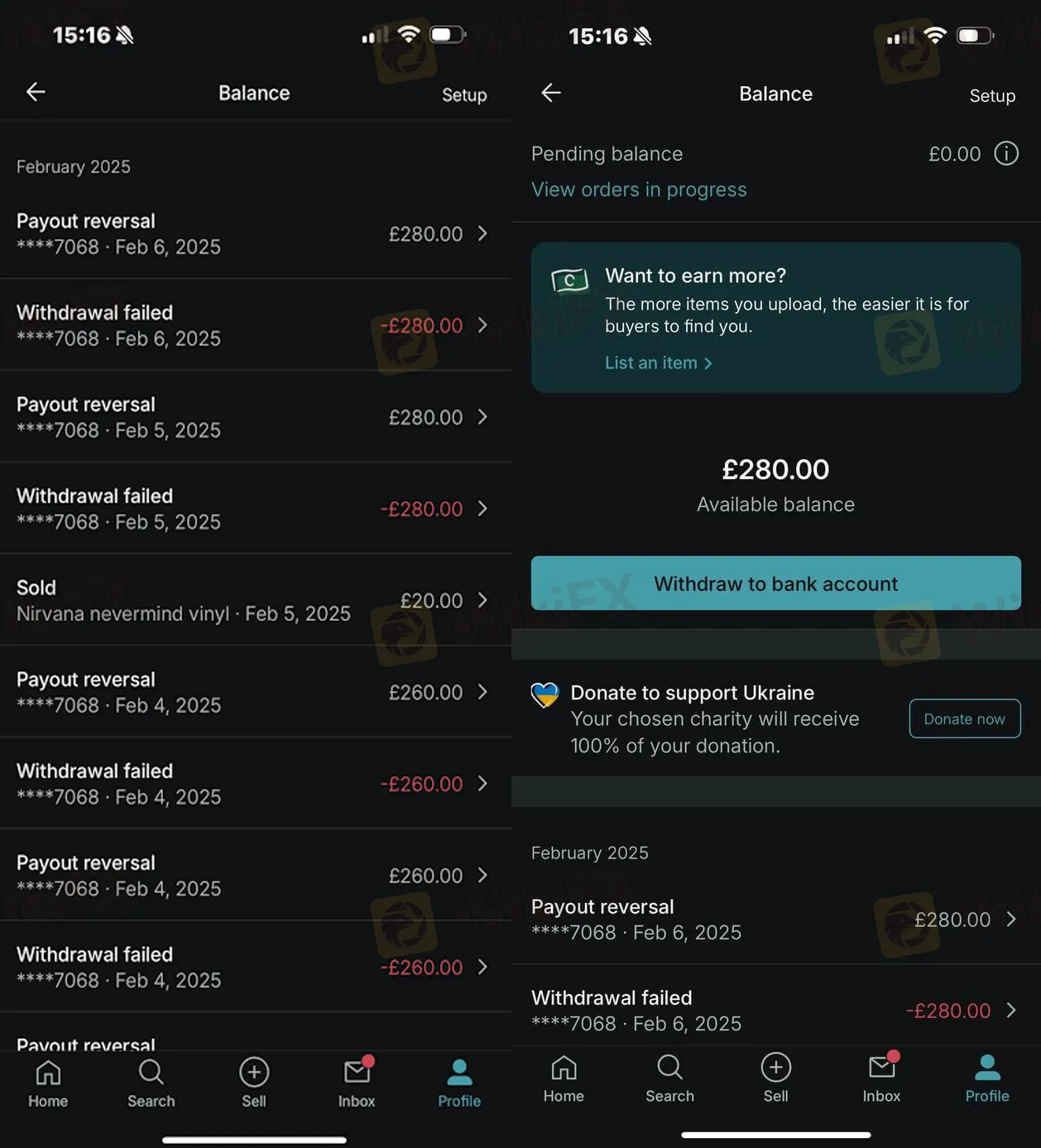

In a separate case, a user reported having £280 in their balance but being unable to withdraw or spend it despite passing verification checks. They noted that they had written two statements to support with “no response.” While Plus500 is a legitimate company, these reports suggest that their automated systems or strict anti-fraud triggers might occasionally flag innocent accounts, leading to frustration.

What trading conditions does Plus500 offer?

Plus500 is distinct from the majority of the market because they do not rely on third-party software like MetaTrader.

Software: The “Walled Garden” Approach

If you are looking for MT4 or MT5, you will not find them here. Plus500 uses a proprietary (self-developed) trading platform.

- The Good: The interface is clean, intuitive, and designed specifically for their system. It is excellent for beginners who find MetaTrader clunky.

- The Bad: You cannot use Expert Advisors (EAs), custom indicators, or automated trading scripts. If you are an algorithmic trader, this platform is likely a dealbreaker.

- Mobile: They offer highly rated native apps for iOS and Android, focusing heavily on mobile accessibility.

Spreads & Costs

Plus500 generally operates on a “zero commission” model where the cost is built into the spread. While specific live spreads fluctuate, proprietary platforms allow the broker to have total control over the price feed. Without an external bridge (like on MT4), you are relying entirely on their internal data aggregation.

Leverage & Risks

As a globally regulated broker, leverage depends entirely on where you live.

- UK/Australia/Europe Clients: You will likely be capped at 30:1 for major forex pairs due to regulatory protections.

- Offshore Clients: Clients registering under the Bahamas or Seychelles entities may access higher leverage, but this comes with significantly higher risk and fewer investor protections.

Bottom Line: Should you trust Plus500?

Plus500 is a legitimate, public powerhouse in the CFD world. With regulation from the FCA, ASIC, and CySEC, and an establishment history dating back to 2010, they are not a “fly-by-night” scam operation. The WikiFX Score of 8.11 reflects this strong legal standing.

However, “Safe” doesn't always mean “Easy.” The strict compliance that makes them safe can also make them frustrating. If you trigger a security check or fail to provide the exact document they want for a withdrawal, your funds may be held until you satisfy their legal department. Furthermore, the lack of MT4/MT5 limits this broker to manual traders who prefer a simplified interface over advanced technical tools.

Recommendation: Ideal for manual traders who prioritize fund safety over advanced technical features. Be prepared for rigorous identity checks.

Markets change fast. Clone firms often try to impersonate big brands like this one. To verify you are on the correct website and view their live license status, search for Plus500 on the WikiFX App before making a deposit.

Read more

Common Questions About ExpertOption: Safety, Fees, and Risks (2025)

ExpertOption presents itself as a sleek, modern trading platform with a low barrier to entry, attracting significant attention across social media and search engines. With its proprietary app and promises of easy profits, it’s no surprise many beginners are tempted to sign up. However, flashy interface design often hides fundamental risks.

【WikiEXPO Global Expert Interviews】Robert Hahm: From Asset Management to AI Innovation

As WikiEXPO Dubai concludes successfully, we had the pleasure of interviewing Robert Hahm, the Founder and CEO of Algorada. Robert Hahm is a seasoned financial executive who has successfully transitioned from managing traditional assets to founding a cutting-edge fintech platform. As the Founder and CEO of Algorada, he leverages decades of experience in portfolio management to bridge the gap between financial domain knowledge and the power of AI.

Biggest 2025 FX surprise: USD/JPY

It has been a bearish year for the US dollar, but the biggest surprise has been the USD/JPY pair for me in the FX space. By Christmas eve, the Dollar Index (DXY) was down 9.6% year-to-date, trading around 98.00, its weakest level since 2022.

Common Questions About Exnova: Safety, Fees, and Risks (2025)

If you are browsing social media or trading forums in regions like Latin America or Southeast Asia, you have likely come across ads for a broker named Exnova. They are currently experiencing a surge in popularity, holding an "A" ranking in Influence according to our data, with significant traffic coming from Mexico, Brazil, Colombia, and Indonesia.

WikiFX Broker

Latest News

The "Paper Money" Lie: Why Your Demo Win Streak Means Nothing

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Fake Government Aid Scams Are Wiping Out Elderly Savings

Voices of the Golden Insight Award Jury | Dennis Yeh, Head of Asia Pacific Region at Taurex

JPMorgan Chase Eyes Crypto Trading for Institutional Clients

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

JPY Forecast: Japan Raises Debt Cost Assumption to 30-Year High

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Rate Calc