Zeven Global Review: WikiFX Risk Warning and Key Investor Considerations

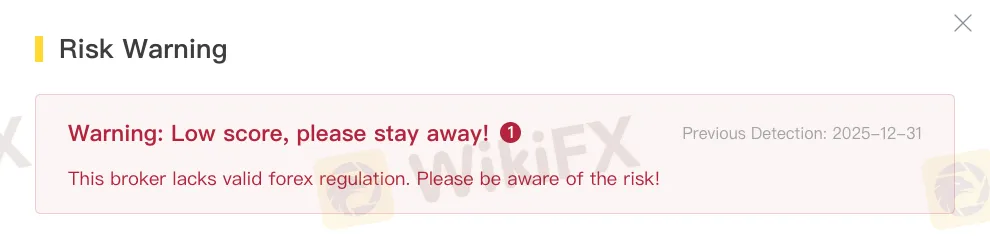

Abstract:A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

Zeven Global presents itself as an online trading platform offering access to various financial instruments and account types. However, based on WikiFX verification results and publicly available information, the broker shows multiple risk indicators that investors should carefully consider before engaging with its services.

WikiFX data indicates that Zeven Global does not hold a valid forex regulatory license, which places its overall risk profile under close scrutiny from an investor-protection perspective.

WikiFX Risk Warning and Safety Assessment

WikiFX has issued a risk warning for Zeven Global, citing its low safety score and lack of effective regulatory authorisation.

As of the latest update, Zeven Global has received a WikiFX Global Score of 1.92 out of 10, categorised as Danger. This assessment reflects weaknesses in key areas that are commonly used to evaluate broker reliability and operational safety.

Score Overview:

- Regulation: 0.00

- License: 0.00

- Risk Control: 0.00

- Business Index: 5.82

- Software Index: 7.73

While certain business or technical features may appear functional, the absence of regulatory oversight significantly affects the platforms overall safety evaluation.

Regulatory Status and Investor Protection Implications

According to WikiFX records, there is no evidence that Zeven Global is authorised or supervised by any recognised financial regulator. Without regulatory oversight, the platform is not required to comply with standard safeguards such as client fund segregation, capital adequacy rules, or independent dispute-resolution mechanisms.

As a result, investors may face increased uncertainty if operational issues arise, including matters related to withdrawals, account handling, or transparency of services.

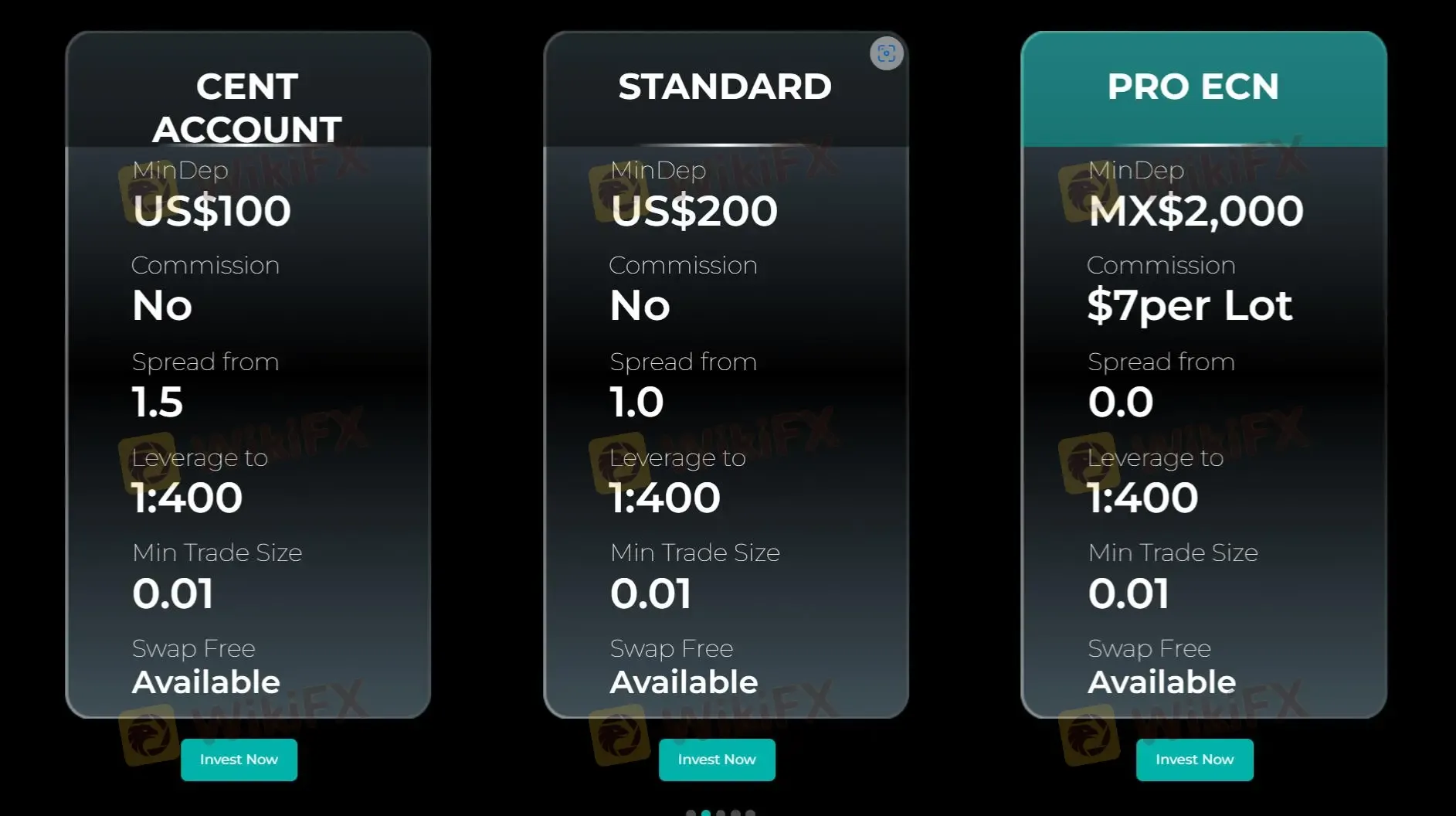

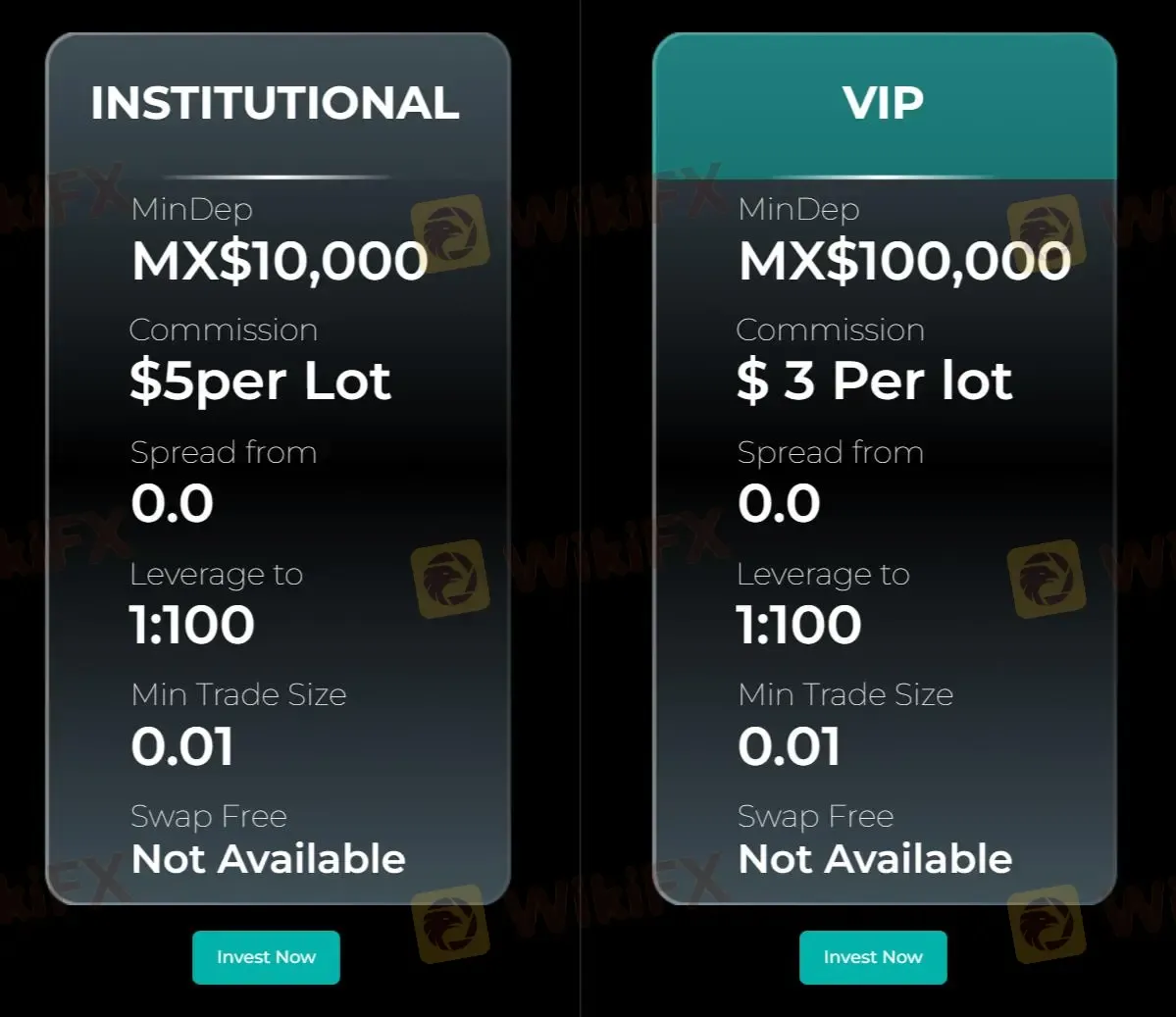

Trading Products and Platform Features

Zeven Global claims to offer trading access across several asset classes, including forex, indices, commodities, and cryptocurrencies. The platform promotes multiple account types—such as Cent, Standard, Pro ECN, Institutional, and VIP—each with different minimum deposit levels, spreads, and commission structures.

The broker also advertises the use of trading tools and software features intended to support market analysis and order execution. However, the availability of trading tools alone does not mitigate the risks associated with operating outside a regulated framework.

Deposits, Withdrawals, and Operational Transparency

Available information suggests that Zeven Global supports several payment methods, including bank cards and electronic payment services. While multiple funding options may offer convenience, WikiFX notes that payment accessibility does not substitute for regulatory protection.

In the absence of oversight, there is no independent mechanism ensuring that client funds are handled in line with recognised investor-protection standards.

Key Risk Considerations

From a risk-control standpoint, the following factors remain relevant:

- No valid regulatory license

- Low WikiFX safety score

- Lack of formal investor protection mechanisms

- Limited regulatory transparency

Taken together, these elements suggest that Zeven Global carries elevated operational and compliance risks when compared with regulated brokers.

About WikiFX

WikiFX is a global forex broker information platform focused on regulatory verification, risk alerts, and data-based broker assessments. By consolidating official regulatory disclosures, on-site investigations, and structured scoring models, WikiFX helps investors better understand potential risks before choosing a trading platform.

Reviewing a brokers regulatory status and independent safety evaluation remains an important step in managing trading risk.

Read more

SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

FP Markets Marks 20 Years of Global Trading

FP Markets celebrates 20 years of innovation, global expansion, and award-winning service, reinforcing its role as a trusted multi-asset broker.

GivTrade Secures UAE SCA Category 5 Licence

GivTrade gains UAE SCA Category 5 licence, enabling advisory, arrangement, and consulting services under strict regulatory oversight.

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

You are likely here because you are considering trading with 9X markets, but their very recent launch date has you worried about the safety of your funds. You are right to be cautious.

WikiFX Broker

Latest News

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

FX Markets: Dollar Holds Firm at 98.00; Euro and Kiwi Breach Key Technical Levels

“Elites’ View in Arab Region” Event Successfully Concludes

Bond Markets Signal 'Hawkish' Risk: The Era of Cheap Money is Officially Over

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

What Is a Forex Expert Advisor and How Does It Work?

Rate Calc