BlackBull Markets Regulation: A Complete 2026 Guide to Their Licenses

Abstract:Before trusting any broker, you need to check if it is properly regulated. The safety of your capital and fair trading conditions depend completely on how well the broker is supervised. For a thorough check on brokers like BlackBull Markets, websites like WikiFX can give you collected information, license tracking and user reviews, providing an important independent check. This article aims to answer a key question: Is BlackBull Markets a safe and regulated broker? The simple answer is yes, but the regulation setup uses two different licenses that every trader needs to understand. We will break down the BlackBull Markets regulation system, explain each BlackBull Markets license, and make clear what this setup means for you as a trader. Our review is based on facts you can check and aims to give you an unbiased, expert view.

Understanding Broker Regulation

Before trusting any broker, you need to check if it is properly regulated. The safety of your capital and fair trading conditions depend completely on how well the broker is supervised. For a thorough check on brokers like BlackBull Markets, websites like WikiFX can give you collected information, license tracking and user reviews, providing an important independent check. This article aims to answer a key question: Is BlackBull Markets a safe and regulated broker? The simple answer is yes, but the regulation setup uses two different licenses that every trader needs to understand. We will break down the BlackBull Markets regulation system, explain each BlackBull Markets license, and make clear what this setup means for you as a trader. Our review is based on facts you can check and aims to give you an unbiased, expert view.

The Company and Legal Setup

To understand how a broker is regulated, you first need to know the legal companies behind the brand name. When you trade, your contract isn't with the brand “BlackBull Markets” but with a specific registered company. This difference is key to knowing the regulatory protections applying to you. The group, started in 2014, works through several important companies.

Key Legal Companies

· New Zealand Company:

· Name: `Black Bull Group Limited`

· Registration Number: `5463921`

· Role: This is the main onshore company, registered in New Zealand. It holds the group's top-level license and serves as the foundation of its regulatory claims. Its registered address is Floor 20, 188 Quay Street, Auckland Central, Auckland 1010, New Zealand.

· Seychelles Company:

· Name: `BBG Limited`

· Registration Number: `857010-1`

· Role: This is an offshore company registered in Seychelles. It handles most of the broker's international clients, offering different trading conditions than the New Zealand company. Its registered address is JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles.

· UK-Related Company:

· Name: `BlackBull Group UK Limited`

· Role: It's important to note that this company is registered in the United Kingdom for payment processing and administrative purposes only. It does not hold a trading license from the UK's Financial Conduct Authority (FCA) and does not offer brokerage services to clients.

This multi-company structure is common in the industry, but it requires a closer look at the licenses each active company holds.

A Detailed Look at the Two-License System

The heart of the BlackBull Markets regulation strategy uses a two-license system. This model combines a high-trust, onshore license with a more flexible, offshore license. Understanding the differences between these two is the most important part of checking out a trader. The company you sign up with determines the leverage you can use, the level of regulatory oversight you get, and the dispute resolution options available to you.

The New Zealand FMA License

The New Zealand Financial Markets Authority (FMA) is widely seen as a top-level regulator, similar in strictness to authorities like Australia's ASIC or the UK's FCA. It enforces a strong and clear financial services environment.

Black Bull Group Limited holds a Derivative Issuer License from the FMA under the Financial Service Provider (FSP) number `FSP403326`. This is an important license that comes with strict requirements. To keep it, the company must:

· Keep a physical, working office in New Zealand.

· Go through regular and thorough financial audits.

· Follow strict anti-money laundering (AML) and anti-terrorism financing rules.

· Make sure client funds are kept separate from company operating funds.

· Meet minimum capital requirements to ensure financial stability.

For traders registered under this New Zealand company, the main advantage is the high level of trust and fund safety. However, this level of oversight typically comes with more conservative trading conditions, most notably lower maximum leverage, which follows global best practices set by other top-level regulators.

The Seychelles FSA License

The international part of the operation, BBG Limited, is licensed by the Financial Services Authority (FSA) of Seychelles. The FSA is an offshore regulator. While it provides a formal legal framework for brokerage operations, its requirements and oversight are much less strict than those of the FMA.

BBG Limited holds a Securities Dealer License with the number `SD045`. The main purpose of this offshore license is to let the broker offer services to a global client base that may not be serviceable from New Zealand. The main attraction for traders under this company is access to more flexible trading conditions, including:

· High maximum leverage, often up to 1:500.

· A potentially faster and simpler account opening process.

· Access to a wider range of promotions or bonuses not allowed under stricter regulatory systems.

It is standard practice for brokers with this two-company structure to sign up most of their international clients, including those from Asia, Latin America and Africa, through the offshore company.

What This Two-License System Means

The practical effects of this two-license model are significant. A trader's experience and level of protection are directly determined by the company with which they sign their client agreement. To make this clear, we have created a comparison.

| Feature | FMA (New Zealand Company) | FSA (Seychelles Company) |

| Regulator Level | Top Level (Strict) | Offshore (Less Strict) |

| Typical Max. Leverage | Low (similar to FCA/ASIC) | High (up to 1:500) |

| Primary Client Base | Mainly New Zealand residents | Most international clients |

| Regulatory Oversight | Very high, includes strict audits | Lighter, focused on business registration |

| Main Advantage | High level of trust and fund safety | High leverage, flexible conditions |

This table clearly shows the trade-off. The FMA license provides a strong indicator of credibility for the brand, while the FSA license lays the foundation for a competitive, high-leverage trading experience to a global audience.

How to Check Licenses Yourself

A broker's claims should never be taken without checking. Learning how to do your own verification is a must-do step in your research process. This ensures you are relying on original information directly from the regulators themselves.

A Step-by-Step Verification Guide

We provide this guide to help you confirm the status of the BlackBull Markets licenses directly.

· 1. Checking the FMA License:

· Go to the official website of the New Zealand Financial Service Providers Register (FSPR).

· Use the public search function. You can search by the company name, `Black Bull Group Limited`, or more directly by its FSP number, `FSP403326`.

· On the results page, you should verify that the status is “Registered” and, importantly, check the “Licenses” tab to confirm it holds an active “Derivative Issuer” license issued by the FMA.

· 2. Checking the FSA Seychelles License:

· Finding a publicly accessible, easily searchable database for FSA Seychelles can sometimes be more challenging than for top-level regulators. The most reliable method is often to visit the FSA Seychelles official website.

· Look for a section listing “Licensed Entities” or “Securities Dealers.”

· Within this list, you should be able to find `BBG Limited` and confirm its status and license number, `SD045`.

Using Third-Party Checkers

While direct verification is the best method, it can be time-consuming, and navigating some regulators' websites can be difficult. For a faster, more complete view, we recommend cross-checking this information on a reputable third-party verification platform. An effective broker verification tool, such as WikiFX, brings together regulatory data from multiple sources, tracks license changes in near real-time, and includes user-submitted reviews. This gives you a much broader view of a broker's operational history, license validity, and overall reputation in the trading community. Using such a tool provides a valuable second layer of confirmation.

Impact on Accounts and Trading

Regulation is not just theory; it has a direct and real impact on your daily trading experience. It determines who can open an account, what documents are required, and the level of security you can expect when depositing or withdrawing funds.

Geographic Restrictions

A broker's licenses determine where it can legally operate and seek clients. Due to its specific regulatory makeup, BlackBull Markets does not accept clients from several major areas. This is not a sign of weakness but a reflection of the following international financial law.

Prohibited Regions Include:

· United States (USA)

· Canada

· European Union (EU) member states

· United Kingdom (UK)

· Other sanctioned nations as per international guidelines

The reason for these restrictions is the requirement for specific, local licenses. To operate in the EU, a broker needs a license from a regulator like CySEC, and to operate in the UK, an FCA license is required. Since BlackBull Markets does not hold these, it cannot legally service clients from those regions.

The KYC Process and Security

Any properly regulated broker, whether onshore or offshore, must enforce strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This is a critical function designed to prevent financial crime and protect all parties involved.

Our research into user feedback shows a common theme: while initial account opening can be very fast, the first significant withdrawal often triggers a request for additional documentation. This can include a recent utility bill (not older than 3-6 months) to prove your address or a bank statement to verify the source of funds. While this can feel inconvenient to a trader eager to access their profits, it is a standard security procedure and a positive sign of a compliant operation. Being prepared with these documents from the start can significantly smooth the withdrawal process. A broker that allows large, unverified withdrawals should be seen as a major warning sign.

A Balanced View on Regulation

In conclusion, our detailed analysis shows that the BlackBull Markets regulation framework is a calculated hybrid model designed to serve two different goals at the same time. The high-trust New Zealand FMA license anchors the brand in a reputable regulatory environment, lending significant credibility and authority to the entire operation. This is the foundation of their claim to be a safe and serious financial institution.

At the same time, the Seychelles FSA license provides the operational flexibility needed to compete in the global retail forex market. It allows the broker to offer high leverage and flexible conditions that many international traders actively seek. The key point for any potential client is to understand the specific legal company they are registered with—either Black Bull Group Limited in New Zealand or BBG Limited in Seychelles. It is the single most important factor determining the level of direct regulatory protection clients receive.

Ultimately, this analysis serves as an expert guide, but it should not be your final step. The regulatory landscape can change, and licenses can be upgraded, downgraded, or withdrawn. Therefore, we strongly advise every trader to do their own final verification before making any financial commitment. Always consult an independent and comprehensive resource, such as WikiFX, to check the most current status of any broker's licenses and read up-to-date user experiences. Your financial safety depends on your own research.

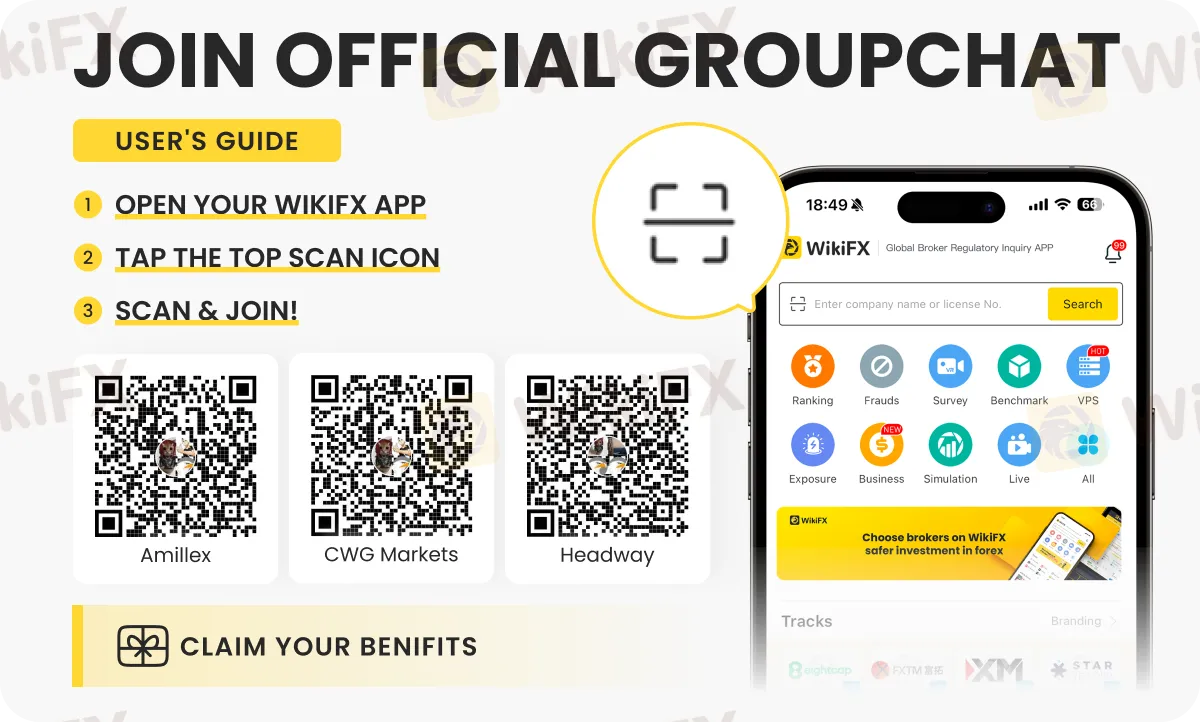

Want to explore innovative forex trading strategies? Join us on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.

Read more

Inside the Elite Committee: Talk with Nguyễn Viết Hải

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Has eFX Markets taken away your deposited capital? Faced losses due to manipulative ‘stop loss and take profit’ orders? Were you denied fund withdrawals because you did not finish your trading lot? Did the broker lure you into trading through a fake welcome bonus and scam you later? Traders have accused the Virgin Islands-based forex broker of driving these fraudulent practices. In this eFX Markets review article, we have shared some complaints against the broker. Take a look!

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

Has OTET Markets scammed you by freezing your forex trading account? Were you caught off guard by hidden trading rules diminishing your trading gains? Is the Otet Markets withdrawal process too slow or negligent? Don’t you receive adequate support from the broker’s customer care department? You are not alone! Many traders have opposed the Saint Lucia-based forex broker for their alleged malicious tactics. In this Otet Markets review article, we have covered a series of complaints against the broker. Read on!

E-Global Review: Order Closure Issues, Alleged Trade Manipulation & Fund Scams

Have you witnessed a failure of order closure by the E-Global Forex executive? Did you see an unprecedented rise in a forex pair not available on platforms other than that of this broker? Did the slow trading server prevent you from closing your trade at a favorable price? Has the broker scammed you after earning you from your investment? Many traders have expressed disappointment over the unfair forex trading practices at the US-based forex broker. In this E-Global Forex review article, we have shared some complaints against the broker. Take a look!

WikiFX Broker

Latest News

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

Merin Review (2025): Is it Safe or a Scam?

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Rate Calc