Markets.com Regulation: What Traders Should Know

Abstract:Markets.com is regulated by CySEC under license 092/08 and FSC offshore, offering forex and derivatives trading, though some users report delays in withdrawals.

Introduction: Why Regulation Matters

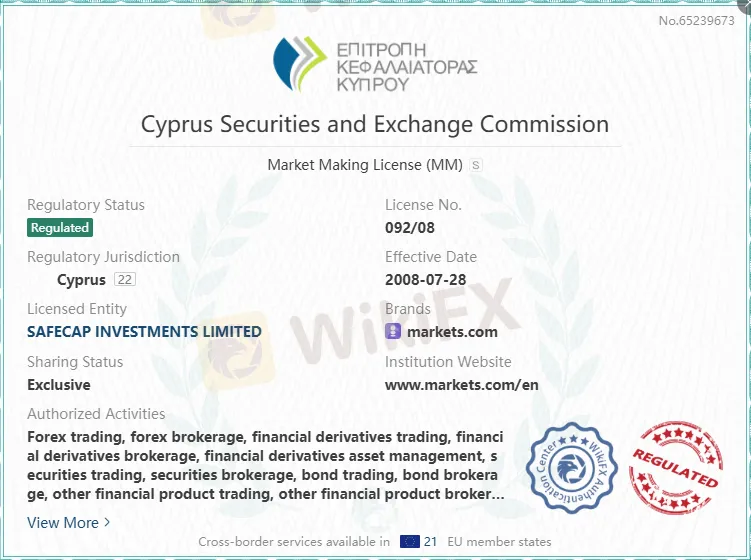

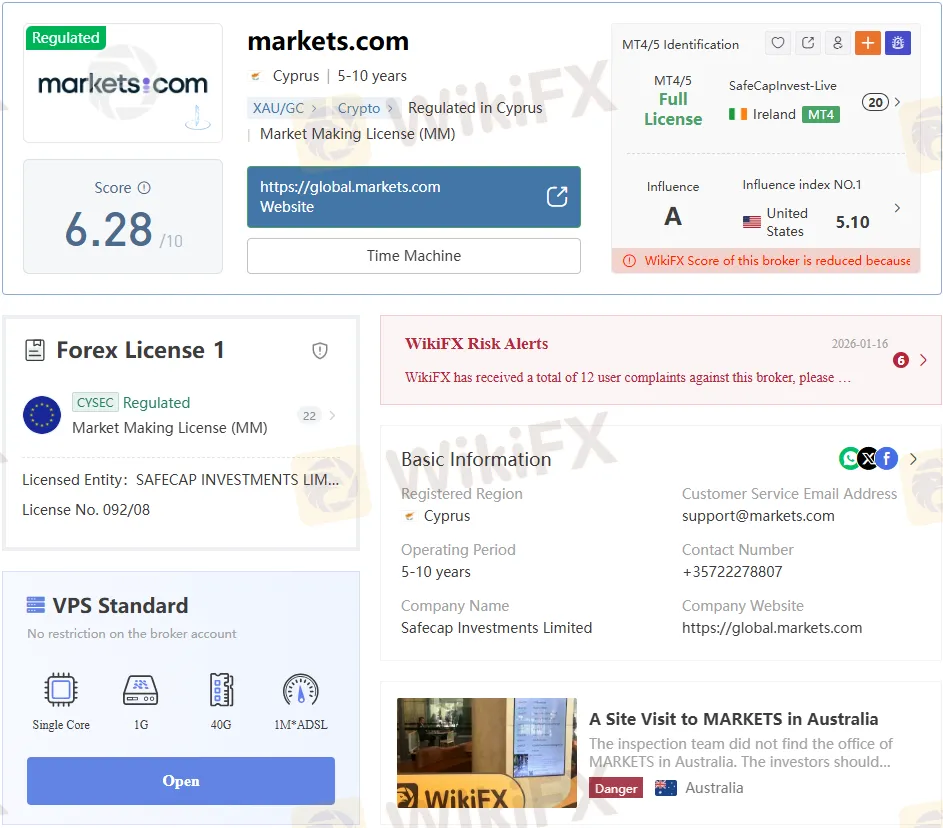

Markets.com regulation has become a focal point for traders evaluating the broker‘s legitimacy and operational standards. Safecap Investments Limited, the entity behind the brand, holds a Market Making license (No. 092/08) issued by the Cyprus Securities and Exchange Commission (CySEC), one of Europe’s most recognized regulators. At the same time, the broker operates under an offshore license from the Financial Services Commission (FSC) in the British Virgin Islands.

This dual licensing structure places Markets.com in a unique position: on one hand, CySEC oversight provides EU‑level investor protections, while on the other, the offshore authorization raises questions about accountability and risk exposure. For traders, understanding how Markets.com Regulation works in practice—across withdrawals, deposits, leverage policies, and client complaints—is essential before committing capital.

CySEC Oversight and Broker Regulation

Markets.com Regulation under CySEC is central to its credibility. Safecap Investments Limited, the licensed entity behind the brand, holds a Market Making (MM) license issued on July 28, 2008. This license permits the broker to engage in a wide range of financial activities, including forex trading, derivatives brokerage, securities trading, and bond trading.

CySECs framework is considered one of the more stringent within the European Union. Brokers regulated under CySEC must comply with capital adequacy requirements, maintain segregated client accounts, and submit to regular audits. For traders, this means that Markets.com is legally bound to maintain operational transparency and adhere to investor protection standards across 21 EU member states where it offers cross-border services.

Offshore Licensing: FSC in the British Virgin Islands

While CySEC provides a strong regulatory backbone, Markets.com Regulation also extends offshore through the FSC. The offshore license is held by Finalto (BVI) Limited under registration number SIBA/L/14/1067. Offshore regulation is often viewed with skepticism due to weaker enforcement mechanisms compared to EU regulators.

For traders, this dual structure means that while CySEC provides a layer of protection, the offshore license may expose clients to jurisdictions with less rigorous oversight. Competitor brokers that rely solely on offshore regulation often face criticism for limited accountability. Markets.coms hybrid model places it in the middle ground—regulated, but with exposure to offshore risks.

Reported Cases: Withdrawal and Deposit Delays

Regulation does not eliminate operational challenges. Several reported cases highlight issues with Markets.coms withdrawal and deposit processes.

- Case 1: A client reported delays exceeding 10 working days for withdrawals, with repeated requests for personal bank statements.

- Case 2: Another trader deposited $2,500, expecting instant credit as advertised. Three days later, the funds had not been added to the account, with the broker citing pending confirmation from the payment provider.

These cases underscore the importance of scrutinizing not just regulatory status but also operational efficiency. Delays in fund transfers can erode trader confidence, even when a broker is formally regulated.

Company Background and Domain Transparency

Markets.com was founded in 2008 and is registered in Saint Vincent and the Grenadines. Its primary domain is global.markets.com, with additional regional domains including markets.com.au and markets.com.cn. IP addresses linked to these domains suggest active operations in Ireland and Hong Kong.

Transparency in domain registration is a critical factor in broker evaluation. Competitors such as eToro or Plus500 often emphasize their centralized domain structures to reinforce trust. Markets.coms multiple domains may reflect its international reach but also raise questions about jurisdictional accountability.

Trading Instruments and Account Types

Markets.com Regulation allows the broker to offer a wide spectrum of trading instruments:

- Forex

- Shares

- Commodities

- Indices

- Cryptocurrencies

- ETFs

- Bonds

- Options

Account types include demo accounts and Islamic accounts, catering to diverse trader needs. The minimum deposit requirement is $100, making the broker accessible to retail traders. Leverage varies, with offshore accounts offering up to 1:500, while CySEC-regulated accounts are capped at 1:30 in line with EU restrictions.

This dual leverage structure is a point of differentiation. Competitors such as IG Group or Saxo Bank maintain stricter leverage limits across all jurisdictions, prioritizing risk control. Markets.coms offshore leverage offering appeals to high-risk traders but may expose them to significant volatility.

Platforms: MT4, MT5, TradingView, and Proprietary Systems

Markets.com provides access to industry-standard platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView. These platforms are widely recognized for their analytical tools, automated trading capabilities, and global user base.

In addition, Markets.com offers its proprietary web and mobile platforms. While proprietary systems can provide tailored features, they often lack the familiarity and third-party integrations of MT4/5. Competitors like Pepperstone and FXCM rely heavily on MT4/5 to attract experienced traders, whereas Markets.com attempts to balance between mainstream and customized solutions.

Fees, Spreads, and Transparency

Markets.com does not provide detailed information on spreads, commissions, or swap rates directly on its website. The EUR/USD spread reportedly floats around 0.8 pips, which is competitive compared to industry averages. However, the lack of transparency on additional trading costs is a concern.

Competitors such as XM or AvaTrade publish detailed fee structures, allowing traders to calculate potential costs with precision. Markets.coms omission places the burden on traders to investigate transaction costs independently, which may deter cautious investors.

Deposit and Withdrawal Policies

Markets.com supports multiple payment methods, including MasterCard, Visa, Neteller, Skrill, Wire Transfer, and ZOTAPAY. Deposits and withdrawals are fee-free, with a minimum deposit of $100.

Despite these policies, reported cases of delays suggest inconsistencies in execution. Competitors like Interactive Brokers emphasize seamless fund transfers as part of their value proposition. Markets.coms operational hiccups highlight the gap between policy and practice.

Educational Resources and Client Support

Markets.com Regulation requires brokers to provide adequate client support and educational resources. The broker offers:

- Glossary of trading terms

- Education center with articles and videos

- Trading basics tutorials

- Video library

Customer support is available 24/5 via live chat, WhatsApp, telephone, and email. Multilingual support enhances accessibility, though reported cases suggest that resolution times may vary.

Compared to brokers like IG, which invest heavily in educational webinars and advanced analytics, Markets.coms resources are adequate but not industry-leading.

Pros and Cons of Markets.com

Pros:

- Regulated by CySEC under license 092/08

- Multiple trading instruments including forex, shares, and cryptos

- MT4/5 and TradingView platforms supported

- Demo and Islamic accounts available

- Fee-free deposits and withdrawals

- Multilingual customer support

Cons:

- Offshore regulation through FSC raises accountability concerns

- Reported delays in withdrawals and deposits

- Lack of transparency on spreads and commissions

- No copy trading functionality

- Limited clarity on bonus structures and promotions

Comparative Analysis Against Competitors

When compared to competitors, Markets.com Regulation provides a mixed picture:

- eToro: Stronger emphasis on social trading and copy trading, absent in Markets.com.

- Plus500: Transparent fee structures and a single regulatory jurisdiction under FCA, offering clarity.

- Pepperstone: Focus on MT4/5 with tighter spreads and faster execution speeds.

- Markets.com: Broader instrument range but weaker transparency on costs and operational delays.

This comparative lens shows that while Markets.com holds legitimate regulatory licenses, its operational execution lags behind industry leaders.

Bottom Line: Assessing Markets.com Regulation

Markets.com Regulation under CySEC provides a legitimate foundation for its operations, ensuring compliance with EU standards. The additional offshore license through FSC expands its reach but introduces accountability concerns. Reported cases of withdrawal and deposit delays highlight operational weaknesses that traders must consider.

For retail traders, Markets.com offers accessibility through low minimum deposits, multiple platforms, and diverse instruments. However, the lack of transparency on fees and reliance on offshore leverage may deter risk-averse investors.

Final Assessment: Markets.com is a regulated broker with legitimate oversight, but traders should weigh the benefits of broad instrument access against the risks of operational inefficiencies and offshore exposure.

Read more

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

Zenstox Review: Is This Offshore Forex Broker Safe?

Is Zenstox safe or a scam? Learn about its 2.24/10 WikiFX rating, offshore regulation, bonus tactics, and trader reports of blocked or delayed withdrawals.

24option Review: Is it Legit or a Scam? Find Out in This In-depth Investigation

Contemplating 24option as your forex trading companion? Want to explore its trading platforms? We appreciate your interest! But how about knowing the Hong Kong-based forex broker and its different aspects, such as withdrawals and deposits. More specifically, if we have to say, what’s the feedback of traders concerning 24option? Are they happy trading with the broker? From a healthy collection of over 200 reviews, the broker is found to be a SCAM! Many traders have expressed concerns over the illegitimate trading approach adopted by the broker. In the 24option review article, we have explored many complaints against the broker.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

Forex 101: Welcome to the $7.5 Trillion Beast

Oil Surge: WTI Reclaims $60 as Middle East Tensions Override Venezuela Deadlock

ThinkMarkets Regulation: Safe Trading or Risky Broker?

ehamarkets Review 2026: Regulation, Score and Reliability

8xTrade Review 2025: Safety, Features, and Reliability

VEBSON Review 2025: Is This Broker Safe or a Potential Scam?

Rate Calc